Introduction

Picture this: you’re perusing Facebook Marketplace, looking for a reasonably-priced used car with a clean record and bill of health. There’s a lot of trust required from both sides of any potential transaction: you need to pay, and the seller needs to be truthful in their listing. Additionally, we trust that both parties are capable of paying or providing the item in question. Typically, the marketplace is the arbiter of the transaction, able to confirm that neither you nor the seller has scammed anybody before. Is there a way to ensure the legitimacy of another person or group without involvement of a third party? What if we could cut out the middleman? Blockchain gives us the ability to circumvent Facebook with a guarantee that both parties are trustworthy--we can see all of their prior transactions, as well as every transaction the car has been a part of.

The internet is evolving. Despite what tech giants may have you believe, “Meta” is not the future. The era of data weaponization, unchecked software monopoly and big tech tyranny is soon to change. People are building billion-dollar companies, completely anonymously. Individuals make millions of dollars trading collectibles and images of nicely-dressed monkeys. What the heck is going on?

Blockchain technology enables an internet built on decentralization, giving ownership and control to those who build it. With the growing popularity of Ethereum and other blockchains operating immutable public code called smart contracts, a new generation of software development enables new forms of digital ownership, securitization of assets and governance systems.

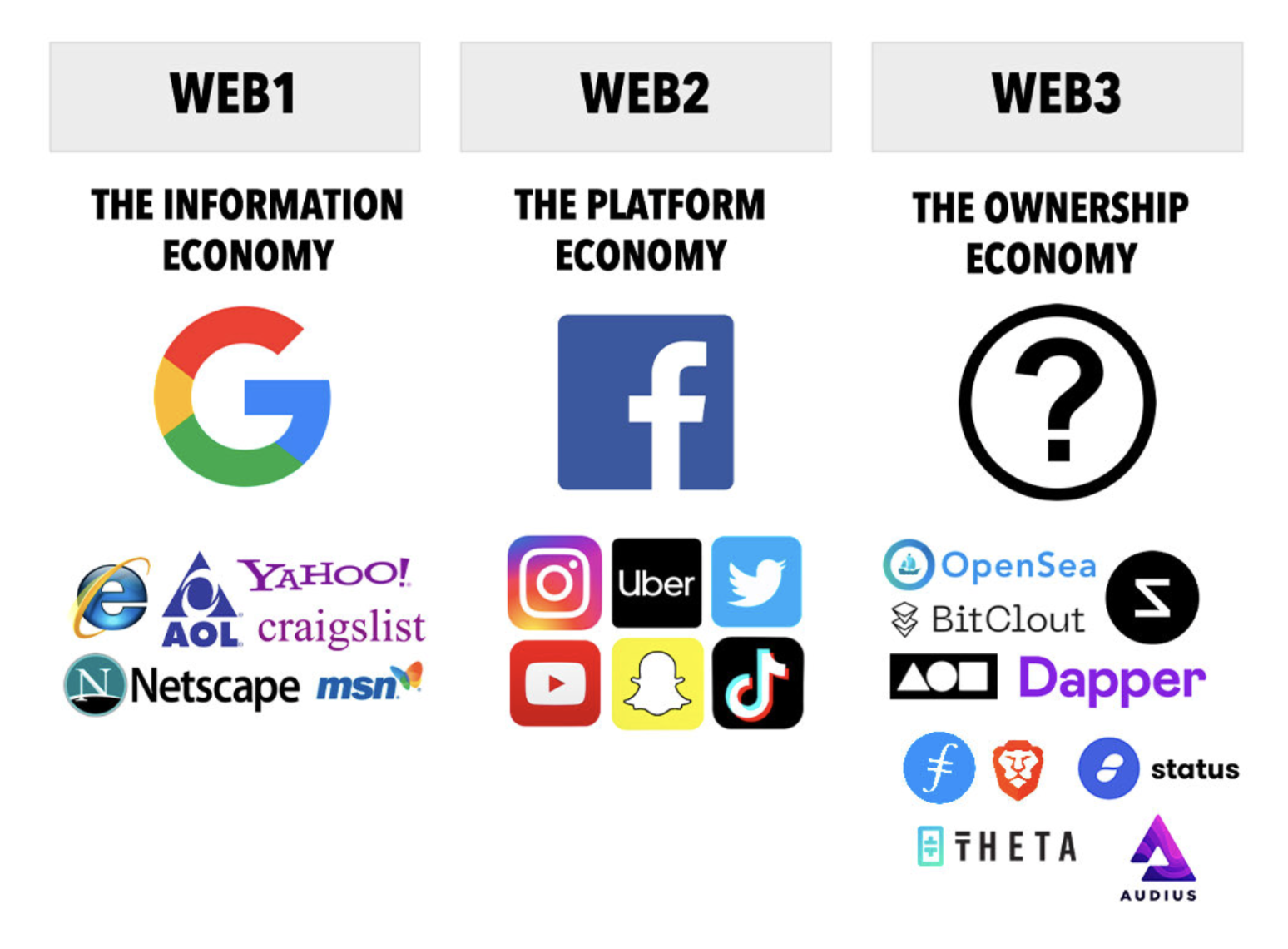

Web 1.0 (read)

The first generation of the World Wide Web saw widespread content consumption for the first time. Between 1990 and 1993, the first web servers went online and allowed anyone with a computer to view hypertext documents transferred from a server to a client (CERN). This generation of the web is colloquially called the “read internet” because most users at the time consumed content and did not have much flexibility with what they created.

Web 2.0 (read-write)

With the introduction of user-centric design and customization, the web gained interoperability. Dynamically generated, interactive, user-generated content changed the way that consumers interacted with the internet, rather than any specific technological innovation (O’Reilly). Web 2.0 saw the rise of centralized platforms, like Google and Facebook, Uber and Amazon, user-centric design in applications and an emphasis on user data as currency. The rapid growth of centralized entities providing a service to users came with the sacrifice of data privacy and competition in tech.

Web 3.0 (read-write-own)

Web 3.0, or “web3“, is the use of blockchain technology to facilitate cryptographic transactions between parties, replacing third-party-driven trust and introducing an economy built on tokens. It is a deep dive into fully open-source, public development where consumers and developers alike do not require permission to access information. Web3 tokenizes assets, ownership, and identity to increase digital security, privacy, and efficiency. A digital economy eliminates middlemen to create direct, trustworthy paths between any number of untrusting parties.

