Summary

After many years of hard work, Spark has gone live in most aspects as of July 1. This article will cover what this means in full detail, including revenue projections, the Sky/Star relationships, the long-term case for Spark, as well as an overview of this new type of decentralized governance structure.

Sky Ecosystem Overview

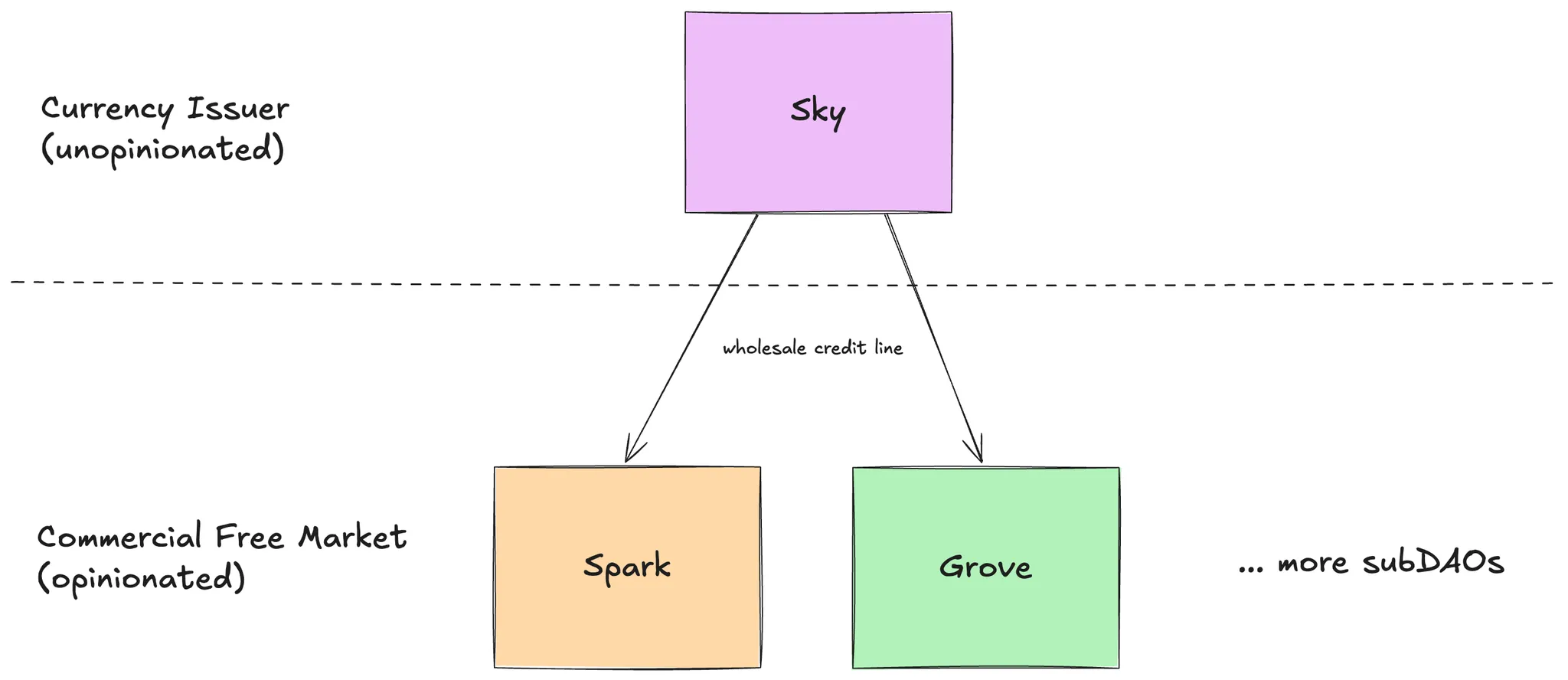

Sky has split itself into a subDAO structure to address the issues of scaling governance. DAOs as they exist today are largely decentralized in name only, with a select group of insiders controlling the parameters. While this is fine as a business, existing DAOs will not work for global infrastructure that needs to remain as neutral as possible.

Sky is solving this problem by outsourcing all growth-oriented decision-making to a competitive marketplace to maintain the properties of decentralization while not losing the agility of centralized companies. It achieves this by defining a general risk framework that the subDAOs (aka Stars) need to follow. This includes all kinds of offchain rules to cover many types of risk such as: smart contract risk, counterparty risk, credit risk, market risk, etc.

