Summary

-

Largest notional liquidation event ever, with the largest ever drawdown in open interest

-

Highest ever 24hr volume in perpetual futures markets

-

$14bn drawdown in open interest roughly confirms estimates of $10bn in liquidations

-

Despite market volatility, zero issues on USDe which moved in line with fiat stablecoins

-

Perpetual futures contracts discounted by as much as 5.8% vs spot markets during the sell-off

-

Ethena uniquely positioned to capture the discount via shorting perpetual futures. Over $500k of protocol revenue was realized last week from unwinding contracts and capturing the discount

-

Automated unwind of Ethena’s underperforming contracts helped funding revert positive, with over $1bn of Ethena perpetual futures unwound and allocated to yield bearing stablecoins

Historical Liquidation Event

Perpetual futures markets just underwent their largest notional liquidation event ever, with most of the volatility concentrated in ETH markets. It marks the ninth drawdown of at least one billion dollars in ETH open interest since Ethena launched, and the second drawdown over $2 billion. In just 24 hours, ETH open interest fell by $2.3bn, the largest 24hr drawdown ever.

Over the course of a week, ETH open interest is down over $5bn, a weekly drawdown of over 25%.

Total open interest across all assets fell over $20bn in the last week, with BTC contracts losing notionally less than ETH, despite the BTC market being almost twice the size. $14bn of that total open interest was wiped in 24hrs between Feb 2nd and Feb 3rd.

The dramatic sell off resulted in the highest 24hr volume in perpetual futures markets ever.

It's hard to judge how much of that volume and open interest was a result of liquidations - as a result of API limitations on how many feeds are pushed out per second, exchanges often underreport their liquidation figures and third party data providers present understated data as a result.

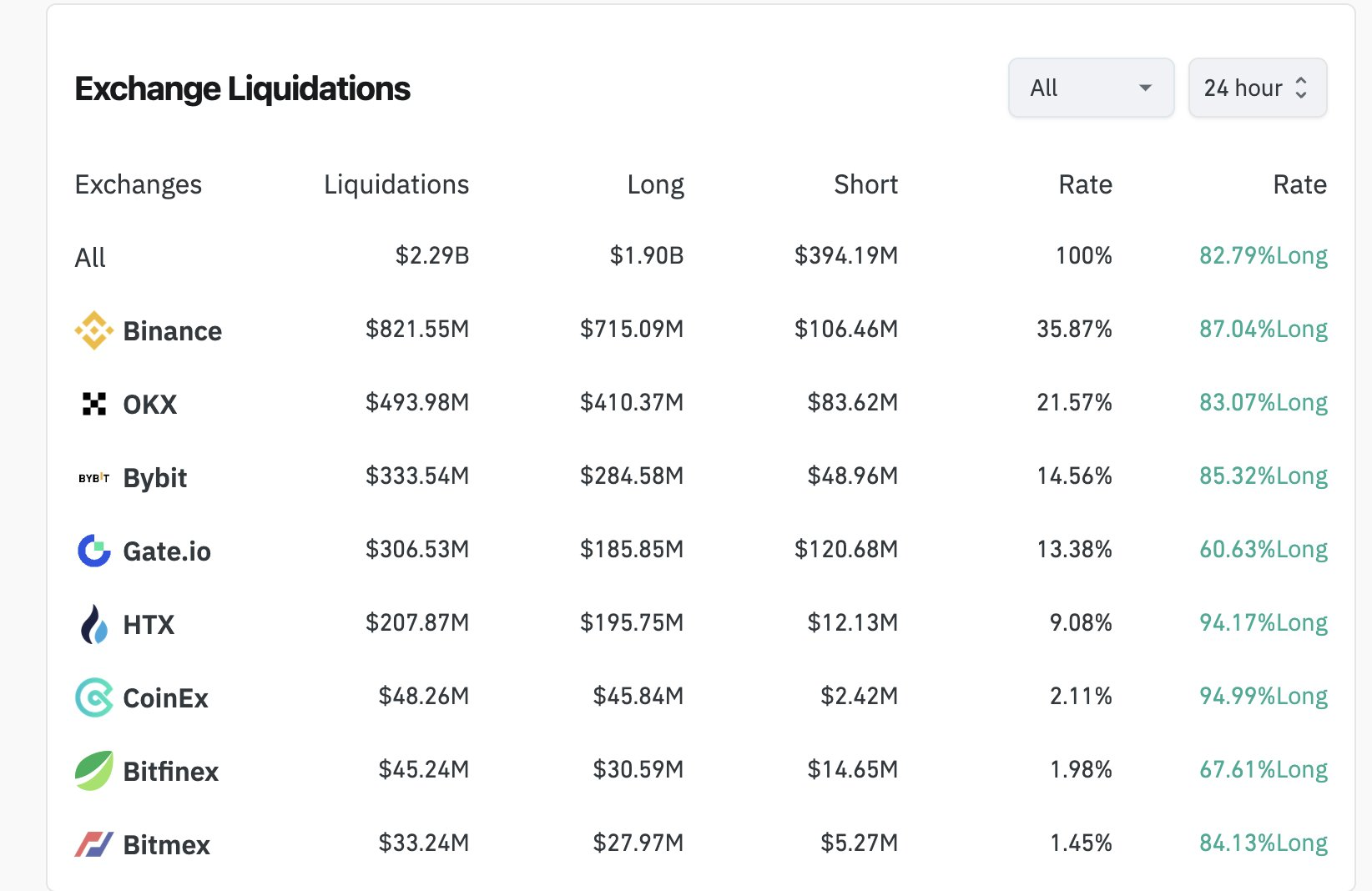

Out of the ~$14Bn of total open interest that was wiped on the 3rd of February, apparently only $2.3bn of that was liquidations.

