As 2024 comes to a close, it’s a great moment to look back on Spark’s journey. Spark launched in May 2023 with the goal of becoming the stablecoin growth engine for DeFi. SparkLend was the first offering and in just six months, SparkLend secured its spot among the top three lending protocols on Ethereum by TVL—a position it has maintained ever since. Currently, SparkLend generates an estimated $200M in annual revenue, demonstrating the transformative potential of efficient liquidity allocation for the entire DeFi ecosystem.

Evolving the Vision: From stablecoin growth to the most advanced yield engine in DeFi at-scale

In 2024, Spark’s focus evolved with the introduction of Sky’s Savings USDS, a stablecoin backed by the principal (stablecoins supplied) and the accrued yield generated by Sky’s over-collateralized loans and real-world investments. Savings USDS (sUSDS) redefined what stablecoins could achieve in DeFi.

The introduction of Savings USDS helped Spark build on its mission, expanding from a focus on stablecoin growth to establishing itself as the yield engine for DeFi. This natural progression led Spark to prioritize maximizing stablecoin utility and yield distribution across the ecosystem.

In line with this vision, Spark launched two key products: Spark Savings and Spark Liquidity Layer, both designed to scale stablecoin utility and optimize yield distribution throughout DeFi.

Unlocking DeFi Yield: Savings and the Liquidity Layer

Both Savings and the Liquidity Layer share a commitment to empowering DeFi users and improving market efficiency through key principles:

Transparency: Real-time dashboards provide users with clear insights into revenue, liquidity allocation, and performance metrics, fostering trust and accountability across the ecosystem.

For Savings, the Sky dashboard provides real-time insights into Sky’s revenue and the funds allocated to Savings USDS, giving users confidence in the source and distribution of their rewards.

For Liquidity Layer, the Sky dashboard provides insights into liquidity allocation and estimated annual revenue, helping protocols and users understand how resources are being deployed and managed.

Predictability: Yield and Borrowing Rates are determined by decentralized governance within the Sky ecosystem, ensuring fairness and transparency. Users benefit from a clear and reliable rate-setting process, avoiding the uncertainty of fluctuating market-driven rates. Governance updates and rate adjustments are publicly accessible, ensuring all participants can track changes and plan accordingly. Follow governance decisions here.

Stability at Scale: Unlike traditional DeFi solutions where rates fluctuate with volume, both products ensure consistent rates, regardless of deposit or allocation size.

Stablecoin-Centric Vision: Savings and the Liquidity Layer prioritize maximizing stablecoin utility. Users can deposit USDC, USDS, or DAI into Savings seamlessly, with no fees or slippage, enabling them to earn predictable returns while retaining flexibility. Similarly, protocols can access liquidity in any of these stablecoins, ensuring their needs are met efficiently. This focus on stablecoins ensures that both users and protocols can interact with DeFi in a straightforward and frictionless manner.

Spark Savings: A Gateway to Predictable Returns

Spark Savings provides users with a stablecoin savings account built for DeFi. With Savings, users can deposit USDC, USDS, or DAI to position themselves in Savings USDS. Withdrawals are flexible, allowing users to redeem funds in their preferred stablecoin or transfer to another wallet without incurring slippage or fees.

Savings empowers users to grow their funds while benefiting from transparency, predictable yields, and consistent stability.

