Disclaimer: This article is for informational purposes only and is not legal, business, investment. Do not base investment decisions on it, nor consider it as accounting, legal, or tax guidance. Mention of specific assets or securities are examples and not endorsements. The author’s views may not reflect those of any affiliations and are subject to change without update.

My goal was to identify how capital could transition from TradFi to DEFi, how to incentive insitutionals, what will be the next gate and discern what could prompt investors to make the shift.

After analyzing over 23 protocols that use RWA to bridge these two sectors, I've found promising solutions and synergistic strategies. One key insight is the game-changing potential of leveraging Treasury Bills within DeFi. Though it's an emerging topic, the early signs are promising.

So, why leverage your T-bills bonds across DEFi is a game changer ?

Let's follow this sequence for this study :

1) How the RWA came to DEFi

2) Current landscape : a comparative analysis of protocols

3) WL protocols and limitations of strategies

4) The future role of DEFi in RWA

5) Risks, insights and final thoughts

1) How the RWA came to DEFi

RWA started when compagnies understood the power of tokenization. Simply put, tokenization is the process of converting assets or rights to an asset into a digital token on a blockchain.

It can be done off-chain to fractionalize traditional assets such as commodities, public equity or real estate. It’s done and supervised by centralized agencies mainly for Investments Banks or AMCs.

And, it also can be done on-chain to tokenized a wide array of assets including private funds, debts, bonds, digital assets, physical arts and even more. This method simplifies token setup, compliance, and economic rule-setting for various assets.

Several major institutions like JP Morgan, Goldman Sachs, Franklin Templeton has already adopted blockchain technology with centralized approach. The arrival of RWA-based DEFi protocols brings new possibilities, more interoperable and efficient.

Blockchain has transformed previously illiquid markets into liquid ones, opening up vast opportunities for speculation, hedging and efficiency of capital.

Here is a non-exhaustive list of new (or potentiel new market) RWA markets :

-

agro-token (backed by grains)

-

real estate

-

gold

-

commodities

-

credit market

-

carbon credit

-

equities

-

bonds

-

treasury debt (T-bills)

-

luxury (vine, liquor, caviar, watches …)

Binance Research highlight that “Tokenized assets are estimated to be a US16 trillion market by 2030, representing significant headroom for growth and a notable increase from US310B in 2022.”

Last bullrun has brought the credit market into the DEFi, but the trend seems to be different for the next cycle as the Money Market and Treasuries eat up a substantial share of the market :

Why the has the RWAs market increased while the other DEFI ecosystems are struggling ? Two reasons :

1. The hike of the Fed Funds Rates, notice how it is correlated to Yield-bearing RWAs growth :

2. The decrease of the DEFI yield. The flippening happened early this year and catch the attention of investors, continuously seeking for better yield opportunities

Inevitably, institutionals, MM and funds are either leaving the DEFi or either investing on new protocols aiming to tokenized this off-chain high yield.

Why should they stay in DeFi? Because it offers superior capital composability, signaling that innovative financial projects based on tokenized T-bills are just getting started.

According to the Binance Research report, “investors are effectively lending over US$600M to the U.S. government today via the tokenized treasury market and receiving around a 4.2% annualized yield in return”

That is why this article primarily focused on examining protocols aiming to create a new market backed by T-bills & bonds.

2) Current landscape : a comparative analysis of protocols

The 23 protocols studied are mainly focused on T-Bills tokenization. But to make a global comparison, tokenized equities and credit markets are also included.

I have used defillama and rwa.xyz databases to gather the most relevant protocols and make a fundamental analysis of each of them.

Each of these protocol do not check its criteria :

-

Build on Algorand, Tron and Stellar

-

Concern gold, real estate or credit carbon

-

Have more than 1M TVL (exception for new interesting protocols)

Although this is the biggest market of the world with more than $150 trillons, I decided to not cover the real estate market because investing in international real estate comes with numerous unforeseen regulatory risks, and requires specific knowledge to do an accurate due diligence. It’s also an interesting topic but out of the scope of this article.

