Introduction

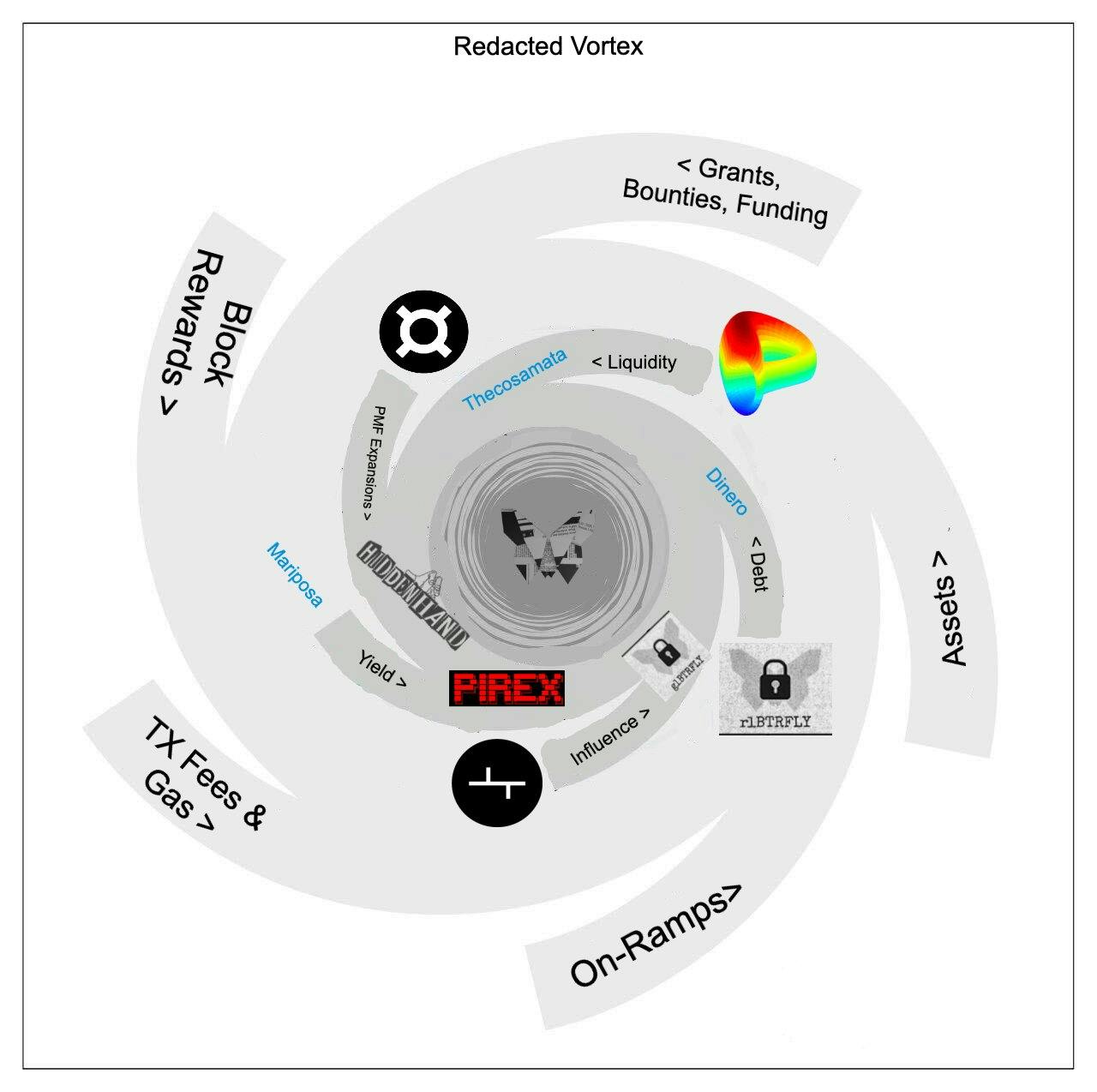

The █████ Cartel is a strategic branch of Olympus DAO initially serving as its arm of exposure in the Curve Wars. Once just a standard fork, the protocol has now flourished into an independent and all-encompassing DeFi product suite. [REDACTED] has positioned itself to be distinctly recognized as the DeFi pioneer it truly is with its latest V2 release.

