Economics is a social science that studies the production, distribution, and consumption of goods and services. Have you ever wondered if something similar exists in the crypto and NFT world?

If yes, here’s your answer. Yes, it exists and it's called tokenomics. In this article, we’ll take a deep dive into what is tokenomics, why it matters, how it is relevant to NFTs and how to create NFT tokenomics for your project.

All about Tokenomics

What is Tokenomics?

The study of crypto tokens is called tokenomics. The term “Tokenomics” is derived from two words, “token” and “economics”. It covers all aspects of the creation, management, and sometimes removal of a cryptocurrency from a network.

Understanding tokens

Tokens are units of value created by blockchain-based projects on top of an existing blockchain. Let’s learn more about the different types of tokens before proceeding further with tokenomics.

On the basis of structure, tokens can be classified into two types. They are Layer 1 and Layer 2 tokens.

Layer 1 tokens - These tokens are specific to a blockchain and are used to power all of the blockchain's services. For example, ETH on the Ethereum network is an example of a Layer 1 crypto token.

Layer 2 tokens - These are intended to aid in the scaling of decentralized applications in a network. For example, Polygon is a Layer 2 solution powering Ethereum scaling.

On the basis of usage, tokens are classified into 2 types. Security and utility tokens.

Security Tokens - These are digital investment contracts that represent fractional ownership of an asset. These tokens are subject to securities and regulatory requirements. Sia Funds is an example of a security token.

**Utility Tokens **- These are tokens issues through an Initial Coin Offering (ICO) and drive the financing of the blockchain network. Brickblock is an example of a utility token.

Another popular criterion for classification is whether the token is fungible or non-fungible.

**Fungible Tokens **- These tokens have the same value and can be replaced with each other. The dollar, gold, and ETH are all examples of fungible assets.

Non-Fungible Tokens(NFTs) - These tokens are unique in nature and do not share the same value. Bored Ape Yacht Club and Beeple’s The Verge are examples of NFTs.

Factors that affect crypto tokens - The basis for tokenomics

Anything that affects the value of a crypto token is worthy of considering when comprehending the tokenomics of that token.

The factors that affect a crypto token

- Allocation and distribution of tokens

- Supply of the token

- Market Capitalization of the token

- Token Model

- Price Stability

- Future Readiness

Allocation and distribution of tokens

The worth of a crypto token is influenced by how it is distributed. There are two ways to generate crypto tokens - pre-mining and fair launch. In a fair launch, cryptocurrency is mined, earned, owned, and regulated by the community from the launch of the crypto. Pre-mining on the other hand creates and distributes a fraction of the coins before they are made available to the general public.

Token Supply

When it comes to crypto, there are three types of supply - total supply, circulating supply, and max supply. Total supply refers to the number of tokens that are in existence, excluding any that have been burned. Circulating supply refers to the number of tokens that have been issued so far and are presently in circulation. Max supply refers to the maximum number of tokens that will be ever created.

Market Capitalization

The market capitalization of a token denotes the total amount of money invested in the cryptocurrency project up to that point. The future value of a token may increase with market capitalization and decrease with circulating quantity.

Token Model

There are two token models - inflationary and deflationary. An inflationary token (like fiat money) doesn't have a maximum supply; production will carry on indefinitely. The opposite is true for a deflationary token paradigm, where a maximum supply is set for the token.

Price Stability

Cryptocurrencies are volatile. Price fluctuations can have an impact on the investors’ interest. There should be measures to combat fluctuations. The supply levels should be adequate so that the price is stabilized.

Future Readiness

Understanding tokenomics also entails knowing how a crypto token might contribute to solving future challenges. This means what currently works for a token initiative may or may not work in the future. Changes to the token's governance may be necessary as a result of the network's development and maturity.

Why is tokenomics important?

As an investor, why should you understand tokenomics? Why does it even matter?

Here’s why tokenomics is important

- It helps you understand the short-term performance of the crypto market.

