Interest in Web3 has exploded over the past twelve months. NBA superstars are paying six-figures for NFT's and proudly displaying them. OpenSea is doing more volume than Etsy. The fastest growing game in the world runs on Ethereum. While this surge in interest has driven new users into the space, usage of crypto products still dwarfs that of their predecessors.

There are hundreds of Web2 apps and games with more than 10M monthly active users - Metamask is the only Web3 app at this scale. We believe that the nascency of Web3 growth strategies are the main reason that these apps have struggled to scale. Web2 companies have a decade of successful growth strategies to build off of and a rich ecosystem of platforms to leverage. Web3 projects are starting from scratch.

Web3 applications embrace a decentralized architecture, pseudonymity, and user-owned data. Web3's core tenets break every mainstream growth strategy. The leading Web2 consumer applications hit massive scale by leveraging centralized platforms like Facebook, bringing identity online to engender trust, and having massive proprietary datasets. Web3 applications have no app store, do not know who their users are, and have no method to communicate with them.

If Web3 is going to succeed in building an internet governed by open, community-controlled services, then entrepreneurs need new growth strategies. Web3 needs a new growth playbook.

Web3 Growth Challenges & Opportunities

Web3 applications face three foundational challenges in growing and engaging their user base.

Identity

Most Web2 growth strategies start from the assumption that (potential) customers are known. Viral growth generally happens on platforms that build social graphs based on IRL identity. Paid growth requires knowing information about your users so you can build targeting profiles. Many, many billion dollar companies have been built in helping companies do this effectively. Web3 breaks this assumption as the vast majority of on-chain activity is currently pseudonymous.

