The Hydrex protocol will launch soon, paving the way for frictionless DeFi and liquidity sourcing across the Base ecosystem. With over 40 partnerships and integrations established in the preliminary Basedrop campaign, Hydrex’s fully audited protocol is well-equipped to drive greater incentive coordination in the fastest-growing EVM L2 ecosystem.

Here’s the TLDR;

-

Hydrex’s TGE and Basedrop redemptions open on September 15.

-

HYDX’s initial listing price is $0.03.

-

HYDX contract address is 0x00000e7efa313F4E11Bfff432471eD9423AC6B30.

-

Basedrop rewards will be redeemable 10 Hydropoints to 1 locked HYDX.

-

All trading fees generated from the Basedrop will be used to seed the Strategic Protocol Reserve.

Please read below or review the updated documentation to be equipped with the latest information. We also suggest reading about Hydrex’s terminology for verbiage insights in this article.

HYDX Tokenomics

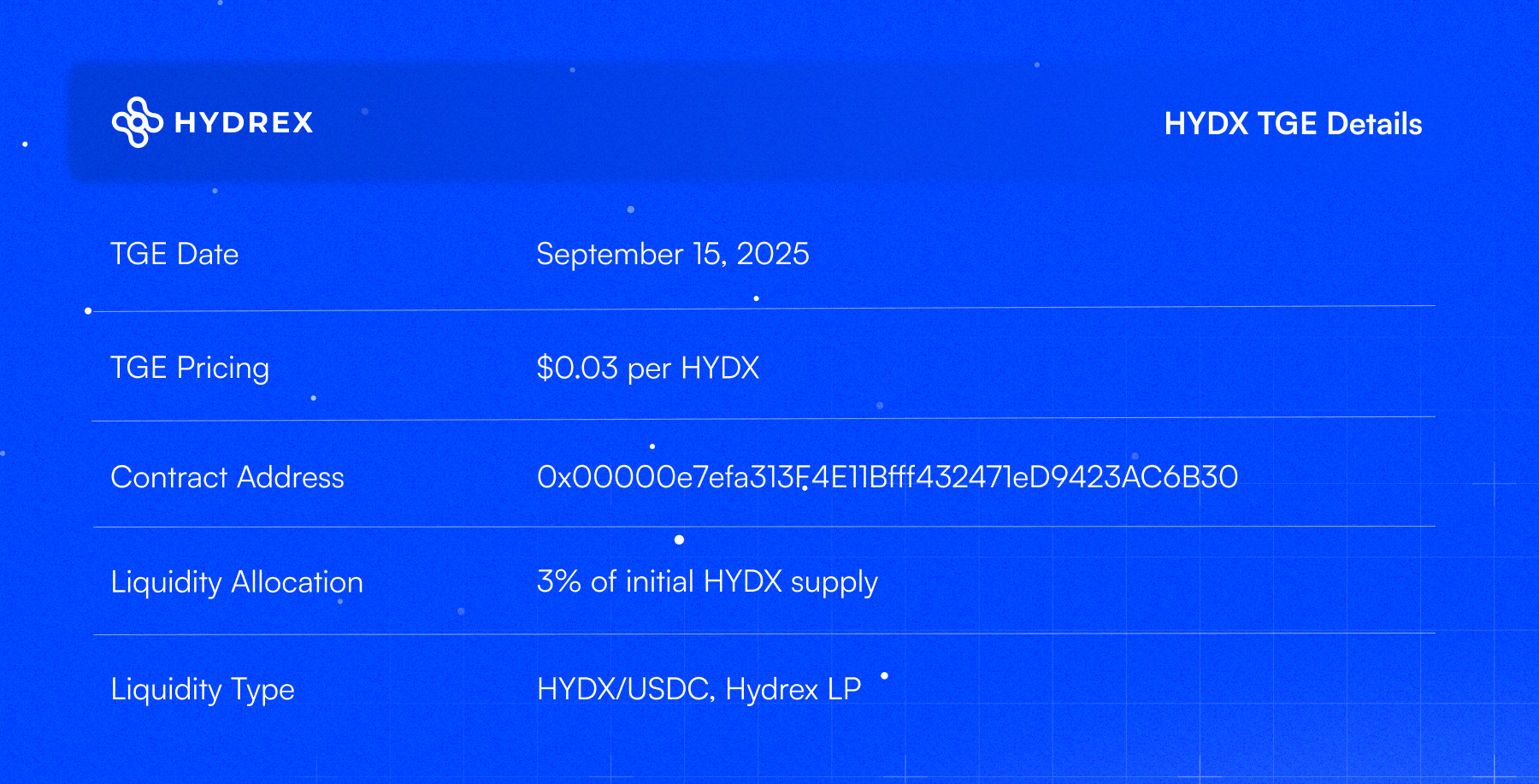

TGE Details

-

TGE Date: September 15, 2025

-

TGE Pricing: $0.03 per HYDX

-

Contract Address: 0x00000e7efa313F4E11Bfff432471eD9423AC6B30

-

Liquidity Allocation: 3% of initial HYDX supply

-

Liquidity Type: HYDX/USDC, Hydrex LP

Initial HYDX Supply

While the initial HYDX supply is 500M tokens, approximately 90% of these will be forever burned through the creation of Protocol Accounts (i.e., permalocked positions, formerly called veHYDX) for a wide range of uses:

-

Basedrop Participants - Users who collected badges and Hydropoints during the Basedrop campaign will be given permanent earning power. See details below.

-

Hydrex Treasury - The Hydrex treasury will maintain positions to incentivize HYDX pairs, key DEX pairs, and Base-aligned liquidity sources.

-

Protocol Grants - Hydrex will give top protocols in the Base ecosystem the ability to participate in the flywheel, finding incentive-aligned growth opportunities.

-

Core Contributors - To support the maintenance and growth of the protocol all Core Contributor positions are permanently locked, mapping the success of Hydrex to the reward structure of contributors.

Ultimately the specific amount of burned HYDX over time will be largely impacted by end user appetite for Protocol Accounts vs Flex Accounts. See the tokenomics section of the docs for full details.

Token Incentives and Emissions

To uphold the Strategic Protocol Reserve, the Hydrex Protocol never emits HYDX directly. Instead it emits Options tokens, called oHYDX. oHYDX allows users to purchase HYDX at a discount by contributing to the strategic reserve.