What is a “blockchain” anyways?

It’s hard to separate the concept of blockchain technology from Bitcoin, as they were synonymous in the early days. Bitcoin was an early catalyst for blockchain innovation, building a financial verification system on top of cryptographic proofs. According to Satoshi Nakamoto in the 2009 Bitcoin whitepaper, “an electronic coin is a chain of digital signatures” (Nakamoto). This manner of one-way cryptographic hashing set the stage for what would become the tech community’s current views on and use of blockchain technology.

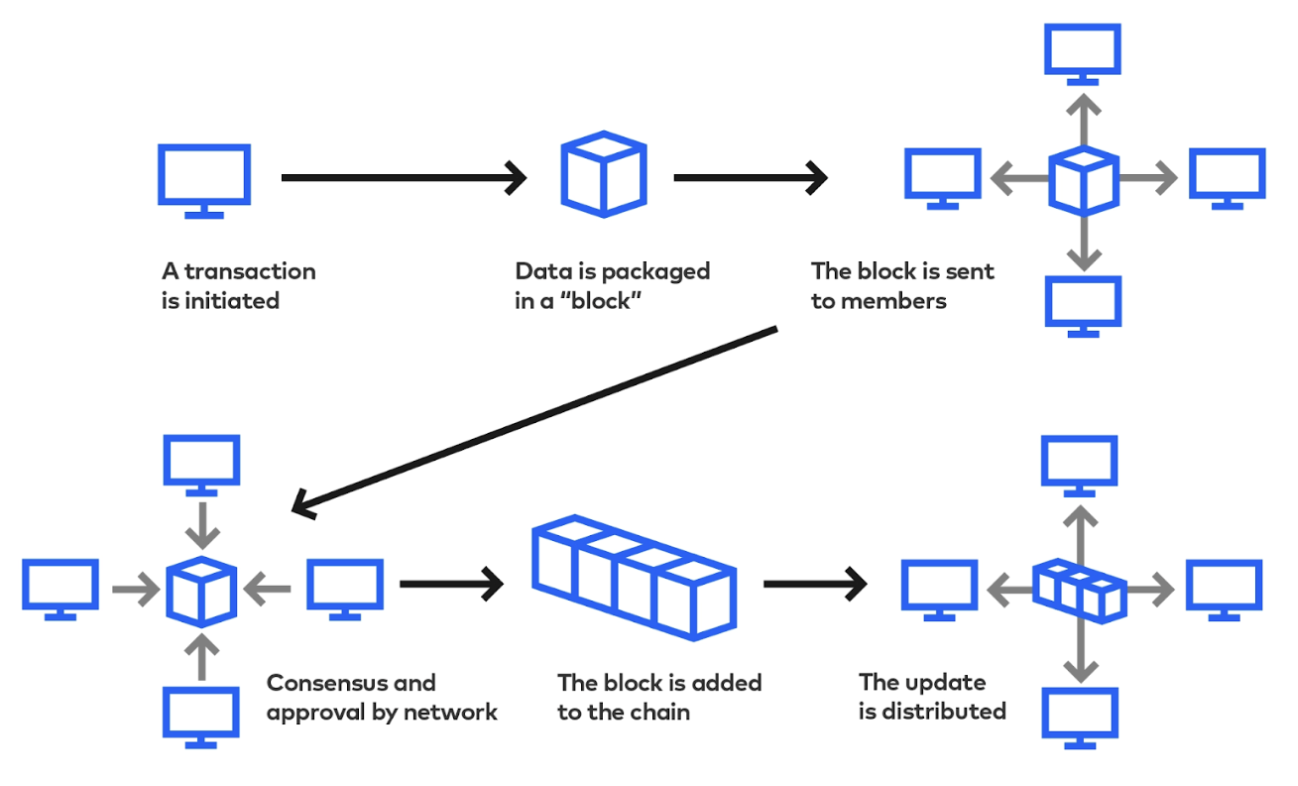

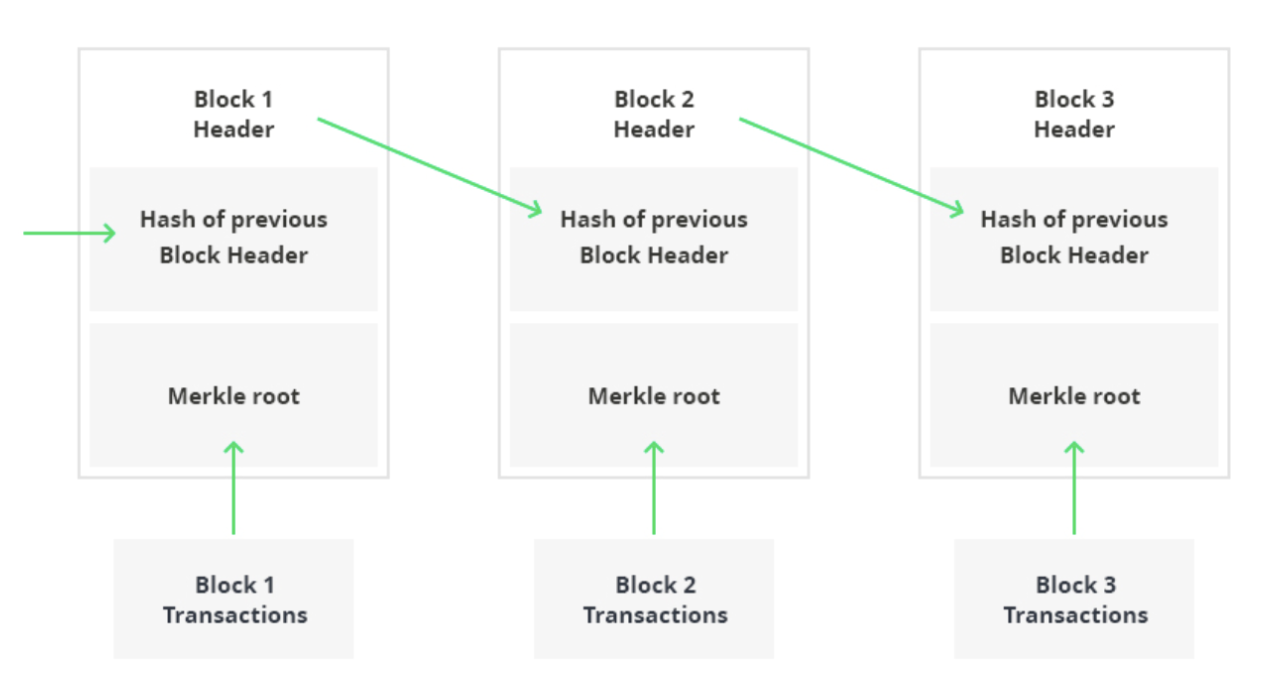

A blockchain is a publicly distributed, autonomously regulated store of information, accessible to anybody but editable by nobody. Information is stored on “blocks”, which are created, authenticated and stored across a peer-to-peer (P2P) network so information cannot be changed retroactively (The Economist). A block is made up of two main parts: a cryptographic hash, and the transactions it stores. Transactions are verified between peers, called miner nodes, in a peer-to-peer network mathematically using what’s called a merkle root to verify all data is unchanged, and a proof-of-work algorithm to solve arbitrary puzzles for consensus.

The algorithm works by sending a set of peer-verified transactions through a hash function (Bitcoin uses double SHA-256 hashing) and getting a specific output of hashcode, used as the reference point for each future block (Coinmarketcap, “SHA-256 | CoinMarketCap”). Verifiers race to calculate the correct “nonce” which, when SHA-256 hashed with the previous block’s information, matches that of the network. When consensus is reached and the block is added, verifiers earn tokens as a reward.

A blockchain works much like a linked list - transactions are stored in a block object, connected to the next block by a pointer referencing a block’s cryptographic hash (MLSDev). In order to make any change, or submit new transactions, a critical mass of anonymous users in the network needs to verify that these changes are legitimate (referencing previous blocks) before writing to a block. The smallest change in a single transaction would completely alter the hashcode generated from the block and require every future block’s pointer to be recalculated. For this reason, even minor malicious changes to a previous block would require control of a majority of the network’s computing power, impossible in an anonymously-verified P2P network.

