Here is the thread of this article

Caveat : this article covers the protocol functioning, ideas of strategies and more (v1 and v2). With the v3 and Tsunami, the approach is now totally different. Some terms changed since : hedge = premium / risk = collateral

Y2K is a hidden gem.

How you can use the on-chain analysis to generate > 70% APR real yield on ETH ?

Breaking down the article into :

1 – Quick introduction to Y2K

2 – Historical data and theoretical conclusion

3 – What is the smart money doing ?

4 – Can we do better ?

5 - Conclusion

1 – Quick introduction to Y2K

Y2K created an exotic market where investors can hedge themselves against potential depeg of an asset It can be stablecoin, BTC/WBTC or LSD

Y2K Earthquake works in a simple way :

-

One vault for 1 asset, 1 strike price and 1 epoch

-

‘Hedge’ to bet on a depeg

-

‘Risk’ to bet on assets staying peg

About weekly epoch; all vaults

-

open on Monday 00:01am UTC

-

close on Tuesday 11:59pm UTC

-

expire on Sunday 11:59pm UTC

So, deposits are opened for 2 days. Then your assets are locked until the maturity of the vaults All the insurance are paid in $ETH (for now)

If there is no depeg event ;

- your hedge position is liquidated : you lose all your ETH & earn Y2K extra yield

- your risk position wins : you earn ETH from the hedge’s investor proportional to your size vault + Y2K extra yield - fees

If there is a depeg event ;

- your hedge position wins : you earn ETH from the risk’s investor proportional to your size vault + Y2K extra yield - fees = YOU’RE GUCCI

- your risk position is liquidated : you lose all your ETH and earn Y2K extra yield = YOU’RE REKT

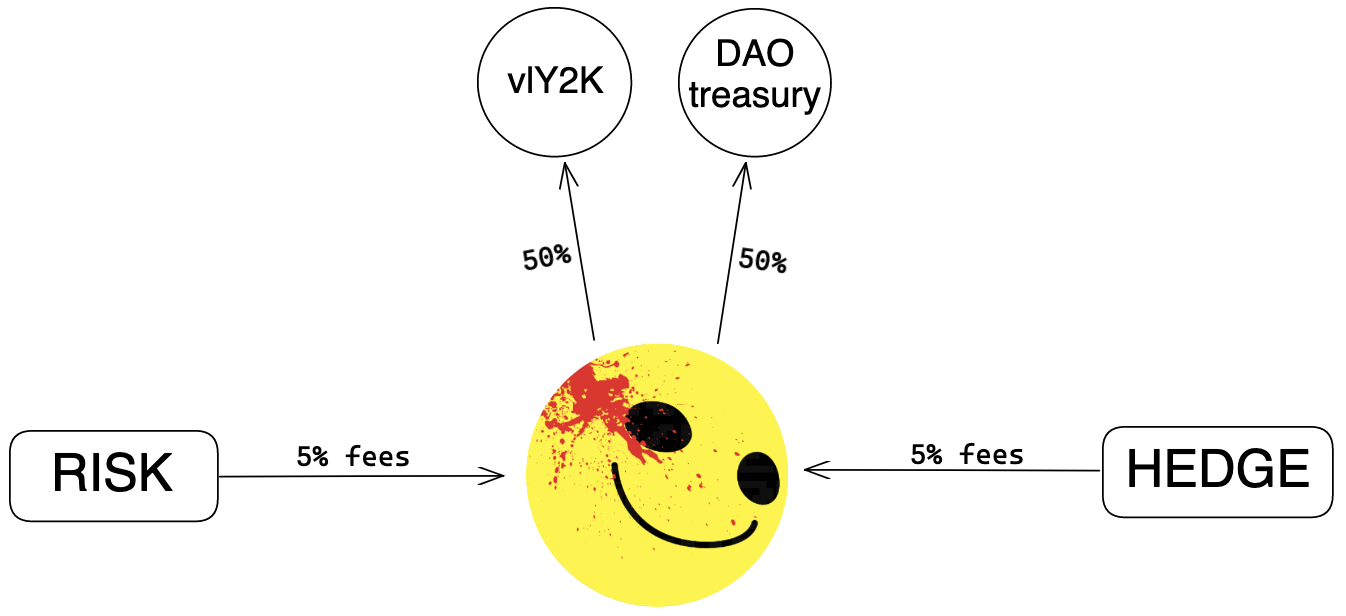

A visual infographic to quickly understand how fees works :

To counterbalanced the high risk taken by the hedger, Y2K offered much greater rewards for ‘hedger’ (premium) than ‘risker’ (collateral).

