Version 1.0 | Liquify Labs | contact@liquify.ventures |

Abstract. Liquify is a Decentralized Liquidity Provision Platform designed to transform how token allocations are managed in the DeFi ecosystem. Traditional token vesting models often result in locked capital and reduced liquidity, limiting flexibility and market participation for both initiators and investors. Liquify addresses these limitations by introducing a Liquid Vesting mechanism, which enables the issuance and trading of liquid tokens representing future vested tokens across multiple vesting periods. The platform allows anyone with any form of token allocation to provide immediate liquidity, enabling dynamic market engagement and capital efficiency. By leveraging liquid tokens, participants can unlock value without waiting for vesting periods to conclude, enhancing access to early-stage investments and promoting a more flexible, liquid market environment. Liquify sets a new standard for liquidity management and investment participation in decentralized finance.

Table of Contents

-

Introduction

1.1. Background

1.2. Problem Statement

1.3. Vision and Mission

-

Liquid Vesting Mechanism

2.1. Definition and Purpose

2.2. Liquid Tokens

3.3. Liquidity and Tradeability

-

Platform Architecture

3.1. Technology Stack

3.2. Smart Contract Functionality

3.3. System Interoperability

-

Wave Points (Work in Progress for Version 2.0)

-

Tokenomics (Work in Progress for Version 2.0)

-

Use Cases for Initiators

6.1. Instant Liquidity - Unlocking Liquidity and Value Pre-TGE

6.2. Instant De-risk - Strategies for Instant De-Risking and Capital Recovery

6.3. Automated Processes

6.4. Dynamic Tokenomics for Blockchain Projects

-

Roadmap (Work in Progress for Version 2.0)

2. Introduction

The landscape of decentralized finance (DeFi) is rapidly evolving, with new projects continuously emerging to solve existing challenges and unlock new opportunities. One of the significant barriers that have persisted is the issue of liquidity during the early stages of a project, particularly around the period before and during token vesting schedules.

Traditional investment models often lead to prolonged periods of illiquidity, where both initiators and investors find their capital locked up until token vesting is complete. This not only limits capital efficiency but also hinders market participation and growth potential. Liquify aims to revolutionize this aspect of the DeFi ecosystem by introducing innovative mechanisms that provide liquidity throughout the entire vesting lifecycle, not just before the Token Generation Event (TGE).

2.1 Background

In the world of blockchain and cryptocurrency, token generation events (TGEs) and vesting schedules have become standard practices for launching new projects and distributing tokens. These mechanisms are designed to align incentives among project teams, early investors, and the broader community, ensuring that all parties have a stake in the project's long-term success. However, this traditional approach often results in significant liquidity challenges.

Typically, tokens allocated to early investors and team members are subject to lengthy vesting periods, during which they cannot be sold or traded. This creates a situation where economic energy is locked up, preventing both founders and investors from accessing or utilizing their capital efficiently. The inability to trade or liquidate these vested tokens often leads to a lack of flexibility and can restrict the project's growth, as it discourages further investment and reduces market dynamics.

Furthermore, the challenge of quantifying the value of a project before its actual release becomes a significant concern. The illiquidity of tokens makes it difficult for the market to gauge the project's potential, leading to undervaluation or overvaluation based on speculation rather than actual market participation and utility.

2.2 Problem Statement

The current approach to token vesting and allocation creates several critical issues:

-

Liquidity Constraints (inability to access or trade assets): Traditional vesting models restrict liquidity, locking up capital until tokens are fully vested. This limits both founders' ability to raise additional funds and investors' capacity to adjust their portfolios or exit positions when needed.

-

Valuation Challenges: The absence of liquidity and tradeable tokens before and during the vesting period makes it challenging to assess a project's true market value. Investors and stakeholders are often left to rely on speculative assessments rather than real market data, leading to potential mispricing and inefficient capital allocation.

-

Inefficient Capital Utilization: The inability to access or leverage locked-up capital during the vesting period results in suboptimal use of resources. This inefficiency impacts both early-stage investors looking for flexibility and projects needing additional funding to drive growth and development.