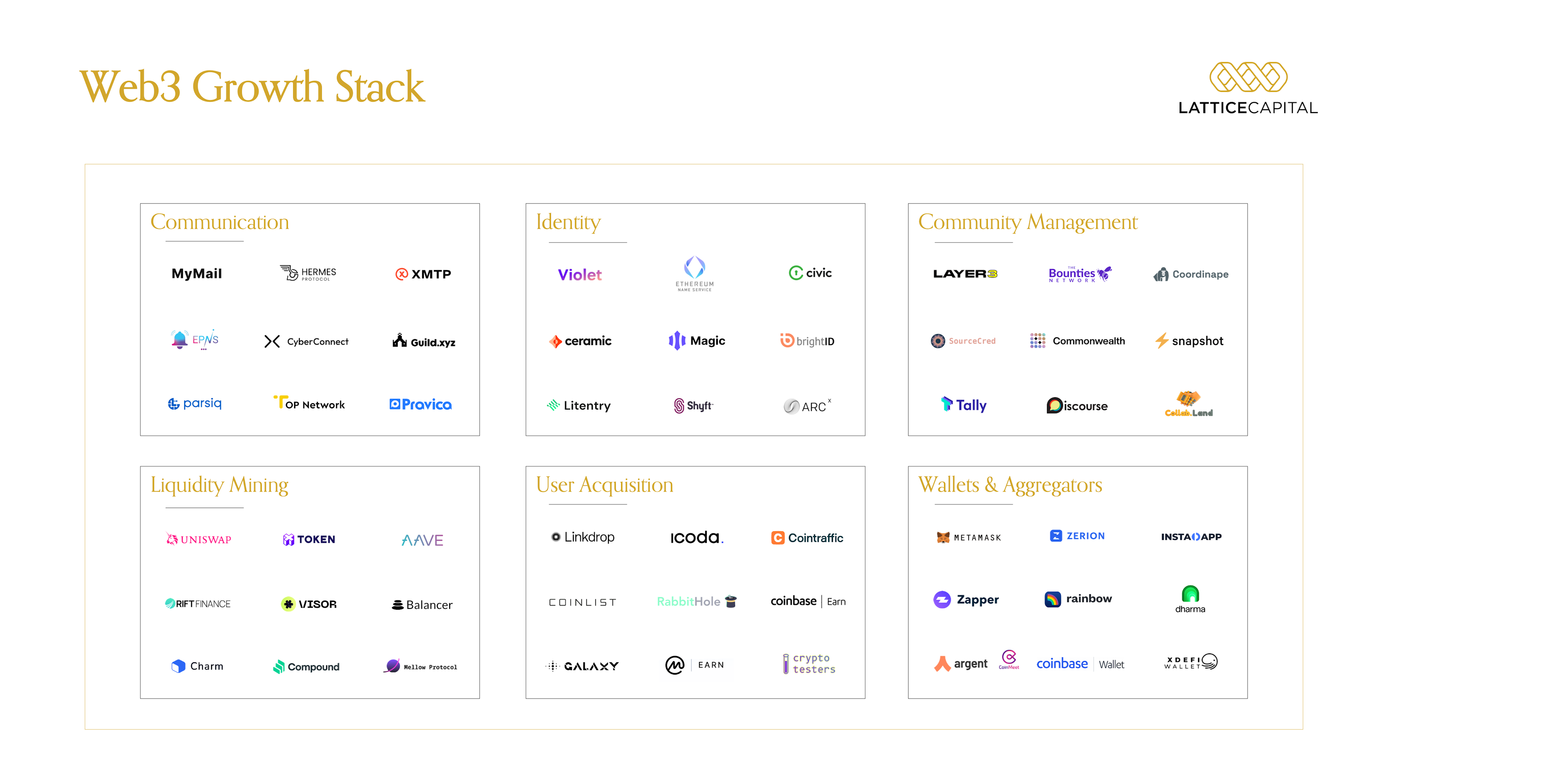

There are a number of teams working on defining what identity means in Web3. The Ethereum Name Service is growing quickly and makes Ethereum wallets - currently the primary 'account' in crypto - much more human readable. Ceramic and other DID providers are also working on building coherent account models for Web3.

Simultaneously, regulatory pressure and institutional interest is helping to drive adoption of 'whitelisted' DeFi products that are less anonymous than their predecessors. Maple recently launched a 'permissioned' lending pool that required participants to go through KYC. Violet is tackling this problem in a more generalized problem by building an identity protocol to bring off-chain identities onto Ethereum.

Meanwhile, other projects are working on building on-chain identity in a bottoms up approach rather than bringing offline data on-chain. Galaxy is building a crypto-native identity solution that leverages a users' on-chain behavior to build their profile. ARCx has introduced a 'DeFi Passport' that gives users' a credit score based on their on-chain activity.

Communication

Web2 companies use Facebook ads to reach new users, email to reactivate churned customers, and push notifications to tell users about new products. There are currently no widely used crypto-native growth tools which presents a major blocker to teams building effective growth loops.

Web3 communication tools are more nascent than identity ones, but there are a number of teams building crypto-native solutions. Ethereum Push Notification Service is working on a protocol that will generate mobile push notifications based on on-chain activity. CyberConnect and other companies are working on decentralized social graphs that can power user-owned social networks.

Other companies are taking a different approach by integrating Web3 into existing communication tools. Collab Land allows Discord servers to be gated based on token balances in a users' Ethereum wallet. Lit Protocol is building a decentralized access control platform to gate content, software, and data using tokens or NFTs.

Platform constraints

Crypto often gets compared to mobile in the context of large paradigm shifts in the internet. We think that the comparison can also be helpful in thinking about market size. All products on mobile have platform dependencies - for example if you're making a mobile meditation app, your addressable market is constrained by the install base of Android and iOS phones. Given that nearly every adult on earth has a smartphone this 'constraint' is largely theoretical.

Web3 products have much more tangible constraints in that they're gated by the install base of crypto wallets. If you're building a DeFi app on Ethereum, your immediately addressable market is defined by the ~25M people actively using Ethereum wallets (although this is growing quickly).

We're starting to see products that can expand the market beyond this current install base. Some do this by abstracting away the wallet experience and so can reach an audience that may not care about controlling their private keys. Dapper has built NBA Top Shot into one of the most widely used Web3 apps by abstracting away any notion of a blockchain. Everbloom is using a similar approach for a mobile first NFT experience and we believe that this sets them up well to reach true mainstream adoption.

Other products are getting around current platform constraints by getting a new audience excited about blockchain based products. For example, Helium has reached an install base of 350K+ by getting people excited about mesh networking and their hotspot's revenue potential (rather than the fact that it runs on a blockchain). We believe that DIMO will onboard a similarly large audience of auto enthusiasts into Web3.

There are a final category of products that are designed to get a broader audience excited about crypto itself. CoinList and Coinbase offer centralized products that incentive people to try out Web3 products. Rabbithole has done a great job of onboarding new users into Web3 in a crypto-native fashion, while Galaxy has done an amazing job of getting communities to use new products. Meanwhile, applications like Layer3 are making it easier to start earning in Web3.