Implementing this algorithm in financial transactions supports the notion of completely “trustless” payments, not verified by a third party, but rather by the network. One can “mine” bitcoin by using a high-powered CPU (or GPU) to run cryptographic hashing algorithms and verify network transactions. Since supply is limited and the blockchain is optimized for security and anti-seizure (Nakamoto), bitcoin is the “gold” of the digital age.

Ethereum: the world’s first “programmable blockchain”

“The big difference between Ethereum and Bitcoin is that Bitcoin is a platform where the value of the ecosystem comes from the value of the currency, but in Ethereum the value of the currency comes from the value of the ecosystem” - Vitalik Buterin (Bitcoinst)

Ethereum aims to add functionality to transactions stored on its blockchain by developing a “highly programmable digital money”. Ethereum is an open-source marketplace for financial services, games and applications that can’t steal data, censor, or control individual assets (Buterin). It builds on Bitcoin’s foundation and incorporates Solidity, a “built-in turing-complete programming language” enabling smart contracts, executable code which “encode[s] arbitrary state transition functions” (Buterin). Turing completeness indicates that Solidity, much like other programming languages, can compute any theoretical function, and thus developers can create completely customizable decentralized applications. In essence, the Ethereum blockchain is a state machine that stores information in the form of code. At any given time, Ethereum’s “state” is both the latest transactions recorded on its final block, as well as all accounts and balances stored within (Ethereum Foundation).

EVM and Smart Contracts

Using the Ethereum network is like using a computer in a public library. Everyone has the ability to access basic functionality: search, querying the library database for books or other information, accessing their email, etc. You can do mostly anything for however long you want, so long as the queue to use the computer isn’t too long. The only thing you can’t do is change the admin settings. The Ethereum equivalent is the Ethereum Virtual Machine (EVM), “the environment in which all Ethereum accounts and smart contracts live” (Ethereum Foundation, “Ethereum Virtual Machine (EVM)”).

