Disclaimer: This article is for informational purposes only and is not legal, business, investment. Do not base investment decisions on it, nor consider it as accounting, legal, or tax guidance. Mention of specific assets or securities are examples and not endorsements. The author’s views may not reflect those of any affiliations and are subject to change without update.

Here is the thread of the article

Uniswap V3 is the most used DEX thanks to its concentrated liquidity model, that has greatly improved the capital efficiency. Can we create news incentives on Uni_v3 with bribes and gauges as Curve’s ecosystem do ? That's what we will discover with Timeless and Bunni

The article is structured as follows :

1 - Quick overview of Timeless

2 - Bunni ; incentivise Uniswap v3 liquidity

3 - The coming $LIT war

4 - Some strategies and analytics

5 - Extend and conclusion

Quick overview of Timeless

We need to first, understand the main project before study in depth what is Bunni. Few explanations with schemes will allow you to quickly understand it

Timeless open a new boosting, hedging and speculating market by using Uniswap_V3 as a ‘layer’

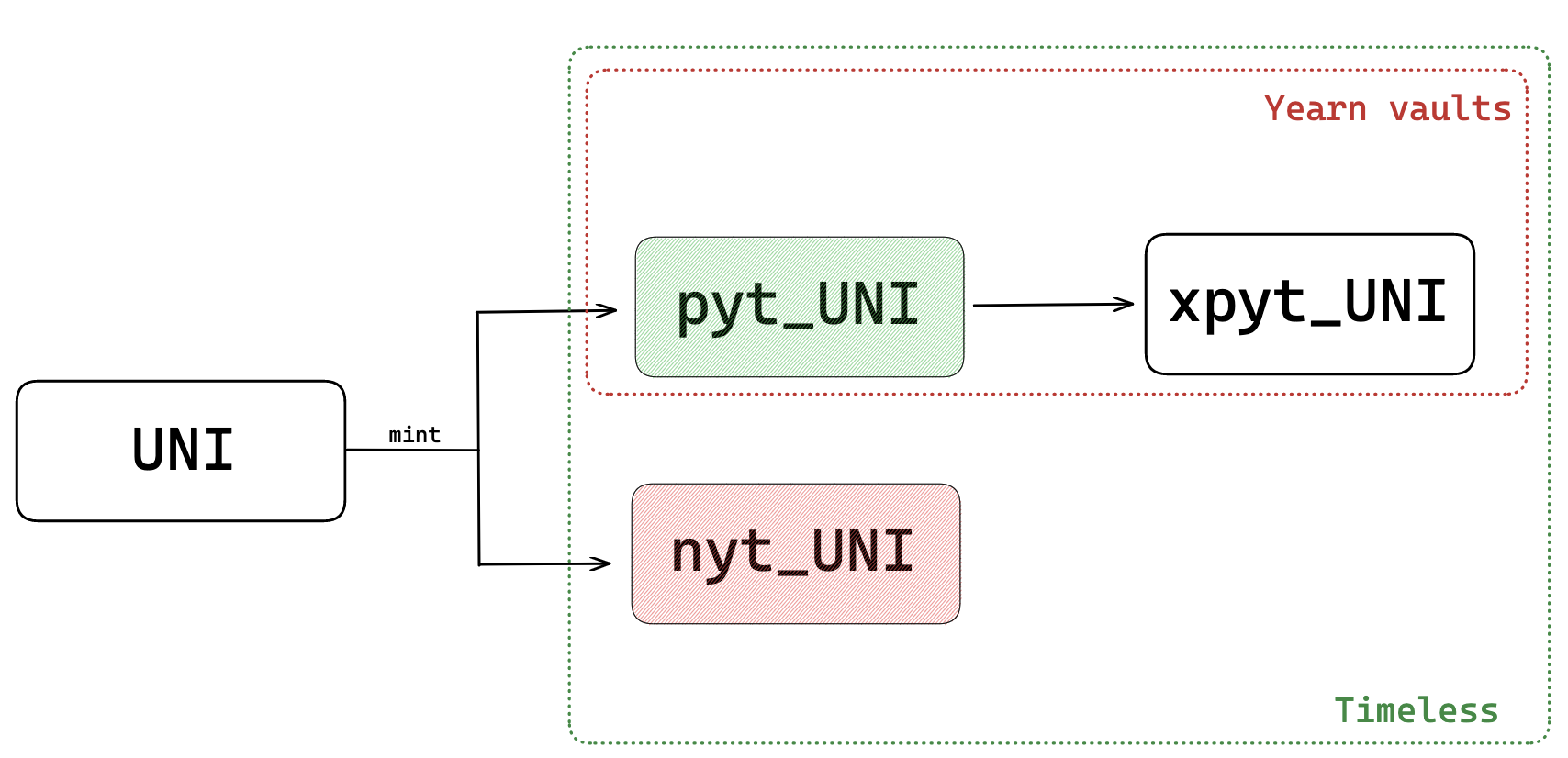

You can use Timeless to mint Perpetual Yield Token (PYT) and Negative Yield Token (NYT). When you mint these tokens, PYT are deposited in Yearn vaults (the only one vault at the moment) to generate yield

You will receive the same amount of PYT and NYT.

That means : 100 UNI == mint ==> 100 pyt_UNI + 100 nyt_UNI

- pyt_UNI represents the future yield generate by the underlaying principal (UNI). It represents the right to claim the yield

- xpyt_UNI represents the autocompound yield generate by pyt_UNI

- nyt_UNI represents the negative yield that moves in the opposite direction of pyt_UNI

Why they do that ? Because the yield is not fixed and moves, depending on the market condition. We will se later the utility of nyt_UNI

