When we talk about Cryptocurrencies, one of the first thoughts that comes to mind for both newbies and veterans is Earning. It is an instrumental part of the industry that, once maximized, projects can utilize to attract a substantial number of community members.

There are various factors that contribute to the success of an earning mechanism or structure in a project, and unlike every other platform, Kamino, the leading Solana lending protocol, has shown why it’s known as a pacesetter.

Kamino Finance, the leading Modular Lending platform on Solana created Earn Vaults as one of its core features towards the alleviation of liquidity fragmentation in Modular markets. After achieving over $4 billion in cumulative TVL without debt, Kamino launched its V2 update on top of its V1 codebase. This further enhanced its scalability functions and added more infrastructure, including automated lending vaults, modular market infrastructure, margin leverage trading, and RWAs, among others.

We live in a world that thrives on credit, and the crypto industry shouldn’t be excluded. Kamino understands this, leading to the launch of its Earn Vaults feature as an improved accessibility function for users' interaction with lending markets. Now, users have access to more than just credit at their fingertips, and this is how Kamino is making it happen.

Earn Vaults

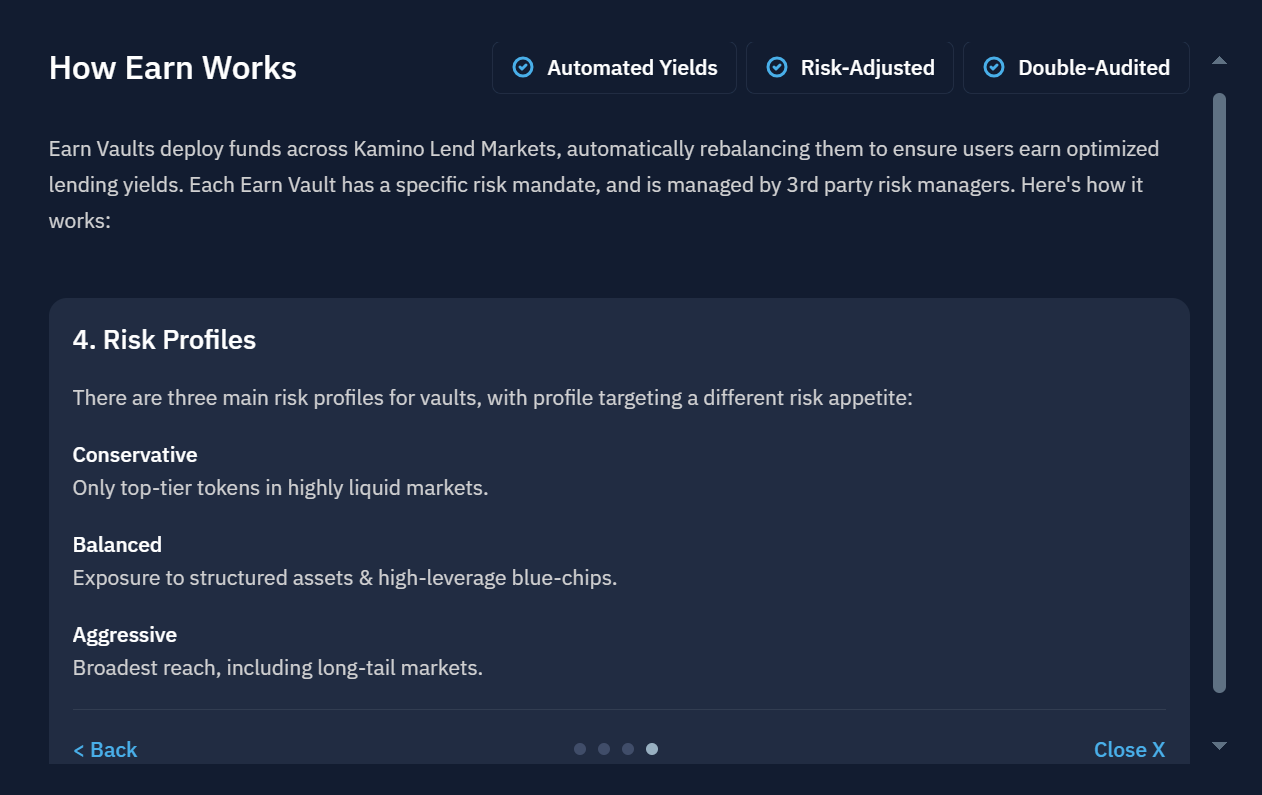

The Earn Vault is an automated, yield-maximizing, market-dynamic, and risk-managing feature that is managed and audited by expert curators, including Steakhouse, MEV Capital, Allex Labs, and Re7. This means that whenever a user deposits into a vault, the deposit is automatically across selected markets to optimize yield and maintain the risk management of that vault. This also means Kamino is doing the heavy lifting to ensure users receive maximum yields on every risk profile selected. But what are risk profiles to earning from these vaults?

Risk profiles are essentially appetite levels, and as expected, these differ in humans. Kamino, through its available three profiles (Conservative, Balanced, and Aggressive), satisfies these appetite levels and offers maximum yields for them.

-

Conservative: This prioritizes stablecoins like USDC, offering lower volatility and safer returns.

-

Balanced: this is for depositors looking for a more friendly environment that combines stable and moderately volatile assets: average risk and higher returns.

-

Aggressive: Volatility is at its highest, and so are the rewards. Spread is across a variety of markets, and the risk ratio is the highest.

Depositing assets in these vaults and selecting a risk profile doesn’t mean all the work is done just yet; this is where Kamino’s architecture steps in to ensure that rewards remain optimal. In response to the dynamism of market conditions, a system managed by curators has been implemented to ensure that rewards are consistently realized.

Mechanics of the Earn Vault

