Written by: Jaime Lao

Edited by: Cyrus Ip and Sidney Lo

Ethereum’s Layer-2 (L2) ecosystem has been growing rapidly in the past year. And within the landscape, Polygon, in particular, caught our eyes. With its massive developer and user base, perpetual stream of high profile partnerships, and strategic acquisitions, it’s a force to be reckoned with in the L2 and zero-knowledge (ZK) ecosystem. This article will dive into its scaling solutions, ecosystem, valuation, and recent on-chain activities.

Table of Contents

- Polygon: The Ethereum’s Internet of Blockchain:

- A Multi-Solution Approach to Scaling

- MATIC Token Use Cases

- Polygon’s Ecosystem Development Strategy

- Recent Development

- Comps: Piecing the Data Together

- Conclusion

1/ Polygon: The Ethereum’s Internet of Blockchain

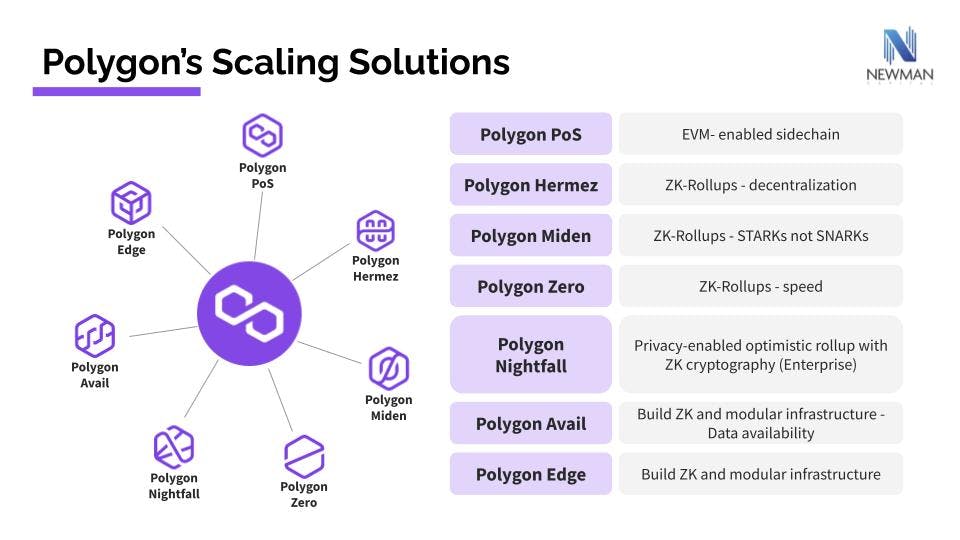

Known as Ethereum’s Internet of Blockchains, Polygon focuses on scaling Ethereum through a portfolio of ZK technologies. The company is developing seven scaling solutions, ranging from numerous ZK rollups to side chains to infrastructure such as software development kits (SDKs). Polygon’s current 7000+ dApps ecosystem spans across the DeFi, GameFi, metaverse, and NFT spaces.

2/ A Multi-Sided Approach to Scaling

Polygon has various solutions, each with a unique focus to support a range of use cases according to users' needs and their own research, test, and launch timelines. Some of the products are live while some are still in beta/development. The figure below illustrates the suite of scaling solutions and their focuses:

3/ MATIC Token Use Cases

MATIC is the native token of Polygon. The token has three primary use cases in the Polygon ecosystem:

- Gas token: Transaction fee on Polygon

- Governance: Vote on Polygon Improvement Proposals (PIPs) to decide on Polygon's direction

- Network security: Stake MATIC and contribute toward securing the network while earning rewards

Since Polygon's rebranded in Feb 2021, it is expected that Polygon will announce updates on its token redesign this year. The future token will work across all Polygon products.

