11.02.2021 | Ming & MelT from Meteorite Labs

Since its initial IDO in July, YGG token reached up to as high as $10 (x6.7) from about $1.5, and now (October) stabilizes around $6–6.5 (x4). AXS took off since the beginning of July this year when it was valued at around $5. Today, it skyrocketed to as high as $140 (x28) in just five months.

By contrast, in the traditional game industry, the biggest half-year yields of the big names, including EA, Blizzard, Tencent, and Netease, are all under 1.6 times.

The daily active user (DAU) number calculated by unique addresses for Axie today (Oct 31) is about 92k. The number neared 2 million in August. On YGG’s discord server, there are more than 300 people actively applying for the Scholarship Program every day. The numbers are indeed impressive, as even the top blockchain games’ DAU numbers jump quickly to only a few thousand or even a hundred.

With their impressive performance, Axie and YGG have grown into the top one leader in the blockchain game industry. How did they succeed? And Why them? This article will walk you through YGG’s history and find the answers from their Game-Game Guild model.

What is YGG and Its Early Engagement with Axie Infinity

Yield Guild Games was founded at the end of 2020, along with the popularization of the Scholarship Program for Axie Infinity. As early as August of 2020, YGG cofounder Gabby Dizon from the Philippines has already been featured on Axie Medium Channel, highlighted as an active player. And later in May 2021, YGG funded the #playtoearn documentary that popularized the concept of Play-to-Earn (P2E). The AXS token was about $5 when the documentary was released.