Liquify addresses these challenges by introducing a novel solution—Liquid Vesting—which allows for the creation and trading of synthetic tokens that represent future vested tokens. This innovative mechanism provides immediate liquidity and tradeability, enabling both initiators and investors to dynamically engage with the market from the outset.

2.3 Vision and Mission

At Liquify, we envision a future where no blockchain project is constrained by illiquid tokens. We believe that for too long, economic energy has been unnecessarily locked up before TGEs, creating barriers to growth and innovation. Our mission is to transform how the market interacts with early-stage investments by ensuring that liquidity is a fundamental feature of token allocations.

We believe that an idea's value can and should be quantified even before the launch of a project. By introducing Liquid Vesting, we are pioneering a new standard where synthetic tokens provide immediate liquidity, allowing for more accurate and dynamic valuation based on actual market demand and participation.

Our goal is to democratize access to liquidity and enable a more efficient and flexible investment environment in the DeFi ecosystem, fostering innovation and growth without the traditional constraints of illiquidity.

Liquid Vesting Mechanism

The Liquid Vesting Mechanism introduced by Liquify addresses the liquidity challenges inherent in traditional token vesting schedules. By using liquid tokens—digital assets that represent future vested tokens—this mechanism provides a solution for founders and investors to access liquidity throughout the vesting period.

2.1 Definition and Purpose

Definition: The Liquid Vesting Mechanism is designed to provide immediate liquidity for token allocations under vesting schedules. It allows for the issuance of liquid tokens, which mirror the value and terms of vested tokens, making them tradeable from the moment of issuance.

Purpose: The goal of the Liquid Vesting Mechanism is to overcome the liquidity constraints of conventional vesting models by allowing the trading of liquid tokens. This enables dynamic market participation and provides key benefits such as:

-

Capital Efficiency: Investors can access liquidity without waiting for vesting periods to end, optimizing capital use.

-

Market Dynamics: Trading liquid tokens fosters a more active market, improving price discovery and valuation.

-

Flexibility for Founders: Founders can offer early token access while maintaining control over vesting, enhancing fundraising and community engagement.

2. Liquid Tokens

Definition: Liquid tokens are a unique type of digital asset created to provide immediate liquidity for tokens that are typically locked in vesting schedules. They are tradeable from issuance and represent the future value of vested tokens, offering flexibility and liquidity even before vesting periods conclude.

Functionality: Issued at the time of allocation, liquid tokens are directly linked to the underlying vested tokens, maintaining their value and terms. They can be freely traded on the Liquify platform, allowing investors to buy or sell based on market conditions. Once the vesting schedule is complete, liquid tokens convert seamlessly into the actual tokens, ensuring uninterrupted liquidity.

Advantages of Liquid Tokens:

-

Immediate Liquidity: Investors can trade liquid tokens from day one, avoiding the constraints of traditional vesting periods.

-

Hedging and Diversification: Liquid tokens allow for risk management and portfolio diversification by enabling the trading of assets that would otherwise be locked.

-

Broader Market Participation: The tradability of liquid tokens attracts diverse investors and fosters a more dynamic market environment.

Significance of the Liquid Tokens Concept:

The introduction of liquid tokens represents a paradigm shift in how token allocations and vesting are managed within the DeFi ecosystem. By providing a tool for immediate liquidity, liquid tokens solve a fundamental problem that has long plagued early-stage investments: the locking up of economic value. With liquid tokens, investors and project initiators can unlock this value from the outset, enabling more efficient capital utilization and fostering a more vibrant, liquid market.

Through the use of liquid tokens, Liquify not only democratizes access to early-stage investments but also empowers all participants in the ecosystem to maximize their capital efficiency and strategic flexibility. This innovative approach is set to redefine the standards of liquidity and investment participation in the DeFi space, paving the way for a future where economic energy is never unnecessarily locked away.

2.3 Liquidity and Tradeability

Overview:

The ability to trade liquid tokens throughout the vesting period is a core feature, ensuring continuous liquidity for investors. This directly addresses liquidity constraints in early-stage investments.