- It created an opportunity for cryptocurrencies to be evaluated according to their real-life utility and not just trade patterns on exchanges. This acts as a safety net as the crypto world still lacks proper regulation.

- It helps determine the future worth of an asset.

- It provides insight into the likelihood that one crypto asset will succeed over another in the future.

Now that we know what tokenomics is, what are the factors that come into play in tokenomics, and why it matters, let’s look into how it extrapolates to NFTs.

NFTs and Tokenomics

NFTs being tokens themselves are subject to the impact of the above-stated aspects of tokenomics.

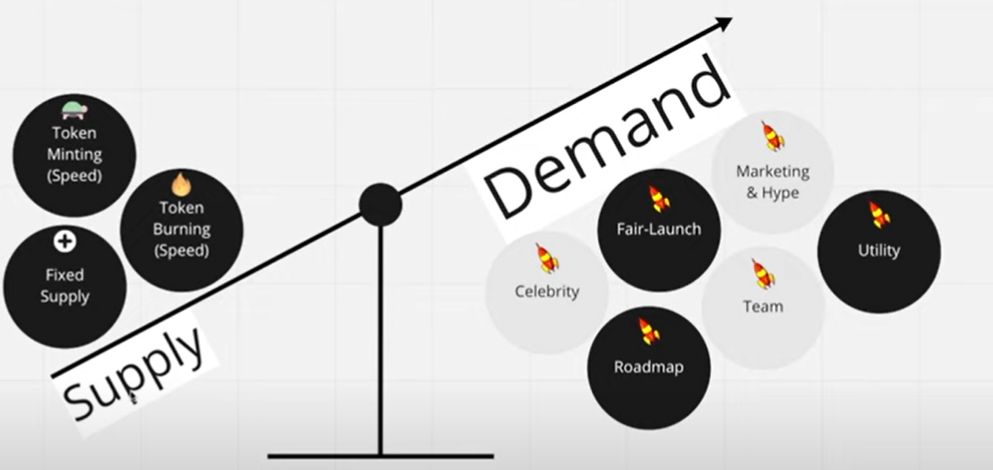

Token supply

The token supply drives the NFT economy. Demand pushes the price of the NFTs. Token supply determines the demand, apart from other factors. Simply put, if the supply increases, the demand for the NFT comes down. This means it is very important to have a cap on the supply.

A comparison between the Bored Ape Yacht Club and the CryptoKitties would explain this phenomenon a lot better. The BAYC has a limited supply of just 10,000 tokens. This has tipped the scales in its favor. Due to limited supply, the demand keeps growing and so does the price of the BAYC NFTs. In the case of CryptoKitties, any two kitties can be combined to create a new kitty. In this project, there is no cap on the supply. Eventually, the demand for CryptoKitties faded out.

