Everything in crypto WILL BE incentivised. It’s the opposite of the race to the bottom, and it’s a one-way street.

Token initial distribution has become more of a dilemma over the past year, on a scale of “SOL ecosystem tokens” to “ENS”, how does the founding team find the silver lining?

Distributing a meaningful percentage of the supply “fairly”, while maintaining sufficient liquidity, and facilitate initial pricing has been a challenge; and there’s no best solution yet. Besides the running joke of a “fair launch auction”, real attempts were made by teams such as Delphi with their lock-drop design. As teams explore different options there’s a common theme of rewarding early supporters, going forward I believe retroactive rewards to be the norm of initial token distribution replacing public sales for a few reasons:

- Over the course of 2021 we have witnessed the sheer amount of attention generated by high-profile airdrops, $DYDX $ENS were talk of the town for months, and till this day I involuntarily slap myself in the face whenever I see their tickers. Web3 has changed the way I live; Impactful indeed.

- The explosion of NFT use-cases starring “on-chain achievement badges” and royalty programs, which is a clearly superior community bootstrapping mechanism than existing marketing outlets; the participation is gamified, the experience is interactive, and the rewards are mutually beneficial (on-chain data give teams targeted information and flexibility in structuring their reward distributions).

- It’s THE most “web3 way” to stimulus initial growth and distribute your stakes; Look at Opensea for how much shit they got for not giving the community a piece of the pie. Everything in crypto WILL BE incentivised, it’s the opposite of the race to the bottom, and it’s a one-way street.

Is the golden age of airdrops behind us?

The lengths Paraswap went to filter out airdrop hunters was debatable, and it certainly backfired on them. However it was necessary; the golden age of “0.42 ETH spread across 69 metamask accounts swapping $1 back and forth” is over. Although there will be casualties, projects will follow Paraswap’s footsteps in weeding out those (weasels that retired in 2021 phuc me!!!), dapps such as BrightID might play a role as well.

On a positive note for you degenerate gamblers, there’s a JPEG market on the rise to potentially speculate and bet on airdrops. After Biconomy & Hashflow airdropping to their NFT holders, Project Galaxy seems to be the next in line with a great resume:

- First notable “Web3 protocol” to find tangible product-market fit (in a short span of time).

- Pioneering actual NFT utility. (The market demand for exploring NFT use-cases is unreal. It’s under the spotlight, at the right time, and has all the buzzwords going for it.)

- Backers with “big trumpet milk”; It will be “reshaping the fabrics of society” as soon as the token launches later this year.

Project Galaxy officially hinted that holders of their galaxy girl NFT will be receiving future benefits (airdrop emoji). Additionally, I suspect their first collection (Shadowy Super Coder) will be receiving more tokens for 2 reasons:

- The collection carries way more industry significance, and the fact that they put in a lot of effort into that campaign, collaborating with 10 projects to give back to builders.

- 3 days after they teased to launch their token on twitter, the campaign ended on 27th Jan, and you can no longer claim this NFT. 110k ETH addresses were eligible whereas only 1700 NFTs were claimed. If project galaxy doesn’t pull a @BETAfinance, this collection should get more tokens than galaxy girl.

Trade Idea:

Below is pure speculation and not financial advice, please don’t ape blindly, numbers are pull from my ass exclusively:

Excluding the rare cases such as @BETAfinance (0.5%) and ENS (25%), normally projects without a public sale would airdrop on average 5-7% of their supply, with the closest comparable case here being Hashflow which airdrop 6.75% to their NFT holders.

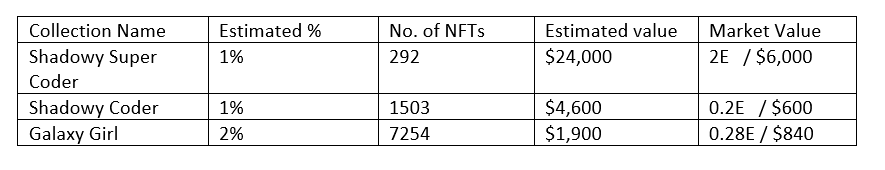

Below are my speculative calculations for Project Galaxy:

- Estimated FDV upon listing – 700m (This is as conservative as it gets)

- Estimated % to NFT holders – 4%