Stablecoins: The Key to Crypto Adoption

Stablecoins are the answer to how we trade, pay, and save in the digital world. Pegged to assets like the US dollar, they offer steady prices—unlike the volatile $BTC, $ETH, etc.

Let's find out how stablecoins are changing the world.

Stablecoin Appeal

Unlike the rollercoaster ride of other cryptocurrencies, stablecoins offer compelling benefits that make them perfect for everyday use:

-

Efficiency: Transactions settle in seconds, and fees are often negligible. This is a huge upgrade to the slow processes of traditional banking. You could send money across the globe in the blink of an eye.

-

Accessibility: Anyone with a crypto wallet can use them. There are no bank accounts, credit checks, or other hurdles. This opens the door for millions who have been locked out of traditional financial systems.

-

Reliability: Because they avoid heavy price swings, they are a trusty medium for everything from buying a cup of coffee to paying employees or getting paid yourself.

The TradFi Bridge

Stablecoins have caught the interest of institutions, including big names like JP Morgan, Bank of America, and PayPal. These companies have already integrated stablecoins into their operations or announced plans to do so.

With more companies joining the crowd, stablecoins are seen as the most sensible way to do business on-chain. This not only validates crypto, but also ushers in a new era of efficient, digital money.

A Lifeline

Stablecoins aren't confined to the US or any country for that matter. They're making a profound impact worldwide, especially in countries dealing with economic instability.

In Argentina for example, many people are turning to stablecoins to protect against inflation of the local currency. This allows them to preserve their savings amidst a changing landscape.

In Nigeria, stablecoins are being used to address the foreign currency shortages, breaking down barriers to internaitonal trade.

For the millions without access to traditional financial systems, stablecoins are a game-changer. They empower people to participate in the global economy in a way they never could before.

Globally, stablecoins are banking the unbanked.

Stablecoin Legislations

As stablecoins rise in popularity, regulators are stepping in to ensure safety and trust. Two notable stablecoin legislations include:

The STABLE Act:

-

Set strict rules for stablecoin issuers, requiring 1:1 backing with the US dollar.

-

Established a clear structure for issuing, requiring issuers to be approved.

-

Encouraged compatibility standards, with the goal of maintaining US leadership in digital finance.

The GENIUS Act:

-

Officially classifies stablecoins as a payment tool, not a security.

-

More regulatory guidelines on becoming an issuer for stablecoins, including a requirement for issuers to be incorporated in the US.

-

Issuers are required to undergo regular audits to make sure their reserves are legitimate.

Future of Stables

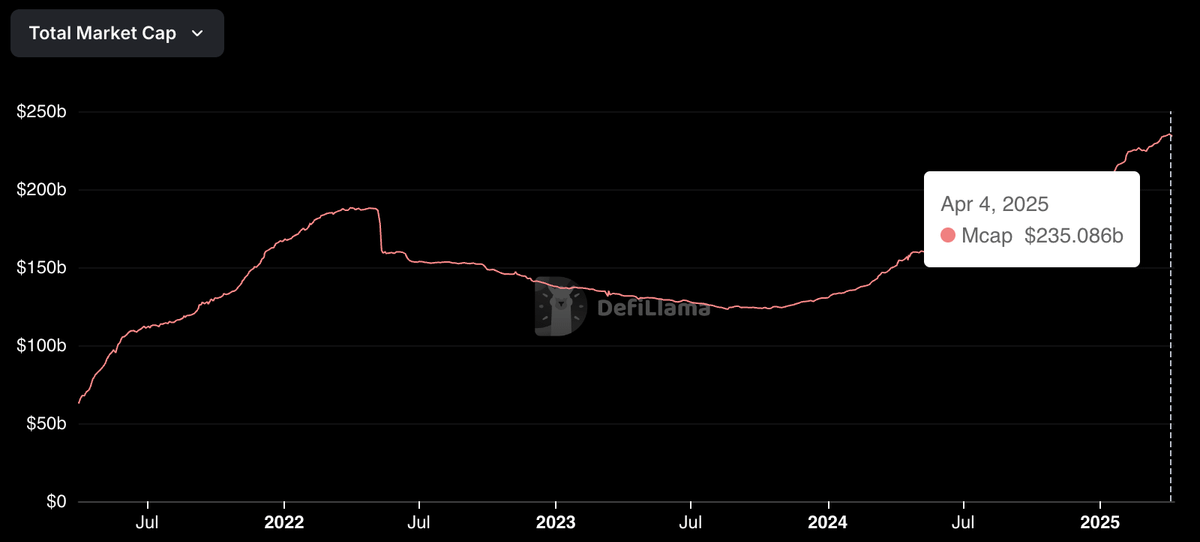

Stablecoins have shown significant growth, with their market cap nearly doubling from $123 billion in late 2023 to $235 billion today. There's a lot of speculation about just how big stablecoins will be, but analysts at Bernstein offer a grounded projection: a 100%+ surge to $500 billion. This increase is set to be fueled by improved regulatory clarity, institutional adoption, and further integration in global finance.

Final Thoughts

By unlocking efficiency, lowering borders, and being a reliable means of transacting online, stablecoins are poised to become the cornerstone of the digital economy. From Buenos Aires to Lagos, Wall Street to Main Street, stablecoins are proving there is a future where money moves faster, reaches farther, and works for anyone.

Stablecoins aren't just changing the world, they're building a better one.