Within the rules of the risk framework, Stars can borrow as much USDS as they want to deploy into any opportunities available, provided the Star pays the “Base Rate” to Sky. This means all Stars retain 100% of the spread earned above the Base Rate.

Sky Base Rate

Having access to a large credit line is an extremely powerful thing. SparkLend was bootstrapped to the second-largest money market in less than a year because of this access. The Sky ecosystem opens up this access by allowing all the Stars to borrow as much as they want to. We will cover how risk is handled later, but for now, you can think of Stars as yield-seeking engines that will deploy as much capital as possible, provided the yield is higher than the Base Rate.

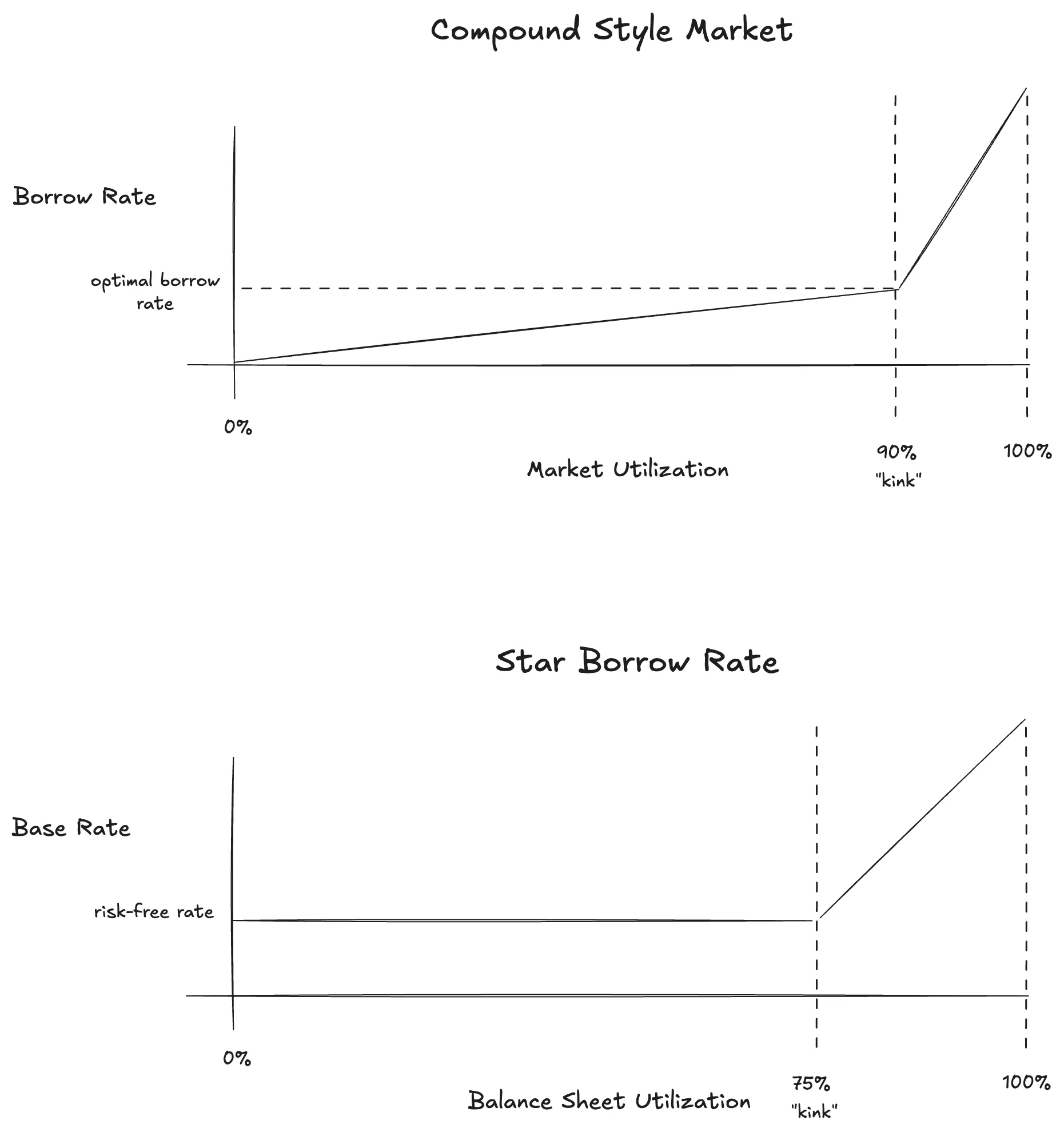

So how is the Base Rate determined? You can think of it similar to a Compound-style utilization rate curve, but covering the entire balance sheet instead of just one asset. Assets that count as Actively Stabilizing Collateral (ASC) are things like USDC and USDT which have strong onchain liquidity. These assets are treated as reserve cash to maintain the peg.

