A look back

2025 has been a busy year for Spark.

The year started with the launch of the Spark Liquidity Layer (SLL). This cross-chain, multi-asset allocation system enables Spark to access new lending opportunities, such as the Coinbase BTC Borrow product, which now supports $500 million of onchain loans directly to Coinbase users on Base.

Coinbase kicked things off, but it is expected that most exchanges/fintechs will follow suit as the world races to get onchain. This is due to the cheap capital provided by stablecoins. Spark is well-positioned to capture all this new demand via the SLL, which has grown to $3.15 billion allocated, generating an average of 5.8% APY across many different protocols.

Spark retains 100% of the spread above the 5.05% Sky Base Rate. The estimated annual recurring revenue of the SLL stands at $26 million.

June marked the launch of the SPK token across most major exchanges, including Coinbase, Binance, OKX, Bybit, and others, with over 320m tokens staked by 5k+ stakers.

Starting July 1st, Sky enabled full Profit and Loss calculations, which means Spark is now retaining the revenue it earns. The first payments closing out the months of July and August were made on September 22, totaling 5,927,944 USDS paid to the Spark Treasury.

What’s Coming

2025 has been a transitional year for institutional adoption, marked by the passage of legislation such as the GENIUS Act. DeFi is maturing to a place where web2 fintechs are coming onchain with examples such as PayPal, Stripe, Robinhood, and others.

Spark is well-positioned to capitalize on this institution-driven growth by providing high-quality lending infrastructure, such as SparkLend and Spark Savings, as well as newer offerings detailed below.

Here are the protocol updates that will be proposed in the coming months to Spark governance:

