Spark recently onboarded PYUSD, and deposits in SparkLend have already surpassed $200 million, with plans to increase to $1 billion deposits over the coming weeks. This milestone reflects both the demand for PYUSD and the effectiveness of Spark’s stablecoin bootstrapping framework.

The Spark Bootstrapping Strategy for Stablecoins

Spark has developed a systematic approach to help new stablecoins grow:

-

Add the token in SparkLend The first step is for governance to add the stablecoin in SparkLend, creating a lending market for supply and borrowing.

-

Integrate with the Spark Liquidity Layer (SLL) The SLL provides liquidity to the new pool, making the stablecoin available for use in the broader market.

-

Set a supportive base rate Borrowing rates are configured to encourage usage in the early phase, creating natural demand for the stablecoin.

-

Support Onchain Liquidity with DEXs The SLL can supply DEX liquidity against USDS, which can leverage other stablecoins on the balance sheet, such as USDC and USDT, to facilitate large swaps.

This approach gives new issuers the critical infrastructure needed to move beyond issuance: a lending market, liquidity provision, and an incentive framework that drives adoption.

Institutional-Grade Lending Backed by Blue-Chip Collateral

SparkLend is built with institutional standards. Every new market goes through a rigorous risk assessment before being onboarded by governance. For PYUSD, this means borrowers must post blue-chip collateral currently supported by SparkLend.

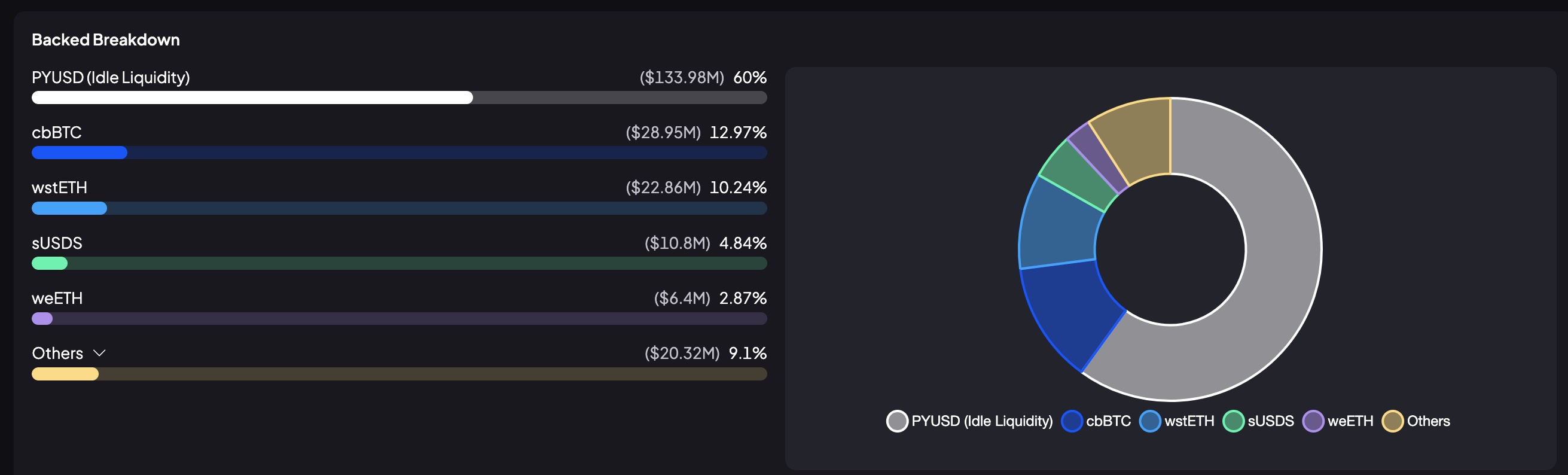

Since onboarding, deposits in the PYUSD pool have exceeded $200 million. Of this, 60% remains idle PYUSD liquidity ready to be borrowed, while the rest is actively backed by collateral: 26.8% cbBTC, 6.9% wstETH, 5.8% ETH, alongside smaller shares in sUSDS (4.6%) and others (1.7%).

This mix of idle liquidity and secured borrowing demonstrates how Spark not only attracts deposits but also provides immediate depth and safety for market participants.

Building the Lego-Structure of DeFi

By combining lending infrastructure, liquidity injection, and incentive alignment, Spark enables new stablecoins to scale. This creates movement in the market, unlocking attractive borrowing opportunities and reinforcing DeFi’s modular structure—where individual components, when connected, generate systemic growth.

Institutional-Grade DeFi for Everyone

The success of PYUSD demonstrates how Spark supports stablecoin issuers through their bootstrapping phase, offering both infrastructure and liquidity.

Spark is building a foundation where new assets can thrive. Institutional-Grade DeFi for Everyone.