The past month has been an active one for Resupply, with key releases and upgrades helping shape an exciting path ahead.

Here’s a quick overview of the highlights, with links for those who want to dive deeper:

Savings reUSD

sreUSD (Savings reUSD) has been developed, audited, and deployed. Its launch and integration with broader defi will be a top priority on Resupply's roadmap.

sreUSD goes beyond a standard ERC-4626 vault. It introduces a system for applying an “off-peg boost”.

The off-peg boost works as follows:

-

When reUSD trades below peg, an amplifier is applied to the baseline interest rates across borrow positions.

-

As the reUSD peg trends toward 0.99, the amplifier increases.

-

Any interest revenue collected from this boost is routed entirely to sreUSD depositors.

This mechanism aims to create the right feedback loops and align incentives between peg stability and yield. More details can be found in the governance proposal here: Savings reUSD Proposal

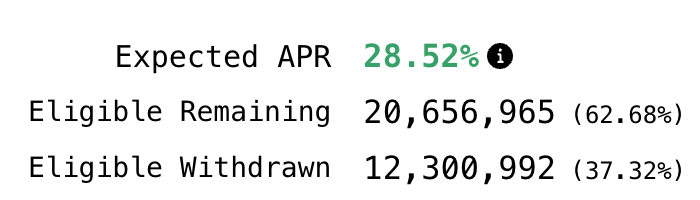

Retention Program: Resupply Recovery Plan

The Resupply Recovery Plan introduced a Retention Program shortly after the exploit, aimed at supporting Insurance Pool depositors who chose to remain.

A total of 2.5M RSUP is being distributed over 1 year to eligible depositors.

These incentives, layered on top of regular Insurance Pool rewards, currently boost yields to nearly double the normal APR—making continued participation significantly more rewarding.

No More Bad Debt

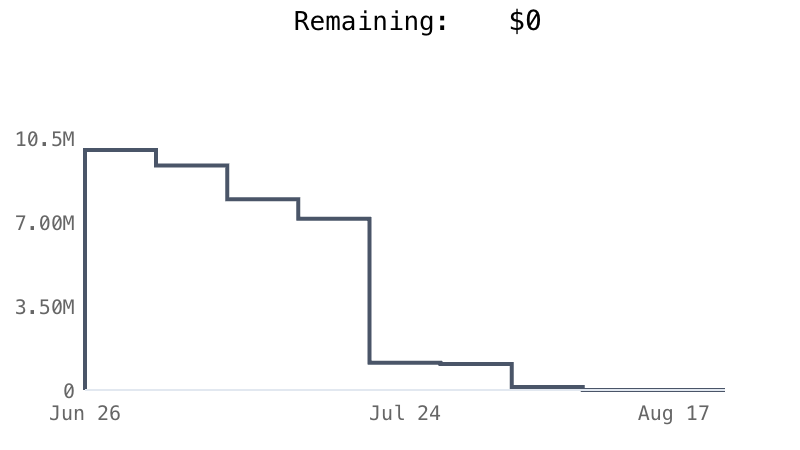

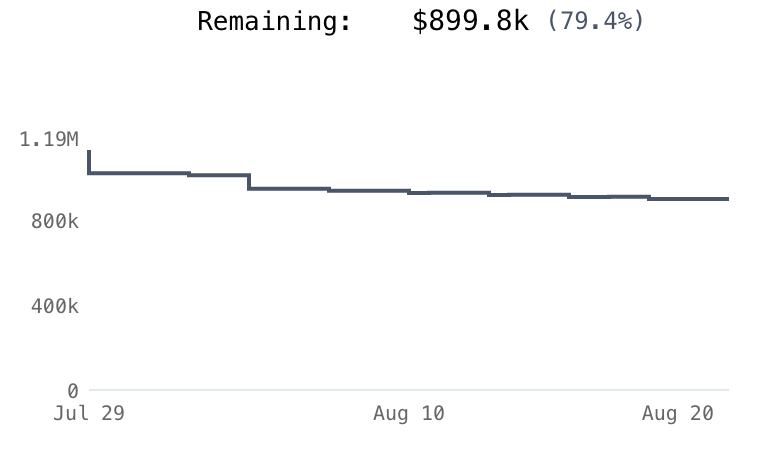

Following the IP burn, ~1.13M reUSD bad debt still remained on the protocol. To resolve this, Resupply negotiated a 6% loan with Yearn treasury.