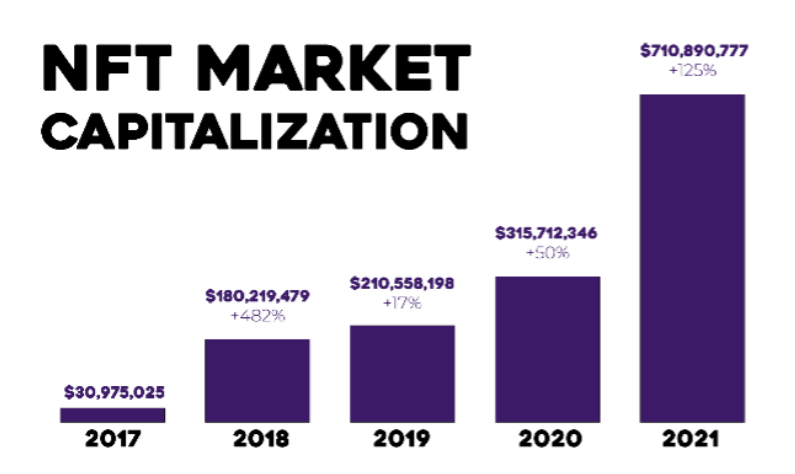

Market Capitalization of NFTs

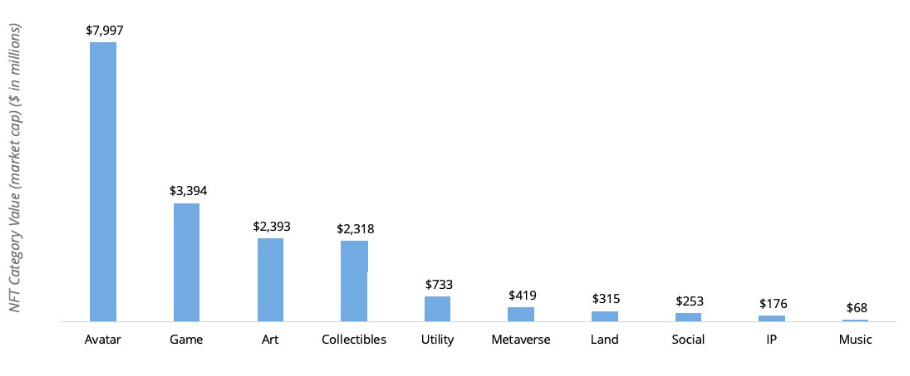

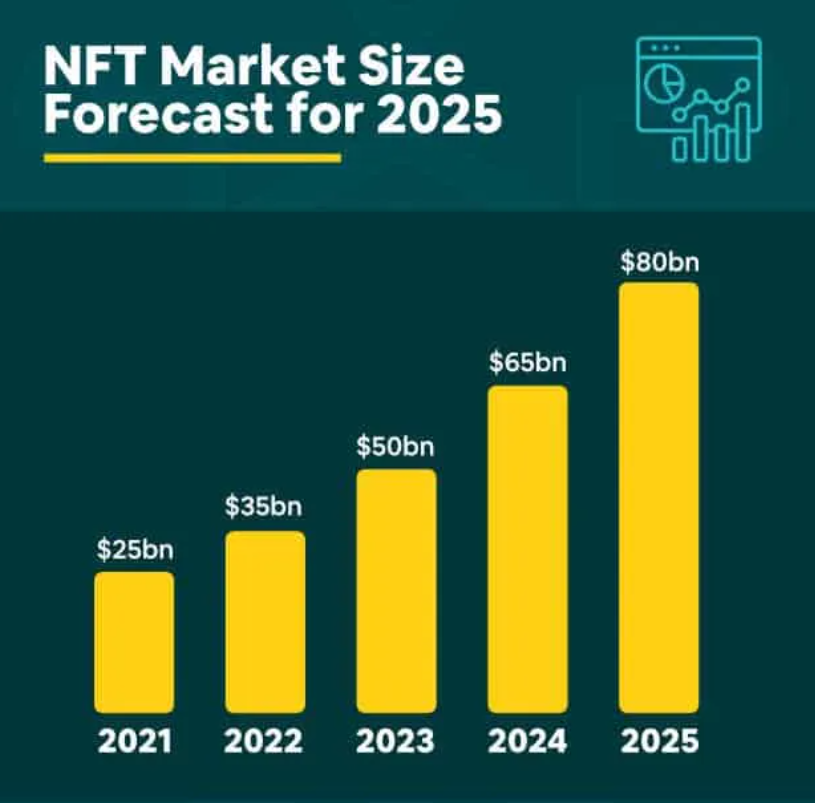

The market capitalization of NFTs has been on the rise since their launch. The current market size of NFTs is $20.4 billion.

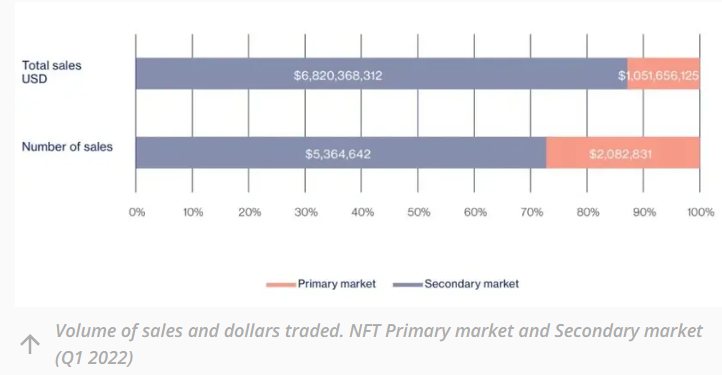

Around 70% of sales volume went to the secondary market, where nearly 90% of the value in circulation was represented by NFTs, with collectibles making up 80% of the market.