The rule for the Base Rate is if the utilization is below 75% (ASC is 25% or higher) then decrease the base rate every X time interval. The magnitude of the decrease depends on how far away from 75% the balance sheet is. Similarly, if utilization is above 75%, then the Base Rate will tick upwards over time.

While this is not precisely true, as the Base Rate goes down or up slowly over time rather than having immediate effects, the effect will mirror the above curve due to market forces.

Let’s run over some examples to see why this is the case:

Scenario 1: Base Rate is below T-Bill rate

If the Base Rate is below the T-Bill rate, then all Stars are incentivized to mint as much USDS as they can and deploy it into T-Bill products such as BUIDL or others. There is virtually infinite capacity in treasury bills so the Stars will capture any positive spread. This feedback mechanism ensures that there is a Base Rate floor at around the USD risk-free rate.

Scenario 2: Base Rate is above T-Bill rate

This is the most common case and the one we are currently in. At the time of writing, the Base Rate at 5.05% and so deploying into T-Bill products has a negative spread. In this case, Stars will compete to allocate to the best spread available up to around the 75% utilization mark. Interestingly, this has already happened just a few weeks in!

See the screenshot below. Market forces are keeping the ASC just above 25% so utilization is just below 75%.

Stars do not want to go above this number because the Base Rate will increase, but a competitive marketplace keeps this number around 75% with the Base Rate settling at just below the undifferentiated yield threshold.

Sky Risk Framework

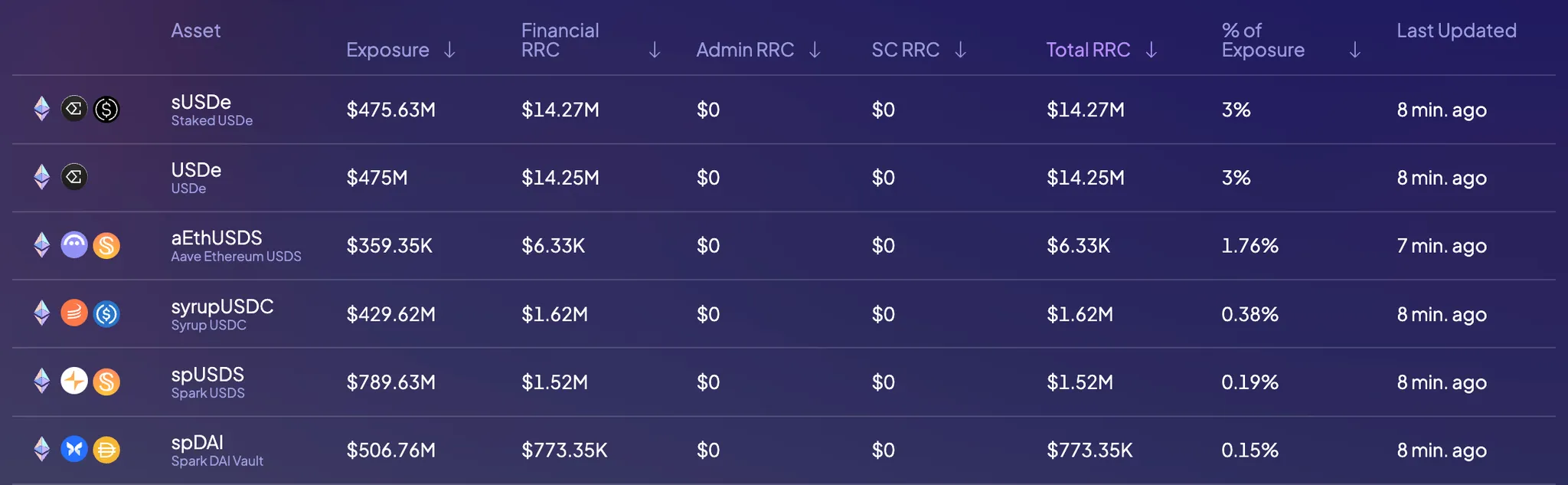

Stars can deploy into many opportunities, but not everything is of equal risk. For example, an unsecured loan generally carries more risk than a secured one. To account for these differences in risk, Sky requires Stars post junior capital to cover any potential losses. This puts the Star’s equity at risk for every decision, so they have skin in the game.