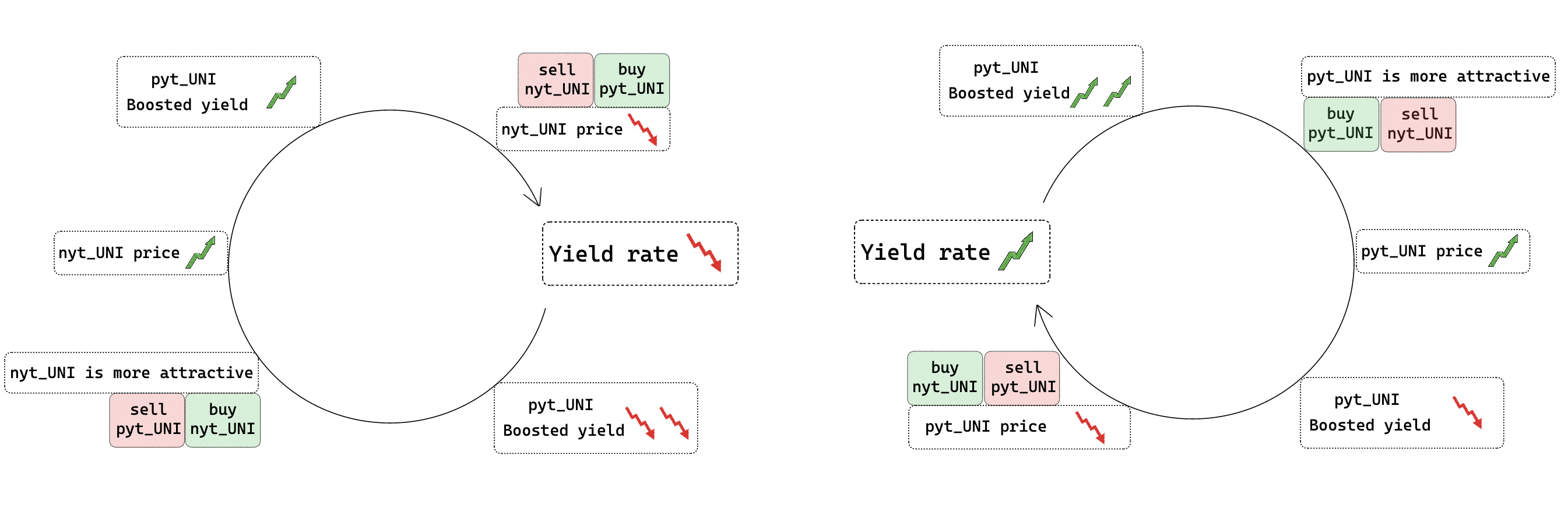

The value of pyt_UNI moves in the opposite direction than nyt_UNI

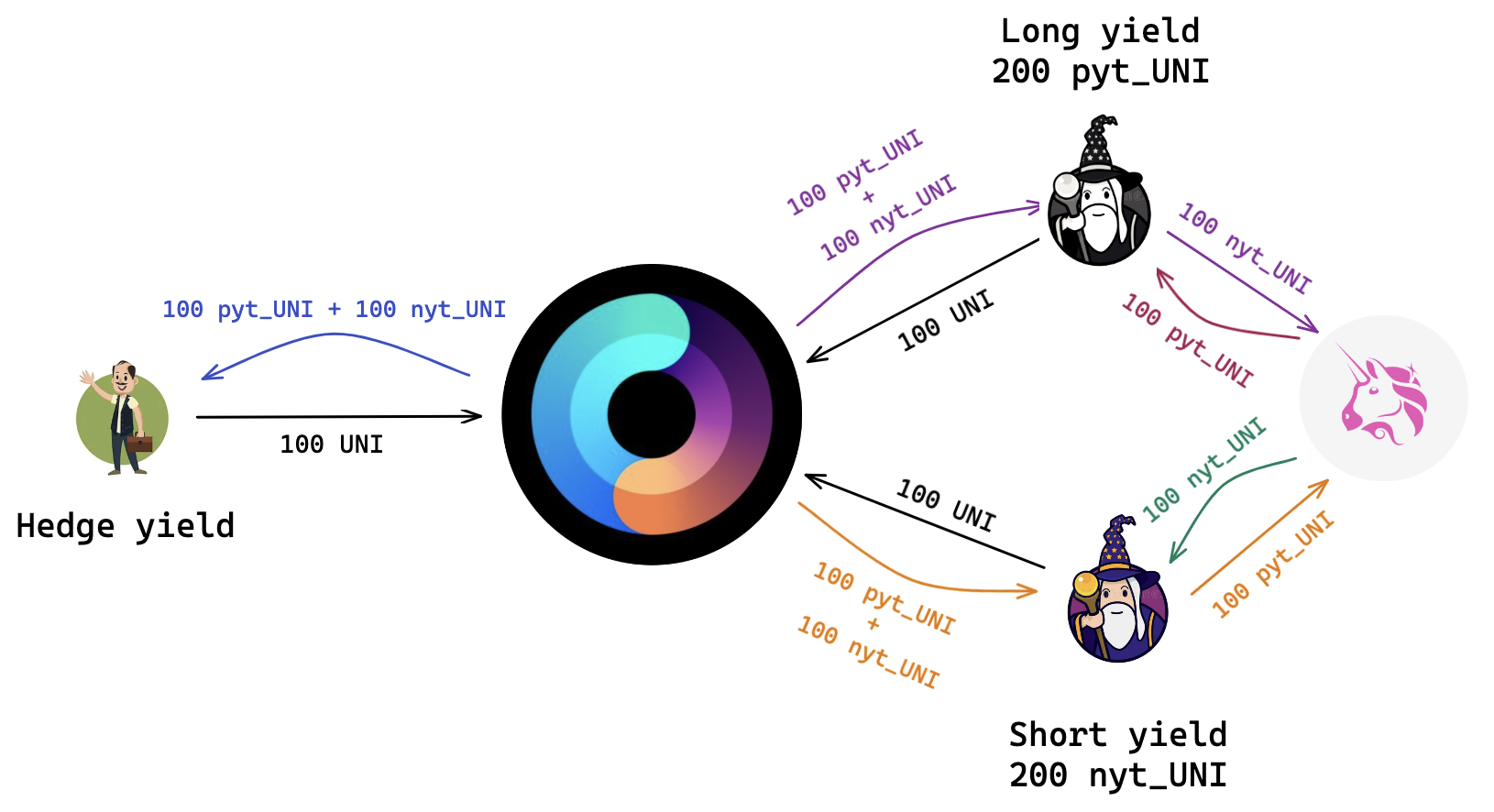

So, we have ;100 UNI = 100 pyt_UNI + 100 nyt_UNI but $100 UNI = (x$ pyt_UNI) + (y$ nyt_UNI) (”x” and “y” depend on the market conditions)

Basically, pyt_UNI increases when the yield increases and nyt_UNI increases when the yield decreases

That creates a market where speculation on yield is possible thanks to the tokenization of both “bearish yield” & “bullish yield”

Timeless’ ecosystem do even more ; PYT, xPYT and NYT are liquid and can be trade in the secondary market (xPYT / NYT Uni_V3 pool)

Lot of information. Make it simpler with a visual overview :

Several strategies possible are :