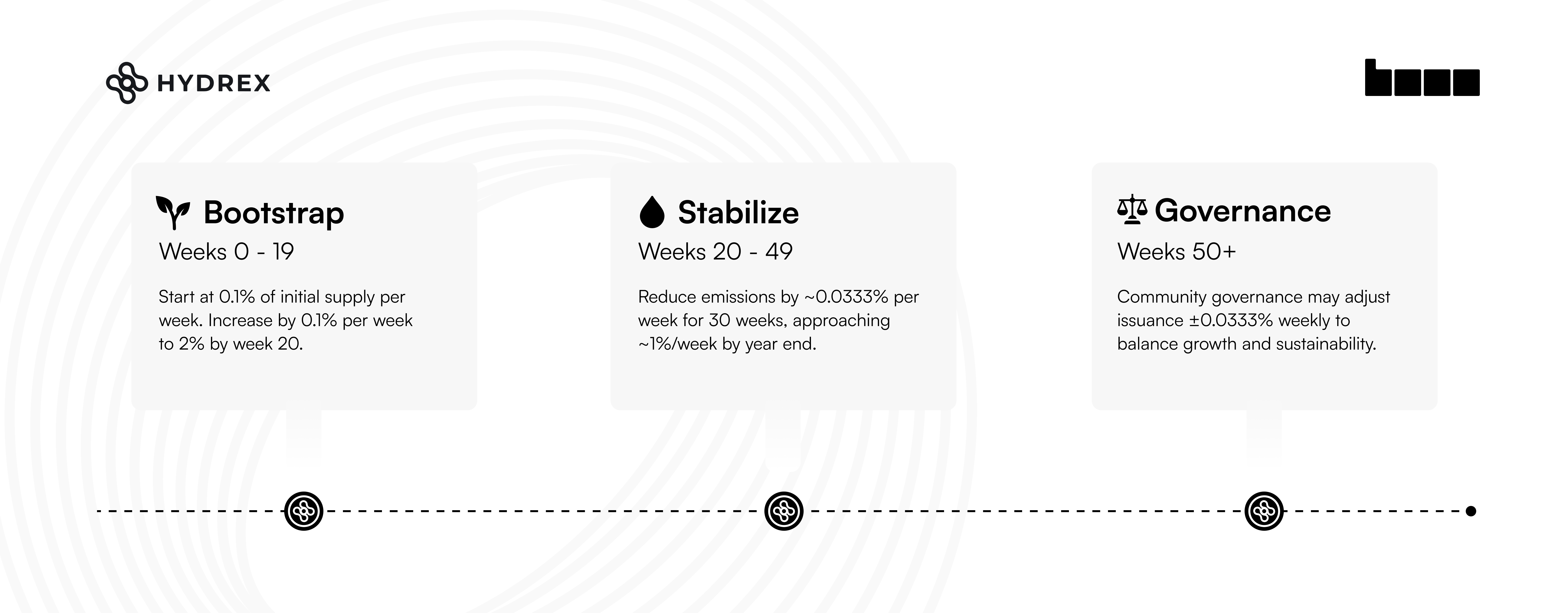

The emissions schedule for oHYDX is broken into three phases:

-

Bootstrap (Week 0–19) - Start at 0.1% of initial supply per week. Increase by 0.1% per week to 2% by week 20.

-

Stabilize (Week 20–49) - Reduce emissions by ~0.0333% per week for 30 weeks, approaching ~1% per week by ~1 year in.

-

Governance‑Guided (Week 50+) - Community governance may adjust issuance ±0.0333% weekly to balance growth and sustainability.

This schedule has been designed to ease into protocol growth, favor a longer term outlook, and give HYDX account holders influence on emissions distributions. oHYDX emissions are shared between anti-dilution rebases and incentivizing protocol liquidity.

See the full tokenomic details here.

Basedrop Redemptions

Between badges and hydropoints, 20% of the initial supply has been reserved for Basedrop program participants. Badges are redeemable for Protocol Accounts, which give permanent earning power by burning the underlying HYDX.