As shown in the screenshot above, the “% of Exposure” is the junior capital requirements. For Ethena, the Star is required to put up 3m USDS as first-loss to cover every 100m of Ethena exposure.

This exposure comes entirely from “Financial RRC” which means it is based on things like counterparty risk, market risk, and credit risk. “Admin RRC” comes from things like multisigs with arbitrary control over the protocol. “SC RRC” comes from smart contract safety — things like code complexity, audits, Lindy, etc.

As expected, Ethena carries a higher risk than crypto lending. Within crypto lending, you can see that onchain (SparkLend) carries a lower risk in general than something offchain (Maple).

Note: the above numbers are a work-in-progress and subject to change as the risk framework evolves.

Spark Revenue Sources

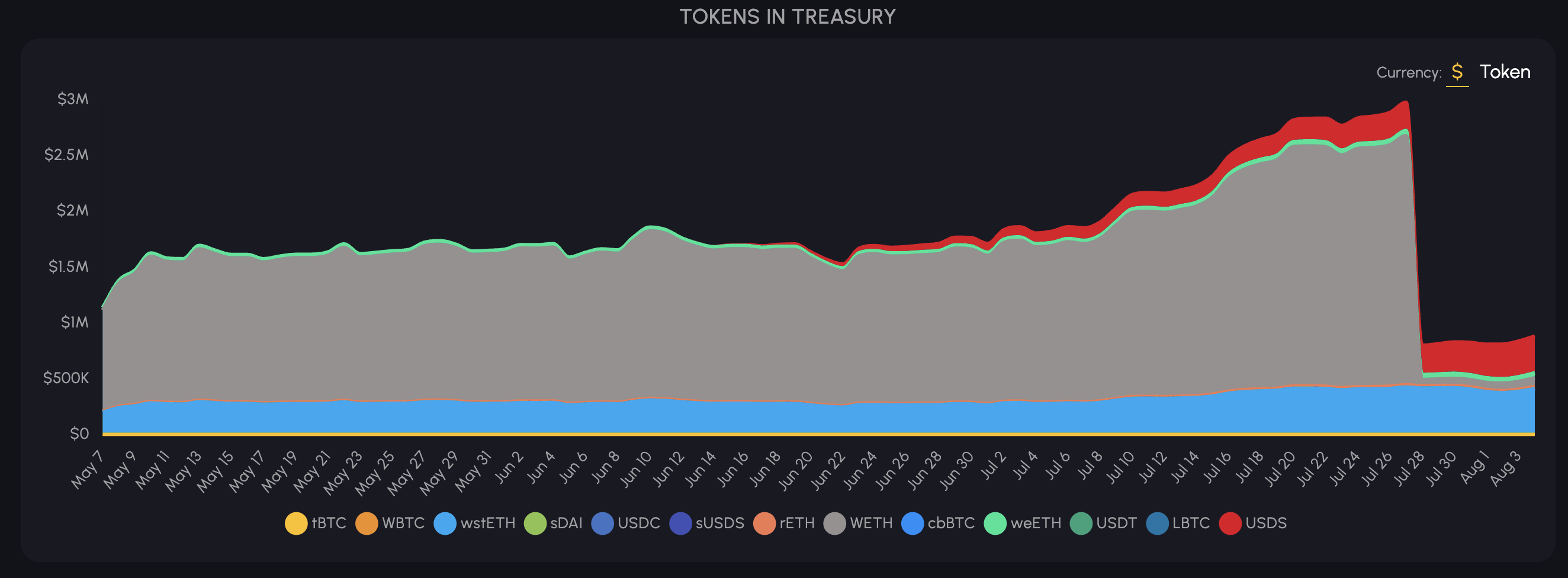

As of July 1st, 2025, Spark and Grove became financially autonomous. With a one-time capital injection of $25 million from Sky, both Stars are now responsible for generating their own revenue and managing their operations without additional funding from Sky.

Spark earns revenue in 3 ways.