-

Be long on the yield : buy PYT

-

Be short on the yield : buy NYT

-

Hedge your yield by holding both PYT and NYT

-

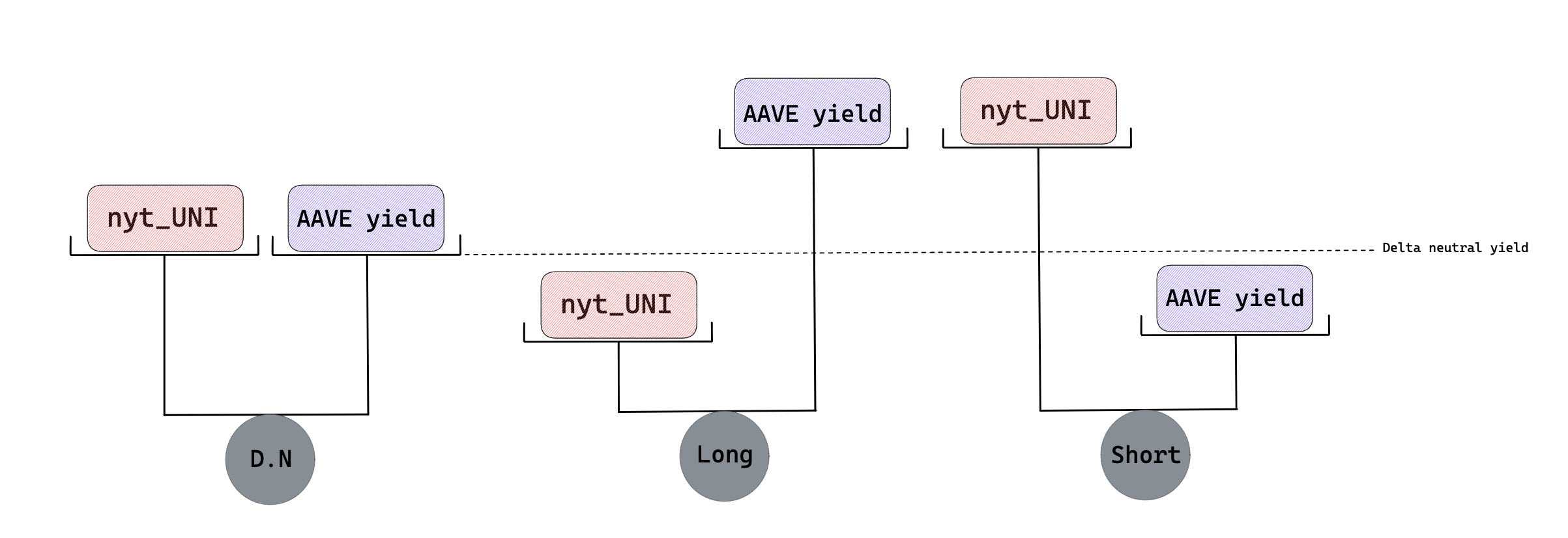

Hedge your yield from other protocol by buying NYT; take a glance below :

That creates interesting flywheels which makes the pyt_UNI more or less attractive compared to nyt_UNI

2 - Bunni, incentivise Uniswap v3 liquidity

Bunni is first and foremost a veTokenomic system working with Liquidity Incentive Token (LIT) The goal is to reduce farming-and-dumping and increase longevity of the liquidity

Here is how the protocol is built :

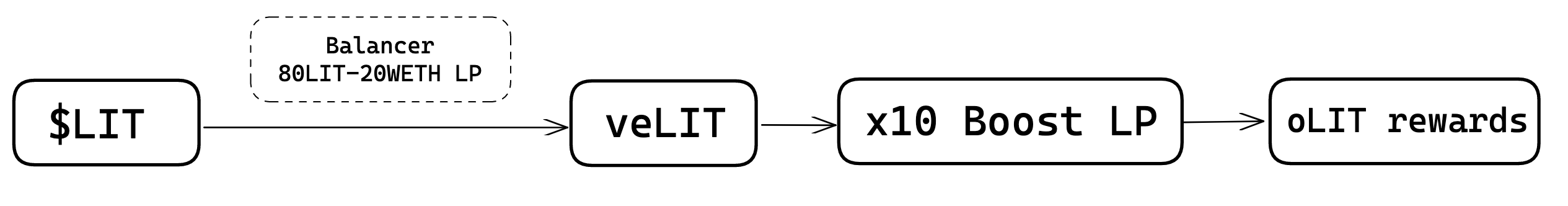

veLIT You need to lock (1 months until 4 years) your Balancer_LP into Bunni in order to received veLIT