However, as the founder and CEO of Bybit tweeted after the sell-off, Bybit alone was responsible for $2.1bn of liquidations vs the $333m reported by Coinglass.

He estimated total liquidations to be in the range of $8-10bn. That more closely correlates to the open interest drawdowns observed on each exchange over the 24hr period, with Bybit total OI down $4bn from Feb 2nd to Feb 3rd, and $5bn on Binance alone.

Assuming that logic holds, this was one of, if not the largest liquidation events in crypto history. A stress test like that gave Ethena the opportunity to prove the resiliency of USDe once again in the face of volatility.

USDe Resilience

Despite being the largest notional liquidation event in crypto derivatives to date, everything functioned as expected, with no disruptions to redemptions and virtually no losses suffered from unwinding perpetual futures contracts, which were trading at a discount to spot markets.

$50 million in USDe redemptions were processed in 24hrs via primary markets with zero issues. Secondary USDe markets saw over $350m in 24hr volume as USDe remains within 10bps of USDT.

USDe price moved in line with USDC and DAI during the volatility as market makers stepped in to close any arbitrage opportunities between primary and secondary markets.

sUSDe and USDe collateral across DeFi functioned as normal (e.g., Aave, Morpho, Fluid, Curve, Pendle), with no material liquidations, unwinding, or liquidity issues.

As prices moved lower, many perpetual futures contract were trading for less than their corresponding spot markets, presenting an opportunity for Ethena to realize profits from unwinding perpetual future positions.

Capturing Profits during the Sell off

What is commonly under-appreciated about Ethena’s design is that during market volatility to the downside, Ethena is positioned on the “right” side of the trade, being short perpetual futures and long spot. During market sell offs, it is quite common to see perpetual future contracts discount in value versus their equivalent spot contracts due to liquidations and general panic in futures markets. These discounts have surpassed 5% in previous market sell offs, and the same behaviour was observed this time around.

Being short a perpetual futures contract that is trading at a discount leads to higher unrealized PnL and consequently more margin collateral buffering Ethena’s already unlevered positions. As Ethena’s system automatically unwinds from perpetual futures, Ethena’s positioning naturally benefits from these dislocations, placing the protocol on the stronger side of the market.

By closing perpetual future contracts that have dislocated to the downside, the protocol can capture that discount as realized PNL and is able to use that revenue for the benefit of sUSDe holders.

For example, the Binance ETH coin-m contract saw a discount of -5.8% vs spot during the sell-off, charted below in bps. With an Ethena short position of approximately $200m on this contract, the theoretical unrealized PNL at the peak discount was over $11m - which could have been captured as protocol revenue were the full position to be unwound.

The discount compared to spot wasn’t as significant on other exchanges such as Bybit and OKX, who had discounts closer to 1% on ETH contracts. BTC contracts across the three exchanges held up better than ETH, as the sell off was mainly concentrated on ETH contracts and specifically coin-margined (inverse) contracts.

Binance perpetual futures generally saw wider discounts across all contracts compared to other exchanges.

The dispersion occurring among contracts and assets puts more emphasis on execution quality and Ethena’s automated execution ensures dislocations are taken advantage of.

Over the course of the week, over $500k of Ethena’s $5.5m of protocol revenue was attributable to both capturing the discount between perpetual future contracts and spot and unwinding the lowest funding rate contracts, adding an estimated extra 50bps to sUSDe’s weekly APY. This realized PNL also provided an additional buffer for any negative funding cycles we witnessed over the weekend.

Adapting to Lower Funding Rates

With volatility picking up and a wide dispersion in performance across both exchanges and assets, it is important Ethena reacts quickly to any structural changes in perpetual futures markets. Over the last week, funding rates on ETH contracts moved significantly lower than BTC, with both moving lower than the levels observed at the start of the year.

Structural changes in funding rates are an indicator for Ethena to begin shifting the allocations of the assets backing USDe. With yield-bearing stablecoins like USDS available as eligible backing assets, there is an opportunity to move more of the backing into liquid stables earning up to 8.75%, and less towards underperforming perpetual futures contracts. Funding rates improved as Ethena began to unwound short ETH positions.

Over the last week, the protocol demonstrated its ability to react quickly to market moves, shifting an additional $1bn into stablecoins and away from BTC and ETH contracts in the face of low funding rates.

Ethena’s dynamic approach to allocation is illustrated in the below comparison of the backing assets at the start of February compared to today. USDe is now backed by almost $1.8bn in liquid stables, or 29% of the backing, some of which yielding more than perpetual futures funding rates. As long as these perpetual future contracts underperform, Ethena will continue to allocate to liquid stables and optimize the assets backing USDe.

Despite the largest notional liquidation event in history, USDe proved its resiliency and seamlessly processed redemptions while remaining at peg. The ability of Ethena to capture profits during market sell-offs further demonstrates the structural design advantage of being short perpetual futures, and how it can benefit the interests of sUSDe holders in market downturns.

With every stress test, USDe proves itself as one of the most resilient assets in the space and Ethena can hopefully continue to earn the trust of our users.