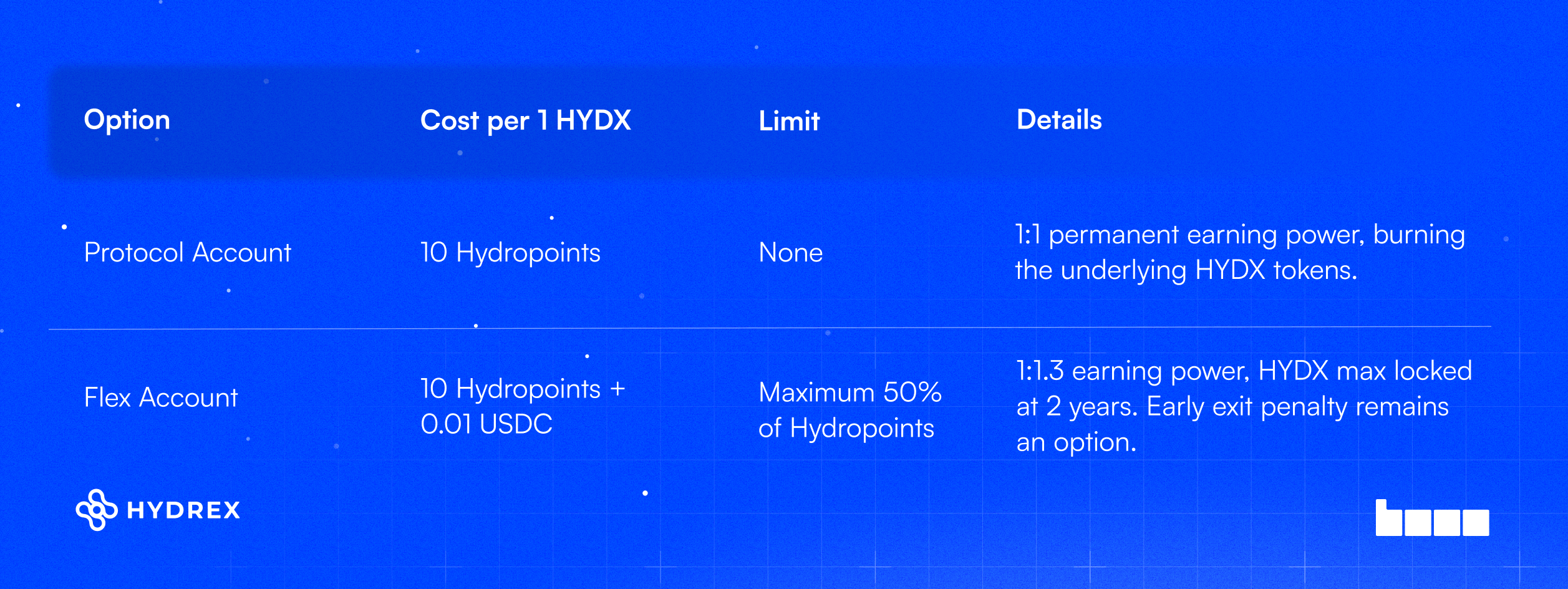

Hydropoints provide 2 options for redemption, both resulting in an Account (e.g., veHYDX position), but with different tradeoffs:

Some key points about redemptions:

-

Flex account creation requires 0.01 USDC per HYDX to uphold the Strategic Protocol Reserve.

-

Any earning power acquired after week/epoch 1 begins will not be eligible for rewards until epoch 2 completes.

-

Any unclaimed Hydropoint or Badge redemptions by October 15 will be moved into the Treasury for future community campaigns and activations.

-

Detected sybil farmers may be excluded from redemptions.

Let’s Make a Splash

Hydrex is committed to the long-term alignment of the Base ecosystem. The protocol is designed to help coordinate not only tokens, but entire protocols source liquidity by directing emissions and protocol revenue. Value flows to where liquidity and volume are most productive.

We are deeply grateful for all of our partners, community members, and contributors who have supported us up to this important milestone. If you are a protocol with liquidity needs and interested in launching on Hydrex, please reach out.

FAQ

What is the schedule for all of this?

What is Hydrex’s Strategic Protocol Reserve?

At the foundation of Hydrex's token model is a Strategic Protocol Reserve: every HYDX in circulation requires at least 0.01 USDC (or 30% of HYDX value) to be released into the market. This reserve mechanism is core to the protocol's economic framework, ensuring that token emissions are supported by actual capital inflow rather than unchecked inflation. This strategic reserve is designed to help the Hydrex protocol build POL & foster growth opportunities.