Liquidity Provision:

Liquid tokens can be traded immediately, providing ongoing liquidity. This allows investors to adjust their positions based on market needs, reducing risks associated with long lock-up periods.

Tradeability Features:

-

Decentralized Platform: Liquify enables peer-to-peer trading of liquid tokens without intermediaries, enhancing transparency and efficiency.

-

Market Dynamics: Continuous trading supports active market participation and real-time price discovery.

-

User Flexibility: Both founders and investors benefit from the ability to trade liquid tokens, optimizing capital use and investment strategies.

By integrating decentralized finance principles with liquid tokens, Liquify’s Liquid Vesting Mechanism offers a solution to the traditional challenges of token vesting, liquidity, and market participation, creating a more accessible and dynamic DeFi environment.

3. Platform Architecture

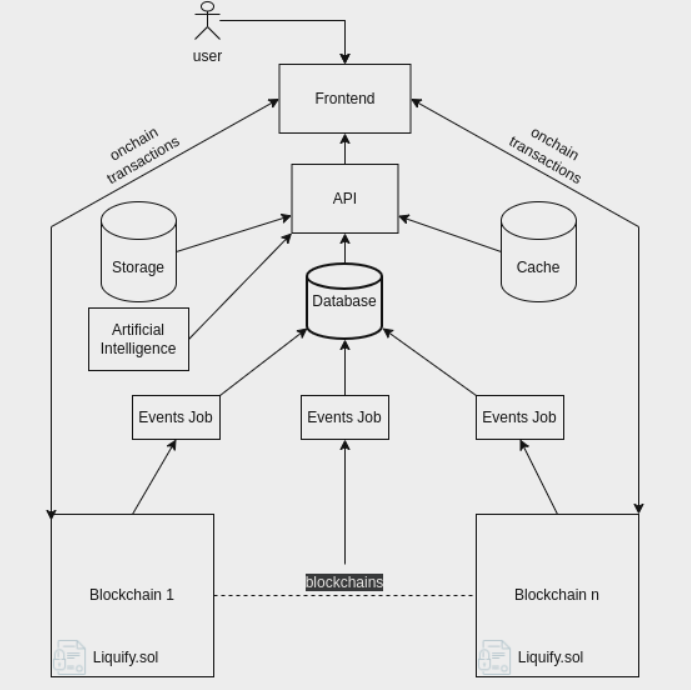

Liquify's platform architecture is designed for scalability, efficiency, and autonomy, combining decentralized smart contract technology with centralized data management. At its core is the Liquify.sol smart contract, deployed independently on multiple EVM-compatible blockchains. Each deployment operates autonomously, ensuring that projects and their corresponding tokens remain fully independent across chains.

3.1. Technology Stack

The Liquify platform integrates several key components:

-

Smart Contract (Liquify.sol): A singleton smart contract, Liquify.sol, serves as the backbone of the platform. Deployed on multiple EVM chains, it independently manages all aspects of project creation, token issuance, vesting schedules, and trading. This independence allows each deployment to function autonomously without relying on cross-chain interoperability.

-

Backend Infrastructure: The backend captures and processes events emitted by the Liquify.sol contracts, securely storing data in a centralized database. This ensures accurate and real-time data synchronization with the frontend.

-

Frontend Interface: A user-friendly interface connects to the backend, providing users with real-time access to their investments, token balances, and vesting schedules. The frontend simplifies interaction with the platform, enabling seamless management of assets across multiple chains.

-

Artificial Intelligence (AI) Engine: The AI engine is designed to automatically process and analyze datasets provided by initiators. By extracting key information and fulfilling all necessary data labels, the AI enables efficient data categorization, enhances data accuracy, and reduces manual input.

3.2. Smart Contract Functionality

The Liquify.sol smart contract is the cornerstone of Liquify's decentralized operations, with the following key functionalities:

-

Project and Token Management: The contract allows initiators to create projects, specifying token allocations, vesting schedules, and investment parameters. For each vesting round, it generates unique ERC-20 tokens that represent the vested value, enabling flexible liquidity management.

-

Event Emission: The contract emits events for actions such as investments, token issuance, and vesting updates. These events are processed by the backend to maintain an accurate and transparent record of all activities.

