Disclaimer: This article is for informational purposes only and is not legal, business, investment. Do not base investment decisions on it, nor consider it as accounting, legal, or tax guidance. Mention of specific assets or securities are examples and not endorsements. The author’s views may not reflect those of any affiliations and are subject to change without update.

- Pendle high yield strategy -

The purpose of this article is to deeply understand how the protocol works so that you'll be able to use it to generate high yield in a smart way

In a nutshell, Pendle allows you to tokenize yield and therefore offer opportunities to boost, hedge and speculate on it, while encouraging yield arbitrage and therefore yield stabilization through DEFi. Yield stabilization and fixed yields also attract institutional investors

Pendle has succeeded in creating a user-friendly interface for newbies and DEFi pros alike

-

Understand Pendle

-

Tokenomic and $PENDLE War

-

Competitive market ?

-

Whales and holders activities

-

What about the Smart Money ?

-

Strategies implementation

1) Understand Pendle

By separating the main token from the yield token, you make the yield token totally liquid. This means you can speculate, hedge and leverage on it

Pendle is grafted onto other protocols offering volatile yield, such as ... just about all DEFi protocols. To date, Lido, Rocket Pool, Frax, Stargate, Aura, GMX, Camelot and Gains have their own Pendle strategies

For the remainder of this article, we'll focus solely on the Pro version of the Dapp on Arbitrum

When you mint a position, you receive the principal asset at discount (PT) + the yield (YT) corresponding to the yield bearing underlying asset (SY)

SY = PT + YT

The main asset gains in value until PT = SY at maturity

What ? you have simply decoupled the yields from its asset, and this is made possible because the asset (PT) is obtained at a discount price: it is worth less than the underlying asset (SY) until the maturity date is reached

1.1 The Pendle AMM

Pendle Finance is inevitably an AMM, in some underlying sense, which you use to swap SY-PT or provide liquidity

By being an LP on GLP for example, you bring liquidity to SY-PT pools and earn Pendle AMM swap fees + underlying protocol fees (+ $PENDLE incentives if you have vePENDLE, which we'll look at in the next section)

The big advantage here is that you gain boosted yield with very little exposure to IL. You can have a very low IL if you withdraw at a time when the pool is highly unbalanced, but if you hock until maturity, the IL will be 0

Why create an AMM? To make the leverage possible

1.2 How to leverage the yield ?

Two examples to better understand the use cases

-

Let's say the yield is at 20% and you think it's too high because there's been a lot of volatility: You can mint PT_USDT + YT_USDT and sell YT_USDT. Yield drops to 10%, you buy back the YT_USDT you need, but at half the price, and redeem your position (to repay your position).

-

In the opposite case, the yield is at 5%, which you consider low because the market is calm. You buy more YT_USDT, which gives you more yield for less money = boosted yield. So, buying YT_token will give you a boosted yield as long as the underlying APY remains above the implied APY

It sounds complicated, but Pendle has made it very simple: with the swap function you can directly

-

be bullish on yield by buying only YT

-

be bearish on yield by buying only PT (because APY is frozen)

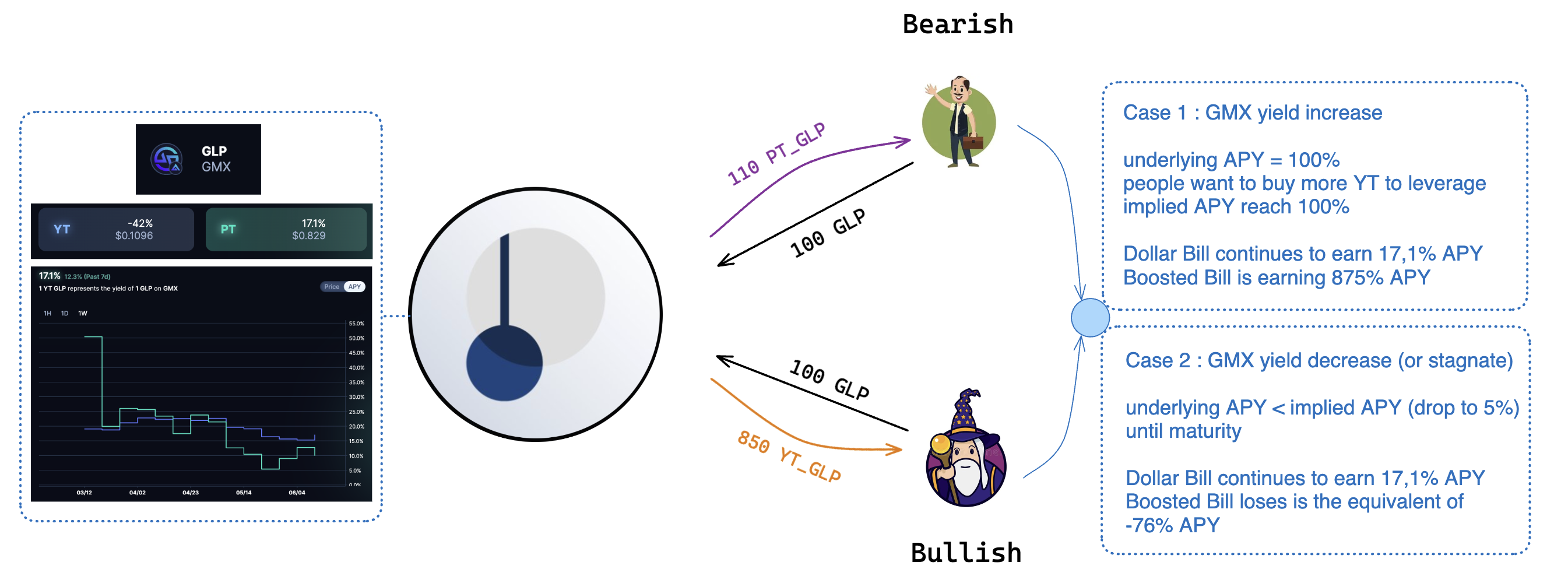

Let’s take the Ceazor’ style to make it more simple :

The key is to understand that the underlying APY is the APY of the underlying protocol & the implied APY is the APY in the Pendle AMM

Dollar Bill & Boosted Bill have different opinion of the market :

Case 1 : just imagine GMX makes xxx millions weekly fees, APR will skyrocket so the YT_token will pump because it becomes attractive.