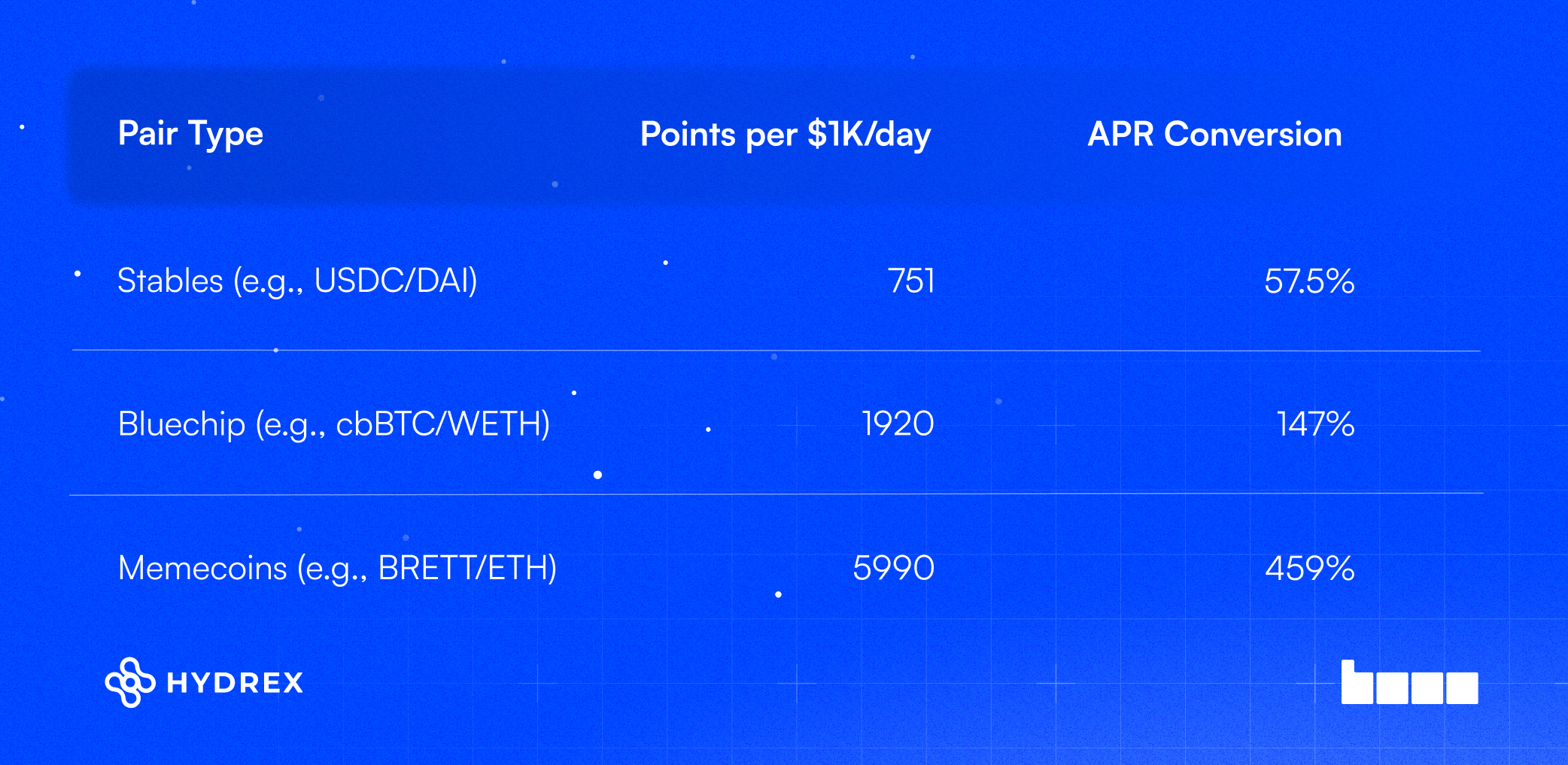

What were my APRs on the Basedrop Campaign?

Given the starting price of $0.03 per HYDX and the conversion ratio of 10:1, the table below provides mapping estimates for the most conservative APRs provided during the campaign, taking into account the potential 0.01 USDC cost per 10 hydropoints redeemed if converted to a Flex Account.

How will initial liquidity be provided?

Hydrex’s initial liquidity will involve single-side positions for both USDC and HYDX.