Several utility for veLIT : governance voting, gauge weights voting, boost gauge rewards, receive bribes for voting, receive protocol revenu

oLIT oLIT is earn as bootstrapping rewards when you LP and hold veLIT

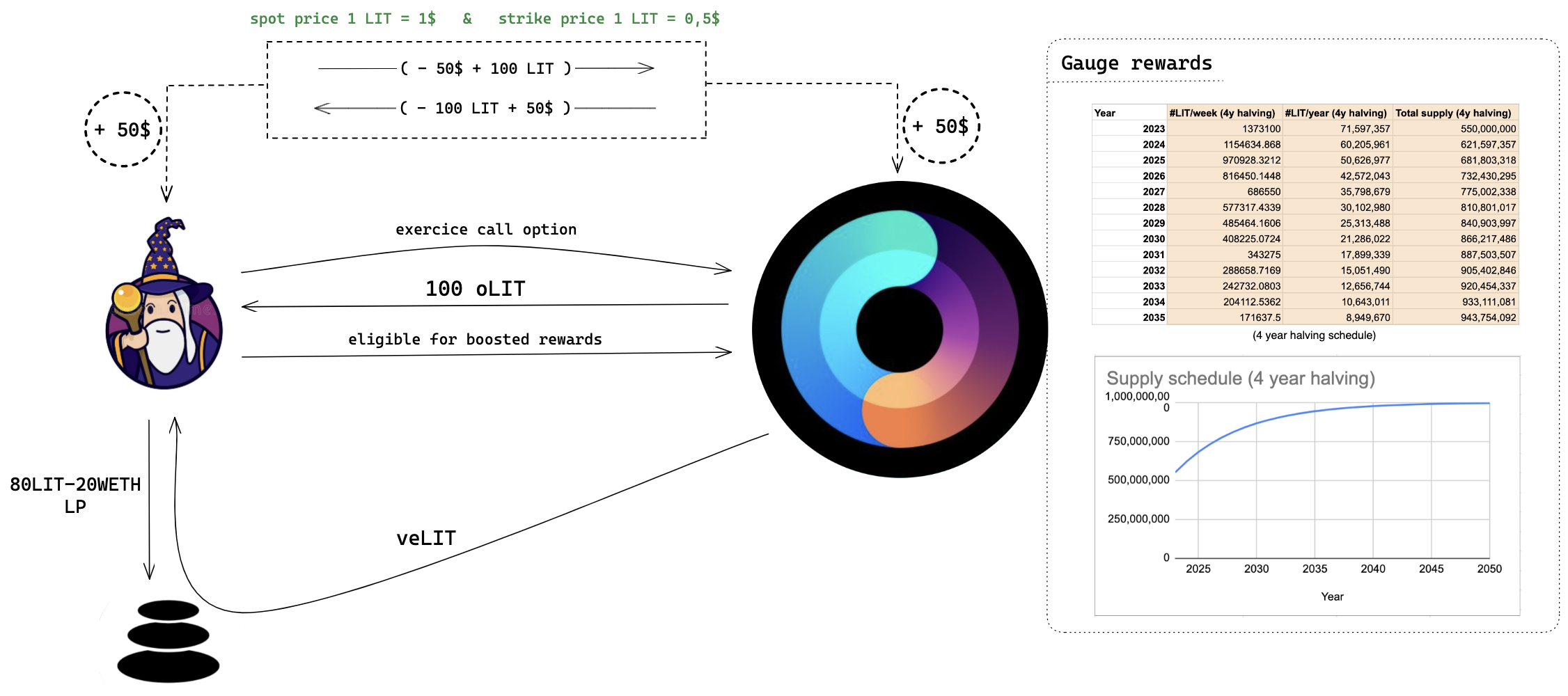

It is a perpetual call option token for LIT, with a strike price currently set to 50% discount ==> The boosted rewards give you the possibility but not the obligation de buy $LIT at discount

On this way :

- LPs are fairly rewards

- Bunni can accumulate a large cash reserve regardless of market conditions

The higher the discount is, the more efficient the incentivization is, but the less cash the protocol gets

32,40% of the total emission is allocated to the gauges rewards, following a 4 years halving schedule

This incentive is profitable for :

- the LP, who earned profit when the option is exercised

- the protocol can build his own liquidity

Here is a scheme to understand it :

By providing liquidity on Bunni, you’re LPing on Uniswap v3 as Bunni is build on the top of it (the protocol take 5% fees on the swap fees generated by Bunni LPs and can be modify by the community)

That means, if your LP goes out-of-the range, the gauge is “killed” and stops receiving oLIT rewards

To make it clear :