Boosted Bill’s bet was right : he was overexposed to the yield, by selling the YT_token at 100% APY and benefits from the interest rate arbitrage

Case 2 : GMX is dying, rather nobody uses it

APR will go down, so Boosted Bill is rekt

The yield lost by Boosted Bill is earn by Dollar Bill

1.3 Protocol adoption

Ultra-scalable protocol that can be easily grafted onto existing projects:

-

Paladin for selling voting powers

-

Permissionless deployment on high-volume Uniswap / Balancer / Curve pools

-

May interest institutional, as it provides a fixed yield over a set period of time

-

Strong interest from whales who want to hedge their LSD yield

1.4 Possible evolution of Pendle

-

Useful for LSD protocols (60% of Pendle's pools today) in offering turnkey solutions (Pendle as a backend) for fixed real yield on ETH

-

Need for revenue consistency for institutional and also for more cautious retails

-

Adoption because it brings stability to yield, as yield arbitrage is now possible

-

Degens now have an new place to leverage

2) Tokenomic and $PENDLE War

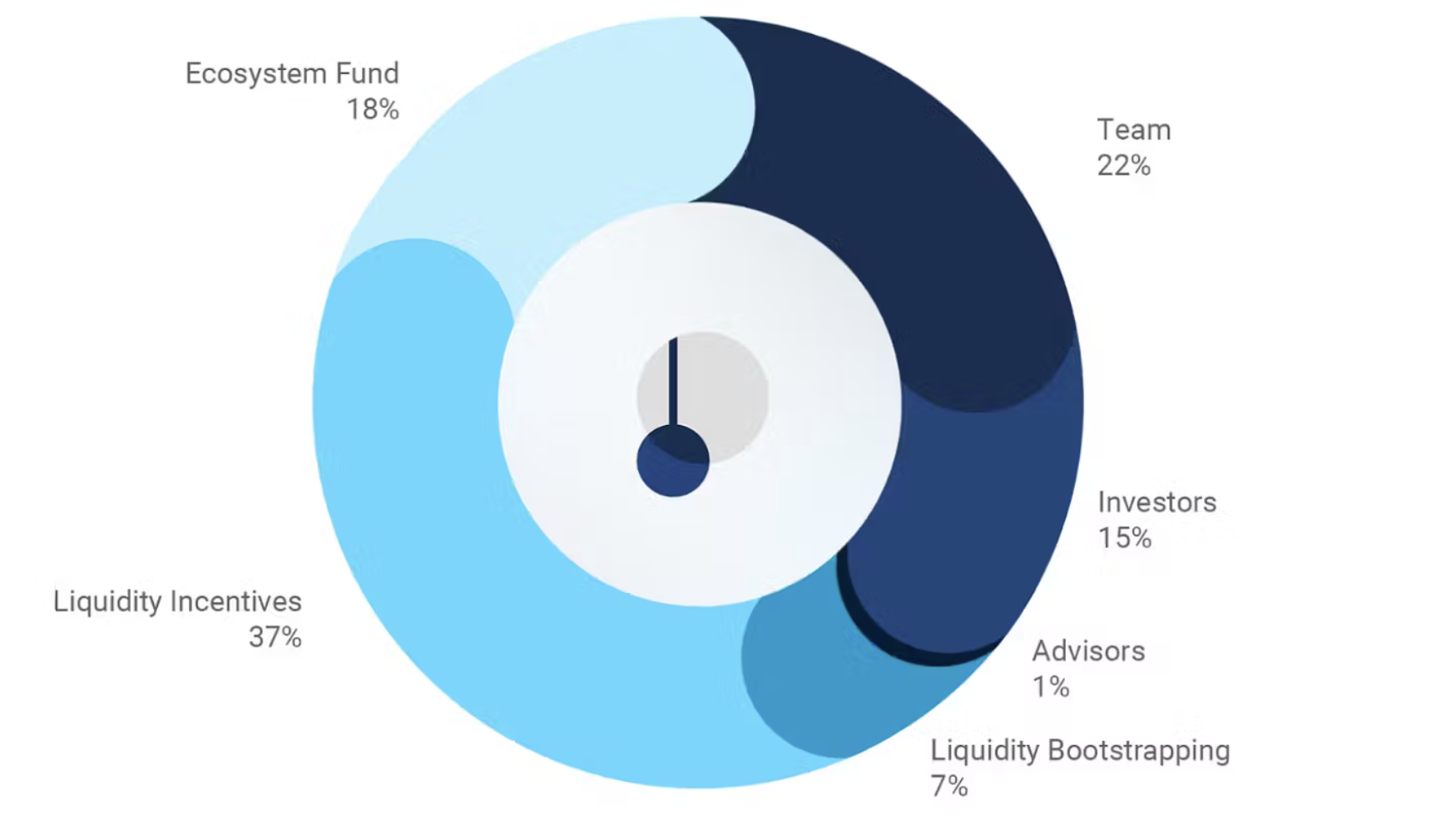

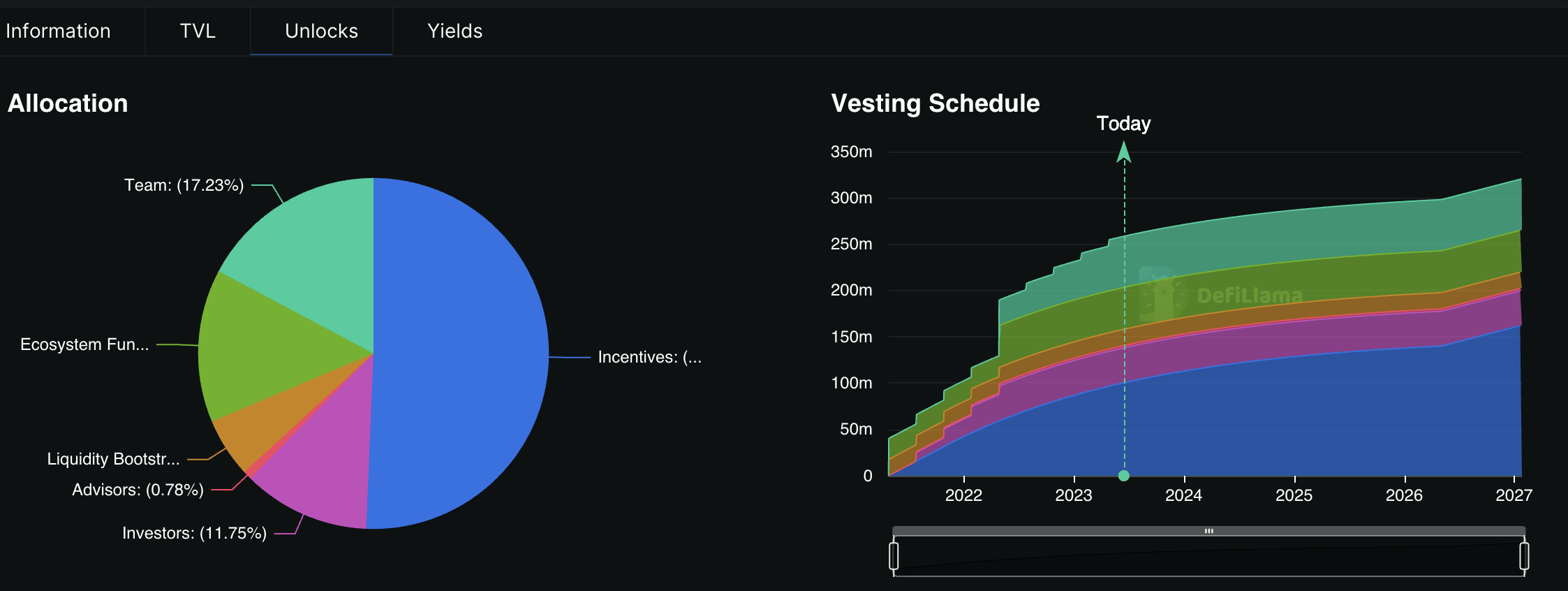

Here is the tokenomic :

38% for the team / advisors / investors, it’s a bit muchBut, all the majors unlock took place :