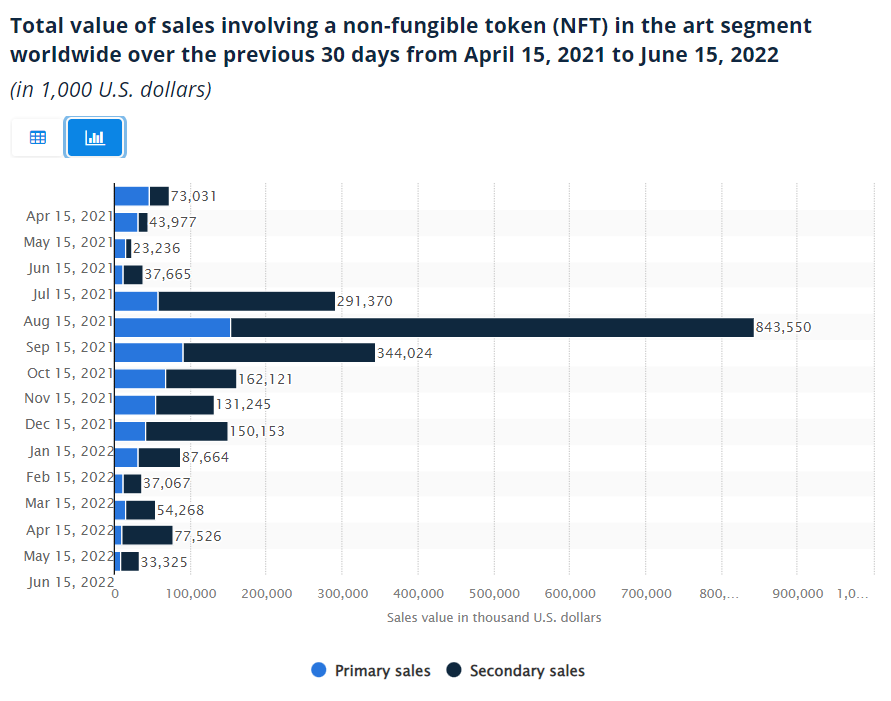

Price stabilization and market growth

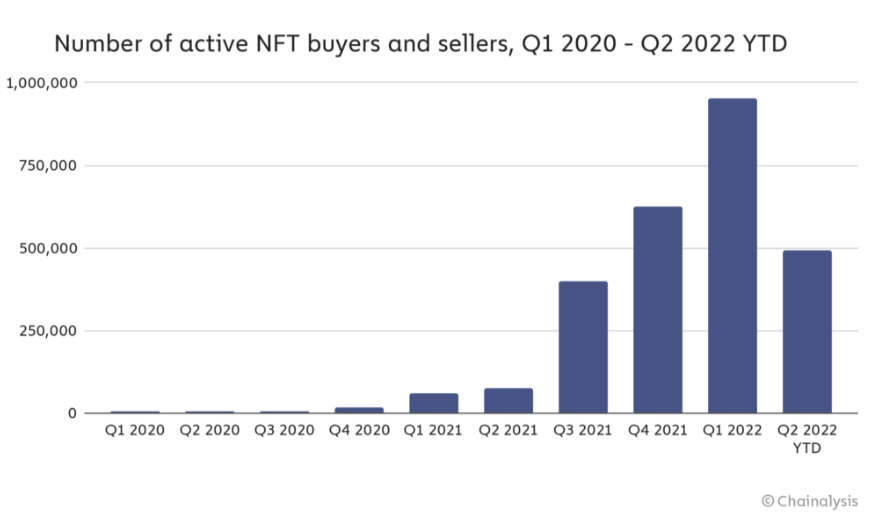

In August 2021, there was a boom in the sales of NFTs. Ever since the prices of NFTs have stabilized. There were ebbs and flows in the sales of NFTs in early 2022. The market began to recover in mid-April. Regardless of the fluctuations, the number of active NFT buyers and sellers is growing.