In my view, the gold market is currently less compelling to study, while tokenized carbon credits are fascinating but not yet mature enough to fully leverage the financial composability offered by DeFi.

The credit market is part of this study due to its high TVL, offering professional investors an on-chain avenue for equity exposure to diversify their portfolios.

Let’s start ;

Protocols have been separated into 3 categories.

1/ T-Bills tokenization

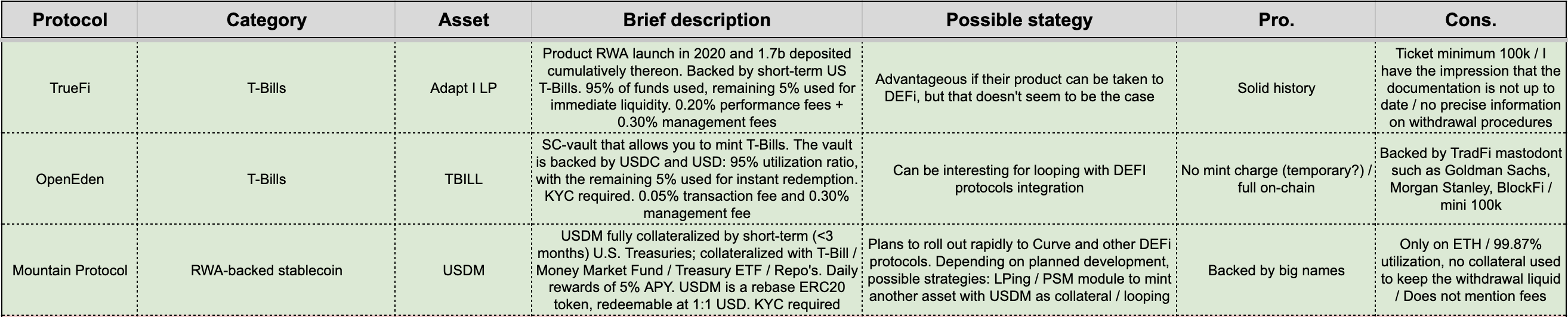

Each of them has unique processes, mechanisms and fee structures.

Globally, Backed / True Fi. / OpenEden have the same function : being accredited to be able to buy Bonds ETF (T-Bills) and the protocol charges fees comparable to what we find in TradFi. They are built in such a way as to serve as a foundation for CDP / lending protocols allowing access to a very liquid market.

Ondo / Matrixdock / Mountain Protocol are similar but they issue a stablecoin backed by T-Bills. This approach is smart because stablecoin are something well-known across the DEFi and can easily be integrated into other protocols.

2/ Credit Market

Aktionariat / Maple offer quality lending opportunities to sophisticated (KYC) capital where the investors can freely select the company they wish to lend. Centrifuge / Goldfinch are similar but also allow the possibility to choose a specific tranche for investment ; higher yield implied higher risk.

Altendis adopted a different approach where lenders decide under which yield range they want to lend.

Clearpool / Credix / Securitize also issue loans to businesses following after successful KYC and credit assessments. These platforms also provide the option to invest in a diversified portfolio of companies, aiming to mitigate risk and stabilize returns.

Private Credit Markets are a good solution to invest in to diversify your folio but not open to all users, with sometimes a quite high minimum investment requirements. It also demands a lot of due diligence (even if borrowers are WL by the protocol) because several protocols have experienced defaults on repayments.

Imo, credit markets are not as scalable and composable with DeFi protocols as T-bills. Even though some credit markets offer 'vaults,' they inherently carry more risks compared to T-bills, which are often considered 'risk-free' and represent the most liquid market globally. This makes T-bills a more straightforward option for generating a basic layer of yield.

More detail on these protocols below :

Tangible is in a way, out of category because their stablecoin USDR is mainly backed by real estate. They are the only ones trying this approach, so it’s interesting to study. They already have a well-established DEFI integration with Pearl and Caviar. Which makes me less reassured, is that the basket of assets backing the USDR has quite low collateralization ratio and currently does not respect the quota shares mentioned in the doc.