-

41% of supply available

-

No massive unlock to come

-

Tokenomic long-term thinking

-

We're in the period with the least inflation, TVL is at ATH and the price has rebounded nicely and is continuing its consolidation phase

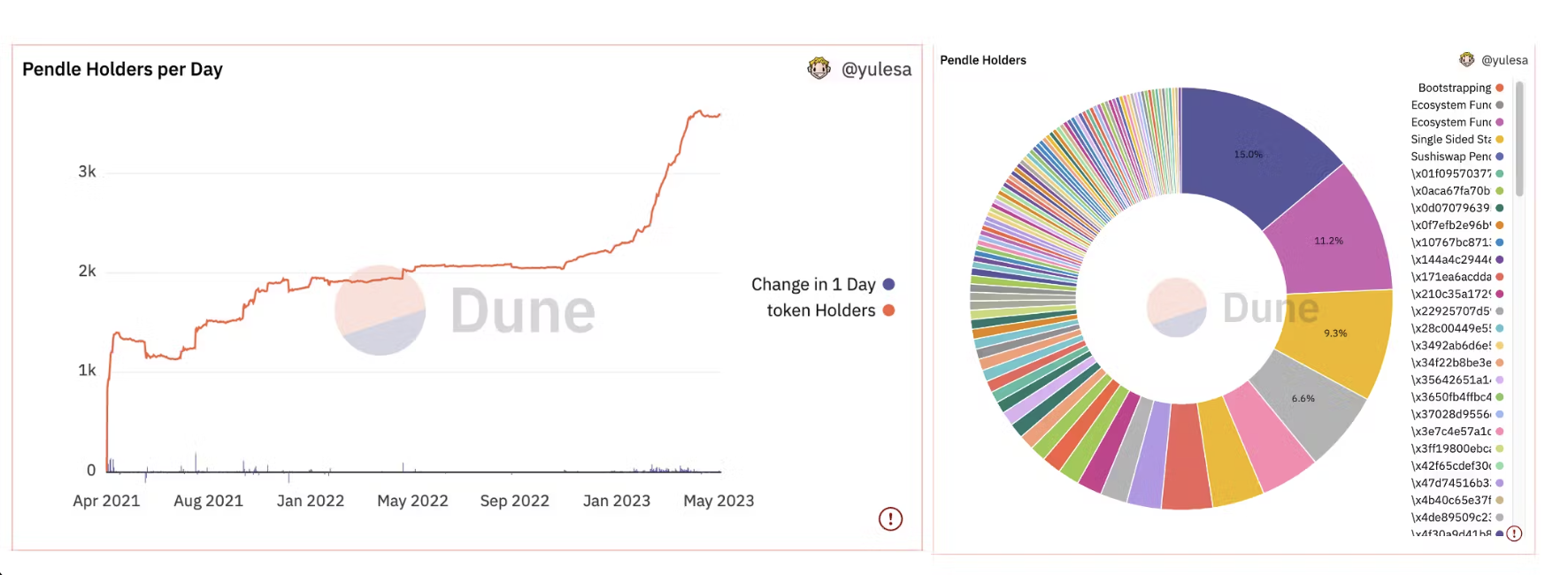

The number of holders is rising, and supply is well distributed :

Widely known, Pendle has chosen the ve-model for its token. vePENDLE is obtained by locking $PENDLE for a period ranging from 1 week to 2 years.

Why accumulate vePENDLE?

-

Receive the PENDLE rewards multiplier ranging from x1 to x2.5, as mentioned earlier

-

Earn 3% performance fees from YT_tokens

-

Earn 80% of the swap fees

-

Governance voting on pool incentives (model 3.3)

In summary, a whale or vePENDLE DAO will:

-

Provide liquidity and enjoy $PENDLE rewards

-

Direct the incentives

-

Earn real yield through swap fees

-

Receive future bribes (upcoming partnership with Redacted Cartel)

This creates a powerful flywheel that encourages long-term action and rewards loyal token holders with native incentives, as well as real yield through shared fees and bribes, which can attract many protocols and greatly boost APR