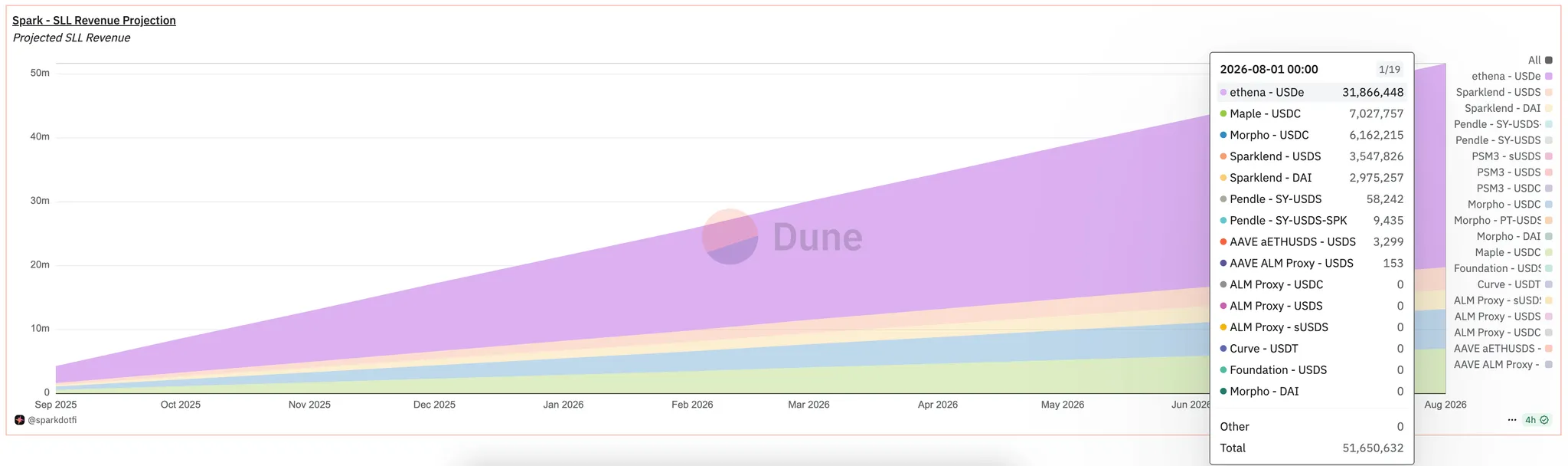

1. Spark Liquidity Layer

The Spark Liquidity Layer (SLL) currently generates the largest amount of revenue at ~51m USD annually (note: Ethena revenue is split between Spark and Grove). It earns this primarily from a mix of SparkLend, Ethena, Maple, and Coinbase (labelled Morpho - USDC).

This revenue is calculated by taking the yield generated by the protocol and deducting the Base Rate paid to Sky. Typical bull market spreads are around 1% for SparkLend, 2-3% for Crypto Lending, and 5%+ for Basis Trade.