The Cartel offers several products, including Pirex liquid wrappers, the Hidden Hand bribe marketplace, and the rlBTRFLY token flowing “real yield” back to lockers. The team is also working on some hush-hush yet highly anticipated products expected in a V3 release.

The Problem

Since the early days of DeFi, protocols have struggled in perfecting a strategy around deep liquidity, active governance, and sustainable incentives. Investors are constantly searching for passive, non-dilutive yield whether it be on their own assets or through a form of derivatives. As research suggests, liquidity mining has proven to be an unworkable strategy for most protocols. This pushed the “DeFi 2.0” narrative to the forefront in a hunt for new ways to combat the mercenary capital problem.

Some argue this narrative did a backflip on itself during the bull market frenzy, creating some of the most unsustainable liquidity mining strategies ever seen in DeFi. Yet when the dust settled, major developments like the Curve Wars and concepts like protocol-owned liquidity (PoL) were still standing strong, working as intended.

DeFi investors quickly learned that yield would dry up in a broader market downturn. Liquidity was evaporating and hyper-inflated tokens plummeted to all-time lows including $BTRFLY and $OHM. Something had to change, and it had to involve a balance of healthy token emissions with an unvarying stream of real yield.

The Goal: V1 Ambitions

The Cartel initially worked towards creating a “black hole” for Curve Wars strategic assets using $BTRFLY bonds and high APY. It modeled Olympus’s (3,3) reserve currency incentive structure at one point offering a whopping 200,000%+ APY to $BTRFLY stakers. This worked too, beefing up the treasury to almost $30 million today with a mix of strategic blue-chip crypto assets and LP tokens. The downside of this dilutive strategy was $BTRFLY holders got absolutely rekt.

A close relationship with Olympus DAO was also a priority, leading the $BTRFLY/$OHM liquidity pair as the only ideal avenue for trading $BTRFLY. The pair’s volatility already deterred LPs in the first place, and tanking prices from liquidations + mass-spot selling of $OHM led to an all-out bloodbath for $BTRFLY. Thus, it was clear that a new approach to not just bonds, but deep $BTRFLY liquidity pairings was needed to sustain the protocol for the future.

The Goal: Pivoting to V2

The team and DAO alike recognized pivoting from the current model was needed, especially because $BTRFLY was not a reserve currency. $BTRFLY yearned for a non-dilutive token structure, hence why the launch of [REDACTED] V2 a massive turning point for the protocol. The V2 design rejected the rebase model and embraced the “real yield” narrative, switching to a revenue-lock model instead. In V2, $BTRFLY lockers are entitled to a consistent yield stream generated by the [REDACTED] treasury and products, reshaping the approach the Cartel was taking in the DeFi ecosphere.

The team has been relentlessly shipping, with Hidden Hand’s launch on April 11 and Pirex’s launch shortly after on May 31. [REDACTED] only continues to cement its role in “empowering on-chain liquidity, governance, and cash flow for DeFi protocols.”

How Does it Work? Hidden Hand

Inspired by the Curve Wars, Andre Cronje’s bribe.crv.finance, and Votium’s success, the Hidden Hand marketplace allows protocols to create governance incentive platforms for their ve-Token holders.

On Votium, DeFi protocols deposit bribes that go to vlCVX voters who vote for their Curve pool’s gauge. With Hidden Hand, protocols can launch their own Votium-like platforms using its customizable and easy-to-integrate framework.

Hidden Hand is like a factory for projects that want to model the Convex-Votium synergy, and respected protocols have wasted no time trying it out. Frax and Ribbon each have a market for their veFXS and veRBN holders. Balancer and its Convex-like Aura Finance have both launched their own platforms on the marketplace. With [REDACTED]’s acquisition of Votemak in its early stages, Tokemak is also on Hidden Hand along with Floor DAO. Hidden Hand’s launch on Optimism and soon on Arbitrum rolls out the carpet for an influx of new integrations as well.