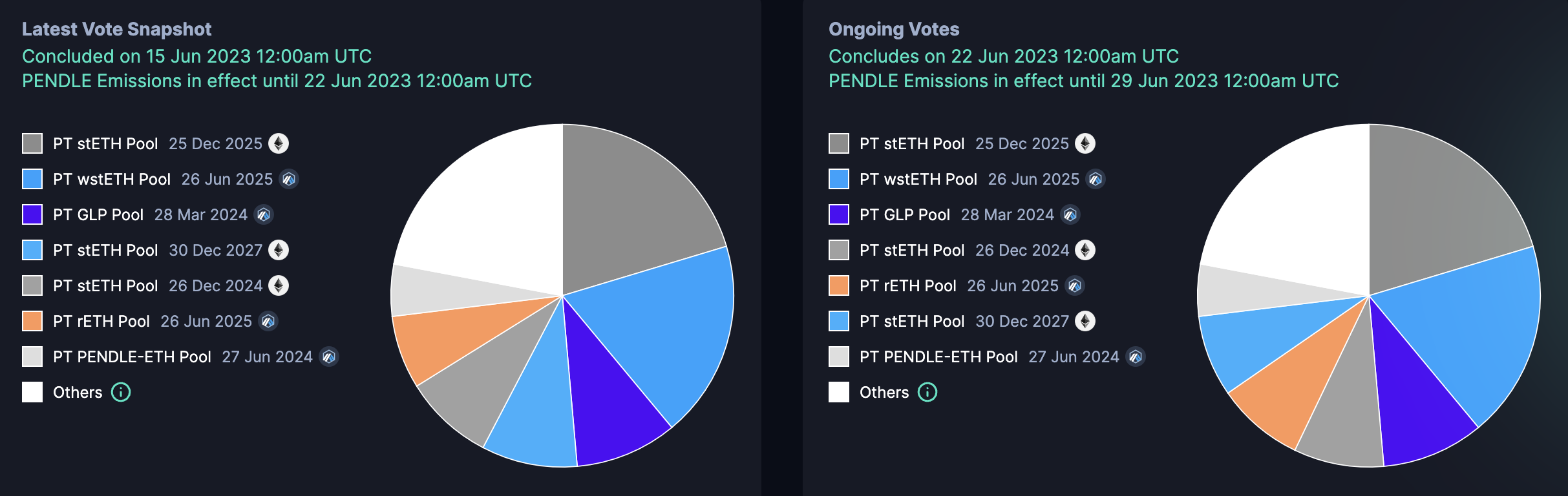

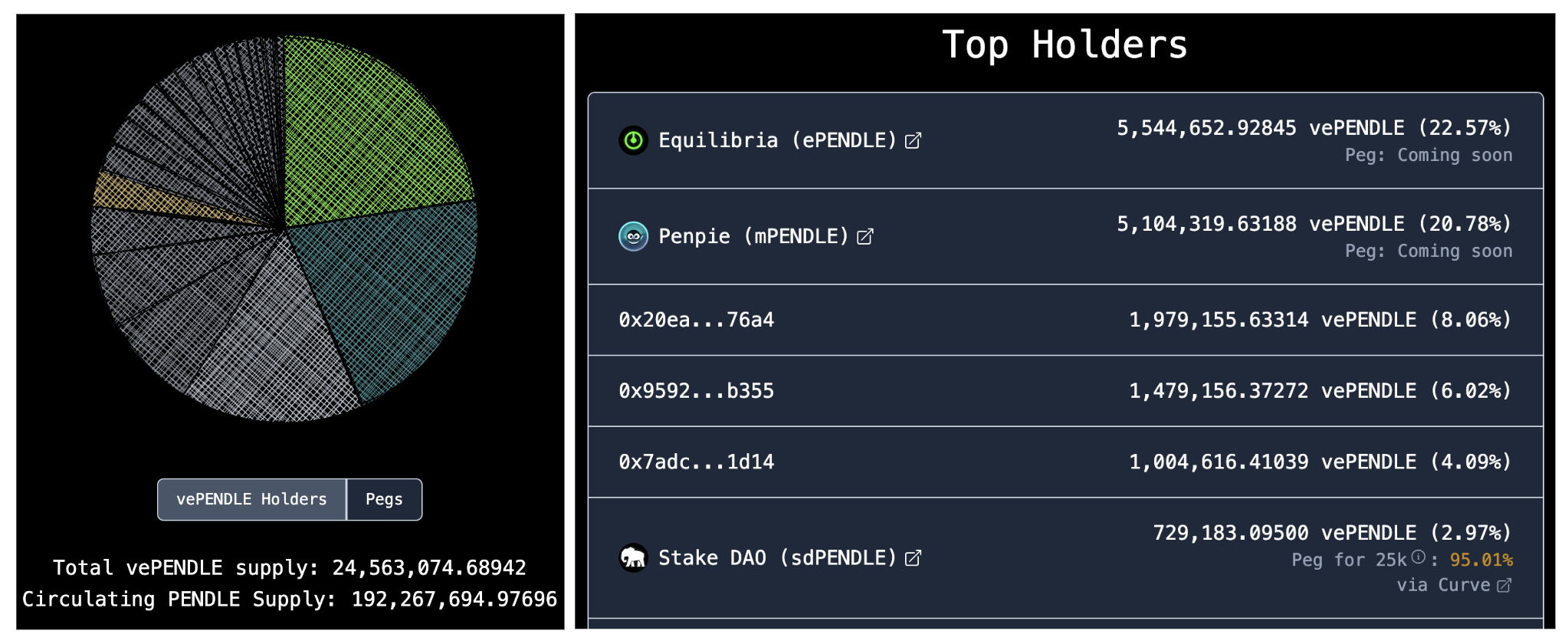

Current state of vePENDLE : Approximately 40% of $PENDLE is locked for an average duration of 395 days. The distribution of votes is fairly balanced, with LSD slightly dominant

Pendle has a solid foundation and a healthy governance distribution, with a well-thought-out tokenomics. We are at a stage where the risk of being massively dumped by the team and VCs seems to be reduce

What about the great $PENDLE War ?

We had to wait until V2 to see protocols built on top of Pendle

vePENDLE distribution :

That’s great to see at least 2 protocols leading the $PENDLE war. 3 protocols are involved :

-

Equilibria: 6,22M $PENDLE

-

Penpie: 5,79M $PENDLE

-

Stake DAO: 736k $PENDLE

These protocols work synergistically in the same way as Convex / Curve

3) Competitive market ?

To my knowledge, 3 others protocols have specialized in the interest rate speculation market in DEFi:

Voltz: live since June 2022 / $2.6M TVL

Timeless: live since July 2022 / $0.17M TVL

Ipor : live since August 2022 / 18M TVL

Pendle: live since June 2021 / $96M TVL

The V2 has propelled Pendle, leaving its competitors far behind

4) Whales and holders activities

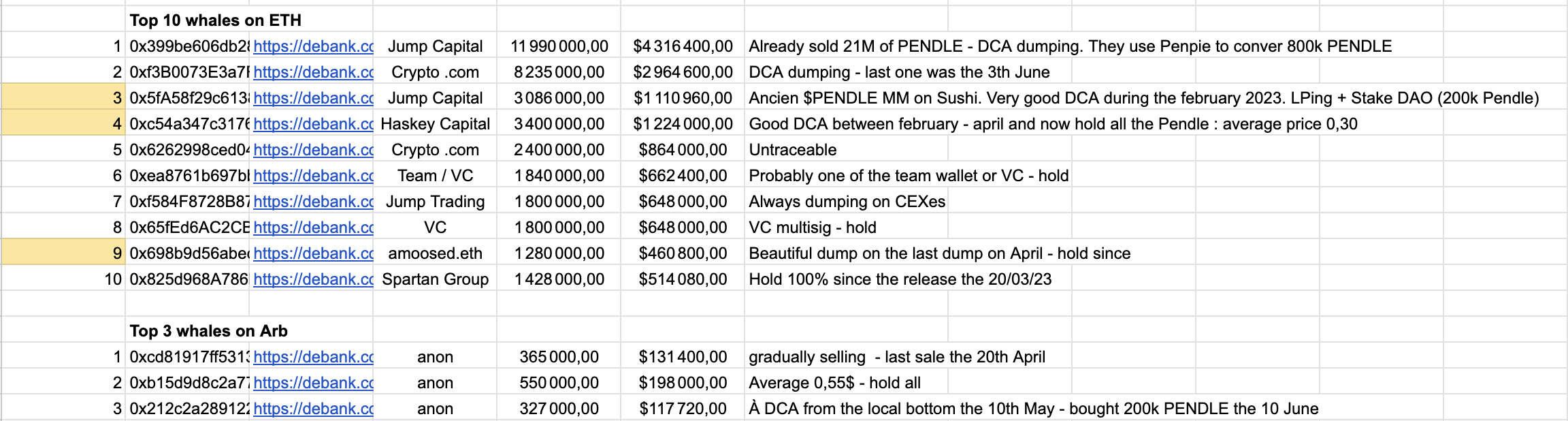

I have identified the top whales and analyzed their actions in relation to $PENDLE :

Many VCs are among the top holders.

This is something we will closely monitor as these top 10 whales hold 34% of the unlocked supply.

Keep in mind that 40% is locked in vePENDLE

Around 4.5% is provided as liquidity on DEXes

Approximately 18% is held on CEXes (source: Nansen) ==> likely around 4% in reality, in my opinion

13,10% is locked on Equilibria, Penpie, and StakeDAO.

Disclaimer: I have doubts about the data from Nansen that states 16M $PENDLE is on Crypto.com. It seems excessive and inefficient to have such a large amount on an exchange with low volume. I believe Nansen's data may also include assets held by VCs, which could potentially account for the 16M

Roughly speaking, we have 20% of the unlocked supply in the hands of smaller traders. This is relatively low compared to what one might assume by simply looking at the pie chart of supply distribution.

Let's zoom in on the yellow-labeled whales:

-

number 3 : This Jump Capital wallet has been using the protocol for several years and has excellently bought the bottom through a long-term DCA strategy.

-

number 4 : A late-stage VC that got involved in the project.

-

number 9 : Taking profits at local tops. These whales, who bought at spot prices, are likely to unload their holdings in a more strategic manner compared to the VCs.

You can find all the tables here, and they will be updated accordingly

5) What about the Smart Money ?