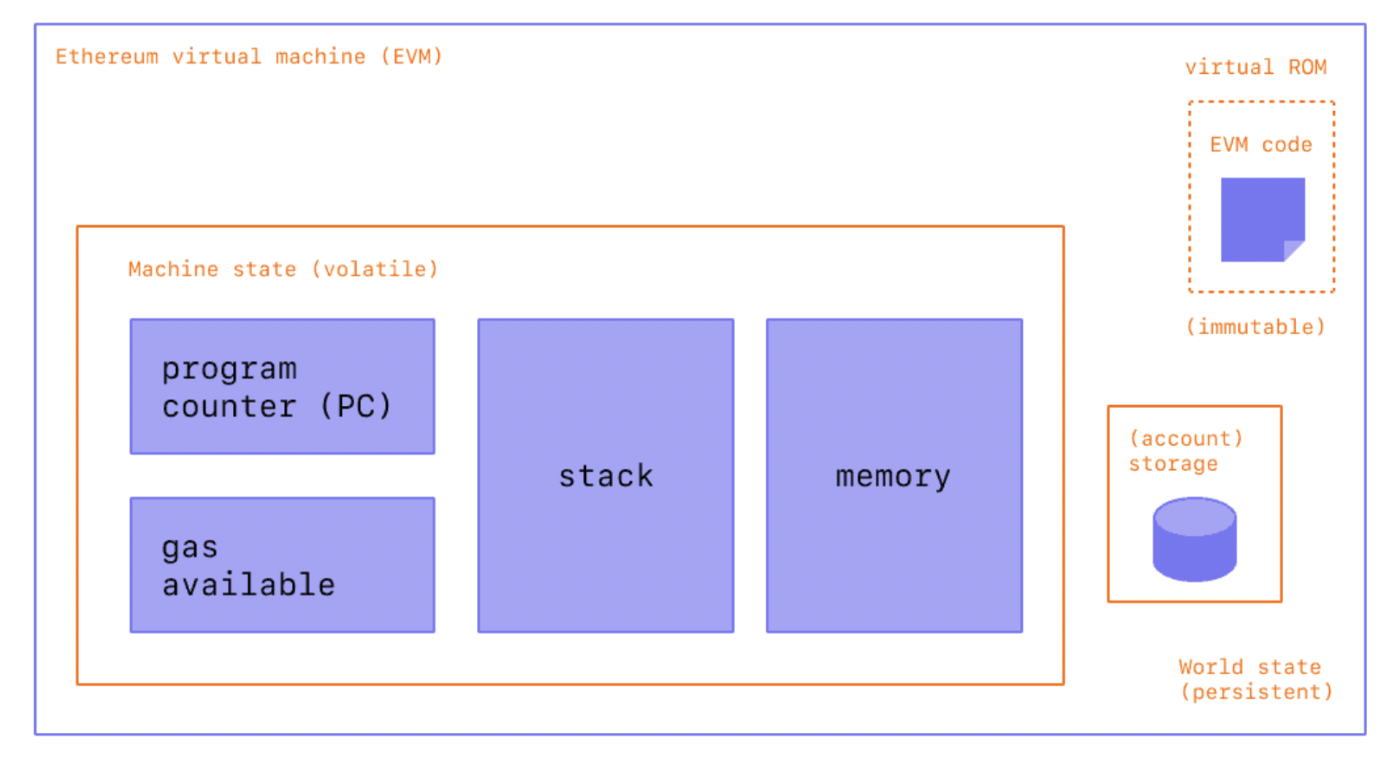

The EVM is a public-access, virtual computer, which executes operations from a stack. It’s made of a few parts: the machine state, individual “storage”, and the EVM code. It almost looks simpler than Windows 95, right?

The ledger itself, as well as the rules governing continuous network operation, are maintained within the EVM code in the same way as the Bitcoin blockchain - double SHA-26 hashing, proof of work algorithm and a P2P network of miners to verify and write transactions to keep it intact. The key difference lies in the configuration. The ability to distill human-readable Solidity smart contracts into machine-readable operations is what makes EVM like a computer.

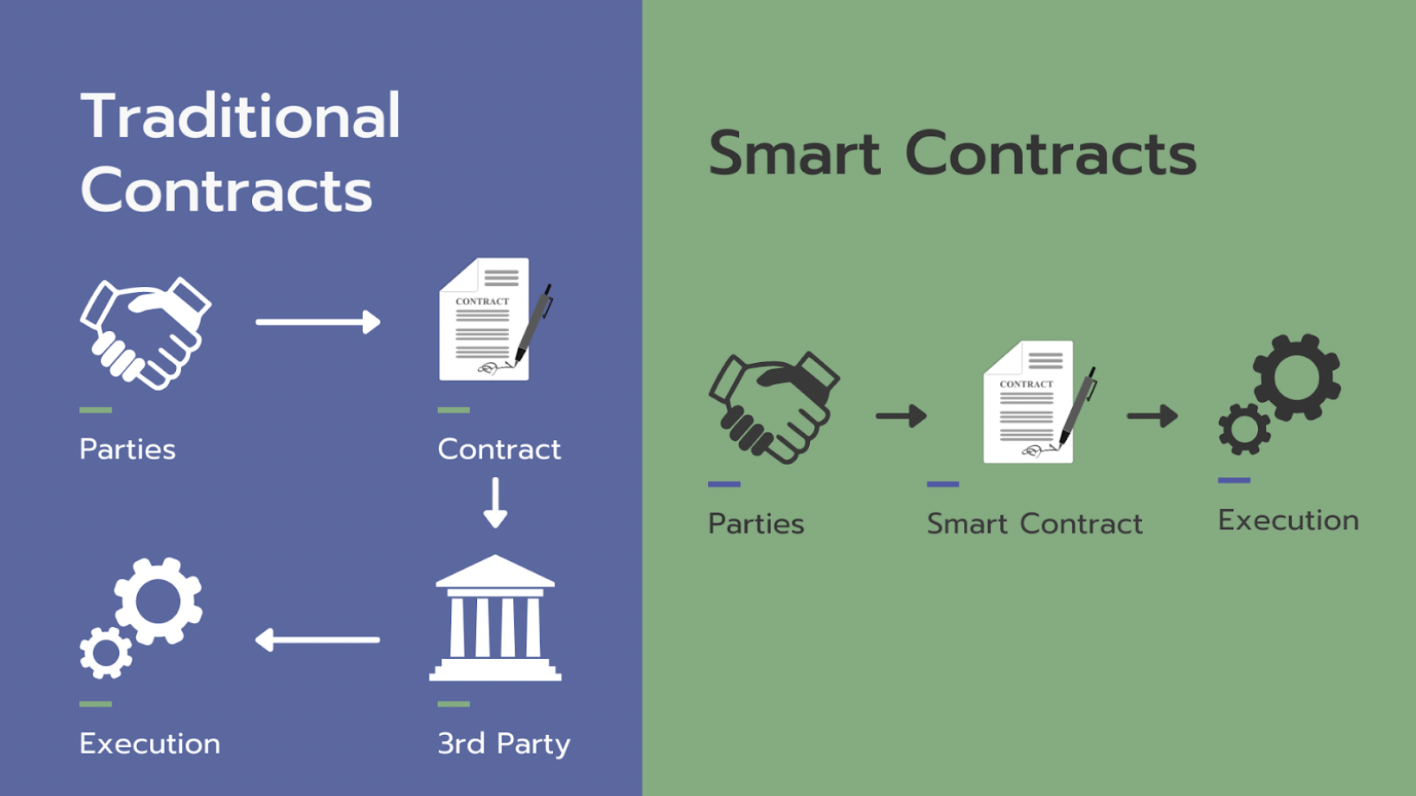

Central entities or trusted third parties traditionally arbitrate contractual obligations. Smart contracts are conditional and automatically-executing programs stored on a blockchain that form the technical basis for a “trustless” ecosystem. Contracts are written in Solidity and create arbitrary, objective rules which specify operations for a given transaction (Szabo). Since contract contents are transparent, the power of arbitration is put into the hands of each party to verify that the contract is fair and the other party has good intentions. Third parties are no longer required, as all stipulations exist within the contract itself.