Basically, since depeg event are rare, hedging (premium) your position can be profitable if extra reward are suffisant to compensate ETH losses

We will see it with numbers later on the article.

2 – Historical data and theoretical conclusion

1) Calculate your potential rewards - RISK position

(No depeg event)

If you often use Y2K, you may know that Y2K extra rewards are peanut for riskers. That is the reason why you need to know which vault will give you the best ETH yield

The main feature to calculate it is the ratio (total ETH risk) / (total ETH hedge). The higher this ratio is, the higher the ETH yield will be

Let's take 2 examples :

We compared 2 vaults, “my risk ETH” is the amount of ETH you want to invest. Here we take 0,50 ETH as an exemple

If you pay attention to your these data, your rewards can go from simple to double

That means, to chose the best vault of the week, you must select the one that have the higher R/H ratio just before the closing of the vault

2) Dare to bet on the depeg

It can tempting to ape when you see 3000% APR, but waiiiiit !

As you will lose your ETH if there is not depeg, the rewards received should exceed the staking position

How high the APR have to be ? Approximately 5400% in average

That means, you must have to chose to vault that will generate the higher APR and bet on Y2K price stagnation or increase. This decision has to be quickly taken, directly at the opening of the vault to enjoy the 5-6 digit APR at the beginning.

Historically, I noticed that the DAI and USDT hedge’s vaults have the higher APR. This strategy has notably outperform Risk strategy during week 06 and 07, but most of the time it’s not profitable

The best ways to increase your profitability :

3) Historical data

Now you have an overview of the 2 strategies usable with Y2K Finance

Let’s check the data about the ratio R/H (Red cells are the depeg event) :

According to the table, Risk strategy is more profitable on MIM, USDT and WBTC

Visually :

All these datas have been extracted from this incredible dashboard made by @webthreeintern

You have access to all the datas about risk & hegde vaults. An overview :

4) Theoretical conclusion

The Hedge’s strategy fully depend on the market, quite risky except if you want to hedge your loan with stablecoin as collateral with Y2K Finance

During the week 05, WBTC_Risk_Vault was x36 more profitable than USDC_Risk_Vault

This data are really important to maximize your profit, but we notice that the more profitable vaults suffered from depeg event …

3 – What is the smart money doing ?

How to track Y2K Smart Money ? Two way to do it :

1) Find the biggest $Y2K holders with this dashboard made by @0xYakitori.

You have so many informations that you can extract from these data. The idea is to study the behavior of holders and focus on those who have the best understanding of the market - those who are / have been very profitable

This is out of the scope of this article. The aims here is to understand how the smart money is using the protocol

2) Find the biggest Y2K Finance’s investors

These wallets are not necessary holding a lot of $Y2K, but they use the protocol in the best way to print $ETH

On this dashboard, you have the “leaderboard” of top depositors

I monitored the top 20 holders, and 5 of them are providing most of the liquidity to the protocol

1 - Top 2 depositor (soon top 1)

Wallet (1) : 0xf9aeb52bb4ef74e1987dd295e4df326d41d0d0ff

Wallet (2) : 0xe04903ea0da52680520903dadc84f5adbef35e9f (not used anymore)

Size : 400k

Strategy : 98% Risk_vault & 2% Hedge_vault

This is the biggest investor, let’s see in depth how he manages his folio I analysed his investments since the week 05, here are the results :

Pretty lucrative investment … except during week 07 when depeg on stETH happened However, the protocol fully refunded the losses as the problems were caused by the oracle

Without including the depeg event, the yield on ETH can easily reach 80% APR

He has cumulated few $Y2K during several weeks, hold them and then strategically sold them during the last pump (with another address : 0x7a0584eafd56e980ef74dd053802b832eabdbbff)

