The crypto market is reeling. Bitcoin has plummeted since President Trump announced his tariffs. He most recently unveiled sweeping tariffs on April 2, 2025, sending Bitcoin crashing from $88,000 to below $74,000. Ethereum’s taken an even harder hit, crashing to $1,500 — a staggering 62.5% drop from its cycle peak above $4,000. Altcoins? Many are down 40% or more, with liquidations racking up billions in losses. It’s a bloodbath out there.

But despite the downturns, crypto’s never looked more promising. Let’s unpack what’s happening, why this downturn is different, and how the chaos might be paving the way for a brighter future.

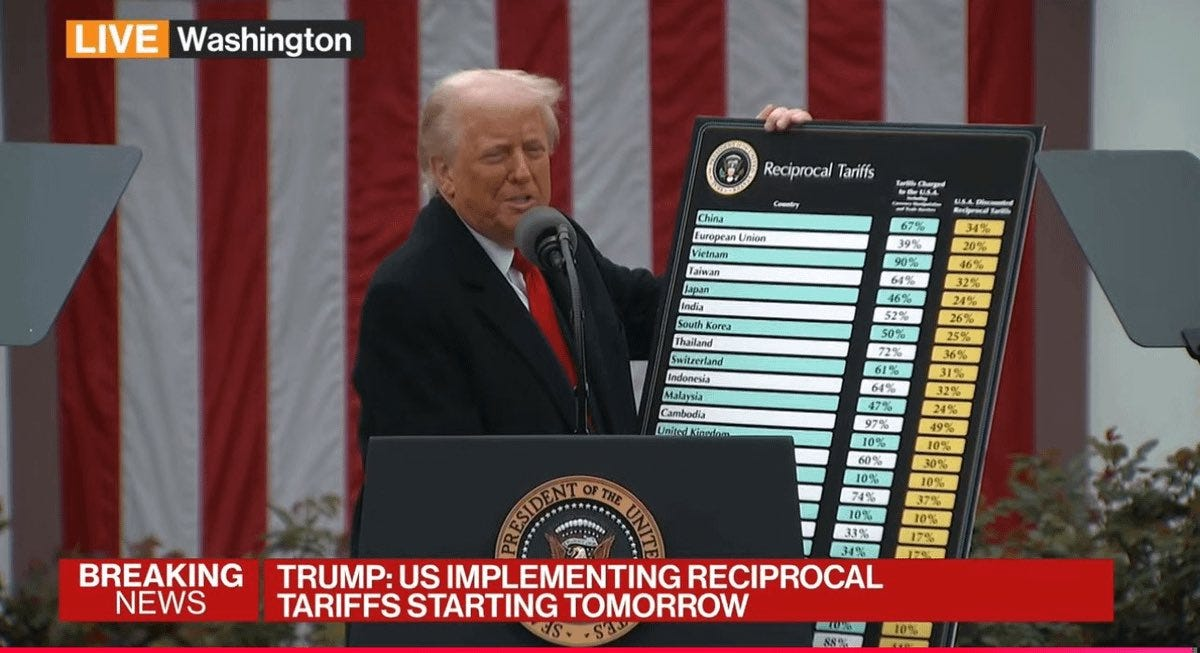

Liberation Day: Trump’s Tariff Bombshell

On April 2, 2025, President Donald Trump unveiled a bold tariff plan aimed at rebalancing US trade. The policy imposed tariffs equal to 50% of a country’s trade imbalance with the US, with a 10% floor. In a surreal twist, Trump’s team even taxed an Antarctic island (which is home to nobody but penguins) with a 10% tariff, proving nowhere is safe.

Markets Recoil: Crypto Feels the Heat

Crypto didn’t just feel the tariffs — it got pummeled. On April 7, there were reportedly an insane $1.4 billion in liquidations across the crypto market in one day. The numbers are brutal: $2 billion in total liquidations over a few days, with longs (those betting on a price rise) taking the hardest hit.

Historically, crypto has weathered big drawdowns during poor macro conditions, but those crashes were often sparked by internal catalysts. The 2022 Terra-LUNA collapse erased $40 billion in value overnight. Later that year, the FTX debacle tanked the market further, with Bitcoin dipping below $16,000. These were internal crypto disasters — fraud, over-leverage, and bad actors within the ecosystem. This time around, the story’s different. The tariffs and the resulting risk-off sentiment in global markets are causing the downturns. Crypto’s getting dragged down by forces beyond its control, a sign of its growing entanglement with traditional finance (TradFi).

A New Era: Crypto’s TradFi Collision

Let’s zoom out. This isn’t just another crypto crash — it’s a milestone. For the first time, the market is bleeding purely from external TradFi factors, not internal drama. There’s no FTX or Terra type implosion here. Instead, trade war rumors and geopolitical tensions have tanked risk assets across the board.

So while crypto is bleeding from external factors, we can take this as a sign of growth.

Investors Watching: Hungry for Good News

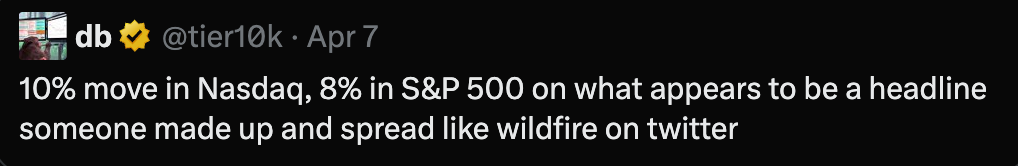

On April 7, a fake headline circulated on X claiming Trump would be pausing the tariffs for 90 days. The market’s reaction was positive, with Bitcoin surging $5,000 in a matter of hours. The news was quickly found to be fake, and prices crashed back down, but this revealed something crucial: investors are starving for positive signals.

The fake headline rally proves the market’s ready to run on any whiff of good news, whether it’s tariff relief, a dovish Federal Reserve, or a de-escalation in global tensions.

Hope on the Horizon

Some countries are already moving to address trade imbalances with the US. For example, the European Union is reportedly, “ready to negotiate” with the US regarding tariffs. If these efforts gain traction, Trump might ease his tariff stance, giving risk assets like crypto a much-needed breather.

Builders Will Outlast the Noise

Even if the market takes another leg down, this chaos is paving the way for a new era. Will it be a destructive reset, wiping out over-leveraged players? Or a slow, steady grind higher as fundamentals take over? The answer’s unclear, but one thing is certain: the real builders will endure.

Projects like Symphony are quietly laying the groundwork for crypto’s next chapter. While speculators panic, developers are shipping code, improving infrastructure, and solving real problems. This isn’t the end of crypto; it’s a stress test. And if history is any guide, the industry will emerge stronger, just as it did after the 2018 bear market, the 2020 COVID crash, and the 2022 FTX debacle. Crypto’s down, but it’s far from out.

Symphony.