Smart contracts replace traditional backend development in decentralized applications (dApps). Using an early example (Szabo) of a simple smart contract, creditors can create a “digital security system for automobiles” they sell on credit. Here’s the contract’s pseudocode:

- Always: the owner’s key can access and use the vehicle

- A creditor can access the vehicle and revoke the owner’s key temporarily if and only if payment was not received for a certain period of time

- Once the car is paid off, the creditor can no longer access the car

As soon as a given condition is met, the network verifies the transaction and records it on the blockchain. This example is crude but demonstrates the potential for removing a middle-man, like a car repossession service with a simple dApp.

Use Cases

The Ethereum developer community is strong and growing rapidly. In 2021 alone, venture capitalists invested over $33 billion in crypto and blockchain startups, and investment in the space is growing 713% year-over-year (Cointelegraph, “Blockchain Startups Grow as Global VC Funding Generated $25.2B in 2021”). Such strong investment into a complex technical space with high potential for financial upside has attracted talent in droves and created a number of new market verticals.

Decentralized Finance (DeFi)

Traditional financial infrastructure is controlled by central authorities and middlemen. Decentralized finance enables “easy and cheap access to capital, efficient lending and borrowing, decentralized crypto and synthetic stock exchanges” (“How DeFi Is Revolutionizing the Financial Industry”) and more. Smart contracts allow DeFi to be completely trustless; two parties can trust that an objective contract governs any given transaction.

Imagine you want to purchase 10 shares of XYZ stock at market price. Even if it costs $100 when you click “buy”, the purchase may not execute until it reaches $102. This slippage happens if an internal order book, provided through a financial institution or centralized exchange, cannot find a stock for sale before the price changes. With smart contracts and the help of automated market makers (AMMs), other users of a financial ecosystem are incentivized to provide the specific stocks necessary at any given price to keep the market moving fluidly and prevent slippage (Coinmarketcap, “Automated Market Maker (AMM) [Updated] | CoinMarketCap”).

Blockchain provides transaction history and an updated state of accounts, assets transact in the form of cryptocurrencies, protocols are combinations of smart contracts to provide functionality and applications act as the user interface. In essence, DeFi enables all users of a financial system to maintain control over their finances, borrow, trade, and transfer funds quickly and at will, at any time.

Non-Fungible Tokens (NFTs) and Collectibles

Consider the cash in your wallet. One dollar in California stores the same value as one dollar in Texas and can be broken down into denominations that store an equal value. Divisible and non-unique. The cash in your wallet is fungible. Fungible tokens like Ether, Bitcoin, Solana, etc., are mostly used as means of exchange and a store of value. Non-fungible tokens, on the other hand, “allow value to be given to art, music, etc. in terms of digital currency” (Gondek).

NFTs represent unique items in a digital environment. They are stored in smart contracts referencing the ERC-721 token standard for non-fungible tokens, meaning they are non-divisible, completely unique, and store data. ERC-721 (EIP-721) is an Ethereum Improvement Proposal that implements an API for tokens within smart contracts (Ethereum Foundation, “ERC-721 Non-Fungible Token Standard”).

Ethereum Improvement Proposals (EIPs) allow developers from the open-source ecosystem to propose core protocol, client API, and contract standard improvements, like ERC-721, which add further use cases to Ethereum smart contracts (Ethereum Foundation, “EIP”). Additional token standards, such as ERC-1238 (non-transferrables) and ERC-1155 (batch non-fungibles) continue to gain popularity among developers in 2022.

The key difference between cryptocurrency and NFTs lies in the fact that ERC-20 contracts store value while ERC-721 contracts store data (Cointelegraph, “Fungible vs Nonfungible Tokens: What Is the Difference?”). NFTs can only have one owner at any given time so they can both verify identity and ownership with immutable transaction history. Digital art is one use case experiencing a boom, but the applications of NFTs and various ERC standards extend beyond collectible items. Owning an NFT can grant the holder access to gated content, like an in-game unlockable or a private community.

Decentralized Autonomous Organizations (DAOs)

DAOs are digital organizations where membership, decision-making and ownership in the organization are governed by automated smart contracts. There is no hierarchy, bureaucracy, or central authority in a DAO. For all intents and purposes, it is both a trustless corporation and a perfect representative democracy.

Decisions are made through a system of token governance. “Shares” of a DAO can come in the form of an ERC-20 (governance) token, or a relative number of NFTs held of a discrete total amount, and equate to a share of the decision-making when consensus is required (Selkis). Theoretically, anybody with an ownership stake in the organization can raise a topic for discussion or decision, and a vote will take place. As with all other transactions, votes are publicly available, guaranteeing a transparent democratic process.

Automated governance extends to all facets of the organization. For example, if a DAO wanted to pay a developer for their contribution to open source software, invest pooled funds or change how the organization works, it is up to specifications in a smart contract and/or a transparent community vote. Members attain a stake in a DAO by purchasing governance tokens on a decentralized exchange, in a formal financing round, or contributing to a project. The token economics of a governance token work similarly to another ERC-20 token’s supply and demand, with an additional perk—utility.

The flexibility of token governance gives rise to all types of DAOs. Common varieties are Protocol, Grant, Philanthropy, Social, Collector, Investment and Media DAOs (Hennekes). All serve different functions, from facilitating non-profit and philanthropic donations, to community organization, to investing in early-stage companies and collectibles. Though their goals are all different, they are all a form of decentralized organization. They are all similar in the way their members interact: according to rules encoded in smart contracts.

Getting Started

Web3 is very good at “log in” but not quite as good at “sign up”, so here’s your guide. The background above should give an overview of some of the Ethereum fundamentals, with some sample use cases.. but how do you actually get involved as a consumer?