Web3 Growth Strategies

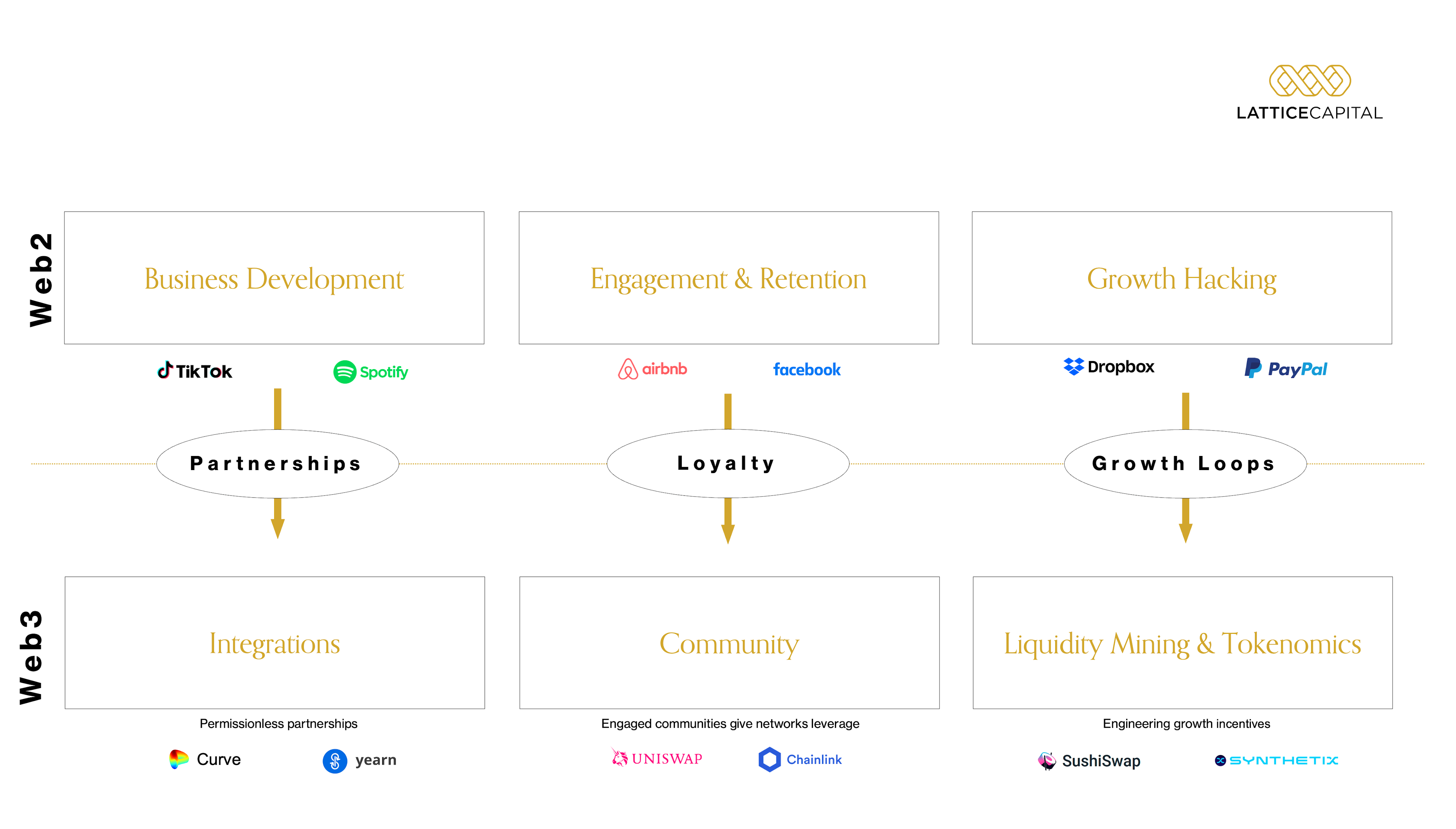

Partnerships & Integrations

Software companies growing through large BD deals is nothing new and many Web3 projects have adopted this strategy. For example, ChainLink executed on a strategy of closing partnerships during the 2018-2019 bear market and $LINK outperformed as a result.