There are several ways to identify PENDLE's smart money :

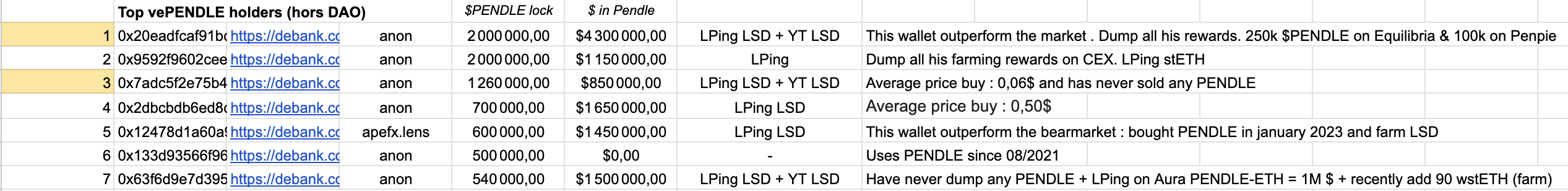

5.1) Top vePENDLE holders

VCs do not lock their holdings in vePENDLE, as they intend to sell them. However, the truly engaged actors utilize the protocol to its full potential

Here are the top vePENDLE holders. The Google Sheet lists the 7 largest holders along with their actions within the protocol :

Likewise, the yellow-colored wallets are the ones to closely monitor as they hold significant weight in governance and generate substantial profits with PENDLE

By examining the wallet history, most of them are also involved in other flagship DeFi protocols. Wallets 1 and 5 are clearly smart money players who consistently outperform the market - it's no coincidence that they are using Pendle

Many of the major players heavily farm PENDLE pools and dump their rewards, which creates some selling pressure, in addition to VCs dumping and despite this $PENDLE is one of the few token which outperform ETH

5.2 Nansen smart money

Pendle launched during the bull run of 2021 and is now navigating the bear market. It's worth noting that 98% of protocols fail during this phase

Pendle is among the remaining 2% with strong fundamentals to outperform this bear market. This is reflected in both the token's appreciation and the activity of smart money players :

The number of $PENDLE held has slightly decreased, but this is likely due to the launch of the PENDLE war, which encourages locking PENDLE in third-party protocols.

On the other hand, the number of Smart Money entities holding $PENDLE has not decreased throughout the bear market

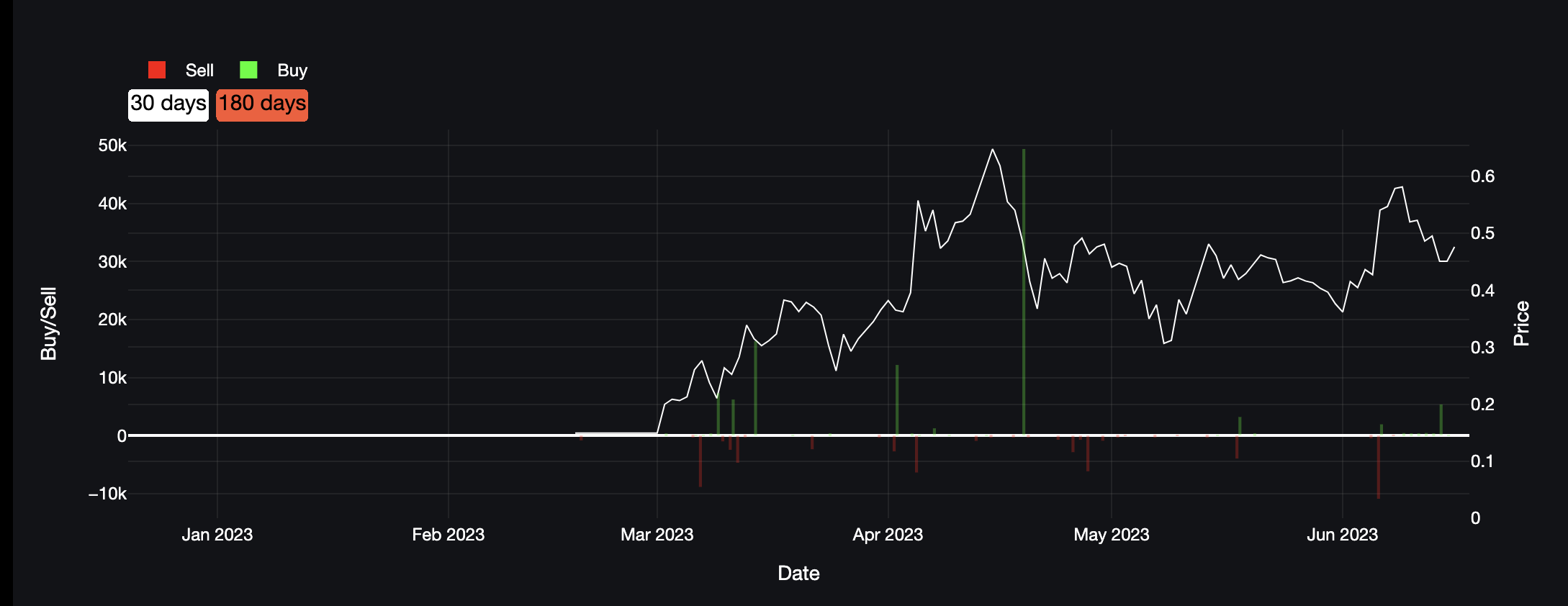

5.3 ChainEdge Smart Money

ChainEdge provides incredible data about the smart money as well, which are complementary to Nansen

There are more liquidities on Arbitrum than Ethereum that is why I think it’s also important to look at it

SMs tagged by ChainEdge are not really involve : only several sales (around 25k on Eth > “Early Ape” sold them at 0,05$) and one buy (50k on Arb > r3van bought them at 0,53$)

6) Strategies implementation

How to use Pendle to high yield your yield bearing assets ?

- Yield speculation -

You must have understood that :

-

When the PT_token appreciates, the YT_token depreciates, and vice versa

-

The implied APY is the yield determined by traders on Pendle

-

The underlying APY is the yield of the underlying protocol

-

If you want to Long the APY : buy YT_token

-

If you want to Short the APY : buy PT_token to “freeze” in the yield

-

If the implied APY > underlying APY : it is more profitable to buy PT_token

-

If the implied APY < underlying APY : buying YT_token can be profitable

Okay, but how do you know when and what to buy ? Simply buy YT_token because implied APY < underlying APY is not optimal

The idea is to identify market phases where the yield is particularly low compared to phases where the APY is higher than normal