-

Token Vesting: Liquify.sol supports decentralized Liquidity Provision Event, allowing users to invest in projects and receive liquid tokens corresponding to different vesting stages. These tokens can be traded independently on the same chain, providing liquidity even before the vesting period ends.

-

Resale and Flexibility: Investors can resell their tickets or partial tickets directly on the chain where they were issued, offering flexibility and liquidity without cross-chain dependencies.

3.3. System Independence and Interoperability

Liquify’s architecture ensures that each deployment of the Liquify.sol contract operates independently:

-

Autonomous Deployments: Each smart contract deployment on different EVM-compatible chains functions autonomously, with no reliance on cross-chain communication. This independence ensures that projects and tokens remain fully self-contained within their respective chains.

-

Centralized Data Management: The backend collects and processes data from all contract deployments, storing it in a unified database. This allows for consistent and accurate information across the platform, while maintaining the autonomy of each contract instance.

-

Seamless User Experience: The frontend bridges the gap between decentralized operations and user interaction, providing a coherent and intuitive experience regardless of the underlying blockchain. Users can easily manage their assets, view vesting schedules, and engage in token trading through a single, integrated interface.

By combining the autonomous functionality of the Liquify.sol smart contract with centralized data management, Liquify’s platform architecture delivers a robust and flexible solution for managing token vesting, liquidity, and project participation across multiple independent blockchain deployments.

6. Use Cases for Initiators

6.1. Instant Liquidity - Unlocking Liquidity and Value Pre-TGE

Instant Liquidity offers initiators a groundbreaking approach to unlocking capital and fostering market engagement before the Token Generation Event (TGE). By issuing synthetic tokens that represent future vested tokens, initiators—including Key Opinion Leaders (KOLs), venture capitalists (VCs), community VCs, validators, and dApp founders—can provide their communities with immediate liquidity and tradable assets, even during the pre-TGE phase. This approach enhances capital efficiency, allowing initiators to actively engage in market dynamics early on and respond to changing market conditions.

Example Use Case: A venture capital firm invested in a blockchain project during its seed round, with tokens locked under a traditional vesting schedule. Instead of waiting until the TGE, the firm uses Liquify's Instant Liquidity feature to issue synthetic tokens that represent the future vested tokens. These synthetic tokens are then traded on secondary markets, providing immediate liquidity that the firm can use to reinvest in new projects or adjust its portfolio dynamically. The community also benefits by gaining early exposure to the project's growth potential, increasing engagement and fostering a supportive ecosystem.

6.2. Instant De-risk - Strategies for Instant De-Risking and Capital Recovery

Instant De-risk is a strategic feature that provides initiators with the flexibility to manage investment risks and achieve capital recovery during the early stages of a project. In the volatile landscape of early-stage investments, the ability to quickly de-risk is essential to maintain financial stability and adaptability. Liquify's platform facilitates this by enabling initiators to resell their token allocations as synthetic tokens, even before the Token Generation Event (TGE). This process allows initiators to liquidate portions of their allocations, thereby recouping part of their initial investment while reducing exposure to market volatility and project-specific risks.

By reselling tokens in the form of synthetic assets, initiators can quickly adjust their portfolios, freeing up capital for new opportunities or mitigating potential losses. This flexibility is particularly valuable for venture capitalists, community VCs, and key opinion leaders (KOLs) who need to dynamically manage their investments. The ability to resell token allocations ensures a more fluid approach to investment management, enhancing both liquidity and risk management strategies while maintaining engagement with the project's growth potential.

Example Use Case: A Key Opinion Leader (KOL) receives a token allocation from a new blockchain project, with a lock-up period restricting immediate access. To manage risk and gain liquidity, the KOL uses Liquify's Instant De-risk feature to resell a portion of these tokens as synthetic assets before the vesting period ends. This allows the KOL to recover some capital early, reducing exposure to market volatility, while offering their community members early access to the project's tokens. This strategy helps the KOL balance risk and liquidity, while fostering community engagement in the project’s growth.