In Q1 2022, 950,000 unique addresses bought or sold an NFT, up from 627,000 in Q4 2021. The number of active NFT buyers and sellers has increased every quarter since Q2 2020. In Q2 2022 as of May 1, 491,000 addresses have transacted with NFTs, putting the NFT market on pace to continue its quarterly growth trend in the number of participants.

The stable increase in the number of active users indicates the persisting interest of investors. The market stabilization is due to the saturation of NFT collectibles, with a consequent decline in the production of new assets in the primary market, while the secondary market seems to try to “digest all the NFTs that were issued in the primary market last year”

Future readiness

A huge size of the NFT market is driven by art and digital collectible, gaming artifacts, and the Metaverse which constitutes digital identities and spaces.

Apart from the current applications of NFT, their usage can be extended to any physical assets or goods which can be tokenized for easier proof and exchange of ownership. NFTs have the potential to revolutionize how creators and fans engage. The prospects for NFTs are vast, and things are looking good for the future of NFTs.

By 2030, the market for non-fungible tokens is anticipated to be worth USD 211.72 billion, expanding at a CAGR of 33.9 percent from 2022 to 2030.

Creating an NFT business - The Tokenomics aspect

To create a successful NFT business, it is essential to design good tokenomics. Here’s a brief outline of the process.

- Identify the use case of the NFT. Some of the use cases include fan engagement, additional revenue streams, customer relationship management, and DeFi collateralization.

- Select the Blockchain network and the NFT Standard. A few factors to consider before selecting the blockchain network include the scalability and cost of transactions on-chain, security of smart contracts, and choice between non-fungible only NFT standard and dual-purpose NFT standard.

- Mint the NFT. It is ideal to choose a platform that is flexible and provides control over the NFT.

- Store the NFT. You can opt for blockchain storage, centralized storage, or decentralized storage for storing your NFT file.

- Distribute across a marketplace. It is advisable to consider the payment methods, services included, the blockchain, and the category of the NFT before picking a marketplace to distribute your NFT.

- Finally, have a solid risk management plan. If you are planning to start an NFT business, then ensure that it follows all the regulatory frameworks of the country you operate from.

Bored Ape Yacht Club NFT Tokenomics - A closer look at a ground-breaking NFT project

Let’s look closely into the tokenomics of a very popular NFT project - The Bored Ape Yacht Club (BAYC).

BAYC has been deployed on the Ethereum Network. Buying a BAYC NFT provides a gateway to the BAYC ecosystem of products and services. It is a community-driven collection that is very popular and has endorsement from celebrities and brands.

Token Supply

The BAYC has a limited supply of 10,000 unique tokens.