-

provide LIT-WETH LP on Balancer to earn veLIT

-

provide liquidities on Uniswap_v3 with Bunni to earn oLIT

-

do both to earn boosted oLIT

Bunni and Timeless can work together as Timeless pool are build on Uniswap_v3 ; you can create a gauge on Bunni and boost your xPYT-NYT pool Bunni has been built because. Timeless need a solution to get deep liquidity for the yield tokens

The liquidity is the holy grail in DEFI.

oLIT system is a genius way to protect veLIT from dumping while allowing the protocol to acquire their own liquidities in a sustainable way

The goal of oLIT is to strengthen treasury which will be use in several way such as bribing or use it as funding for this on others protocols and whatever else the community would think is good

You can directly follow the growth of the treasury here

3 - The coming $LIT war

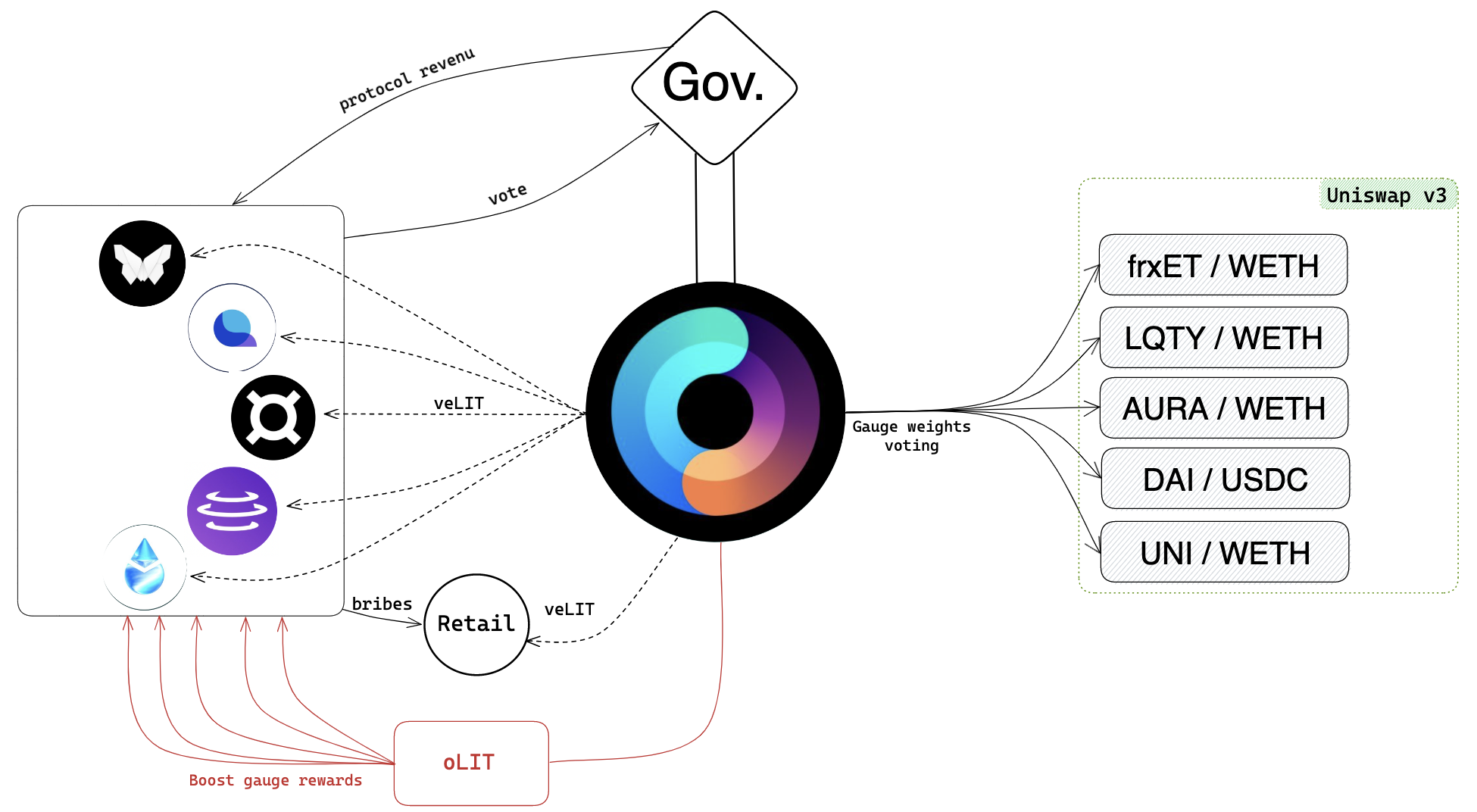

Gauges are not individual, exactly as Curve works. Your boost received will depend on the gauges weight of the pool, that is the reason why veLIT are so important