The loan was approved, allowing Resupply to immediatlely clear all protocol bad debt.

Full liability for repayments to Yearn was transferred to both Convex and Yearn treasuries.

What may look like a simple accounting shift was in fact a major win: it eliminated Resupply’s debt burden entirely while refinancing at a much lower effective rate than it was paying on the original reUSD.

Repayments to Yearn are fully automated and trackable via the protocol debt dashboard. This structure significantly reduced costs to Resupply DAO while clearing the books of bad debt.

Security Upgrades: New Protocol Guardrails

A governance proposal introduced a suite of security enhancements, all formally audited and now part of the deployment flow (Security Guardrails Proposal).Key features include:

-

Ability to ramp debt limits up over time, allowing for safer limit increases.

-

Burning collateral shares on each new deployment.

-

An oracle-based block on loans during abnormal collateral price movements.

-

Historical pair tracking, enabling stronger validation before adding new pairs to the registry.

These guardrails strengthen resilience against both market shocks and governance oversights.

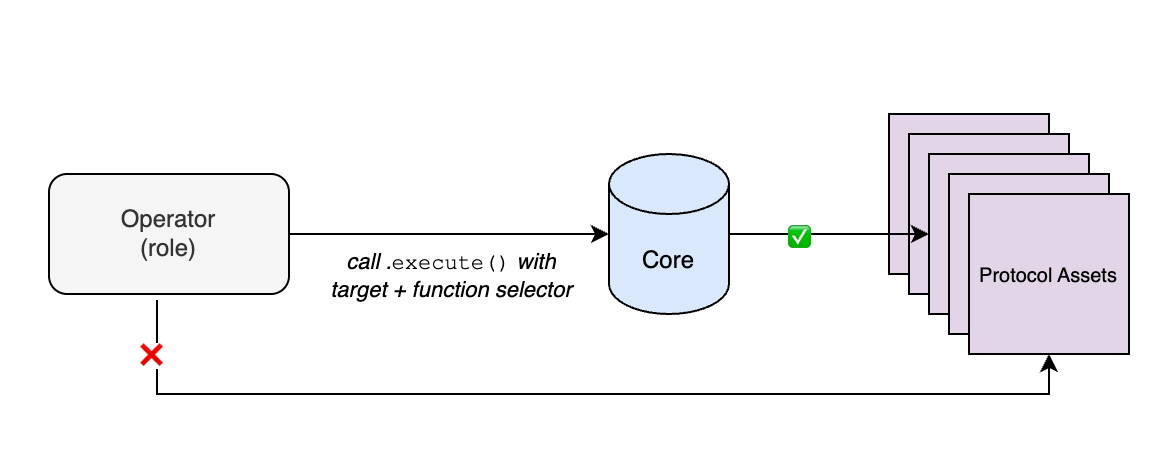

Permissions & Roles: Upgradeable Operators

Resupply has inovative a unique approach to role-based access. Throughout the protocol, all permissioned functions are guarded by onlyOwner, with ownership centralized in the Core contract.

The Core contract, however, retains ability to grant fine-grained permissions via its execute() method. All calls to execute() check the caller, target, and function selector before forwarding the call along. This mechanism allows governance to authorize precise permissions to sensitive actions without exposing unnecessary control.

For example:

A guardian is whitelisted to call

pause()on any pair. The guardian account submits this viaCore.execute(), which checks the payload, and validates msg.sender permission to call the particular function on the specifcied target contract.

“Operators” is the term for any such whitelisted account or contract within Resupply. Operators can be simple EOAs, but their true power comes when implemented via smart contracts. These contracts can bundle multiple permissions and enforce arbitrary rules (e.g. a cooldown period on repeated .pause() calls to limit abuse).

The latest upgrade working through Resupply governance introduces upgradeable operators via proxy contracts. This means permissions can evolve (e.g. guardians gaining new function access on new assets) without having to migrate to new operator contracts, reducing governance overhead and risk.

Looking Ahead

Upcoming milestones:

-

Activation and launch of sreUSD.

-

Use of sreUSD as collateral on LlamaLend.

-

Yearn auto-allocating vaults accepted as collateral.

Resupply has closed the chapter on bad debt, reinforced its security and governance systems, and developed a major new yield-bearing primitive. The next phase is all about enabling these capabilities in production—stay tuned.