Spark Liquidity Layer: Addressing Stablecoin Fragmentation

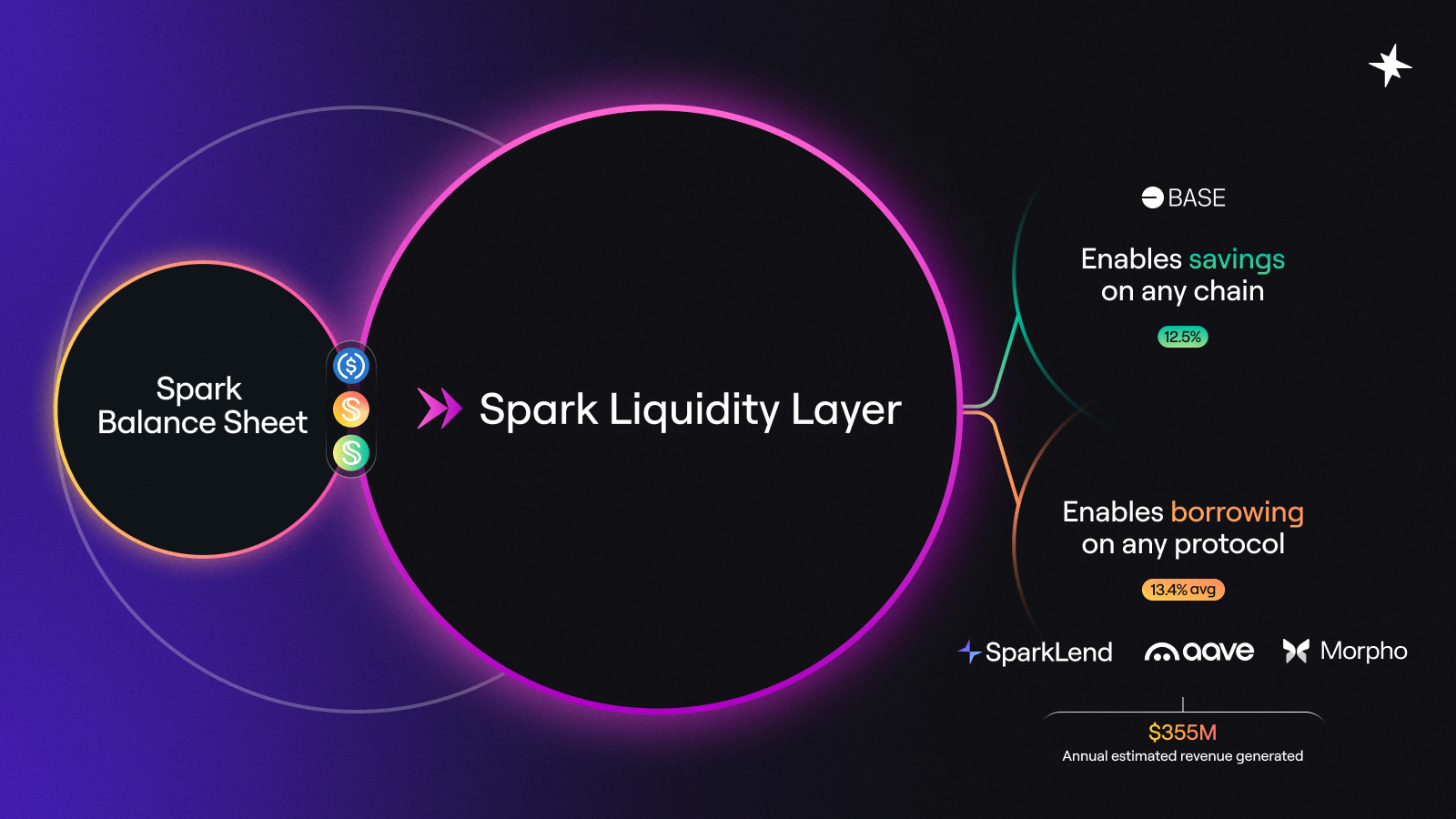

Spark Liquidity Layer solves a fundamental challenge in DeFi: stablecoin liquidity fragmentation across chains and protocols. By leveraging its robust stablecoin balance sheet, Spark allocates liquidity efficiently to improve market conditions, enable Savings across chains, and grow Spark’s treasury.

So far, the Liquidity Layer has deployed $2.6B in stablecoins to leading DeFi protocols, including SparkLend, Aave, Morpho, Ethena, and Pendle, generating an estimated $355M in annual revenue for Spark’s treasury —a remarkable 10x increase since the start of the year.

Another key feature of the Liquidity Layer is enabling multichain access. Beyond providing stablecoin liquidity to other networks, it also facilitates Savings USDS, allowing users to deposit stablecoins like USDC on supported chains and earn yields tied to Ethereum. For example, Base users can deposit USDC into Savings and earn 12.5% APY, withdrawing their earnings in USDC or USDS seamlessly.

Growth Milestones in 2024

As Spark evolved throughout 2024, its growth was reflected in several key milestones across products and adoption. These achievements highlight Spark’s impact on the DeFi ecosystem and set the stage for continued expansion.