6.3. Automated Processes

Liquify’s Automated Processes feature significantly simplifies the management of token allocations and vesting schedules, reducing the administrative burden on initiators. Traditionally, community VCs conduct Capital Formation within their communities in a centralized manner, manually managing the distribution of tokens. This process involves extensive effort to track each investor’s status and allocation, often using complex spreadsheets and manual operations, which can be error-prone and inefficient. Liquify automates these workflows, providing a secure, decentralized platform for managing Liquidity Provision Events and token distribution.

With Liquify, community VCs can conduct Liquidity Provision Event campaigns on a decentralized platform, offering participants liquid tokens that can be traded immediately, even before the actual tokens are available. Once the real tokens are ready, the VC simply deposits them into the Liquify platform. Liquify then handles the distribution of these real tokens in exchange for the liquid tokens in a fully decentralized manner. This ensures a transparent, error-free process that enhances trust and efficiency while allowing VCs to focus on strategic growth and community building.

Example Use Case:

A community VC manages multiple early-stage blockchain projects and typically conducts capital formation in a centralized manner, manually distributing tokens to investors. This process is time-consuming and prone to errors. By using Liquify's Automated Processes, the VC can run Liquidity Provision Event campaigns directly on the platform, issuing liquid tokens to investors that are tradable immediately. When the actual project tokens are ready, the VC deposits them into Liquify, which then automatically and securely distributes the real tokens to investors in exchange for their liquid tokens. This automation not only saves time and reduces administrative overhead but also ensures a secure and transparent token distribution process, benefiting both the VC and the community.

6.4. Dynamic Tokenomics for Blockchain Projects

For blockchain projects, Liquify provides a powerful tool to design and implement a more dynamic and liquid tokenomics model. Instead of adhering to rigid, traditional vesting schedules, project founders can use Liquify to make their entire or partial tokenomics structure more flexible. By issuing liquid tokens that represent future vested allocations, projects can maintain continuous liquidity, enhance market-driven price discovery, and incentivize early participation and engagement from their communities. The price of these liquid tokens will serve as a real-time indicator of the project's valuation, providing valuable insights into market sentiment before the Token Generation Event (TGE).

Example Use Case:

A blockchain project founder launching a new network aims to avoid the common issues of token illiquidity and limited market engagement typically associated with traditional vesting schedules. By leveraging Liquify’s platform, the founder chooses to adopt a more dynamic tokenomics model. This involves issuing synthetic tokens from the outset that represent all or part of future vested tokens. These liquid tokens can be traded immediately, establishing a liquid market that reflects the project's perceived value in real-time. As these liquid tokens trade on the open market, their price provides an early, market-driven valuation of the project before the TGE, allowing the project to gauge investor interest and adjust strategies accordingly. Investors benefit from early access to liquid assets and can actively participate in the project’s growth, while the project gains from continuous market engagement and dynamic capital flow, improving both valuation and community involvement.

3. Roadmap:

V1 - Sept 2024:

-

Onboarding Initiators (Whitelist + KYC)

-

Liquid Vesting Live (Investing, Refund, Synthetic Tokens & Exchanging them for Real Tokens)

-

Referral program & Wave Points - Activity Based

V2 - Q1 2025:

-

Initiators Buffer

-

Whitelisted Projects (by Address or NFT Ownership)

-

Private Projects for Initiators

-

Resell Allocations

-

Liquify LITE

V3 - Q2 2025:

-

Liquid Tokens Marketplace

-

Projects Page (Allocations Creator by Projects)

-

Token Launch -> Wave Points Conversion

Glossary

-

User: An individual who can participate in projects by contributing resources. Users can engage in various activities on the platform, including acquiring synthetic tokens.

-

Initiator: A project creator who can be a Key Opinion Leader (KOL), Venture Capitalist (VC), Community VC, validator, decentralized application (dApp) founder, or anyone with vested tokens or project allocations that are not liquid in any manner. Initiators are responsible for launching projects, issuing tokens, and managing token vesting schedules on the Liquify platform.