3/ Yield-bearing market

We are getting to an interesting part, where DeFi starts to intersect with RWA.

I have categorized these protocols as “yield-bearing” because they are built on T-Bills tokenized products.

Let’s start with Ondo Finance <> Flux Finance ; you can borrow (f)stable with OUSG as collateral. Great idea ? Yes, but the borrowing fees rather reach the level of the underlying yield, making the looping very inefficient. The other interesting products are the fToken, composable with other protocols.

Angle <> Backed is probably the most interesting and profitable use case available today in DEFi. Same synergy with the previous example, but here, the lower borrowing rate allows you to loop until reach you more than 27% APR. That’s huge, but vaults are capped.

Tprotocol <> Matrixdock ; Tlending market but they have imo, the same ‘problem’ as Ondo/Flux, borrowing rate is too high to make the looping unattractive. But, they recently announce the v2 with the introduction of the $TPS token ; “locking for protocol rewards and governance proposal voting to earning yield multipliers”. LM ? If that’s the case, it will only be a temporary incentive. Let’s see further.

Blueberry <> Backed ; really new protocol offering a lending / borrowing market build with the TBYs. Lenders can access to a “safe” and fixed yield (backed by tokenized Treasury Bond ETFs) while giving the possibility to WL borrowers to loop the spread between what they borrow and the token’s yield they have in collateral. This looping could offer 50% APR (hypothetically) while giving the possibility to lenders to use TBYs anywhere else in DEFi.

How to talk about RWA without mentioning Spark ? The new product of Maker brings the sDAI into DEFi. sDAI is collateralized by a basket of assets (ETH, BTC, stablecoin and RWA) that provide a 5% fixed yield without any fees. This is the most widespread yield-bearing stablecoin, but still not that much composable (yet). Imo, this is a must have for a DeFi protocol that has already reached a sufficient level of maturity and stability, and Aave understands this.

Spark leads us to talk about Pendle, the most important interest rate market in DEFi which allows investors to LP in PT_sDAI-ST_sDAI, adding another layer of yield. This functionality is also available for fUSDC from Flux Finance.

Chai.money is rather an “utility protocol” build on top of sDAI, to convert sDAI (erc-4626) into CHAI (erc-20) => making the DAI an erc-20 yield-bearing token while being transferable and fungible. Useful to create a pool with sDAI (CHAI), but don’t see it concretely in DEFi yet. 1inch fund has 26M of $CHAI, it can't be for nothing.

Raft has an interesting approach to use sDAI ; they recently launched the RSR, issuing the $RR token by depositing R. RR is providing a 8% fixed yield coming from borrowing, liquidation and flash mint fees (CDP) and CHAI yield (PSM). The idea is great, but I am skeptical about the origin of this yield as the R is mainly backed by collaterals from CDP and partially by CHAI => does the 8% yield is scalable and doesn’t affect lenders’ profitability too much ?

You can find more information about these protocols below :

3) WL protocols and limitations of strategies

As we are still at the beginning of the RWA area, I think that only a few protocols are worth to being involved in. I made a list of these protocols that you will find below, with more detailed comparison about economic setup, security and the limits of the strategies.

Globally, the limitations are :

-

Withdraw fees can force you to maintain positions for a certain amount of time to be BE

-

Sometimes, you’re not immediately free to use the asset directly on-chain (OUSG cooldown period e.g)

-

Even if the combo Angle <> Backed is attractive, keep in mind that you can liquidate if the Euro dump versus Dollar (if you use the blB01 as collateral, it’s not need for bHIGH). You need to hedge your looping with off-chain option for example, which will degrade your final yield.

-

Even if T-bills are supposed to be very liquid, this is maybe not the case on-chain like Pendle where you have to consider the slippage and gas cost.

The combo Ondo <> Flux & Matrixdock <> Tprotocol are not attractive now, but I’m pretty sure other strategies will be soon available ; Ondo arrives on Mantle and $TPS is coming.

Blueberry has a quite different perspective on how to attracted borrowers while offering an interesting opportunity for anon lenders IF TBYs is widespread through DEFi.