Case study for GMX x ARBITRUM

You must hold GLP, an index token used to provide liquidity to GMX traders

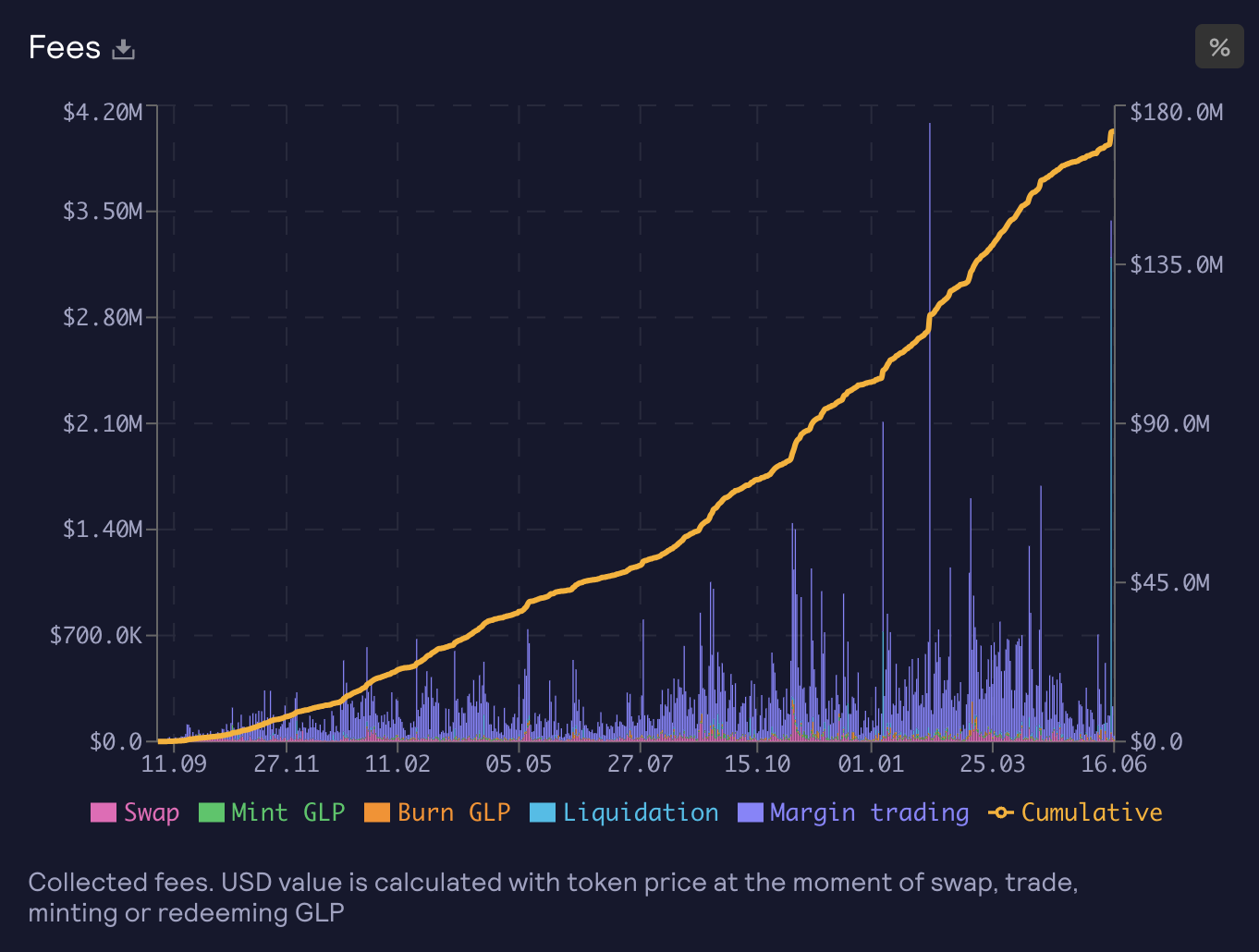

The yield of GLP comes 90% from margin trading ; the "fees" paid by traders to access leverage (source).

The 14th January was exceptional day for GLP stakers as liquidation reached >3M$ (representing 87% of the daily fees). But usually, the yield of GLP depends directly on the utilization rate of GMX

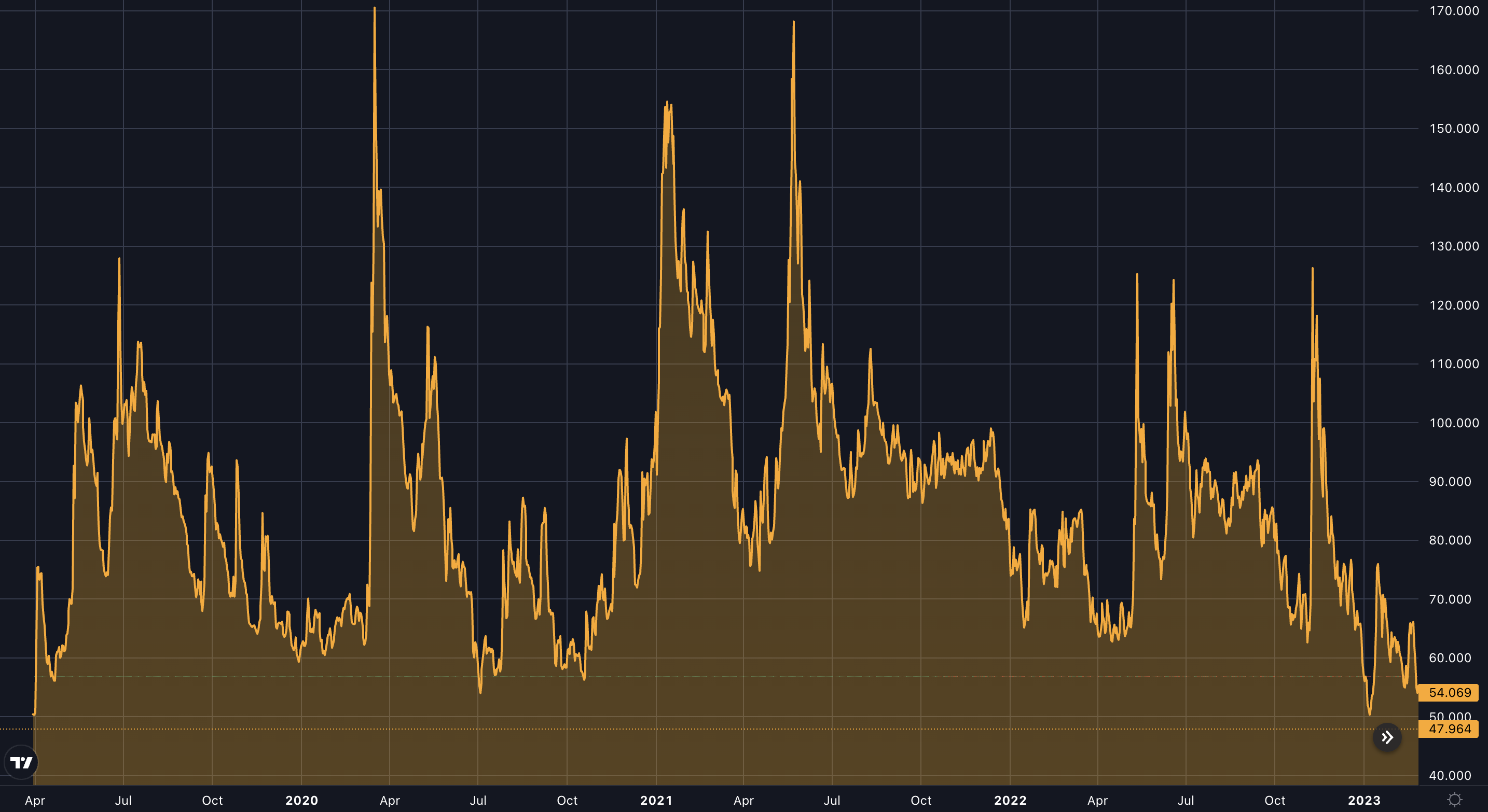

Historical APY of GLP :

The average APR of GLP is 25% and the median APR is 20.5%

(source , becareful, these figures do not take into account data up to today, I have given projected and hypothetical values while waiting to find a solution to have the real values)

How to explain such a decrease in APR ?