Market Capitalization

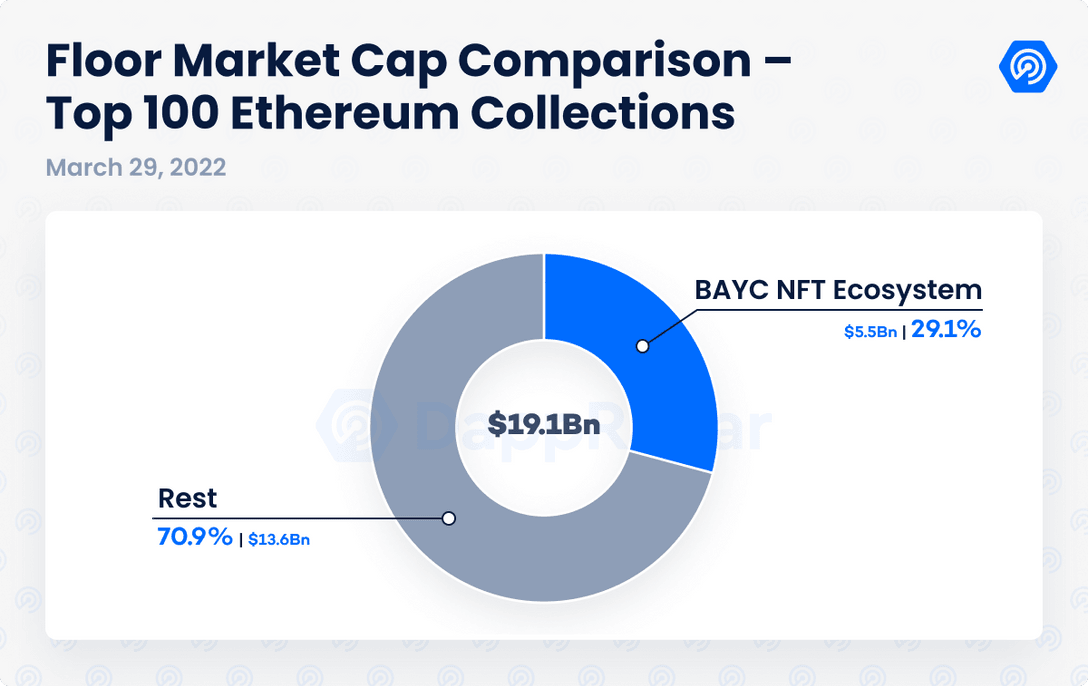

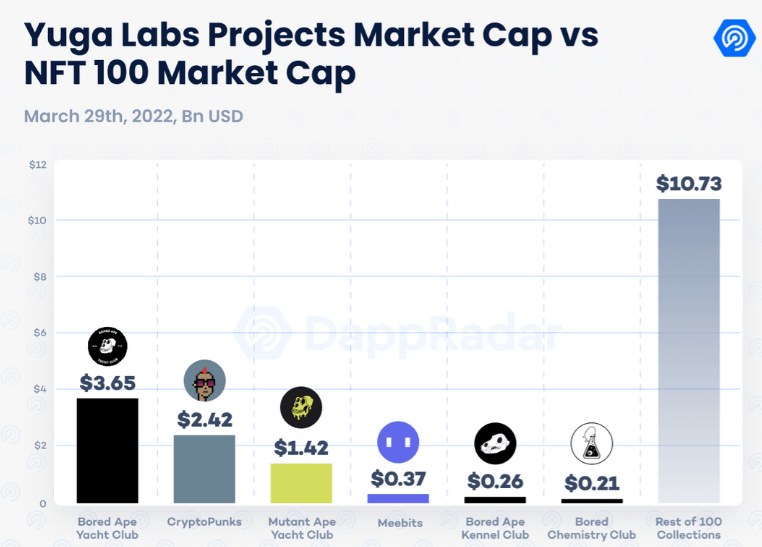

There is a total of 10000.0 NFTs minted held by 6452.0 unique owners with a total market cap of $953,943,054.90. (as of 23 June 2022).

Revenue Sources

Revenue is generated through multiple sources. These include:

- Primary sales/New drops/new tokens

- Royalties on secondary sales

- Merch

- Brand Deals

Future Prospects

Yuga Labs, the creators of BAYC announced the release of its Metaverse project, The Otherside. There are Mutant Apes which is an extension of BAYC. Yuga Labs has created a BAYC ecosystem. It also has a token ApeCoin which is restricted for day-to-day users. This token has a chance of becoming one of the primary tokens that are used in the NFT ecosystem.

Final thoughts

Regardless of whether you are an NFT business owner, an investor, or a Web 3 enthusiast, understanding the economics of the crypto world is crucial to dabble safely in it. With the unpredictable nature of cryptocurrencies and the high risks involved in NFT trading, knowing tokenomics would provide you the means to stay ahead in the game. We hope this article provided what you needed to know about tokenomics.