SparkLend

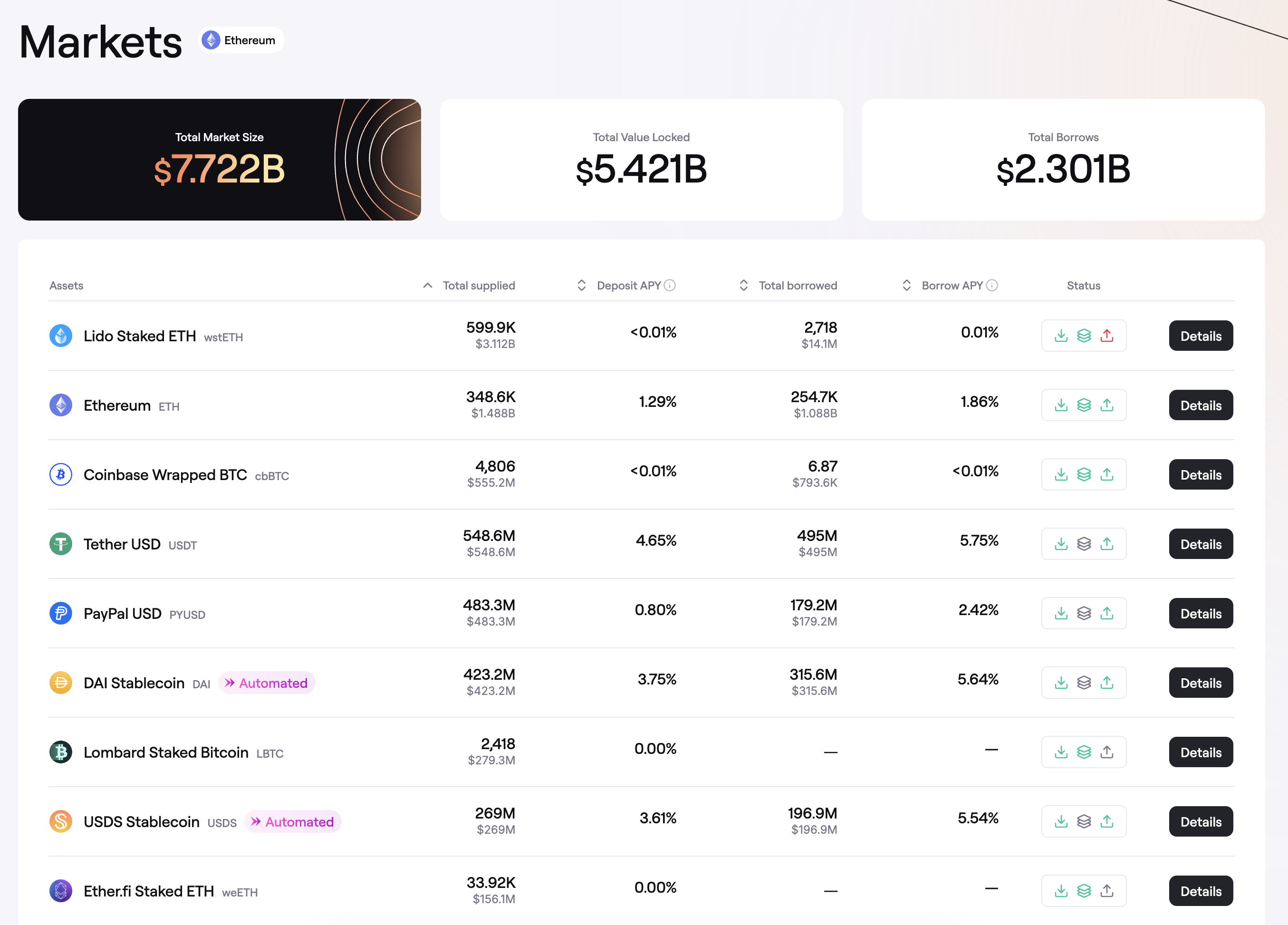

SparkLend is the second-largest lending market on Ethereum with over $7.7 billion in total deposits. While Spark has external lending operations in protocols such as Morpho, SparkLend remains one of the safest places to lend or borrow with your blue-chip crypto assets at scale.

Institutions consider risk-adjusted yield when evaluating investments, and SparkLend has consistently differentiated itself by not chasing the highest yield available in a single pool. Instead, Spark curates isolated higher-risk opportunities on Morpho. This allows for more user choice without sacrificing liquidity.

Recently, Spark has been ramping up support for USDT and PYUSD markets on SparkLend. USDT has demonstrated strong growth over the past year, increasing its market capitalization from $119 billion to $174 billion. Users can now borrow USDT at scale from the USDT market, which stands at $550 million in deposits, with plans to continue growing.

SparkLend is one of many institutional-grade lending options available for lenders and borrowers.

Savings V2

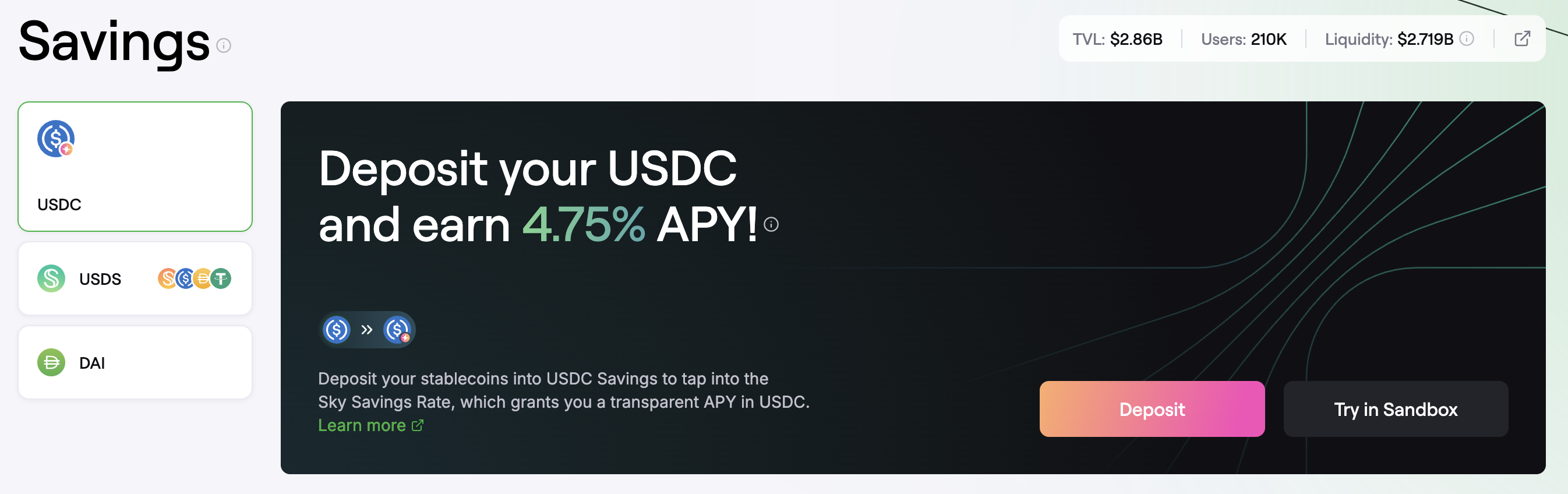

Spark Savings started as frontend support for access to Sky’s Savings USDS, but has since evolved to include Spark’s USDC vault. This enabled easy access to the Sky Savings Rate (SSR) by combining the USDC swap in the PSM with USDS staking.