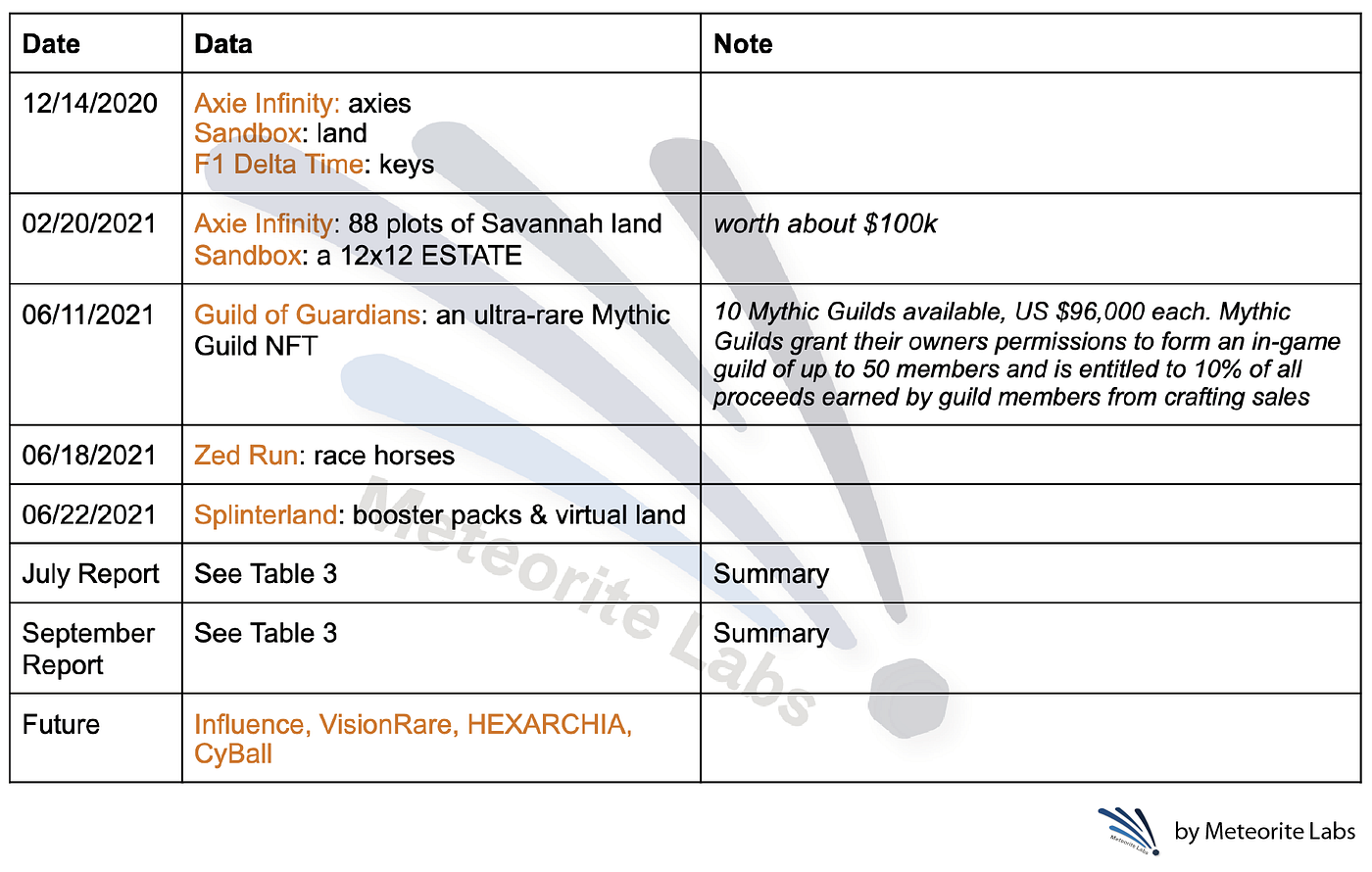

Nowadays, YGG is positioned as a conduit between players and games, including The Sandbox, F1 Delta Time, Embersword, Splinterlands, Guild of Guardians, etc. (See Table 2, Table 3, and Figure 3). On one hand, it makes it extremely easy for games to onboard gamers; on the other, it makes games accessible to players by investing in-game assets in the first place and by organizing Scholarship Programs.

The Scholarship Program was created with people, especially those who cannot afford the upfront costs, in mind. By loaning the game assets to the scholars, it allows scholars without assets to play the game and start to earn a certain portion of SLP, determined by the mutual agreement between the owners (mainly) and the scholars.

The Game — Game Guild Model from YGG’s Performance Data

So far, YGG is the most successful game guild in crypto. Let’s take a deep dive into some of its statistics, including community size, earnings, and investments, to get a sense of how this game and game guild model works.