-

Liquid Tokens: ERC-20 tokens that represent future vested tokens. These tokens are issued at the time of contribution and provide immediate liquidity and tradeability. Liquid tokens mirror the value and terms of the vested tokens, enabling market participation before the actual tokens are unlocked. They maintain a 1:1 parity with the real tokens.

-

Real Tokens: The actual tokens of a project that are subject to vesting schedules. These tokens are only accessible once the vesting period ends and can represent various forms of digital assets or cryptocurrencies.

-

Token Generation Event (TGE): A specific event when a project officially issues its tokens to the public or participants. It marks the beginning of the token's availability in the market.

-

Vesting Period: A predefined duration during which allocated tokens remain locked and cannot be accessed or traded by the holders. Vesting periods are commonly used to incentivize long-term commitment to a project.

-

Synthetic Tokens: Another term used for liquid tokens on the Liquify platform. They represent the future value of vested tokens and provide immediate liquidity and tradeability before the actual tokens are unlocked.

-

Instant Liquidity: A feature that allows initiators to provide immediate liquidity to their community by issuing liquid tokens representing future vested tokens before the Token Generation Event (TGE). This approach enhances capital efficiency and early market engagement.

-

Instant De-risk: A strategy that enables initiators to manage investment risks and recover capital early by reselling liquid tokens even before the Token Generation Event (TGE). This feature allows for flexible portfolio management and reduces exposure to market volatility.

-

Automated Processes: A feature that automates the management of token allocations, capital formation, and distribution, reducing the administrative burden on initiators. It streamlines token management by providing a secure, decentralized platform for these activities.

-

Dynamic Tokenomics: A flexible model for managing token allocations and market engagement. By issuing liquid tokens that represent future vested allocations, projects can maintain continuous liquidity, enhance price discovery, and incentivize early participation and engagement from their communities.

-

Key Opinion Leader (KOL): An influential individual in the blockchain or cryptocurrency space who can promote and support a project. KOLs often receive token allocations as part of their involvement in a project.

-

Venture Capitalist (VC): An investor or investment firm that provides capital to startups and emerging projects, typically in exchange for equity or tokens. VCs are key participants in early-stage investments.

-

Community VC: A decentralized group or community-based venture capital entity that pools resources to invest in early-stage projects. They often represent the interests of a specific community or group of users.

-

Validator: An entity or individual responsible for validating transactions and maintaining the security of a blockchain network. Validators can also be project initiators on the Liquify platform, issuing tokens and managing vesting schedules.

-

Decentralized Platform: A platform that operates on blockchain technology, enabling peer-to-peer interactions without intermediaries. Liquify's decentralized platform allows users to trade liquid tokens directly and transparently.

-

EVM-Compatible Blockchain: A blockchain network compatible with the Ethereum Virtual Machine (EVM), enabling smart contracts and decentralized applications (dApps) to operate across multiple blockchains with similar functionalities.

-

Liquidity Provision Event: A method for raising capital where a project gathers resources from a group of participants. Participants receive tokens in exchange for their contributions, providing liquidity and fostering market engagement without legal implications.

-

Market Dynamics: The factors and forces that impact the price and availability of tokens in a market. In the context of Liquify, market dynamics are influenced by the continuous trading of liquid tokens.

-

Capital Efficiency: The optimal use of capital to maximize returns and minimize waste. Liquify aims to improve capital efficiency by providing liquidity throughout the token vesting lifecycle.

-

Price Discovery: The process through which the market determines the price of an asset based on supply and demand. The trading of liquid tokens facilitates real-time price discovery for projects on the Liquify platform.

-

Economic Energy: A term used to describe the potential value and utility of capital that is currently locked up and not being used efficiently. Liquify seeks to unlock this economic energy by providing liquidity solutions.

-

System Interoperability: The ability of different systems or blockchains to interact and operate together seamlessly. While Liquify maintains independent deployments across EVM-compatible chains, it ensures centralized data management for a unified user experience.

-

Singleton Smart Contract: A unique smart contract deployed on multiple blockchains that operates autonomously and independently across each chain. In Liquify, the singleton smart contract (Liquify.sol) manages project creation, token issuance, vesting schedules, and trading.