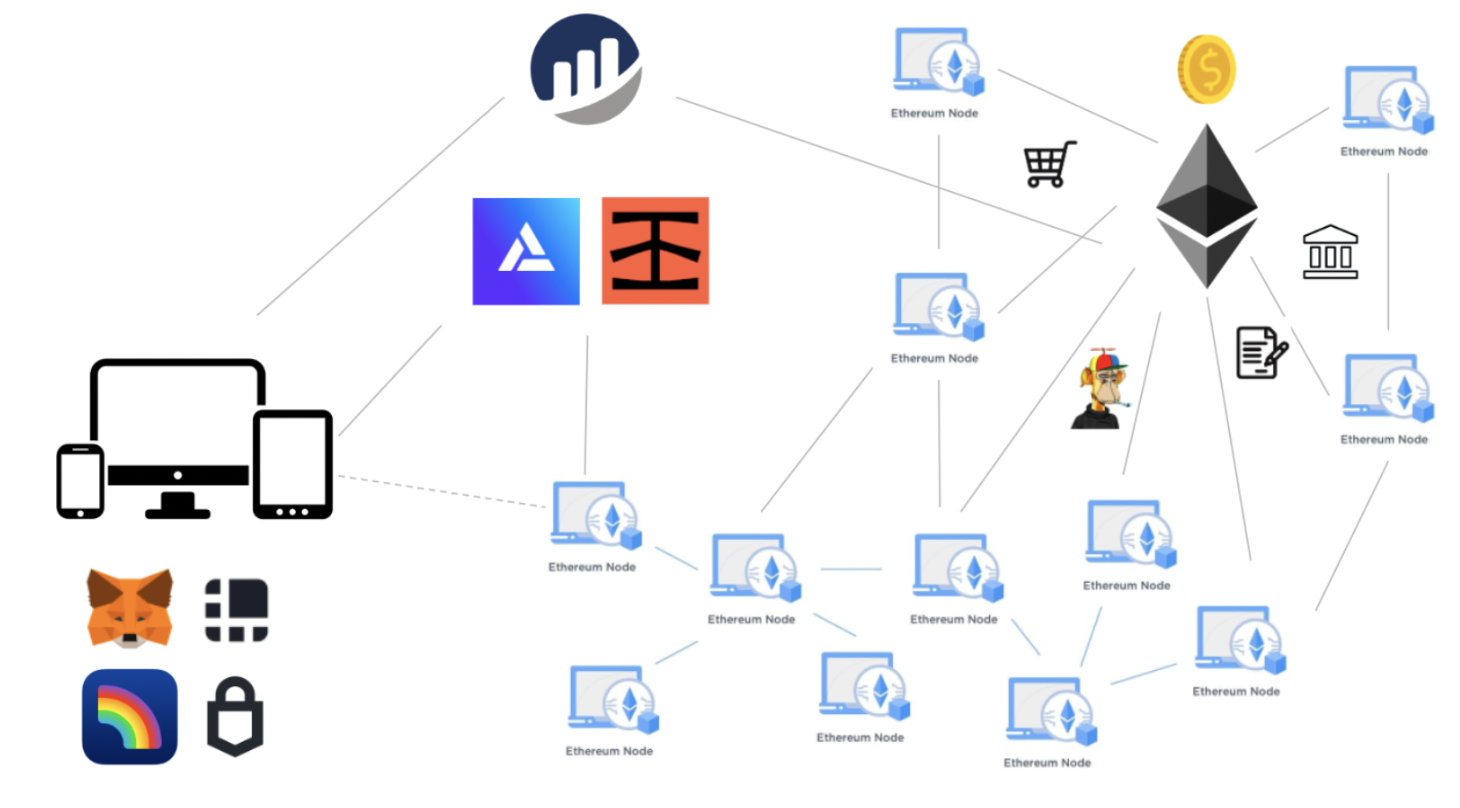

Interacting with the blockchain

If you’ve ever visited a web3 site, you’ll see big letters somewhere telling you to “CONNECT WALLET” before you can really do anything. In order to communicate with the Ethereum blockchain, the dApp or software executing a transaction must connect to an Ethereum node. Connecting to a node allows the program to read information and send transactions to the network (Moralis).

A crypto wallet is your gateway for an Ethereum client to interact with the EVM. A wallet is the key to your digital assets, identity, and currency. Unlike a physical wallet, it doesn’t actually store anything but allows you to access web3 sites and interact with various blockchains. Choose from either a software (online) or hardware (device-based) wallet—there are benefits and drawbacks to both, namely security and utility.

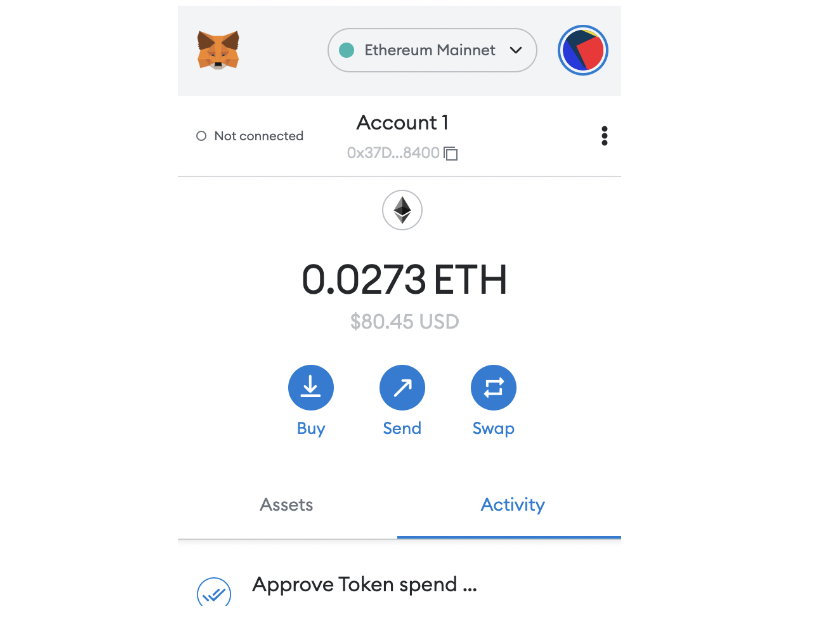

Only once you have acquired many digital assets and a non-negligible sum of cryptocurrency would I recommend a hardware wallet, like Ledger, to use as a vault for your digital valuables. Start with Metamask, a customizable software wallet available as a browser extension. It comes preloaded with connections to the Ethereum blockchain and several other test networks via Infura’s API (Metamask). Go through their signup flow, and make sure to install the browser extension for easy access later.