Community Size: Members, Players, and Collective Earning

Axie Scholarship Application & Acceptance Mechanism

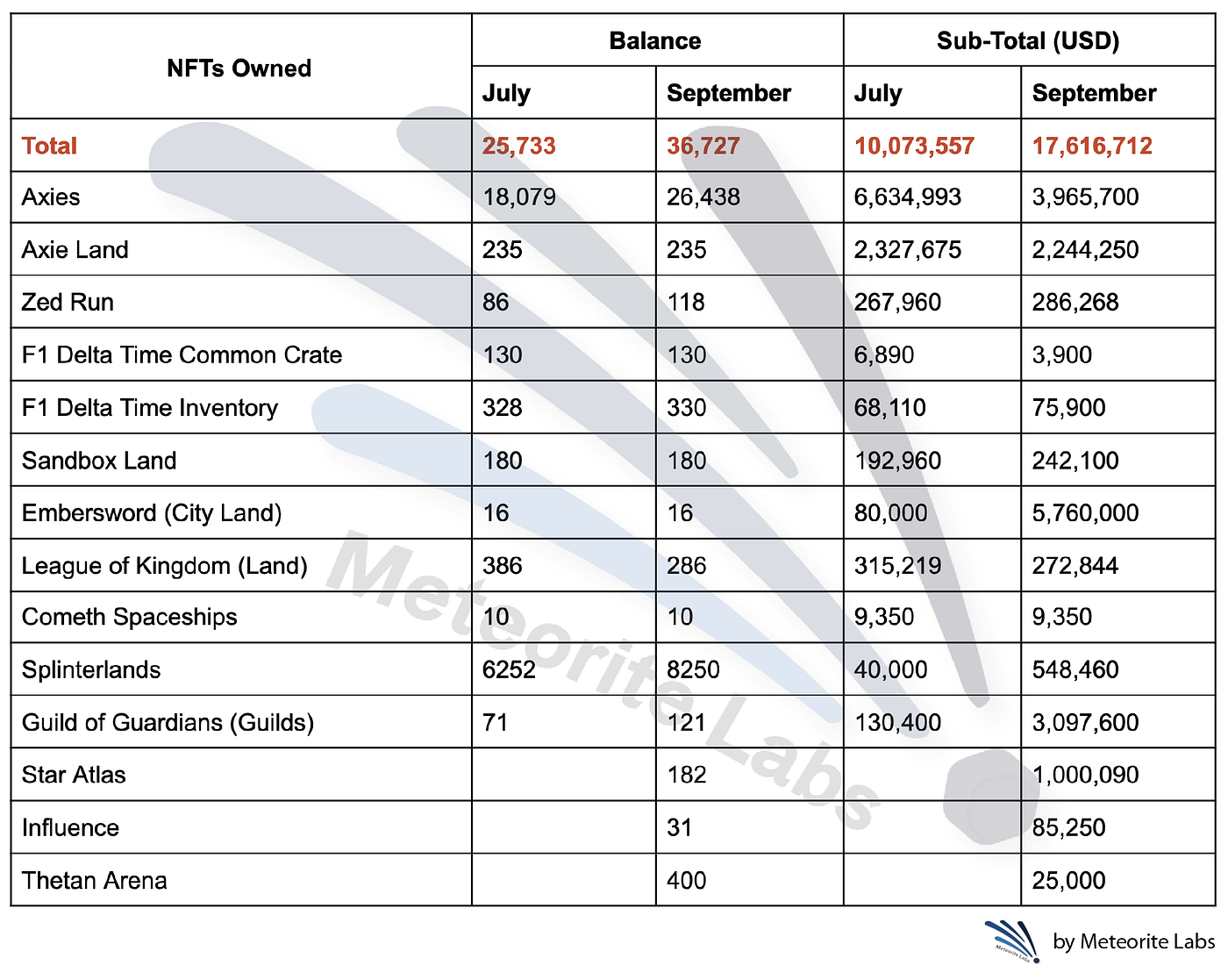

YGG holds 26,438 Axies according to its September Report, a 46.2% increase from its July holding. The total number of Axies indicates a hard cap of 8812 on its scholar headcount to.

Currently, there are around 250–300 people per day who apply to be a scholar through YGG discord. A total of 15 have been accepted in October. In September, the number was 8 in total, August 42 in total, and July about 6–10 per day. Players can earn 100–200 SLP per day depending on their skills, Axie team, and time commitment. Applicants are usually willing to commit 6–10 hours per day.

Through the Scholarship Program held by YGG, Scholars get 70% of the earnings, Community Managers 20%, and YGG Treasury 10%.

The Axie players do not need to login to the Ronin wallet that holds Axie NFTs to be able to play. The owners need only to give the scholars the account and the password, or simply a QR code which is more widely used nowadays. SLP earned will be collected in the wallet and transferred to the player’s account.