Mountain Protocol is really new as well, and seems to have the tools to be a serious competitor.

Recently, a member of the Frax Finance core team has proposed the introduction of sFRAX. It seems to be an improved version of the $RR of Raft (I’m not trolling here). sFRAX will be backed by T-Bills from FinresPBC company. It means that it will earn a 5% (approx.) native yield + revenues from the FRAX’s AMO controllers. I don’t have any idea about how much the yield can be, but I will not be surprised to see something around 7% which will spark enthusiasm across all of DeFi.

4) The future role of DEFi in RWA

We saw all along this article that Ethereum is a fertile land for building smart and efficient protocols, allowing buildors to create various kinds of protocols improving the composability and efficiency of capital.

Is Ethereum the best place for that ?

Lofty with 25M TVL tokenized real estate on Algorand while Franklin Templeton Benji (278M) and WisdomTree (10M) use Stellar to offer tokenized T-Bills.

But, why should financial institutions use blockchain ? Because it injects an element of trust into what is essentially a three-party agreement and considerably removes risk while also providing a societal benefit.

At the same time, Financial institutions need privacy and Ethereum or other public blockchain are not made for that.

Sam Martin from 0xResearch previously mentioned in his thesis that there will be rollups for institutions who want a certain level of control added into it, and the potential of a cluster of such rollups. This seems to be along the lines of that.

Anchorage Digital with more than 3 billion $ AUM seems to be well-positioned for this.

Provenance Blockchain, built on Cosmos SDK, already includes more than 70 projects and has more than 9 billion $ AUM !! This is half of the Ethereum TVL. Their hybrid blockchain offers the possibility to leverage RWA without compromising control or having to comply with specific jurisdictional regulations.

First, gates with TradFi need to be done.

Then, the liquidity will be able to flow into DEFi to create efficient and more profitable products, such as :

-

use RWA as collateral on blueship protocols (Aave, Compound…)

-

create attractive product for instit mixing LSDFi and RWA

-

CDP protocols backed by RWA

-

exotic market with looping-RWA as collateral (Timeswap, Stella …)

5) Risk, insights and final thoughts

Boston Consulting Group estimates a potential gain of $20b simply by reducing processes and costs thanks to blockchain. With its limitless composability, DEFi could be the next favorite financial ecosystem for institutional investors.

That is why leverage T-bills bonds across DEFi is a game changer. Even if not everybody can have access directly to T-Bills exposure, we can buy it directly on-chain and use it as collateral. Many protocols / forks and innovation will emerge in the next following months, and it's all for a good thing : forks are good.

Even if I look enthusiastic about RWA, I’m also skeptical about certain aspects :

-

T-Bills are issued by purely centralized structures. They are the ones who will capture the most value from this emerging ecosystem.

-

Tokenized T-Bills suffer from a liquidity problem, and redeeming them can be time-consuming as it involves asset sales.

-

What is the level of backdoor-ness ?

-

What are the biggest use cases ?

-

T-Bills are attractive now, but how long will it last ? 5% yield on short-term maturity is really high.

-

Everything will be fine until ETH staking and re-staking will be accessible for institutional and provide a better and more sustainable source of yield.

-

You need to pay attention to the KYC/AML model required, the structure of the collateral backing the token and the associated fees.

-

RWAs are inevitably linked to oracle risks (+ this must have a cost?).

Thanks for your attention and I hope you enjoyed reading this article !

See you soon :)

Source :

https://www.galaxy.com/insights/research/top-stories-of-the-week-9-1/

https://web-assets.bcg.com/1e/a2/5b5f2b7e42dfad2cb3113a291222/on-chain-asset-tokenization.pdf

https://redstone.finance/reports/rwa-report.pdf

https://x.com/0xTindorr/status/1688961144063762432?s=20

https://www.binance.com/en/research/analysis/real-world-assets-state-of-the-market

https://blog.cosmos.network/real-world-financial-assets-find-provenance-181c36181a9c

https://provenance.io/solutions/defi/alternative-asset-platforms-and-marketplaces/