When you deposit in an earn vault, most of the time you might opt towards stables because of less volatility and how it’s somewhat immune to the dynamism of the market. Kamino’s Earn Vault, on the other hand, doesn’t align with this mindset and structure, as it can provide maximum rewards for any coin or token deposited.

When you deposit your token in a vault and select a risk profile, professional risk managers take your deposits and lend the funds to borrowers who offer collateral access to them. Now here’s the catch, if the borrowing demands in a market increase, your deposits are taken there to ensure lenders receive the best of yields before the risk profile selected. The wonderful thing about this is that every user does not need to manually follow up their deposits, and yet rewards will still be compounded and maximized.

Lenders through Earn Vaults also help create balance across various markets over time. When a market experiences massive demand due to a higher APY, deposits are reallocated to it or any underutilized market to stabilize and provide liquidity to that market. All of this happens across various markets automatically and helps eliminate stagnation of liquidity in low-yield pools and overcrowding in high-yield ones.

These Earn Vaults also provide users with exclusive access to various rewards from collaborations with other projects, which are added to the overall returns. Kamino also helps users access Defi features within its ecosystem, such as RWA markets and Margin Leverage. The good part in all of this is that you don’t need to understand the complexities of DeFi or even be a professional to participate. By just depositing into a vault and choosing a risk profile, you’re set for compound rewards.

Benefits of the Earn Vaults

It is well established the scalability experience Earn Vaults provide users. Below are highlighted benefits of Kamino’s entire V2 composition:

-

User friendly: There are no complexities to using these vaults, all you need to do is deposit, select a risk profile and allow automation to handle the rest.

-

Capital maximization: By spreading deposits across various markets over time, vaults ensure that there is no idle capital but only maximized returns.

-

Risk Management: By adhering to risk profiles of choice and utilizing features like soft and oracle-based liquidations, losses are reduced.

-

Enhanced Automation: Users don’t need to worry about constant monitoring and complex decision-making due to market dynamics, as they are sorted upon deposition.

These benefits and more showcase the position of the Earn Vaults as a core component of Kamino V2, especially in driving user adoption and its necessity in the infrastructure of Solana as a whole.

Wrap Up

With the ever-increasing need for DeFi solutions, even in Solana, Kamino has demonstrated its excellence and reinforced itself as a pacesetter in the crypto industry. Now more than ever, its necessity is non-negotiable.

This means that everyone from every sector can and should utilize this feature, especially those looking to explore the latest and best of DeFi features and tools. Welcome to Kamino, the leading Defi hub on Solana.