1) Market volatility index is at its lowest in 4 years

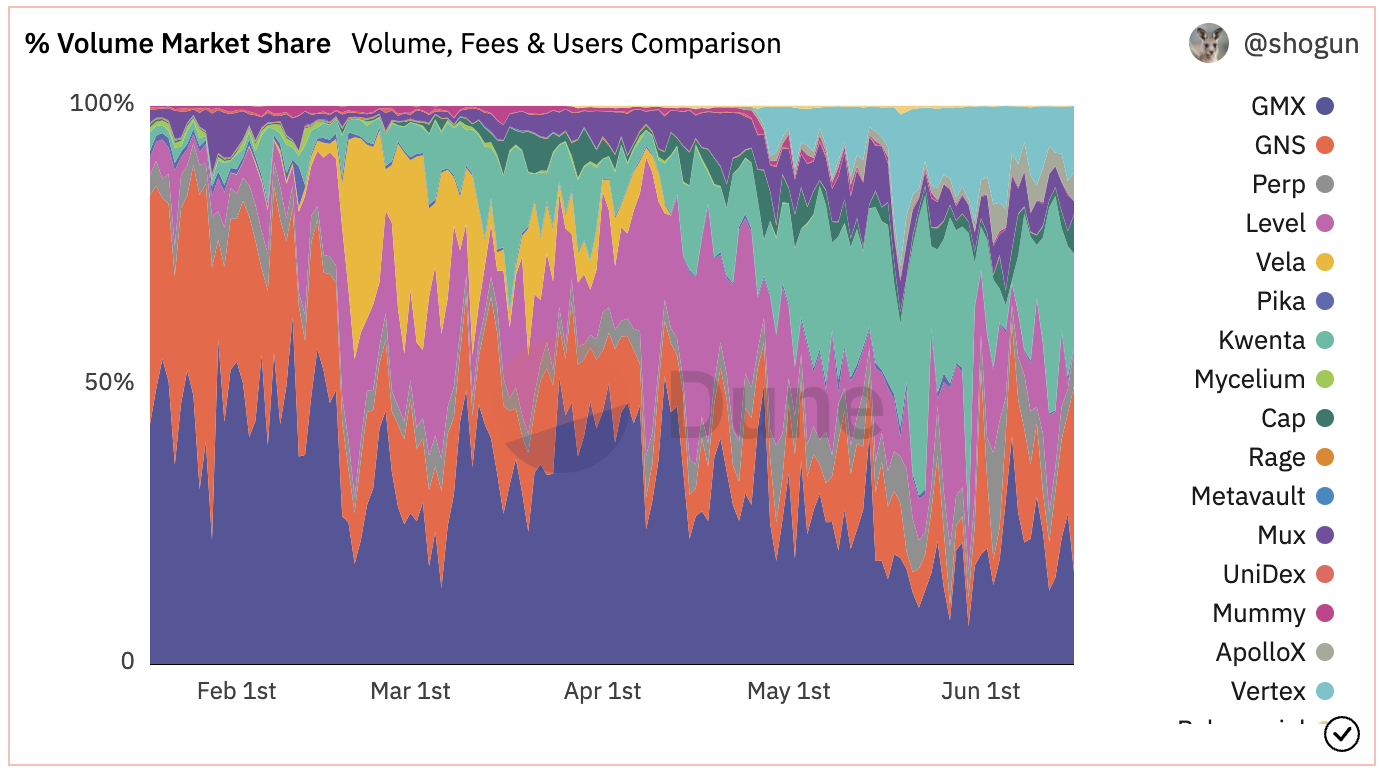

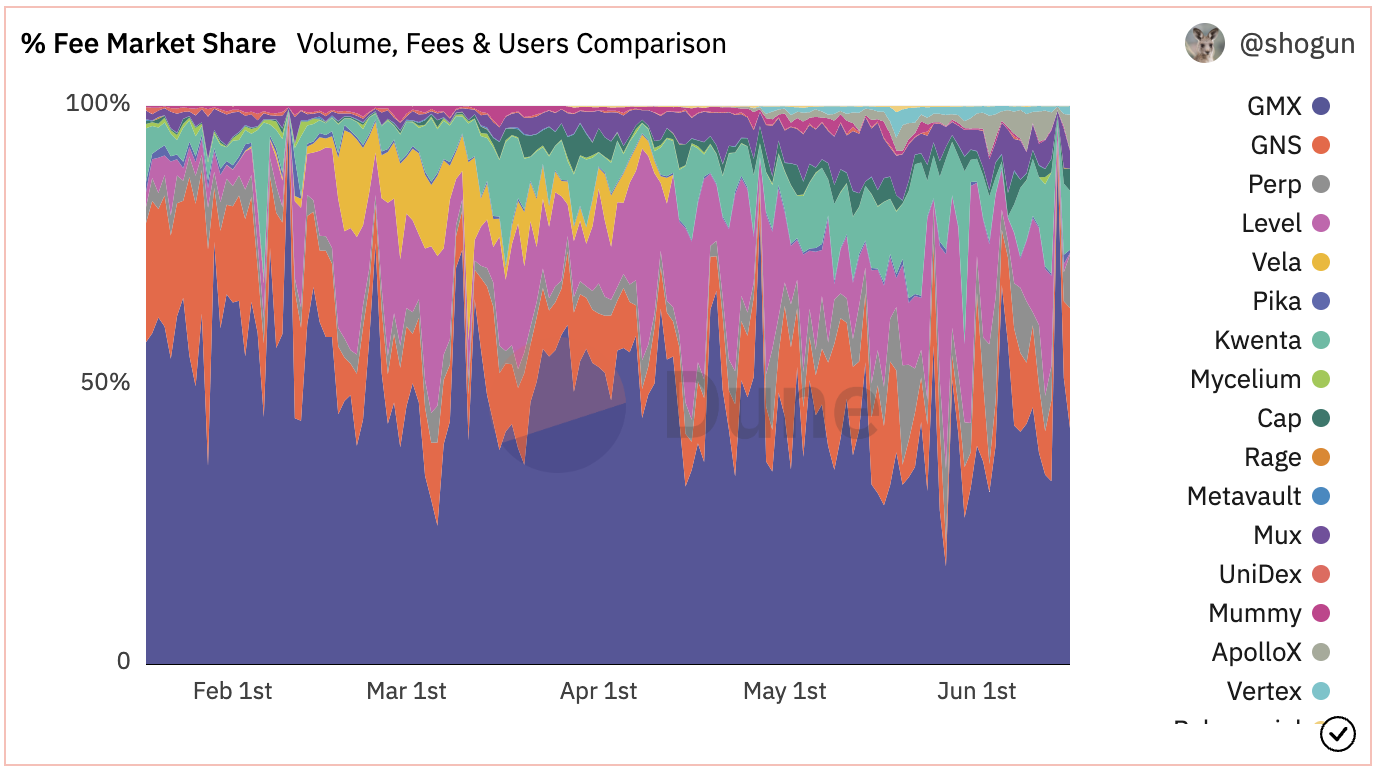

2) Loss of market share by GMX - from 80% to 16%

GMX losing its appeal? Not really ...