Assets Holdings

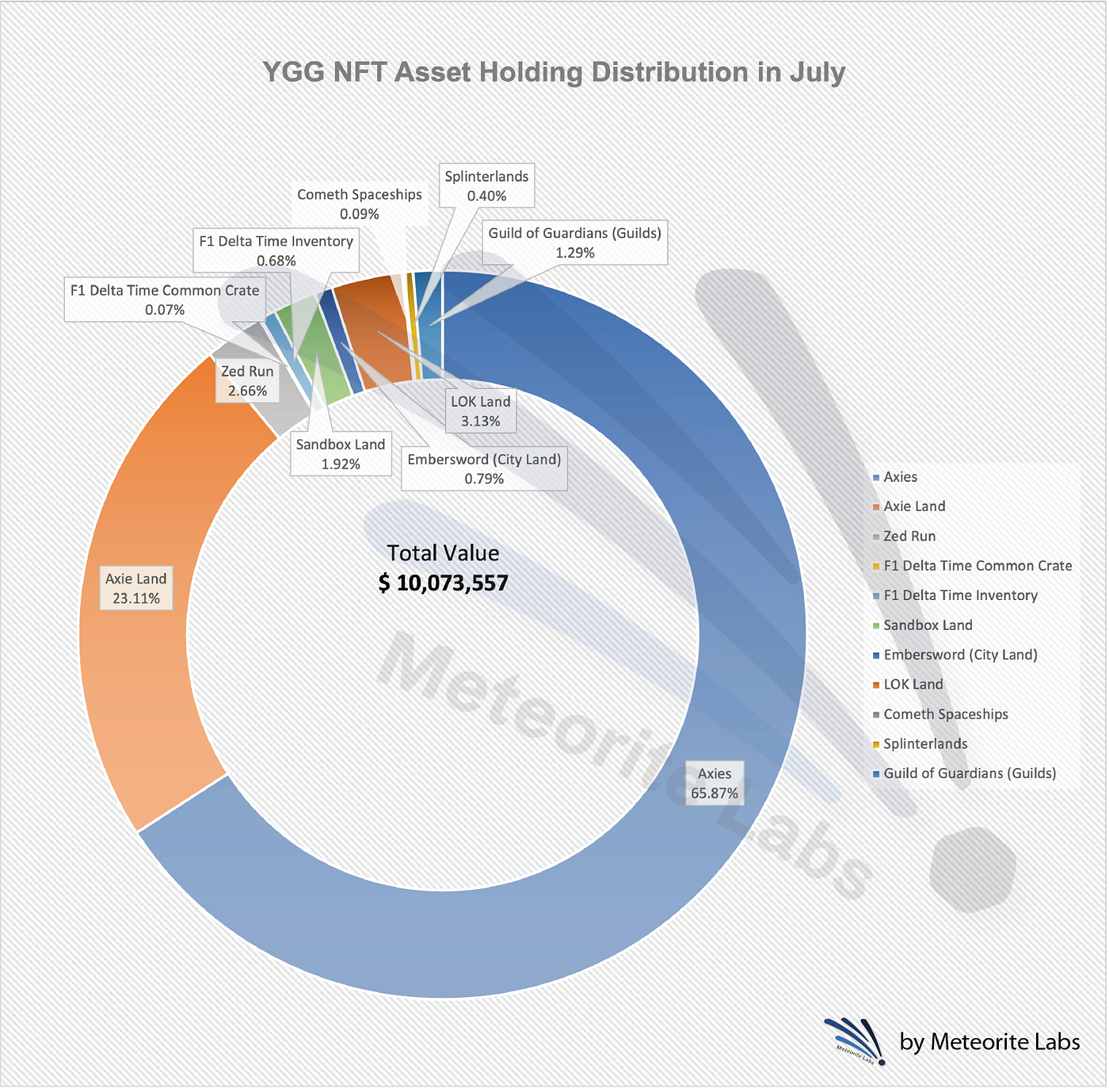

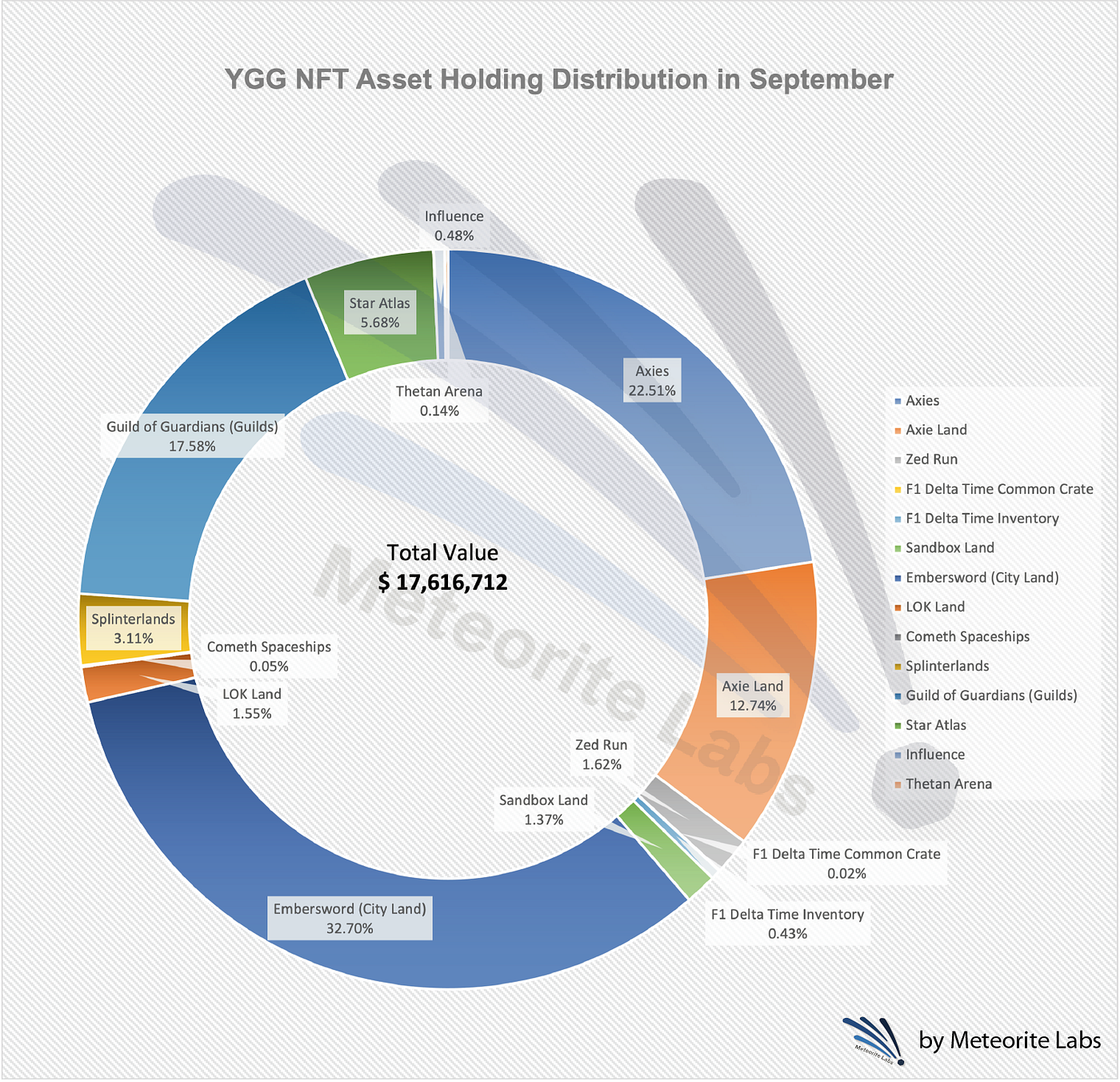

According to YGG’s Asset and Treasury Reports, YGG holds $814,812,378 in tokens (including YGG, USDC, USDT, ETH, AXS, and SLP) and $17,616,712 in NFT assets in September (see the tables and figures below). That is a 206.8% increase of ERC20 token positions from July ($393,983,391), and 174.9% increase of NFTs from July ($10,073,557).

In particular, in terms of NFT Assets, YGG has been diversifying its investment in various games.

Milestones

- 2021.04 — $1.325m round led by Delphi Digital

- 2021.05 — Advisory Board Round 1

- 2021.06 — $4m round led by BITKRAFT Ventures

- 2021.07 — $4.6m round led by a16z

- 2021.08 — Advisory Board Round 2

YGG’s Next Move

Solely relying on Axie Infinity would raise problems of uncertainties in terms of profit-making (see figure 1 and figure 2). In response, YGG has been working on expanding its cross-platform and cross-chain footprint in a variety of games to sustain its growth in the post-Axie era.

From the September Report, we can see that YGG has increased its investments on Guild of Guardians and Splinterlands, and added new games such as Star Atlas, Influence, and Thetan Arena (See Figure 3). In October, YGG added Cyball, RFOX VALT, and MOBOX onto their portfolio.

Among the most recent investments, CyBall stood out by having YGG‘s Co-Founder, Gabby Dizon onboard as their advisor.

CyBall is a football (US: soccer) themed, play-to-earn game where users can collect, trade, mentor, and battle with CyBlocs NFTs. YGG has acquired part of the initial Genesis CyBloc NFT packs, which will enable YGG to equip at least 1,000 CyBall scholars.

In CyBall, CyBlocs come in five different classes, each with an increasing overall skill rating and rarity. The six footballing skills include tackling, passing, dribbling, crossing, shooting, and physical, which all CyBlocs are born with at a base level, randomly generated based on their classes. Players train their CyBlocs to compete in various game modes with varying levels of rewards. Existing CyBlocs can mentor up to three young CyBlocs to avoid inflation, potentially passing on their classes and traits.