2. Spark Savings

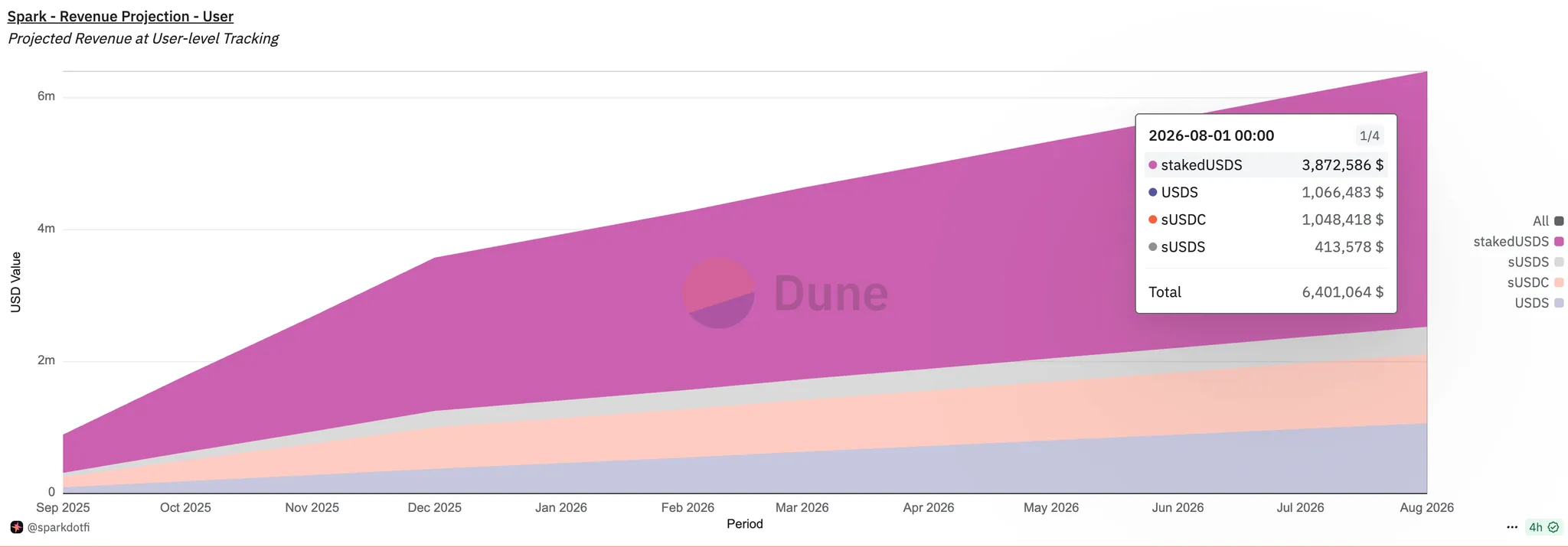

Sky also runs a longer-term program called the Accessibility Rewards program, which rewards Stars for finding new users to deposit USDS. Stars earn 0.2% (0.6% until the end of 2025) on the TVL placed into deposits. While this amount is initially lower than SLL revenue, it is a sustained long-term revenue source for Spark.