The mission is to add a layer of efficiency to protocols looking to create demand for their ve-Tokens. User cost is zero, and [REDACTED] collects a 4% fee on all bribes in the marketplace.

How Does it Work? Pirex

Pirex supplies liquid wrappers for yield generating tokens. These liquid wrappers attempt to deepen liquidity, improve yield, and optimize utility for token holders. The only Pirex product currently is pxCVX, a liquid version of vlCVX. Pirex accepts 1:1 CVX deposits for pxCVX which it perpetually locks for vlCVX to earn Pirex users yield. The team has mentioned a second Pirex A 4% fee is taken from all Pirex-collected bribes.

Users can enter or exit from a usually-locked position by trading between the liquid pxCVX token. By default, pxCVX holders collect bribes claimed by Pirex from Votium at the end of every two-week Pirex epoch. This is called “Standard Mode”, but users can take advantage of Pirex’s other two position types too.

With “Easy Mode”, Pirex users can opt to compound their yield using the Union’s advanced auto-compounders. Pirex CVX depositors can instead directly enter a uCVX position (a share of the pounder vault) which compounds yield into more pxCVX as they earn bribes. Right now Easy Mode is very popular, with 60% of pxCVX deposits preferring this auto-compounding position.

With “Expert Mode”, users can tokenize and trade their pxCVX yield. Expert Mode lets pxCVX depositors lock in future bribe revenues or DAOs to pre-purchase votes ahead of time. Depositors choose a duration in weeks that they would like to tokenize their yield for, in return receiving two things: a 1:1 spxCVX token and an amount of “futures notes” equal to how many Pirex epochs they have locked for.

There are two forms of futures notes, Reward Futures Notes (RFNs) and Vote Futures Notes (VFNs). Simply put, these tradable futures notes will allow users to speculate on and redeem future yield while also building an avenue for protocols to acquire “guaranteed” votes. Examples of how Expert Mode works can be found in the docs.

How Does it Work? Wen V3?

The rough sketch of the 2022 roadmap discusses several discrete developments that all seem to improve the Cartel’s overall capital efficiency. Ideas like “Harberger Taxation”, Racket pools and RAX, Dinero, DEMEV, and the Rolling Hills Strategy are all ingenious developments expected in a V3 release or later.

Harberger Taxation attempts to revolutionize the bond/rebase mechanism. Users can stake supported treasury assets through a limited number of staking slots. Stakers receive treasury cashflow as well as $BTRFLY Pulse emissions (decided by governance) varying by staked asset. However, stakers must pay a tax/rent so they can maintain the staking slot and keep earning revenue/emissions. This “tax” is really a burn rate on their stake that varies by asset type, and this burn rate grows the protocol’s treasury. With only a fixed amount of staking slots per asset pool, others can “out-bid” current stakers by paying a higher Harberger tax for the slot. It is confirmed Harberger will not release by V3, but is still under development.

Racket pools are another highly anticipated under-the-hood development. It has scarce documentation, but described in more simpler terms:

“Racket is a market for users to go short or long on assets like ohms ability to maintain price premium over RFV. Basically creating a sustainable alternative to (9,9) and (-9.-9) where there is no liquidations and it’s net positive for treasury.” - 0xSami & RealKinando

These leveraged, “shared” short and long derivatives positions are tokenized into RAC (short) and KET (long). Racket brings liquidation-free leveraged derivatives which are aiming to be soft-pegged to the Frax Price Index (FPI).

The main premise of Racket is to create a derivatives market directly based around the [REDACTED] and Olympus treasuries, flowing operational fees back to rlBTRFLY lockers and preventing the mass liquidation cascades seen in V1. Rather than a standard lending market, the duo can liquidate against their own treasuries mimicking PoL with something Sami calls “protocol-owned debt” (PoD). Racket spins up so many other opportunities like creating Harberger pools for KET positions, an index of RACs (RAX), a gauge for controlling index weights, and much more.

Dinero is [REDACTED]’s exciting iteration of a protocol-native stablecoin. What we know is it is planned after the Merge and over-collateralized by “custom Ethereum block-space”. Users can deposit ETH into CDP-powered lending vaults, which is then used to set up an Ethereum [REDACTED] validator.