The CyBall match engine determines the winner through a series of key events that occur throughout the match. Each Key event involves CyBlocs competing against each other in one or two of their skills, resulting in either a goal or a draw (no goals).

**CyBall has a two-token ecosystem: CYB (CyBall Token) and CBT (CyBloc Battery Token). **CYB is a governance token that can be earned from special rewards by competing in League and Tournament PVP modes, in addition to staking rewards. CBT is the game’s play-to-earn reward token that can be earned by competing in various PVP modes (Exhibition, League, and Tournament). These tokens can be used in various in-game and ecosystem features, and also to mentor new CyBlocs.

As YGG has been trying to diversify its portfolio and develop mechanics to progress toward full decentralization, this partnership seems particularly important. What CyBall also brings to YGG is its unique built-in scholarship mechanism. CyBall offers automated scholarship-type loans called CyLoans, quoted from YGG’s Head of Investments, Jeff Holmberg.

This mechanism may revolutionize the in-game NFT renting and profit-sharing models. And the CyBall-YGG collaboration could potentially shake the old Axie-YGG type of Game-Game Guild model and lead a new movement in this industry.

While finishing up this article, CyBall announced their collaboration with Binance NFT and GuildFi in launching their IGO (Initial Game Offering) on November 4th at 1:00pm UTC, the world’s first Triple IGO Event.

About 11 hours after we published the article, the Triple IGO ended with an astonishing success — everything sold out in less than 1 minute.

We look forward to the game launch.

Author(s): Ming & MelT @ Meteorite Labs

Data speaks.