TL;DR

-

Prediction markets on Seer suggest ~9–10% of Tesla’s market cap is tied directly to Elon Musk’s presence.

-

Tesla’s valuation isn’t just about EVs — it’s wrapped up in AI, energy, and robotics narratives, most of which are personally associated with Musk.

-

Musk’s growing political persona adds volatility: he’s both Tesla’s greatest asset and its biggest risk.

-

Conditional markets show clear pricing differences between a Musk-led Tesla and a post-Musk Tesla.

-

Tesla is as much a Musk trade as it is an EV play.

Tesla’s Multi-Narrative Valuation

Tesla today isn’t “just a car company.” Investors buy into overlapping stories:

-

EVs – Model 3/Y/S/X dominate, but margin pressure from BYD, NIO, Rivian, and legacy automakers is real.

-

Energy & Storage – Powerwall + Megapack remain under 10% of revenue, but carry long-term optionality.

-

Autonomous Driving & AI – FSD and Dojo position Tesla as an AI/robotics play, not just autos.

-

Robotics & Moonshots – Optimus humanoid robot is early-stage, but investors price in Musk’s track record of turning sci-fi into reality.

The throughline across all these stories? Musk himself. Investors buy Tesla as much for him as for the tech.

The “Musk Premium”

Unlike Toyota or Ford, Tesla’s stock is inseparable from its CEO. The Musk premium is visible in three ways:

-

Innovation halo — Musk signals Tesla is a frontier tech company.

-

Fundraising edge — Billions raised on vision alone.

-

Brand-as-Musk — Tesla spends near-zero on ads; Musk’s persona drives attention and demand.

Quantifying the Musk Premium via Seer

Trad analysts argue about how much of Tesla is “Musk.” But prediction markets let us see how investors actually price it.

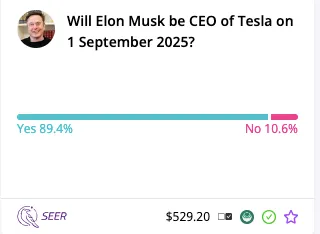

On Seer, users bet on whether Musk remains Tesla’s CEO by Sept 1, 2025.

That market is linked to two conditional markets:

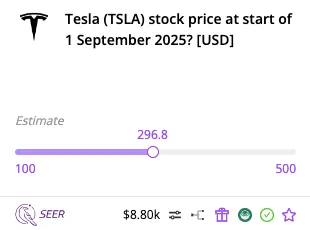

1. Tesla stock price if Musk stays CEO

2. Tesla stock price if Musk steps down

Together, these imply ~9% of Tesla’s valuation depends directly on Musk. That’s not analyst speculation — it’s money-on-chain sentiment.

🌀 This is where web3 intersects with tradfi: prediction markets make investor psychology quantifiable, transparent, and tradable.

The New Variable: Politics

Musk’s influence now extends beyond tech:

-

Polarization — He’s embraced partisan positions that alienate some buyers.

-

Regulation — EV incentives depend on governments Musk often clashes with.

-

Volatility via X — A tweet can move markets.

The Musk premium today isn’t just tech-vision upside; it’s political risk baked into a stock.

Founder Dependency in Context

Tesla isn’t unique — Apple, Amazon, and even OpenAI faced founder-driven valuation shocks. The lesson: transitions can work, but require institutional resilience.

Investor Takeaways

-

Tesla is a multi-narrative bet (EVs, AI, energy, robotics), but Musk is the narrative glue.

-

Prediction markets suggest ~10% of market cap is Musk-dependent.

-

Political overexposure makes that premium more volatile than ever.

-

For both investors and market-watchers, Tesla isn’t just about cars — it’s about the evolving Musk trade.

FAQ

Q: How much of Tesla’s value is Musk?

≈ 9–10%, based on prediction market pricing.

Q: Why Seer?

Because it converts sentiment into tradable probabilities — no analyst bias, just crowd risk assessment.

Q: Do Musk’s politics affect Tesla?

Yes. His persona now shapes consumer demand, regulator relations, and ESG narratives.

✦ If you want to explore the markets directly: