Introduction

What do we want to see at DeFi? Everyone will have their own preferences, but no one is going to say no to these things:

-

Low transaction costs

-

Simplified user experience

-

Low risks

-

Good returns

All these conditions are impossible when we need to use several protocols of different networks at once. Here's why:

-

We often have to move funds from one network to another. Using cross-chain bridges carries risks, it is one of DeFi's weaknesses in terms of security;

-

The need to work across multiple networks and protocols makes the user experience heavy and confusing. This makes it difficult for mass adoption of DeFi, and thus the flow of capital;

-

Dispersed liquidity reduces capital efficiency and leads to low returns;

-

Transaction costs depend on the complexity of smart contracts of different protocols, so it would be more profitable to manage your funds in an optimized unified environment.

And the creation of such an environment is already being done by Cedro Finance.

Protocol Overview

Cedro Finance is a cross-chain decentralized liquidity protocol where users can lend and borrow the listed assets across multiple chains with affordable transaction fees. Lenders are able to deposit their assets to contribute to the liquidity of the platform and borrowers are able to borrow the liquidity in an overcollateralized manner.

Thereby simplifying the user experience, eliminating the need to use bridges and interact with complex smart contracts across multiple protocols. This significantly reduces risks and transaction costs.

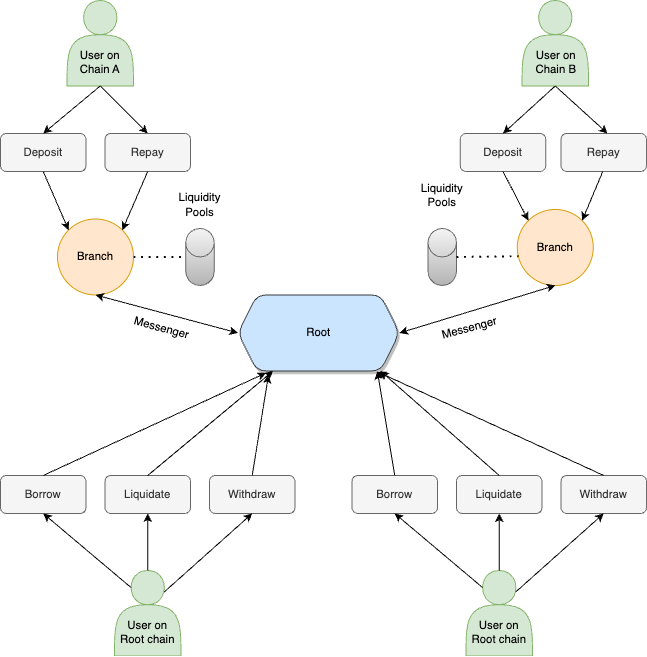

Architecture

The Cedro architecture includes three main elements:

-

Root - main chain that stores all the protocol's global variables (ex. total protocol liquidity);

-

Branch - any chain through which users can deposit funds;

-

Messenger is a stack of multiple generic cross-chain messaging protocols. It provides interaction between Root and Branches.

Division of operations in Root and Branch is done to optimize the number of cross-chain calls for each operation. All major transactions take place in Root, thereby reducing transaction costs.

This architecture gives Cedro an excellent scaling environment. An unlimited number of Branches can be connected.