A scheme to quickly understand how Bunni is replicating the Curve war on Uniswap_v3

The more a protocol has veLIT, the more the protocol can incentive its own pools Protocols such as FRAX and AURA already started to accumulate veLIT … BTRFLY, others LSD protocols and more will come

At the moment, everyone can earn oLIT even who are not holding veLIT. However, veLIT are clearly advantage with boosted oLIT rewards. Once matured, the protocol will switched to the FOO model, described here

4 - Some strategies and analytics

Leverage (Timeless)

The protocol offers a new source of investment where you can long or short yield

That is a powerful solution to use leverage is a ‘safe’ way, because PYTs receive 100% of the yield from the underlying for less than it costs to own the underlying

Currently, leverage your yield by +50% on USDC and WETH

==> leverage in perpetuity without risk of liquidation

Free boosted rewards (Bunni)

Enjoy the oLIT gauges rewards until the FOO will be running

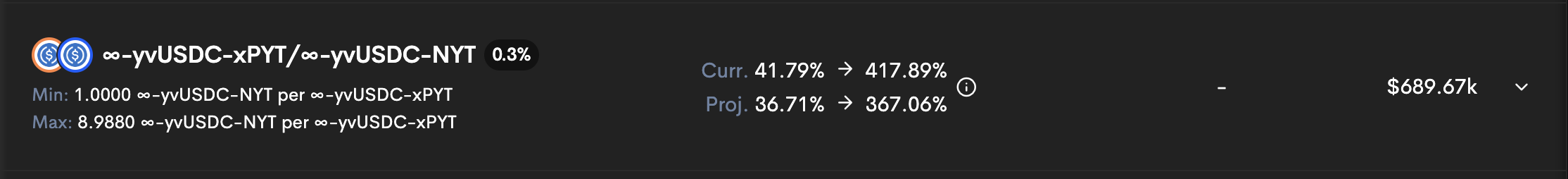

The yvUSDC-xPYT / yvUSDC-NYT & yvWETH-xPYT / yvWETH-NYT pools have juicy rewards (swap fees + oLIT) and rather no IL

