With the rise of any new industry comes its fair share of frameworks for analyzing the industry. With the rise of crypto, many of the brightest minds have shared their own breakdowns of ways to look at crypto as a technology or an investment. In this article I decided to compile 5 of the most important ones.

Ownership economy

The ownership Economy is a thesis proposed by the Variant Fund. At a high level it talks about how users of the economy can now own parts of the economy that they participate in. In the traditional world, users are often exploited by the few people in positions of power who enrich themselves, the insiders and shareholders. The average individual has never managed to gain anything despite providing so much value to these systems.

Banks are by far some of the biggest institutions in the world. Almost every person uses a bank due to which they have seen tremendous growth over the years and rightfully so, because they provide a very important service. However, multiple financial collapses have shown us that banks do not care about the end customer. The insiders get incredibly rich and when things go wrong they get bailed out while the average innocent individual gets hurt. Users have no say in what goes on in these banks because they have no degree of ownership. They simply have to trust those in power.

Similarly, in the so-called web2 companies, the user is the focal point of all their products. Instagram, Youtube, facebook, Twitch, or TikTok all depend on the users. Users create the content and they consume the content. For the amount of value that is created by the users, the benefit they receive is negligible. A few content creators have created very strong careers, but the ones who have made significant money are those who have used their platforms and created businesses of their own. In these Web2 companies, it was again the VCs, insiders, and shareholders who made copious sums of money while relentlessly shoving ads down their users throats. Yet again, users had no control or ownership over anything that happened on these applications.

The cryptoeconomy changes this. The average user can now own a part of the economy they participate in through tokenization. They can be owners in the financial services and can also use tokenization to interact with/fairly monetize their communities. Crypto has given control back to the individual. Users can not only participate in the economy but be engaged in deeper ways through things like governance. Users get airdrops for being early adopters of a protocol and they can also help build protocols by participating in DAOs. Through crypto, every person can now be an owner. When the economy creates value as a whole, the users also get to enjoy some of that upside.

It is Naïve to say that insiders profiting is completely abolished in crypto. There are still tons of VCs who make many multiples on their early investments. There is still some form of disparity in that many VCs get access to much more favourable deals than a retail participant would, but comparatively the gap has been bridged by a significant amount. The average participant has much more of a say, and they also have more of an opportunity to gain value.

Fat Protocol thesis

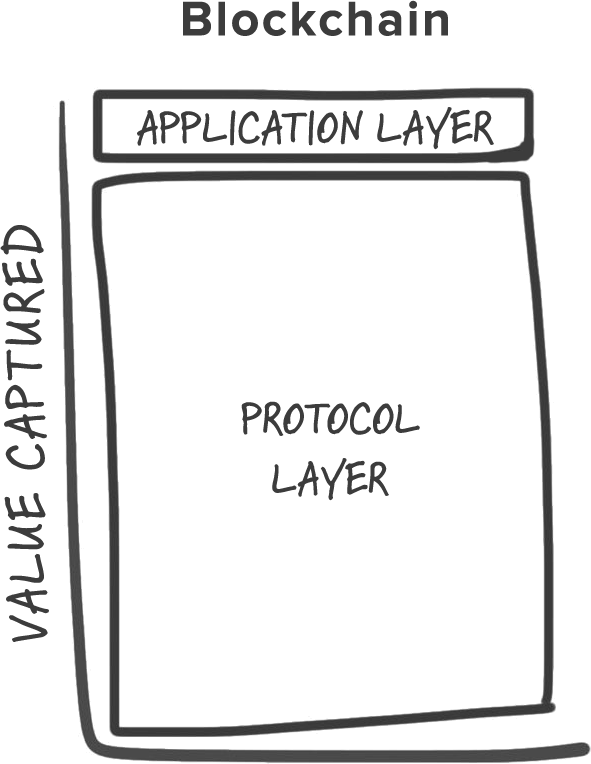

The fat protocol thesis is another popular framework written by Joel Monegro on how to look at investing in crypto/blockchains. This thesis compares the web to blockchains. In the web, the protocol layer of the technology consisted of things like HTTP and TCP/IP. These protocols generated value but even more value was captured on the application layer through things like google, facebook, Netflix etc. People realized that in order to capture value from the web, you will make sizeable returns by investing in the applications. This means that in the traditional web the protocols were “thin” but the applications were “fat”.

With Blockchains, this equation gets flipped. Majority of the value is generated and concentrated at the protocol layer, the base layer blockchain, while the application layer gets a fraction of the value. Hence, when you look at blockchains the protocol layer is “fat” and the application layer is “thin”. Hence fat protocol thesis. Essentially, when you invest in this industry you will find greater returns by investing in the protocols rather than the applications. If you look at the top 10 cryptocurrencies by market cap and take out the stablecoins, every single one of them is a base layer blockchain. Even further down the list it is all base layer blockchains. Applications within a layer 1 have never surpassed the blockchain they are built on in terms of value.