Spark Savings has been highly successful, growing to a $620 million TVL across five chains in six months. Savings V2 expands upon this success by offering the same vaults for USDT and ETH, powered by the Spark Liquidity Layer cross-chain infrastructure.

With Savings V2, swap liquidity is no longer a concern. Use your favorite asset on your favorite chain and earn the governance-determined universal savings rate on it. Spark will have a universal rate for USD assets and a separate rate for ETH assets. These yields are generated using the same conservative strategy that Spark Savings has employed from the beginning. ETH yield will start with SparkLend ETH and Lido stETH for yield.

Pending governance approval, Savings V2 will launch in October on Ethereum Mainnet. Existing V1 USDC vault depositors will not be required to take any action, but migrators will receive Spark Points. You can keep funds deployed in the Savings V1 contracts indefinitely.

Spark Institutional Lending

Spark’s strength lies in institutions; however, some features are not covered by Spark’s existing capabilities. In particular, institutions are seeking fixed-rate loans and established counterparties. Spark Institutional Lending is the latest offering from Spark, utilizing Morpho’s V2 architecture.

Unlike pooled variable rate lending, Morpho V2 works by matching lenders with borrowers directly for a fixed term. This approach was attempted early on, but with limited success due to the fragmentation of lenders and borrowers. Spark solves this problem by providing an evergreen list of offers at a scale exceeding $100 million. Borrowers can select the desired duration and proceed without permission.

The Spark Liquidity Layer will ensure that liquidity is always available at market rates, just as it does with SparkLend and Morpho V1.

Spark Institutional Lending is set to launch with Morpho V2 towards the end of this year, pending approval by Spark governance, with the expected loan size to grow rapidly to over $1 billion.

Spark Mobile

While the Spark Liquidity Layer has been great for covering B2B2C use cases, it is important to have a Spark-first curated consumer experience for distribution. Spark Mobile is launching in the new year to provide a way for users to save, borrow, and pay with ease.

Stablecoin Liquidity as a Service

Launching stablecoins and chains has one thing in common – a need for liquidity. Spark is uniquely positioned to bootstrap this liquidity using the cross-chain Spark Liquidity Layer. Operating at the scale of billions, this system can support giants like Coinbase and PayPal.

For stablecoins, Spark provides lending infrastructure (SparkLend/Morpho/Aave), liquidity (Spark Liquidity Layer), and DEX support (Uniswap/Curve) to bootstrap any stablecoin to a size of billions. PayPal’s PYUSD is a good example, with the SLL having allocated $500 million to PYUSD, which will grow to a total allocation of $1 billion in the coming weeks.

For chains integrating with fintechs/exchanges, it is common for borrowing demand to mismatch earn suppliers. Spark can bridge this gap as organic demand is filled. In the case of Coinbase, they launched a borrow product without the earn side. Spark was able to fill this gap.

Similarly, chains have to run large incentive programs to keep deposits to ensure there is enough liquidity to bootstrap lending markets. With Spark, this is no longer necessary, as Spark imports the universal savings rate to all chains. As organic demand grows along the chain, Spark will move liquidity alongside borrowing demand without the negative user experience of spiking interest rates.

Spark Automated Trading Operations

The Spark Liquidity Layer is already covering most of the lending opportunities in DeFi Money Markets, RWAs, and Basis Trade. With the expansion of stablecoin coverage to include USDT and PYUSD, Spark is now holding over $900 million of non-USDC stablecoins across the DeFi ecosystem.

Spark will expand its coverage of automated trading operations in Q4 to include integrations with OTC Desks, Exchanges, and Uniswap V4, covering $100m+ stablecoin swaps. This will not only be a new source of revenue for Spark, but also a significant improvement in onchain liquidity between stablecoins, with USDS serving as the hub for onchain swaps.

While these types of operations are not new to hedge funds, high-frequency traders, and market makers, what is new is running these operations in a non-custodial manner with complete blockchain transparency, ensuring that assets are always visible. No need to trust, verify.

Spark - Institutional-grade DeFi for everyone

Spark is the first of its kind. Operating at the scale of billions while adhering to principles of transparency and openness. 2025 is a year of reaching scale within DeFi, but the size of the market opportunity is so much larger.