By GRAMMYboy

Earlier this year, while putting together the Product Requirement Document (PRD) for a product idea and designing its technical architecture, I encountered a blocker, at that point I saw a critical gap in onchain accessibility and interoperability amongst emerging local stablecoins. At that moment, I had two choices: either implement a quick fix using offchain services or build the foundational infrastructure that would potentiallly help other builders as well. I chose the latter - being based is putting the community before an individual yeah? That decision led to the birth of IFÁ LABS

What is IFÁ Labs?

IFÁ Labs is an onchain trustless oracle network providing accurate, real-time data for local stablecoins and other financial instruments - onchain and offchain. Starting with Africa and scaling globally, we’re building tools that will empower local builders to build. On top of that is our oracle-based swap protocol engineered for stablecoin-to-stablecoin transactions. Unlike traditional AMMs, it prioritizes price stability, low slippage, and efficient execution - minimizing volatility and eliminating impermanent loss.

What Problem Are We Solving?

With the growing evolution, adoption, and diversification of stablecoins on Base - emphasized by Jesse and Brian's recent tweet, my team and I envisaged a critical gap in onchain Accessibility and Interoperability amongst these assets.

PROBLEM

1. Limitation in Stablecoin Accessibility Onchain

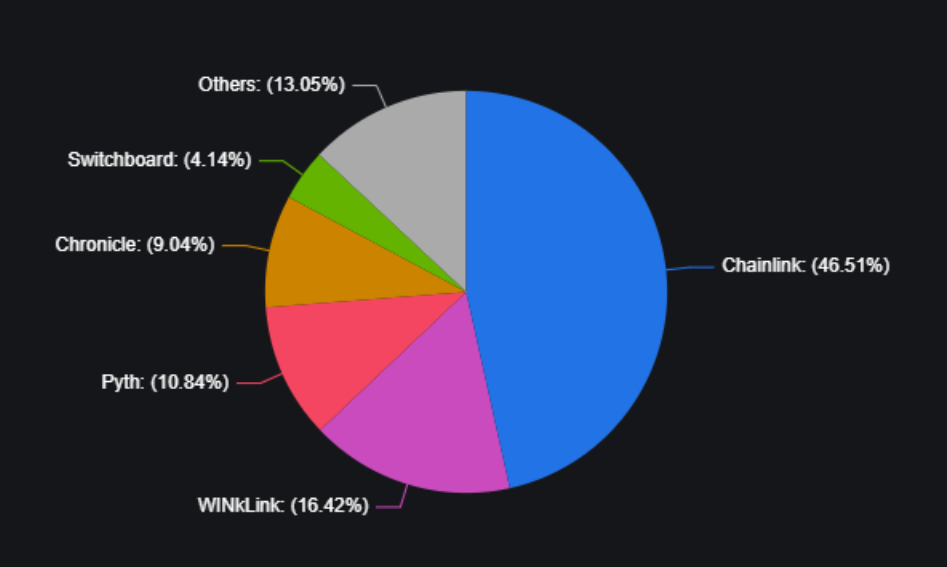

According to Cointelegraph, approximately 86.95% of DeFi products rely on Chainlink, Pyth, WINkLink, Switchboard, and Chronicle for price data.

However, none of these oracle providers currently support price feeds for local stablecoins on Base. After conducting a deeper research, I found that their listing requirements are nearly impossible for most local stablecoin issuers to meet. This creates barrier to adoption, stunting the growth and integration of local stablecoins within and beyond the ecosystem. As a result, builders are often left with no choice but to either pivot away from stablecoin-focused products or rely on offchain oracles, which compromise decentralization and reliability.