Vertex and Kwenta who have recently absorbed market share with incentive programs on steroids. Level Finance on the BSC too, boosted on steroids with LVL incentives Perpetual Protocol, which is more established than the latter 3, benefits from OP incentives. Despite this, Perpetual hasn't attracted many users...

3) Fee distribution: from 90% to 50%

So GMX has seen an 80% decrease in its market share while the share of collected fees has only decreased by less than 50%

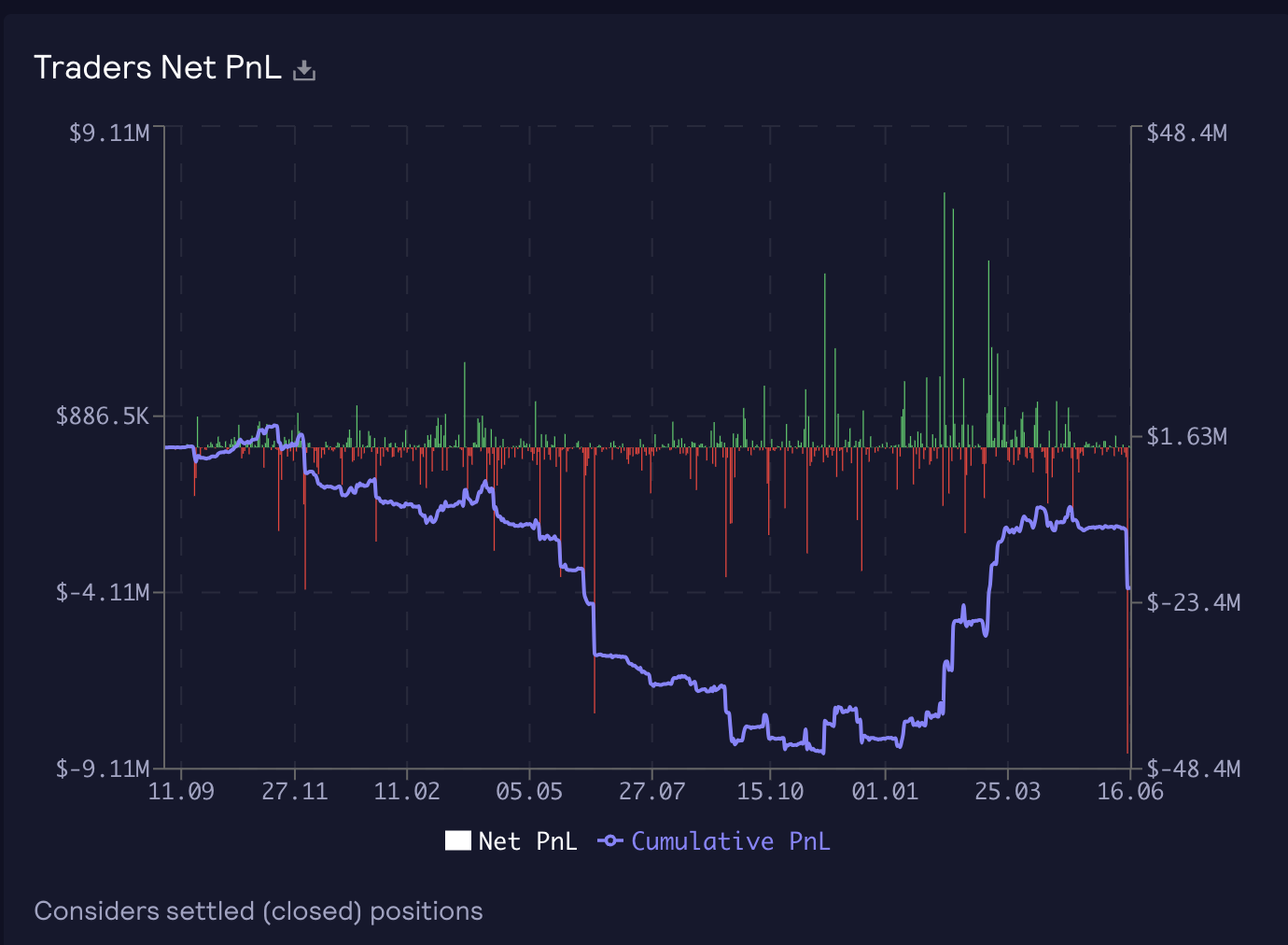

4) Traders have mostly been winners since January

Traders have achieved an impressive PnL of 30M $ since the beginning of January just before suffer heavy losses following the liquidations on the 14th June

By being exposed to GLP, you pay for the gains and receive the losses. It's no wonder that the APR has decreased these last weeks

It's not for nothing that we say smart money is on Arbitrum ...

To summarize, we have an overall decrease in crypto market volatility, reaching its lowest point in 4 years (1). GMX is losing market share to others protocols benefiting from native incentives (2), but despite that, it continues to collect the majority of fees in the market (3), while traders have been achieving significant performance over the past 5 months (4)

The crypto market never remains calm and flat for long (1). GMX is one of the few protocols that received the maximum amount of $ARB from the airdrop, which will be used soon (2), allowing it to regain market share (3). Traders using leverage are generally losing out compared to the market, and this is true in various domains (4)

Can you see where this is going ? That's why we see a 18% APY on Pendle compared to 10% on GMX, as traders are already positioned Long on the GLP yield, and this 8% delta represents the risk that investors consider fair to be leveraged on the yield. That's why buying YT when the implied APY is lower than the underlying APY is not always optimal

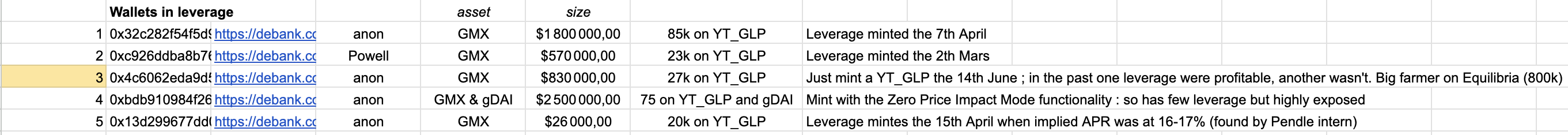

GMX has generated enormous amount of fees during week number 24, which encourage SM to purchases YT_GLP as Pendle shows it in this thread. The APY are smoothed over the week, which means that next Wednesday, the underlying APY on Pendle can significantly increase

The smart money in Pendle has already positioned itself for this opportunity. Here are a few that I have identified - it can provide some indicators :

The risk of leveraging with the YT token is that you expose yourself to losses if you withdraw your position while the implied APY is still above the underlying APY.

Implied APY is still rising day after day, bet on a rapid growth of the APR after the 21th June

It's a strategy that can be extremely profitable, as explained by @gabavineb in his thread & notion where he achieved a 35.6% ROI in 13,5 days, equivalent to a 378 936% APY !!!

Now it's up to you to take action and leverage this market opportunity !

See you soo degen