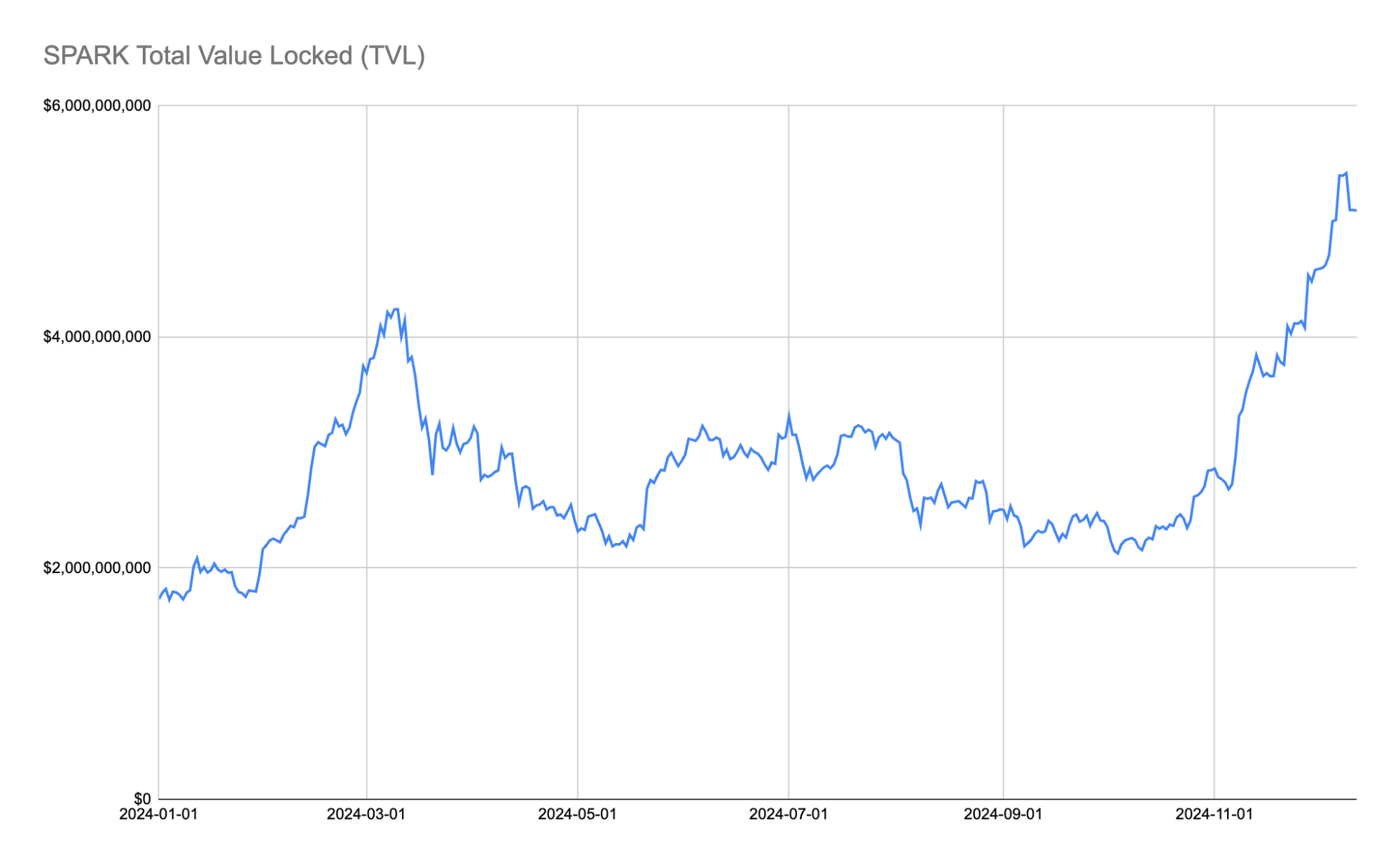

SparkLend Total Value Locked (TVL)

Since its launch in 2023, SparkLend’s TVL has grown rapidly, crossing over the $5 billion mark. The growth has been a function of direct user supply into SparkLend and the liquidity allocation coming from the Liquidity Layer. Today, SparkLend has a record supply of $8 billion and borrows of $3 billion on its platform. With $5 billion in stablecoins available for lending, SparkLend has established itself as the leading platform for borrowing stablecoins at scale, setting a new standard for transparency, predictability, and stability in decentralized lending.

Stablecoins Deployed

Thanks to the Liquidity Layer, total stablecoins deployed through Spark rose to $2.6 billion. This amount equates to over 50% of the total USDS in circulation. The ability to supply liquidity to other leading DeFi protocols and networks has allowed for opportunistic allocation of stablecoins into new markets. An example is the $700M deployed to Morpho. The stablecoins in the vault are lent to borrowers with Ethena collateral (USDe and sUSDe), exposing new yield sources to Spark whilst mitigating risk through isolated markets that Morpho provides.

The Spark Liquidity Layer has proven to be the most efficient mechanism for allocating liquidity across DeFi, creating a mutual benefit for the ecosystem and Spark. The ecosystem gains access to a reliable and stable liquidity source where it’s needed most, while Spark ensures a steady stream of revenue for the DAO. By bridging liquidity gaps and stabilizing rates, the Liquidity Layer not only strengthens DeFi’s infrastructure but also drives sustainable growth for Spark.

Revenues

During 2024, estimated annual revenues generated through Spark surged 10x, from $37 million in January to $335 million at the time of this writing. The growth was fueled by both protocol expansion as well as higher DeFi yields with favourable market conditions.

Looking Ahead

2024 was a pivotal year for Spark. An expanded vision, the introduction of innovative new offerings and a massive increase in stablecoins deployed have resulted in a notable increase in TVL and expected revenue for the Spark. And while these are important milestones for the project, the more exciting outcome has been the increased utility and benefit DeFi is seeing from incorporating Spark’s core functionality. As we head into 2025, Spark’s focus will be on extending the reach of the Liquidity Layer and enhancing stablecoin efficiency across DeFi, driving greater utility and value for users and protocols alike.