2 - 0x5c6d32cbcb99722e6295c3f1fb942f99e98394e8

Size : 700k

Strategy : 98% Risk_vault / 2% Hedge_vault

DCA on the vaults from the opening to the closure. Dumped the $Y2K reward all along the week

The amount earn with the risk_vault cover the expenses in the hedge_vault ; the yield is from Y2K reward ; APR reach > 200%. I don’t know if the amount put in hedge_vault are calculated or not, but in case of depeg event this strategy is probably rekt

Here are his performance during the week 08 :

3 - 0x69c509e9765c49cc6b9b4568b90aa47b89f4992f

Size : 210k

Strategy : 100% Risk_vault on FRAX / DAI / USDC

Invest no matter when during the 2 days when the vaults are opened. Reinvest 100% of the profit in the next epoch. Since week 02 : 58% APR (without Y2K rewards)

4 - 0xe9e1479a9a6dde5dd0ee4ac9bee0091eba5e9e37

Size : 460k

Strategy : 98% Risk_vault / 2% Hedge_vault.

DCA on the vaults from the opening to the closure. Dumped the $Y2K reward all along the week. I don’t know if the amount put in hedge_vault are calculated or not : strategy based on $Y2K rewards

Here are his performance during the week 08 :

5 - 0xd97a2f65f89f99ce03ca8f3fd2431d053d387e8f

Size : 170k

Strategy : 100% Risk_vault USDC

Incredible return since the launch (week 45) : 101% ROI by participating in 6 epoch only (week 45 > week 7)

By seing the investment of each of them, I really ask myself if these guys take attention to the R/H ratio. Similarly, is the amount put into the hedge vault to protect against risk exposure calculated or just randomly determined ?

By checking all these whales (and the old ones), I noticed something interesting. Between week 45 and week 51, big players used the protocol to farm $Y2K in large quantity ; that includes VCs, Sifu and many others whales. They stop dumping after a long DCA-selling, around the 30th January. It perfectly matchs with the Y2K’s rally !

Buying power was here during January but faced to a big farm-dump selling. After the dumping has finished, the rally begins. Monitoring the behavior of these big players can help you make better decisions

4 – Can we do better ?

After studying all these features and observing the movement of smart money, I find myself asking: “Is there a way to earn passive income and be fully protected with Y2K Finance ?”

My first idea was to use risk_vault to earn ETH and at the same time, use the hedge_vault of the same asset / same epoch / same strike to protect your risk exposure in case of depeg event. Basically, the $Y2K extra rewards would be the net real yield Looks it messy ?

An example : I put 1 ETH in the MIM_risk_vault because this week, this vault has the best R/H ratio According to my % share, I will earn 0,05 ETH at maturity. So, to counterbalanced that, I put 0,05 ETH in the MIM_hedge_vault

If depeg happen, I lose all my ETH from MIM_risk_vault but I earn with my MIM_hedge_vault and it should “delta neutralilzed” my risk_vault exposure. In addition to that, I earn $Y2K extra reward

In fact, it doesn’t work ! Take a glance below

The protocol is well-designed to make it impossible to exploit in this way, as otherwise everyone would do it and the Y2K ecosystem would devolve into farming and dumping

Two reasons why it doesn’t work :

1- Mathematically, your risk exposure is linked to your hedge exposure. The more you earn with the risk_vault, the more ETH you need in the hedge_vault

2- Protocol fees are the key component to prevent this strategy from working ;

Simulation with no fees :

5 - Conclusion

Y2K Finance was incredibly profitable, especially during the first two months. However, in the last 16 weeks, there were 4 depeg events that were enough to scare investors

Depending on your risk tolerance, you can elaborate passive strategy by using only stablecoin that had never depeg before and select the one who has the higher R/H ratio And / or, you can used riskier assets to have xxx% yield on your ETH

I don’t find any solution to be fully protected and passively earn with Y2K. However, Y2K can probably be used with others protocols to create passive strategy

Anon, do you know any protocols that are working on that?

This is not a financial adviseI only share data analysis and strategies with you. The responsibility for your investments lies primarily with you

I hope you enjoy it ! See you soon