Joel Monegro outlines 2 key reasons for this switch. A shared data layer & Cryptographic “access” tokens with some speculative value. A shared data layer simply means that everyone has free & equal access to the underlying data which is blockchain transactions. This creates a scenario wherein the barriers to entry are heavily reduced and the ecosystem of applications become increasingly competitive. The market is forced to find cheaper and better products which constantly dilute the value of another product, not to mention the constant forking (or copying) of successful applications that takes place.

The second aspect is the cryptographic token of the protocol. Having a token creates a type of feedback loop. When a token slightly appreciates in value, it attracts speculators and maybe some developers or entrepreneurs. These early participants are now owners of the protocol and have a vested interest in its success, this leads them to build applications on the protocols which brings in more users and VCs to the protocol. They buy the token as it’s needed to transact on the protocol but they also build their own applications which brings more people to the protocol and further increases the value of the protocols token. Other than new users driving up demand for the token, the early investors also hold their tokens in anticipation of a greater appreciation in value which further constricts supply and drives up the value even more. This then attracts even more people and this kind of loop repeats which keeps bringing more and more people to the protocol who drive up its value.

“The market cap of the protocol always grows faster than the combined value of all the applications built on top, since the success of the application layer drives further speculation at the protocol layer.”

Metcalfe’s law/network effects

Metcalfe’s law was originally formulated by George Gilder and later attributed to Robert Metcalfe. The general premise is this “the value of a telecommunications network is proportional to the square of the number of connected users in the system”. This law brought about the concept of network effects and it has been very accurate in assessing the internet age.

An example for understanding network effects is as follows. Say you have a world where phones have just been invented. The first person who buys the phone derives almost no value from it because there’s nothing he can do with it. When a second person buys a phone then both of them derive value from owning the phone, when the 3rd participant comes in there is even more value as they all can interact with each other. As this network keeps growing, it becomes increasingly interconnected, thereby continually increasing the value of the network.

This model has been true for the Web2 companies such as facebook, snapchat, tiktok, youtube etc. As more and more people started using their networks, the companies became exponentially more valuable. The more interconnected links a network has the more useful it is. Given how accurate this framework has been with other internet/communication related networks, it can also be applied to blockchains and cryptocurrencies. As the adoption of a crypto economy incrementally increases, the value of the protocols that see the most network effects will increase exponentially.

Raoul Pal has a macro framework which he calls the “exponential age”. In this framework he talks about how the network effects created by the adoption of digital assets over the next 10-15 years will be nothing like we have seen in the past. It is the creation of an entire different realm. The network effects that we will see from digital assets will be much more different from other technologies because it’s a shift in the way the global economy operates. The ripple effects of such a change could lead to things that are currently unimaginable to us.

Attention economy

This is an investment framework that was written by cobie titled “tokens in the attention economy”. He talks about how ever since the web was created and adopted by the mainstream, attention has always been the main currency. In the token economy, attention is an extremely important and scarce resource. Every new NFT project, every new IDO (Initial Dex offering), and every new memecoin is constantly fighting for the attention of the almost nonstop inflow of risk-seeking capital. They all want your money and want you in their community.