2. Stablecoin Interoperability/swap Inefficiency

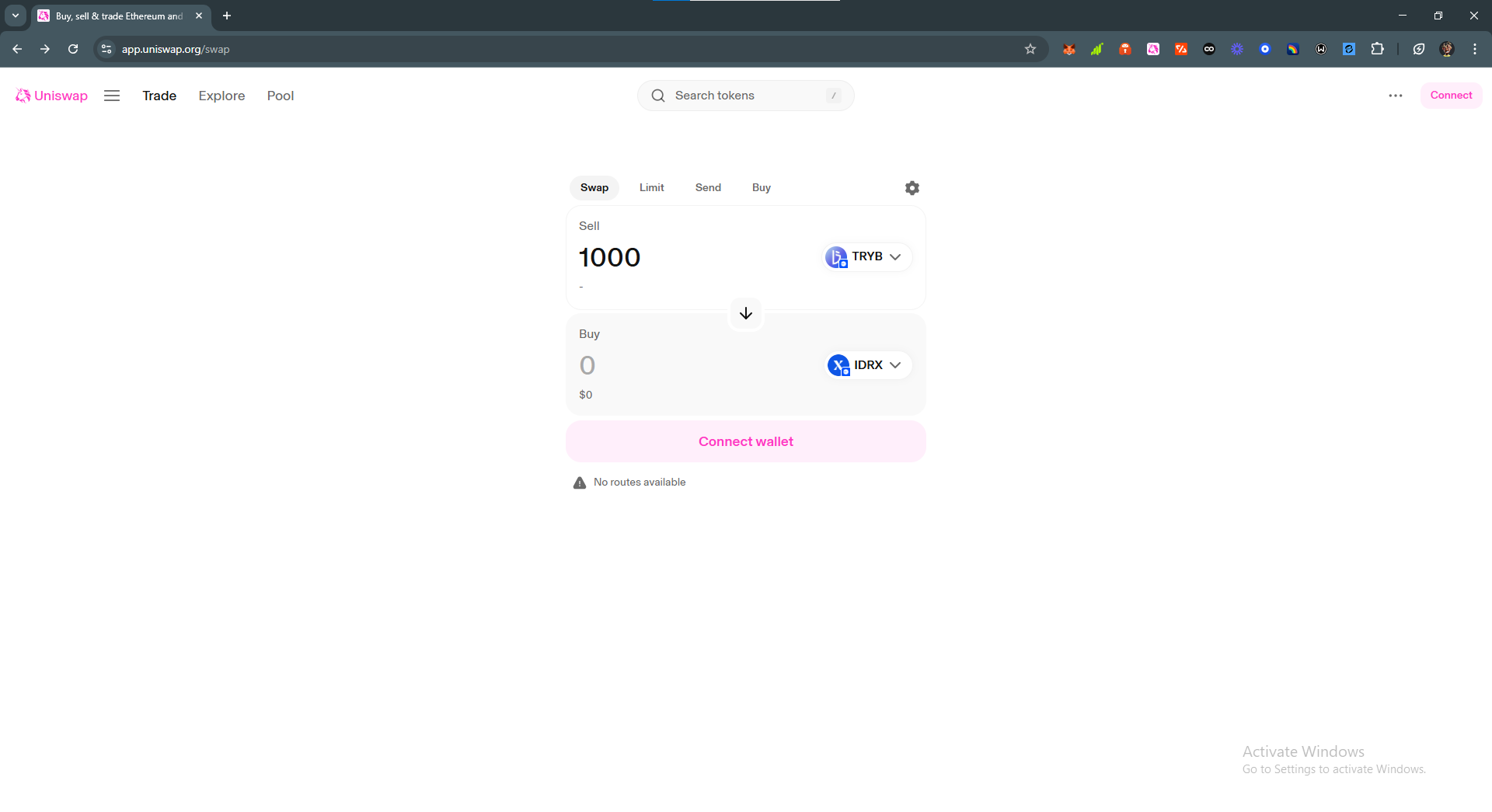

Uniswap is widely used as the default swap solution for most Ethereum, Base, and broader EVM ecosystem builders, as well as everyday users, with thousands of liquidity pools across multiple chains. However, when it comes to stablecoins, Uniswap’s Automated Market Maker (AMM) model presents several inefficiencies. Issues such as price volatility, slippage, and impermanent loss make it less reliable for stablecoin-to-stablecoin swaps, which require high precision and minimal exposure to volatility. Furthermore, most local stablecoins do not have dedicated liquidity pools on Uniswap, making interoperability and trading challenging.

How Are We Solving This Problem?

IFÁ LABS is built to support verified local and global stablecoins. By providing reliable, auditable onchain price feeds for assets like cNGN, ZARP, CADC, BRZ, EURC, USDC, TRYB, IDRX, MXNe, NZDD and others as they evolve, we empower developers and issuers to build efficiently.

Alongside this, our oracle-based swap protocol is engineered for stablecoin-to-stablecoin transactions. Unlike traditional AMMs, it prioritizes price stability, low slippage, and efficient execution - minimizing volatility and eliminating impermanent loss. We are creating the foundation for a robust and scalable stablecoin ecosystem.

Supported Assets

-

cNGN (Nigerian Naira)

-

USDC (US Dollar)

-

BRZ (Brazillian Real)

-

EURC (European Euro)

-

CADC (Canadian Dollar)

-

IDRX (Indonesian Rupiah)

-

MXNe (Mexican Peso)

-

ZARP (South African Rand)

-

NZDD (New Zealand Dollar)

-

TRYB (Turkish Lira)

-

USDT (US Dollar)

Real Use Cases We’re Enabling

-

Stablecoin Wallets & Payment Apps

-

Cross-Border Remittance Platforms

-

DeFi Protocols (Lending, Borrowing, Yield)

-

Exchanges

What Is Up Ahead?

Here’s what’s next on the IFÁ Labs roadmap:

Mainnet Launch

We're moving from test environments to the real world. Our onchain oracle and swap protocol will officially go live, enabling seamless and secure transactions onchain.

Early Adoption & Integrations

Wallets, fintechs, and payment apps will start integrating our APIs. We're working with early partners to enable real-world usage - from remittances to stablecoin savings - all backed by verifiable sources.

Ecosystem Growth & Protocol Expansion

As adoption scales, we’ll expand support for more stablecoins as they evolve. Our goal is to enable stablecoin accesibility and interoperability onchain.

Decentralization & Governance

In time, we’ll hand over decision-making to the community through DAO governance. This ensures IFÁ Labs stays transparent, community-driven, and aligned with local users' needs.

Token Launch

A native token will power governance, reward liquidity providers, and fuel ecosystem growth. It will be designed with utility, sustainability, and community alignment at its core.