However, business development can look very different in Web3 when these partnerships are negotiated transparently in governance forums rather than behind boardroom doors. Given that these integrations often do not require permission from one of the two parties, they are not always mutually beneficial. For example, a number of platforms have integrated Curve in ways that do not necessarily benefit Curve itself.

A few examples of Web3 partnership categories:

- Token utility - projects that have a native token want to make it as useful as possible. This could include exchange listings, collateral listings (eg adding $LINK to Compound), or a partnership with a DEX to drive additional liquidity.

- Distribution - all users interact with DeFi protocols through wallets (Metamask, Rainbow) and increasingly aggregators (Zapper, Zerion). These frontend interfaces control which protocols they show to users and so getting your yield aggregator integrated with wallets can be a big deal.

- Lego building - leveraging another DeFi primitive to bring additional utility to your product. For example, Notional leverages Compound to increase its effective yield.

- Mergers - the recognition of two teams building in similar directions and no longer making sense to compete has led to protocol mergers, notable Keep & NuCypher and Fei & Rari.

We're starting to see times prioritize hiring a partnerships/BD lead given its increased importance .

Liquidity Mining & Tokenomics

Growth hacking has become incredibly popular over the past decade as marketing has become more analytical and engineering driven. While growth hacking in Web2 has historically been on building affordable, repeatable growth loops, the focus in crypto has been on leveraging a project's native token to drive growth loops.

Liquidity mining is a "a network participation strategy in which a user provides capital to a protocol in return for that protocol’s native token." Just as VC funds helped subsidize marketplaces until they reached scale, Web3 protocols can bootstrap their growth using their native token.

Crypto projects that have grown through token incentives have faced similar challenges to Web2 startups that burned through piles of venture funding. The data is quite clear that most subsidized liquidity is highly mercenary. Hence, we're starting to see more thought out liquidity mining products including OHM and Rift.

Community

If Web2 companies have focused on driving loyalty amongst their uses in the form of engagement and retention, Web3 companies are focused on driving user ownership. One of the most exciting and unique features of Web3 is that "users...fund the products, information, and services that they consume." We're still very early in understanding all of the downstream implications of this innovation.

We think community is critical in a network growth context because engaged communities will give networks leverage in everything they do. This is evident if you look at the Twitter feeds of projects with engaged communities - every announcement sees a ton of engagement and retweets.

Communities can substitute or complement key stakeholders in Web3 projects:

- Early customers (and cheerleaders) - having a small group of fanatical customers is crucial for any startup. Community members can serve this role (and then some) because they're both early customers and have meaningful upside

- Leverage core team - community members can help with hiring, token design, fundraising (things investors historically helped with)

- Extend core team - community members can provide both technical and non-technical support to the core team. Sometimes they step up and join core team, other times this happens more ad-hoc.

- Distribution - upstart token projects want to partner with other projects with large communities, just like new products look for distribution in channels with a large footprint

Introducing Lattice: an early-stage venture fund that helps founders build defensible moats

We've been working in the trenches with crypto projects for over four years and launched Lattice because we wanted to build the venture fund that we would've wanted to work with. Our journey together started near the top of the last bull market as the early chills of crypto winter were starting to blow in. While working together we endured a prolonged bear market where the general public forgot about crypto and crypto forgot about token sales.

As crypto Twitter and the crypto markets often distracted by the latest shiny toy, we've been impressed with the teams & communities that continue to build even when the spotlight turns off. We've seen firsthand how some of the biggest successes in the industry did not happen overnight. Teams like Audius, Dune Analytics, OpenSea, and Terra worked for years before the spotlight fell on them. We want to work with founders that share that same level of determination.

In an industry built on open-source interoperable software, we believe that partnerships and community are the only sustainable moat. We've spent years helping to drive growth initiatives at leading companies in the space including Aztec, Celo, CoinList, Index Coop, and Solana. Seeing the challenges of growing crypto projects firsthand is what inspired us to build Lattice.

Lattice invests in early-stage companies and help founders build repeatable growth playbooks. If you have the commitment to see a vision through another bear market and are looking for a long-term partner, come say hi: hi[at]latticecap.co

Lattice holds positions in CyberConnect, DIMO, Galaxy, Layer3, Lit, Maple, Rift, and Violet. Lattice employees' hold personal positions in ARCx, Audius, Dune Analytics, EPNS, LUNA, INDEX, Notional, Rabbithole, and OpenSea.