As illustrated earlier, transactions (txns) require verification from Ethereum nodes before they are written to the blockchain. A txn includes “the address of the receiver, the amount to be transferred, the fees that the sender is willing to pay known as ‘gas’ and the private key authorization to verify the transaction” (Weidner). When a txn is added to the queue, miners will prioritize txns with higher gas fees for faster approval.

In order to pay gas fees, you need to have some crypto in your wallet. Convert fiat to crypto, and transfer that crypto to your Metamask. Purchase crypto with a credit card on a centralized exchange like Coinbase, transfer it to your wallet by clicking “send” and entering your wallet’s address. Using the image above, your wallet’s address can be found under “Account 1”—copy it directly and paste into Coinbase to avoid sending money to the wrong address. Double-check the address is correct. Once a transaction is sent, it cannot be undone.

Browsing Safely

Just as you wouldn’t give your credit card info out willy-nilly, or intentionally download malware, don’t connect your wallet to just any website. Smart contracts are powerful; a simple solidity function can go so far as to transfer all your assets to another wallet.

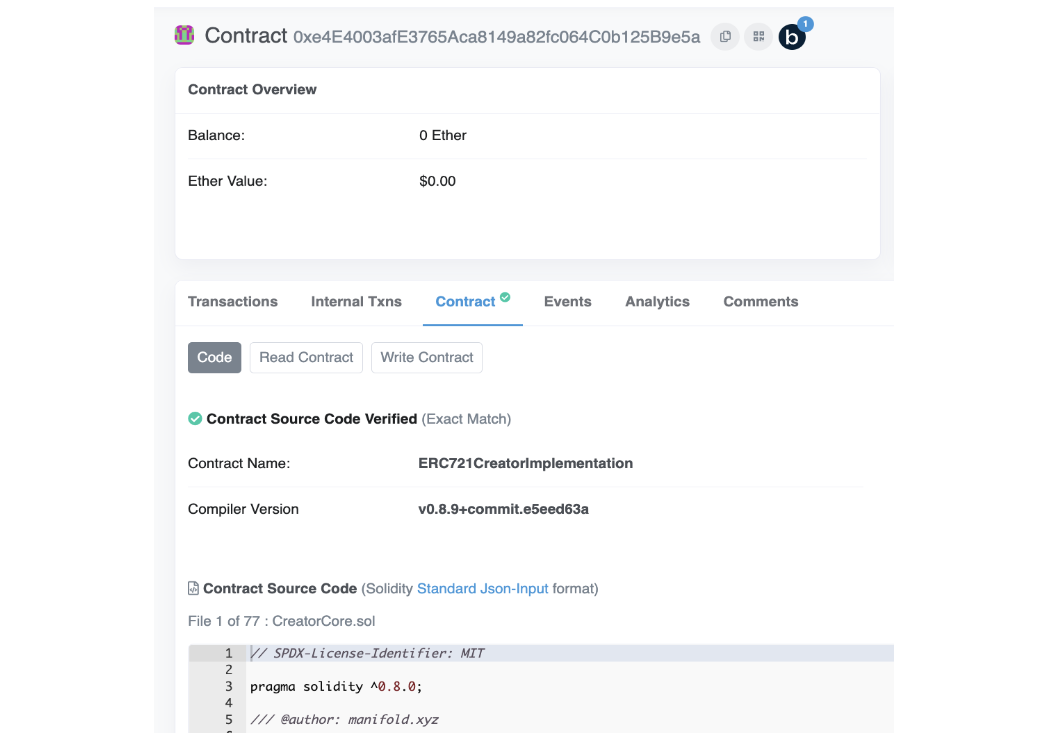

Everything may seem normal until it is too late. You can combat scammers by learning to read smart contracts on Etherscan. Etherscan is an “independent block-explorer that allows you to access details on any Ethereum blockchain transactions that are pending or confirmed” (Cointelegraph, “What Is Etherscan, and How Does It Work?”). Essentially, it is the equivalent of a SQL Server UI for querying immutable Ethereum transactions. Search by address, txn hash, block number, or token name to access all transactions that have come in or out of an address, or learn about a specific transaction.

Above is an example taken from an NFT in my wallet. In the image above, we care about: the contract’s ERC-20 balance, the tab for transactions, and the tab for the contract itself (with source code verified). Because a smart contract is a type of Ethereum account, it can store token balances.

A smart contract is like a vending machine. It has logic built in, only has certain items inside, and “with the right inputs, a certain output is guaranteed” (Buterin). As this contract is simply for deploying an ERC-721, it does not have an ERC-20 balance. We can dive deeper into the transactions from this contract, but we don’t care about that for now. If you are concerned about what a contract does, a guaranteed method is to familiarize yourself with the code. Optionally, you can select “Read Contract” or “Write Contract” to query or execute individual methods of the contract and view their metadata.

Useful Terminology To Know (Unstoppable Domains)

Airdrop: common marketing strategy where projects will send their native tokens directly to a user’s wallet in order to increase awareness and adoption or show appreciation for involvement.

ENS: protocol for human-readable crypto addresses and decentralized domain names.

Gas: a fee paid by a user to conduct a transaction or execute a smart contract on the Ethereum blockchain. This fee is dependent upon network activity and transaction complexity.

Mainnet: short for “main network”, this is a layer 1 blockchain, as opposed to a testnet or layer 2 solution.

Mint: validating information and hashing the validation as a txn onto the blockchain.

On-chain: transactions that occur on a blockchain that are reflected on the distributed, public ledger. Typically refers to metadata, the underlying data behind an asset.

Rollup/Sharding: Ethereum scaling solutions that aim to improve transaction throughput and scalability and decrease fees.

Sidechain: a parallel blockchain used to offload transactions from the main chain in order to increase scalability or add other functionality. Sidechains are connected to their main chain, or parent chain, via a two-way link that allows data and assets to be seamlessly transferred.

Testnet: a software environment that mimics a mainnet blockchain, used to test smart contracts before deploying them to the mainnet.

Txn hash: short for transaction hash. This is a unique identifier used to represent a specific transaction, written as a long string of letters and numbers. By pasting a txn hash into a block explorer like Etherscan, you can find the details of the transaction it represents.