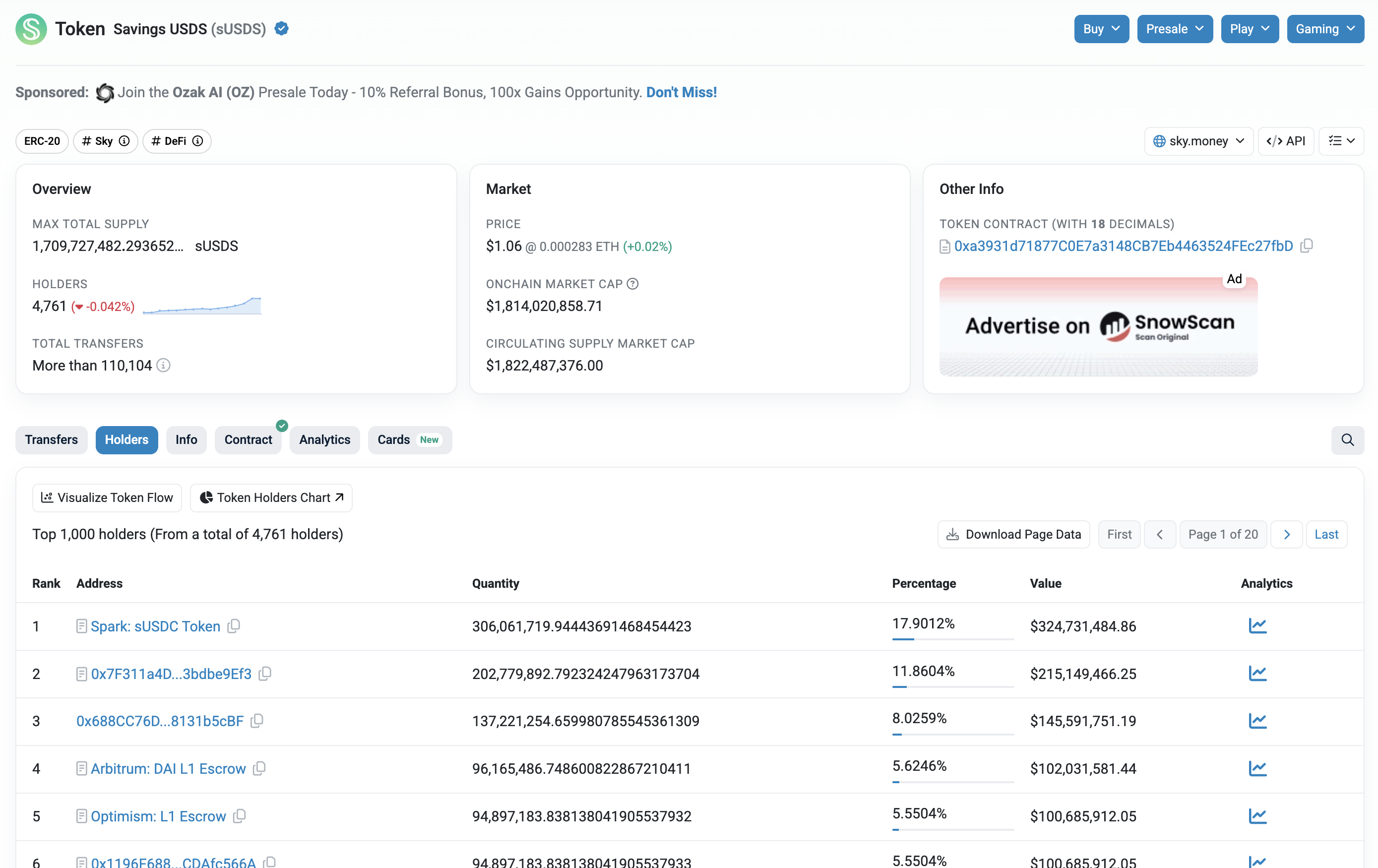

Spark is already earning 6.4m / year from this program by facilitating ~1.8b in deposits to sUSDS.

3. SparkLend

Finally, SparkLend also generates revenue for Spark on the reserve factor inside the market. This is included in SLL revenue above for USD markets, but ETH is another market that is heavily utilized with over $1 billion USD of outstanding loans.

Sky and Star Flywheel

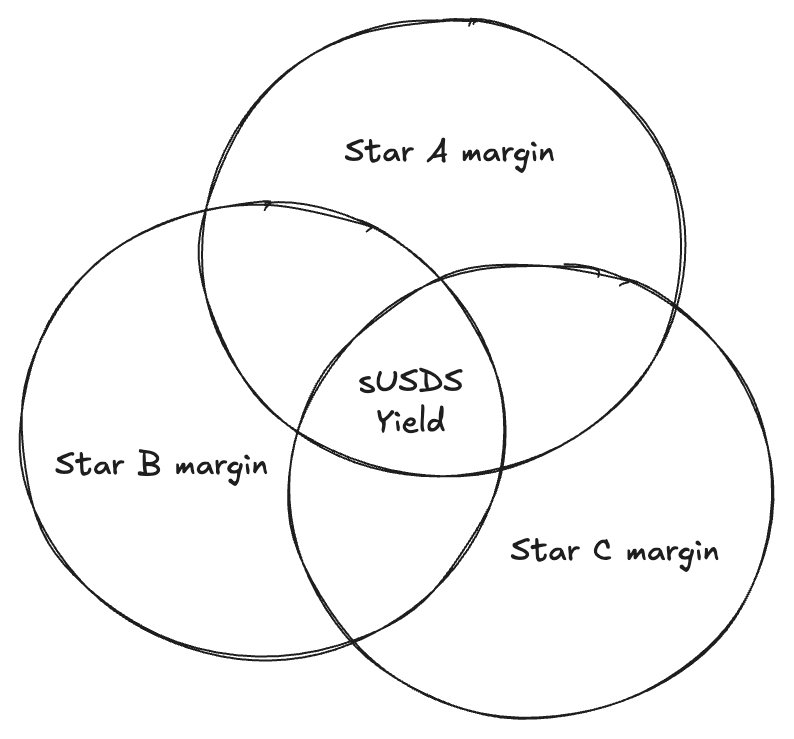

You can think of a Star as a machine that converts undifferentiated yield sources into benefit for sUSDS holders. The Sky Savings Rate is anchored to be 0.3% below the Base Rate. This means that the margin for Sky is 0.1% (after the accessibility reward incentive of 0.2%). The structure of the system ensures that Stars can be successful, but they need to find unique differentiation and keep innovating.

This system provides some very positive feedback loops that provide users with confidence in sUSDS’s multiple sources of yield while giving Stars a robust set of tools to start on third base if they find a differentiated business line.

Spark’s Long-Term Differentiation

So what are the differentiators for Spark? It’s important to note that Stars will be more ‘divide and conquer’ to start, but here is where some long-term moats exist today.