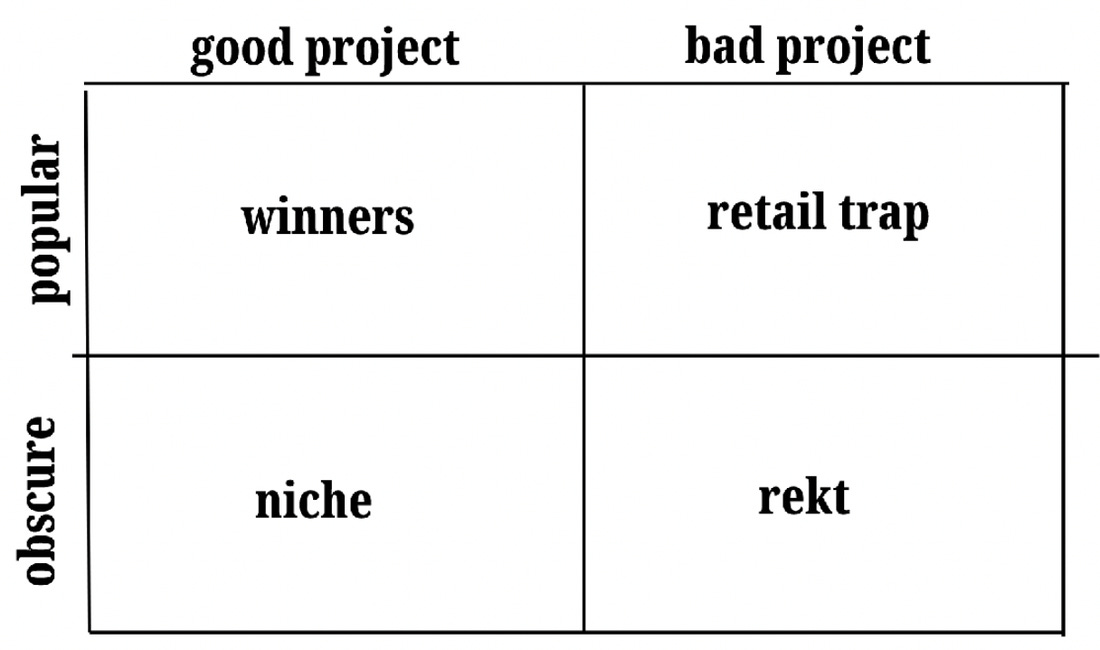

When you try value assets based on attention, you can breakdown crypto markets to the purest function of supply/sellers & demand/buyers. Attention is the main variable that affects these two factors, especially in the fast-paced and often frantic crypto markets. The best way to look at projects through the lens of attention is through the diagram below

The Winners are easy to spot; hence they are good for the casual investor or the long term passive investor who is satisfied with performing more or less at par with the market. This is because when a coin becomes a clear winner (eg bitcoin or Ethereum) the attention towards these coins get very saturated, after that point it would require the overall crypto marketcap to grow or a major shift to the fundamentals in order for it to provide very high returns. This is why the active traders who are looking to consistently outperform and massively outperform the market will look for undervalued projects in terms of attention but also quality. Historically, the best performers have been those who find projects that move from “niche” to “winner”. People can also find some success by finding projects that move from “rekt” to “retail trap” but this is incredibly risky and also unlikely. Those who have good technical knowledge can benefit from finding projects that go from “rekt” to “niche” but overall, finding coins that move up the attention spectrum allows the good/active traders to outperform the market.

Cobie calls this movement up the attention spectrum the period of “becoming favoured”. When a project/token goes through this period is when they experience the most change in their value. This is where majority of the gains are made. Traders who manage to catch the meat of the move in this period are going win big. After this, they often rotate into “winners” and chill as they look for the next opportunity. This is the general gist of how attention is the only scarce resource in crypto. Buy when a project is obscure and scale out as ownership catches up with attention. In the rest of his article, he goes over 3 real crypto examples which I recommend checking out.

The Hyperreal Economy

The hyperreal economy is a framework written by Hazard. It gives an insight into what the metaverse really is and how it should be looked at. They key focal point is “thought property”. The writer depicts a scenario of banana republic where the government suddenly decide to do as they please. In this scenario, all physical property is effectively owned by the most violent interested party. The party who has monopoly over violence can switch at any time and take control of everything you supposedly own.

The example in the article goes a bit like this. Imagine you are a lover of bananas and own some bananas. The government declares a banana republic and says all bananas must be given to the state. You lock your banana in a safe, memorize the code and destroy any physical evidence of the code. The code is now your thought property and the state can do nothing to take from you. If you are willing to withstand torture, then the state can’t do anything. The problem with thought property in this scenario is that it is only the code. The state can still take the safe and break it or do whatever else to gain access to the physical property. So the thought property is linked to physical property in a way.

The real power comes from having thought-property that is not connected in any way to the physical property. By completely transcending from the physical realm to the digitial realm, you enter the hyperreal economy. Blockchains are the embodiment of the hyperreal economy. As long as tokens on the blockchain have value then thought-property can be exchanged on the blockchain completely free from the physical realm. No monopoly over violence can stop it because ownership on the blockchain is simply a mathematical fact. There is no need to police a mathematical fact nor is there a need to argue about it in court. Everyone can see it.

So when people talk about the metaverse, it isn’t meaningful to think about the Zuckerberg VR dystopia where everyone has the headset on in a pod and becomes a vegetable buying groceries and talking to colleagues in some weird 3D world. The metaverse can be thought of as the complete transition from the bounds of physical property and ownership to digital ownership. Societies and communities will be governed differently, rights and laws will be different and the way the world will change, whether for better or worse, is unimaginable.

Thank you for reading

If you enjoyed and are feeling generous, then please consider donating to my ETH wallet: 0x43A5D9C141125Cd67B9268ef28C7c6a9dC15F3c9

Subscribe to the substack and follow the medium (ITS FREE)

Follow on twitter @LeftsideEmiri