How To Learn In Web3

This space is moving so fast, it’s often hard to find up-to-date information about a given topic. To stay up to date with news and new projects, folks stay active on Twitter and in specific Discord and Telegram communities.

Additionally, reading and writing smart contracts takes practice. I recommend the MEV Army quests for digestible exercises on reading and writing smart contracts on Ethereum. All quests are open-source, on-chain and on the Rinkeby testnet, so they do not cost real money and help familiarize users with the Ethereum network with full transparency.

So.. where to go from here? Try Messari’s Crypto Theses for 2022 for a 150+ page deep dive into most of the topics covered here, use Rabbithole and Coinbase Earn for a “learn to earn” method, complete Buildspace and Ethernaut challenges to begin your solidity journey, and don’t be afraid to meet folks online and ask for help. The best part about the crypto ecosystem is that it’s in its infancy; Everyone is learning together to build a better Web3.

If any of this was useful, or you’d like to chat, find me @zachglabman. Good luck!

References

Bitcoinist. The Big Difference between Bitcoin and Ethereum, according to Founder Vitalik Buterin | Bitcoinist.com. 13 Oct. 2021, bitcoinist.com/the-big-difference-between-bitcoin-and-ethereum-according-to-founder-vitalik-buterin/.

Buterin, Vitalik. “Ethereum Whitepaper.” Ethereum.org, 2013, ethereum.org/en/whitepaper/.

CERN. “A Short History of the Web.” CERN, home.cern/science/computing/birth-web/short-history-web#:~:text=Tim%20Berners%2DLee%20wrote%20the.

Coinmarketcap. “Automated Market Maker (AMM) [Updated] | CoinMarketCap.” CoinMarketCap Alexandria, coinmarketcap.com/alexandria/glossary/automated-market-maker-amm.

---. “SHA-256 | CoinMarketCap.” CoinMarketCap Alexandria, coinmarketcap.com/alexandria/glossary/sha-256.

Cointelegraph. “Blockchain Startups Grow as Global vc Funding Generated $25.2B in 2021.” Cointelegraph, cointelegraph.com/news/blockchain-startups-grow-as-global-vc-funding-generated-25-2b-in-2021.

---. “Fungible vs Nonfungible Tokens: What Is the Difference?” Cointelegraph, cointelegraph.com/nonfungible-tokens-for-beginners/fungible-vs-nonfungible-tokens-what-is-the-difference.

---. “What Is Etherscan, and How Does It Work?” Cointelegraph, cointelegraph.com/news/what-is-etherscan-and-how-does-it-work.

Ethereum Foundation. “EIP.” Ethereum Improvement Proposals, eips.ethereum.org/#:~:text=EIPs.

---. “ERC-721 Non-Fungible Token Standard.” Ethereum.org, ethereum.org/en/developers/docs/standards/tokens/erc-721/#:~:text=The%20ERC%2D721%20(Ethereum%20Request.

---. “Ethereum Virtual Machine (EVM).” Ethereum.org, ethereum.org/en/developers/docs/evm/.

Gondek, Christopher. “What Is Ethereum and What Are Its Use Cases?” Originstamp.com, originstamp.com/blog/what-is-ethereum-and-what-are-its-use-cases/.

Hennekes, Bud. “The 8 Most Important Types of DAOs You Need to Know.” Www.alchemy.com, www.alchemy.com/blog/types-of-daos.

“How DeFi Is Revolutionizing the Financial Industry.” Www.moneycontrol.com, www.moneycontrol.com/msite/wazirx-cryptocontrol-articles/how-defi-is-revolutionizing-the-financial-industry/#:\~:text=A%20DeFi%20protocol%20uses%20computer.

Jin, Li. “The Ownership Economy in 2022” Li’s Newsletter, 28 Apr. 2022, https://li.substack.com/p/the-ownership-economy-2022.

Metamask. “Introduction | MetaMask Docs.” Docs.metamask.io, docs.metamask.io/guide/.

“MLSDev.” Mlsdev.com, 2019, mlsdev.com/blog/156-how-to-build-your-own-blockchain-architecture.

Moralis. “Ethereum RPC Nodes - What They Are and Why You Shouldn’t Use Them» Moralis» the Ultimate Web3 Development Platform.” Moralis» the Ultimate Web3 Development Platform, 22 July 2021, moralis.io/ethereum-rpc-nodes-what-they-are-and-why-you-shouldnt-use-them/#:~:text=Ethereum%20RPC%20Nodes%20%E2%80%94%20JSON%2DRPC.

Nakamoto, Satoshi. “Bitcoin: A Peer-To-Peer Electronic Cash System.” Bitcoin.org, 31 Oct. 2008, bitcoin.org/bitcoin.pdf.

O’Reilly, Tim. “What Is Web 2.0.” Oreilly.com, 2005, www.oreilly.com/pub/a/web2/archive/what-is-web-20.html.

Selkis, Ryan. Key Trends, People, Companies, and Projects to Watch across the Crypto Landscape, with Predictions for 2022. Dec. 2021, messari.io/pdf/messari-report-crypto-theses-for-2022.pdf.

Slalom. “How Blockchain Will Disrupt Your Industry | Slalom.” Slalom, Slalom, 2019, www.slalom.com/insights/how-blockchain-will-disrupt-your-industry.

Szabo, Nick. “Nick Szabo -- the Idea of Smart Contracts.” Www.fon.hum.uva.nl, 1997, www.fon.hum.uva.nl/rob/Courses/InformationInSpeech/CDROM/Literature/LOTwinterschool2006/szabo.best.vwh.net/idea.html.

The Economist. “The Great Chain of Being Sure about Things.” The Economist, 31 Oct. 2015, www.economist.com/briefing/2015/10/31/the-great-chain-of-being-sure-about-things.

Time Magazine. “Time.” Time.com, time.com/connect-crypto-wallet/.

Unstoppable Domains. “The Web3 Glossary.” Unstoppable Domains, Unstoppable Domains, 13 July 2021, unstoppabledomains.com/blog/the-web3-glossary.

Weidner, Dennis. “How Are Ethereum Transactions Verified?” CryptoTicker, 22 Dec. 2019, cryptoticker.io/en/ethereum-transactions-verified/.