1. SparkLend

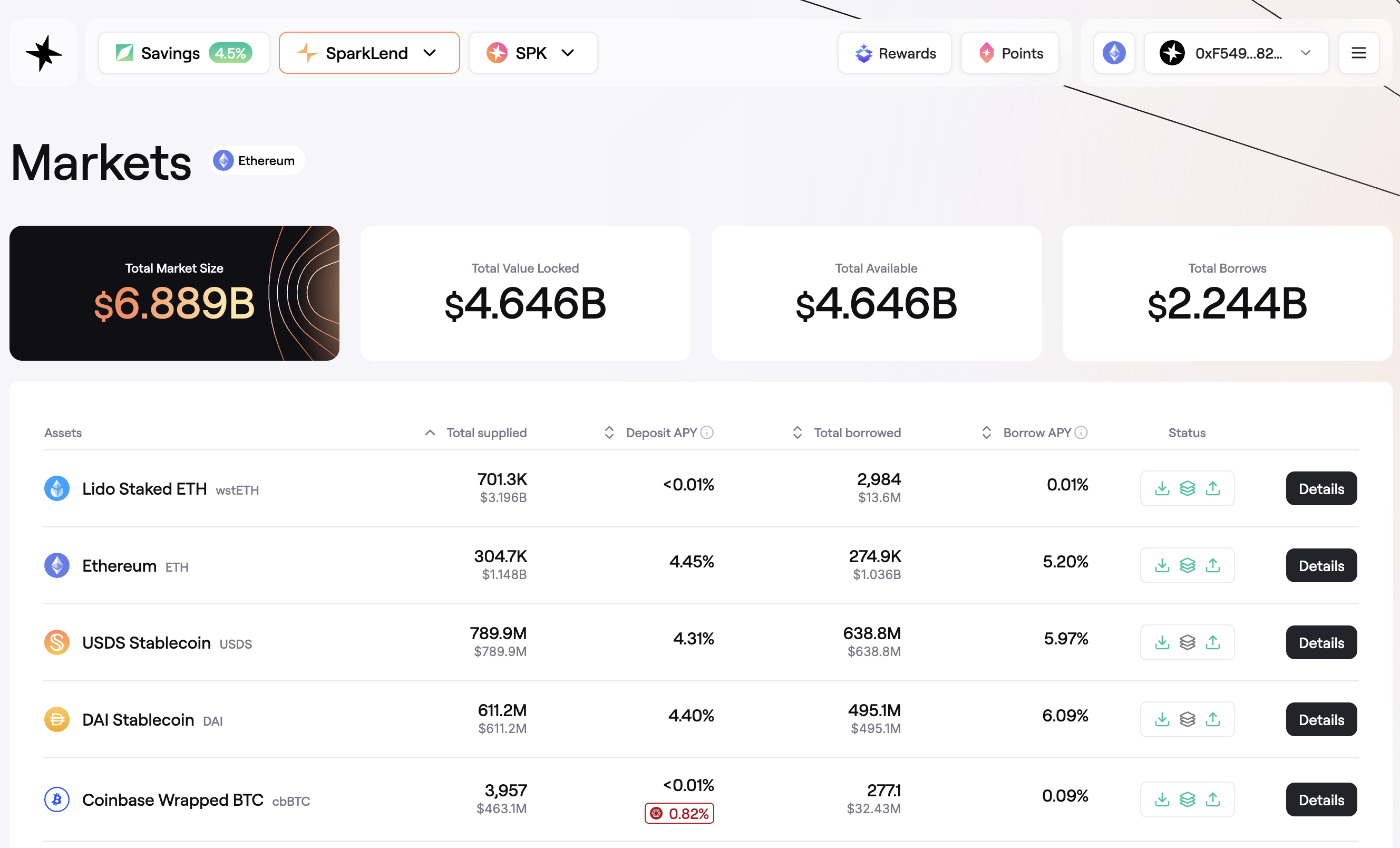

SparkLend is the second-largest money market in DeFi with ~$7 billion in total deposits. Other Stars are free to tap into SparkLend’s liquidity, but they need to pay reserve factor fees to Spark for the privilege.

The biggest differentiated factor is that SparkLend is home to the second-largest amount of ETH in lending markets, with over $1 billion in total deposits.

2. Spark Savings

Spark has its own vault called sUSDC as a wrapper on top of sUSDS. sUSDC is the largest holder of sUSDS at 325m on mainnet. Similar vaults will soon be deployed to do the same thing for USDT — offering 1:1 liquidity to USDT with yield-generation via the SLL.

3. Brand

Spark is an emerging, globally-recognized brand. The Spark brand stands for transparency and individual empowerment. It aspires to drive the future of decentralized finance and tradfi forward by making finance and capital accessible to all, including both retail and institutions seeking stable, reliable, and trustworthy yield and lending options.

4. More to Come

Spark has some big announcements coming over the rest of 2025.