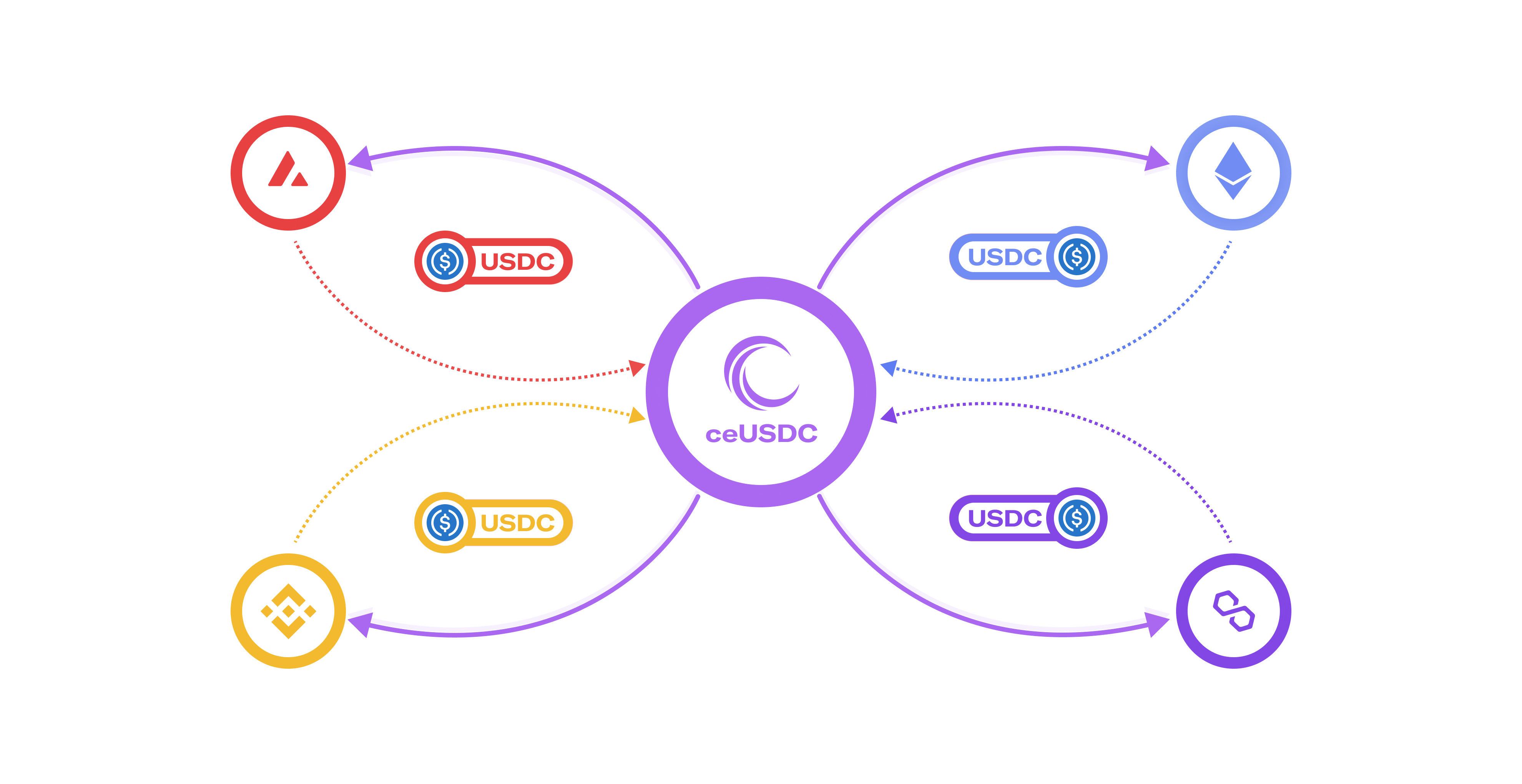

CULT (Cedro Unified Liquidity Token)

If a token is deployed on multiple chains, the liquidity pool will be separate for each chain. CULT lets users deposit multi-chain assets (ex. USDC) from different chains and add them to a unified liquidity pool.

The capital will be concentrated in a single pool and the efficiency will be maximal because of the unified liquidity pool. This makes Cedro an extremely appealing landing platform.

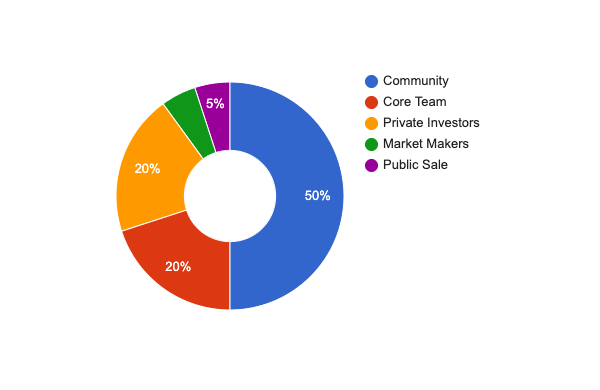

CED Token

The driving force behind the protocol will be the CED token. It will serve as a reward for Lenders, Borrowers, and Stakers. This environment is conducive to even greater capital inflows.

Conclusion

Cedro creates the perfect environment for us. Liquidity from several networks is concentrated here. It has a reward system in the form of the CED token. It has low commissions due to the simplicity of smart contracts in the Root chain. And all this with an intuitive interface. Bingo!

New protocols (e.g. Cross-chain DEXs, Omnichain Yield Aggregators and so on) can be deployed based on Cedro. This makes it an ecosystem-oriented project.

So you need to dive into the new world of global liquidity with Cedro right now.

How can you do that?

You can participate in the testnet and try out the features of this protocol now. It is conveniently implemented via Zealy with the possibility to get a tester role in Discord.

Stay tuned for protocol updates and don't blot out the new era of global liquidity.