==> earned free oLIT rewards

Analytics

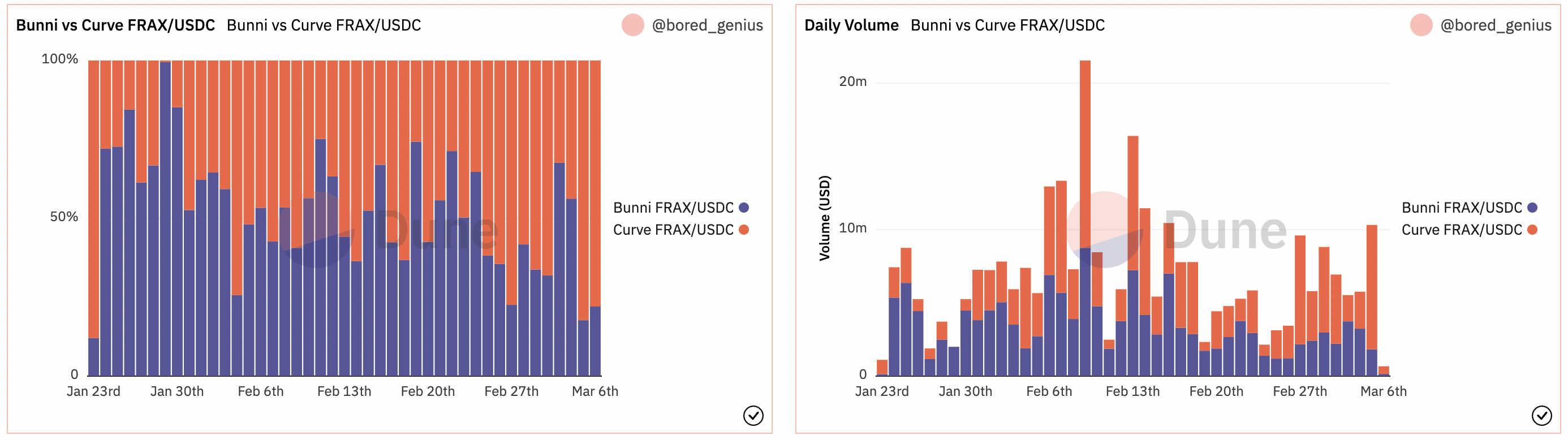

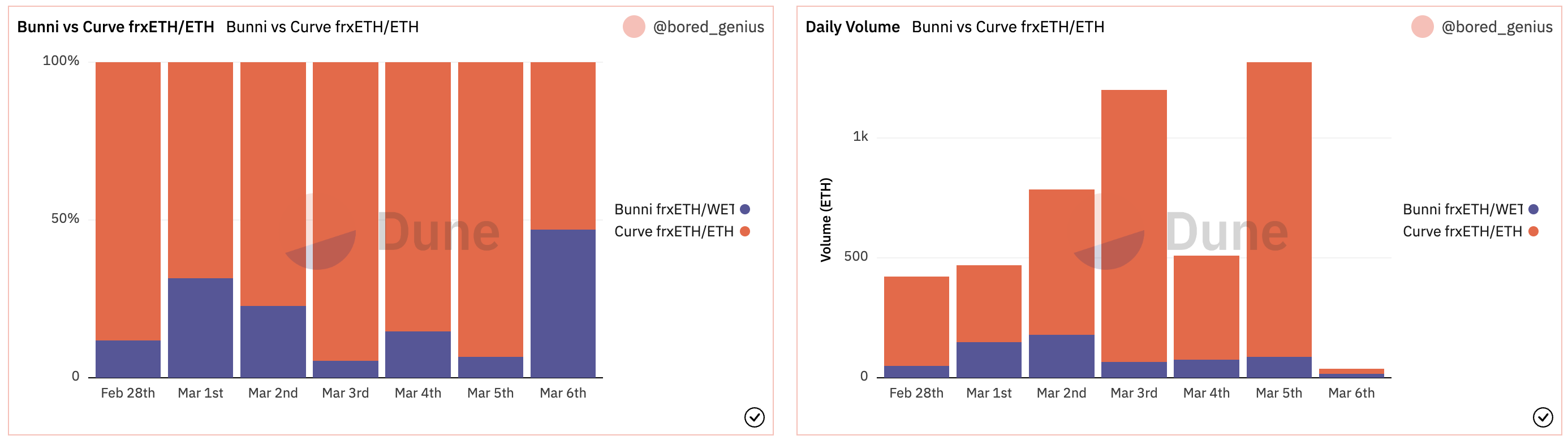

Let's make a comparison between Curve and Bunni on FRAX/USDC and frxETH/WETH pools which have the more liquidity on Bunni

Bunni TVL FRAX/USDC pool = 2,88M

Curve TVL FRAX/USDC pool = 520,3M

Curve has x180 more TVL than Bunni

Bunni has in average 54% of the daily volume

Bunni TVL frxETH/WETH pool = 2,78M

Curve TVL frxETH/WETH pool = 116,4M

Curve has x41 more TVL than Bunni

Bunni has in average 20% of the daily volume

Bunni is really more efficient and these data can be seen in others pools as well

Obviously, the two protocols are at different levels of maturity and incentive are not the same & currently the protocol fees on Bunni are 5% compare to 50% on Curve and this may change in the future

5 - Extend and conclusion

What could the future of Timeless and Bunni ?

-

Uniswap layer-3 ; it is expected that new protocols will be build on top of Bunni, exactly as Convex do with Curve

-

Extension on layer 2 ; PYT and NYT tokens can find an attractive market with more volatile and higher yield like Jones DAO and GMD on Arbitrum

-

Treasury growth ; How to continue to build a treasury without oLIT emission ? The protocol has years of building ahead of it and the community will contribute greatly

-

Attract liquidity without oLIT rewards ; $LIT has a limit supply contrary to $CRV. 10 years (approx.) of oLIT incentive will be enough to bring Bunni to maturity and essentially run with bribes and gauges ?

-

Delegating veLIT ; earn boosted rewards by delegating your governance power should see the light of day soon, rumours say that some folks are working on it

Why build a DEX when you can just profit off of the most successful DEX with the most volume & integrations ?

Bunni & Timeless have been built as Uniswap’s layer 2 by adding a new utility to the liquidityDue to its tokenomic model and utility token, Uniswap didn’t have the necessary components to create a new incentive model to catch more liquidities and imply more protocols in their ecosystem. But, Bunni is bringing gauges and bribes on Uniswap v3 with an elegant model to build their own liquidity

This is not a financial adviseI only share data analysis and strategies with you. The responsibility for your investments lies primarily with you

I hope you enjoy it ! See you soon