$DINERO, made possible with EIP-712, can be used for Ethereum “meta transactions” and subsequently serve as sort a replacement for $ETH gas. Best described in Degen Sensei’s fantastic article:

“Meta transactions are transactions that are passed on to a secondary network that acts as a relayer, this relayer then wraps the request into an actual transaction and broadcasts it to the main network.”

With this kind of model, [REDACTED] looks to establish a Flashbots-like product (private mempool) on Ethereum PoS, entirely bootstrapped by the strategic asset-rich protocol treasury.

There are other facets of V3 and beyond like the Rolling Hills liquidity strategy, the exclusive “DEMEV” Curve MEV bot, and more. Unfortunately further V3 speculation is out of the scope of this breakdown. For more, please refer to the 2022 roadmap rough draft.

Partnerships

On top of its Hidden Hand partners, Olympus, and Llama Airforce, [REDACTED] just recently partnered with Dopex’s Plutus DAO. It is widely speculated that this spontaneous partnership is a likely indicator of a greater relationship between the Cartel and the Dopex ecosystem ($DPX $PLS $JONES). Sami in the most recent townhall meeting lightly confirmed this theory by mentioning Plutus’ eventual launch on Hidden Hand. The Cartel also earns from its $veVELO NFT on Optimism.

[REDACTED]’s established product stack lays a framework that welcomes new partnerships with open arms. Protocols can seamlessly integrate on Hidden Hand to capitalize on a ve-Token bribe market, and the plan to establish a larger multi-chain presence with products like Pirex only brings partnership opportunities into much closer reach.

Tokenomics

$BTRFLY Price: $257.30

Market Capitalization: ~$33 million

Circulating Supply: 129,009

Total Supply: 129,014

SOURCE: Coingecko

The $BTRFLY token post-V2 looks to split into revenue-locked $BTRFLY ($rlBTRFLY) and governance-locked $BTRFLY ($glBTRFLY).

Currently only $rlBTRFLY is available, and is received by locking $BTRFLY for 16 weeks. Deposited $BTRFLY is locked every epoch (one week), and lockers can collect rewards every two weeks. Lockers can only withdraw after their 16 weeks is up. They collect cashflow in the form of $ETH from the treasury and product suite, in addition to fixed $BTRFLY Pulse emissions. Specifically, revenue-locked $BTRFLY receives 50% of Hidden Hand and 42.5% of Pirex revenue. This becomes exponentially more attractive as [REDACTED] launches its product suite on other chains, flowing multiple streams of revenue to Ethereum mainnet lockers.

$glBTRFLY is expected to release later this year granting holders governance rights in the DAO. The extensive details of this form of $BTRFLY have not been released yet.

$BTRFLY is like a “Curve Wars index” passing on exposure to the greater Curve Wars ecosystem (its treasury). The treasury can dynamically deploy its abundance of strategic assets, whether for revenue generation or bootstrapping liquidity. The recent Aura proposal to expand the [REDACTED] treasury proves it is evolving on this too. V3 $BTRFLY could promise even more utility, generating cashflow from more new fronts and bringing forth exclusive product access like DEMEV. As the Cartel keeps building its treasury and product list, its cashflow will just become more lucrative.

Conclusion

[REDACTED] has been through it all, launching in the midst of a transformative period in the market and withstanding the collapse of its parent DAO’s reserve currency. Nonetheless, the team and community have maintained unwavering support to achieve a shared vision of a successful protocol. Many realized what [REDACTED] built with its “liquidity-directing” treasury couldn’t go to waste, and with Sami’s determination the transition to V2 was just one of many evolutionary steps for $BTRFLY holders and the rest of DeFi.

Many have dismissed [REDACTED] after declaring the fate of $OHM forks as forever doomed, but doubters may soon come to realize the stunning magic Redactors have been working on all along.

Special thanks to Degen Sensei

Follow me on Twitter

Come join the Galaxy Box

Learn from Redacted University

Join the Redacted Discord

Follow Redacted on Twitter