Coinbase’s crypto-backed loans (built on Morpho’s infrastructure) are powered by USDC liquidity from Spark. This integration gives Coinbase users a simple way to borrow USDC against their BTC directly within the Coinbase app, while Spark provides the onchain capital behind the scenes.

Fully Onchain Loans, Seamless UX

The borrowing process is simple: users select their collateral, review terms, and receive USDC into their account in just a few clicks. Everything runs onchain through Morpho, while Coinbase retains full control of the user experience.

Spark supplies the liquidity, making funds available when users borrow. Repayments are flexible, and rates remain competitive thanks to the efficiency of onchain execution.

Elastic, Programmatic Liquidity

Spark acts as the liquidity engine behind this integration. Through the Spark Liquidity Layer, capital flows programmatically where it's needed, without intermediaries..

Liquidity is elastic: as demand grows, Spark can allocate more USDC into Morpho markets. This ensures scalability and makes it possible for institutions to offer lending products at size.

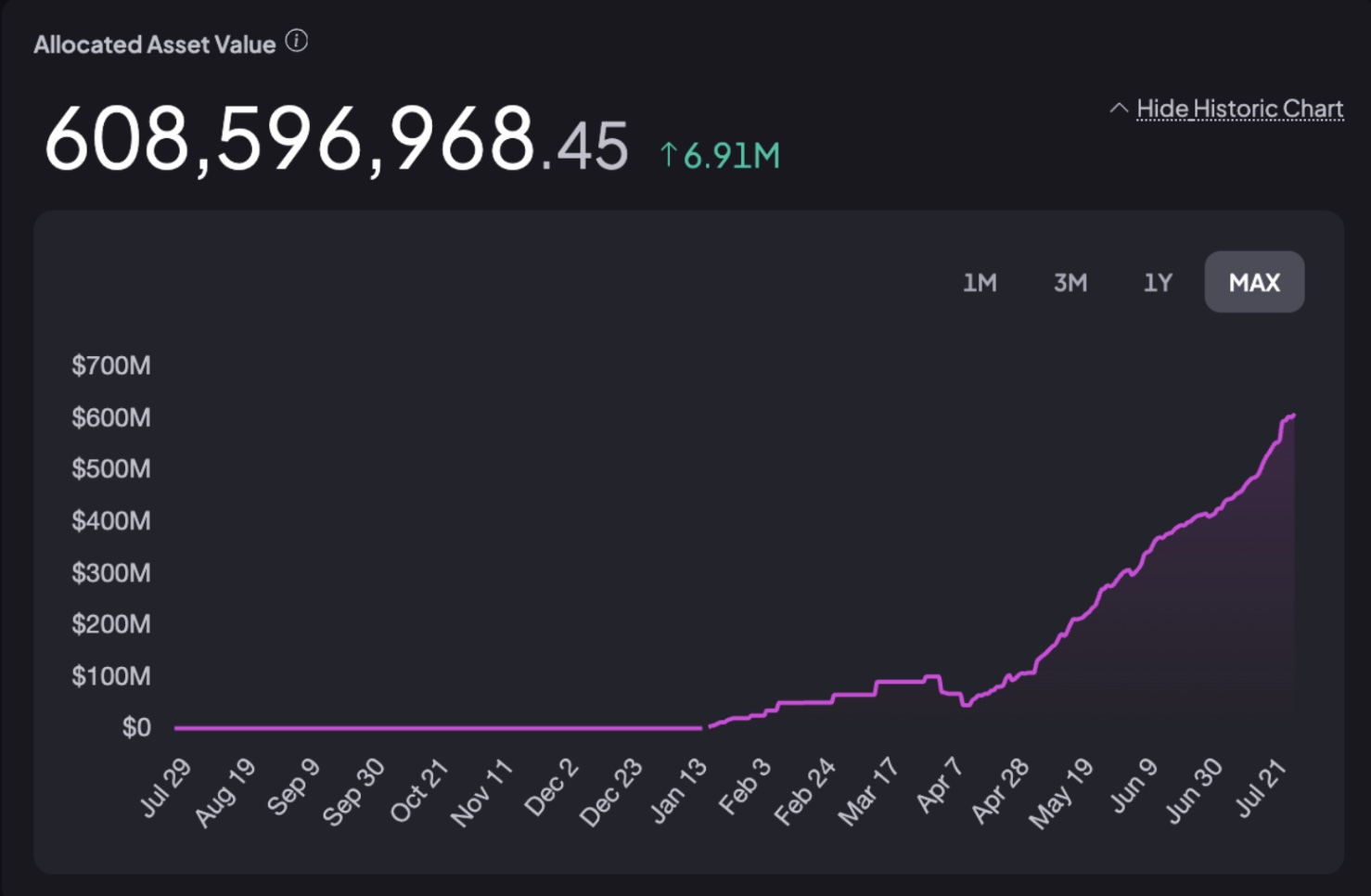

This approach has proven effective. Since launch (January 2025), allocated USDC has grown rapidly, reaching over $600 million and continuing to climb:

The chart shows consistent and accelerating demand for onchain loans powered by Spark. It’s a clear signal of product-market fit and infrastructure reliability.

Any Platform Can Build This

This model is modular: Morpho provides the lending protocol, Coinbase delivers the user experience, and Spark powers the liquidity.

Other exchanges, wallets, or fintechs can adopt the same approach. Build the front end, integrate with an open protocol like Morpho, and tap into Spark for deep, reliable capital.

Spark is here to power the next generation of onchain financial products, securely and at scale.