-

HYDX Side - HYDX liquidity at multiple tranches, pricing starting at $0.03.

-

USDC Side - All Protocol Mining Trading Fees will be converted to USDC and set as single sided positions between $0.01 - $0.03 to serve as the basis of Strategic Protocol Reserve.

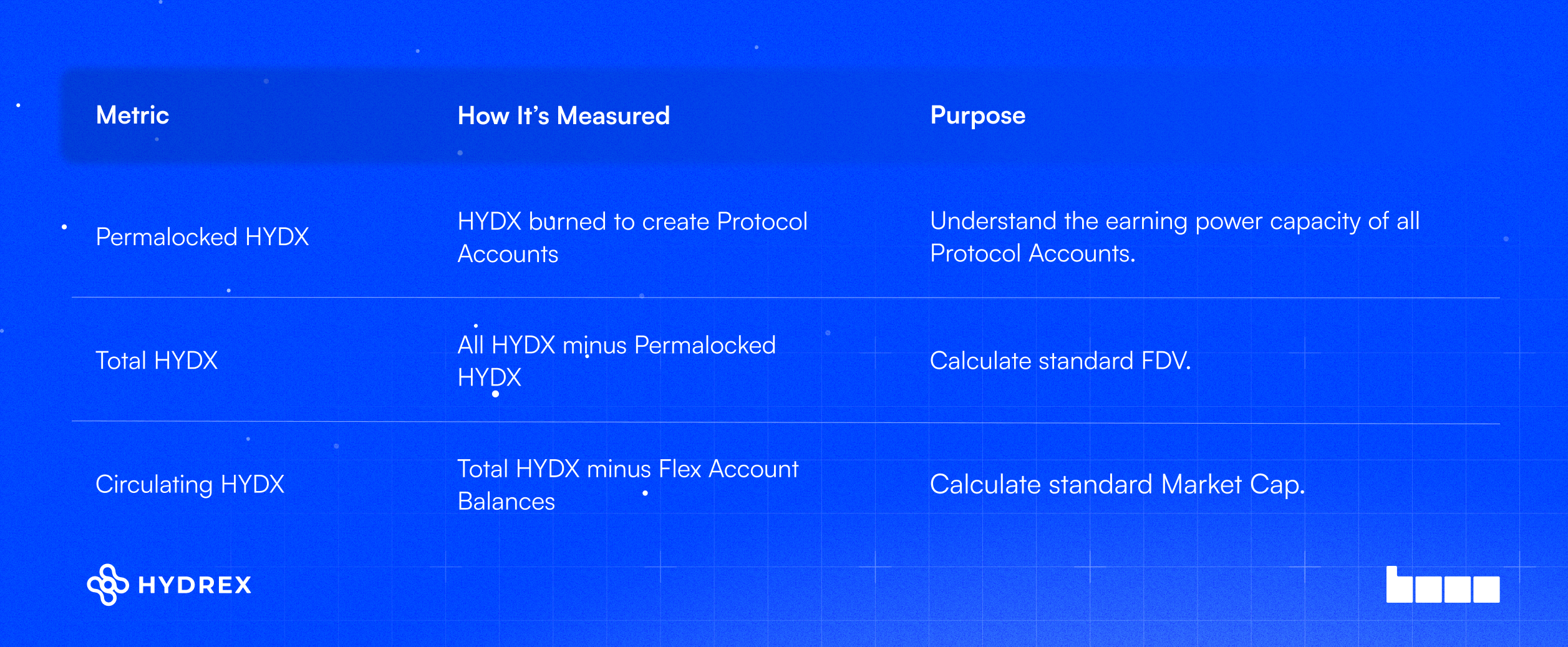

How are Protocol Accounts / burned HYDX treated in the tokenomics?

Follow Hydrex on X and Farcaster to stay up to date on our latest news, and join our Discord community to connect and ask any questions.