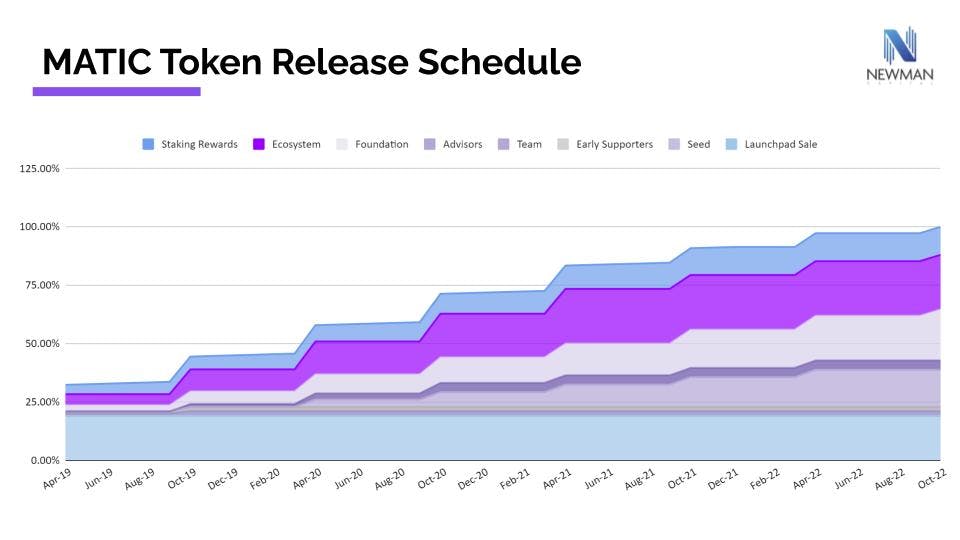

At the time of writing, there are roughly 9.7 billion MATIC tokens in circulation, with 26% of the total supply staked. On 2 Aug, 14% of the total supply (i.e 1.4 billion MATIC) was released from the vesting contract; out of those, 640 million MATIC were claimed by Polygon’s founders, and they committed to staking all the tokens in the network. The supply will be fully emitted by October this year.

4/ Polygon’s Ecosystem Development Strategy

Corporate development strategy:

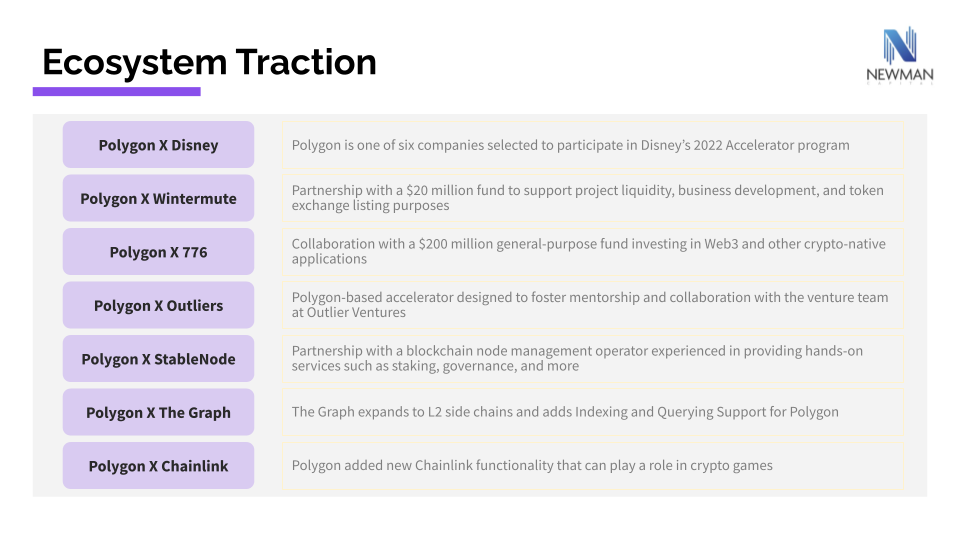

Corporate development is a key focus in expanding Polygon's multi-chain Ethereum world. These developments are not only limited to Web3 companies but also multinationals and conglomerates in the traditional world. Notable partnerships include Disney, Wintermute, Outlier Ventures, The Graph, and Chainlink. Additionally, Polygon has been developing its NFT and gaming ecosystem, and operating internal investment funds.

India crypto community:

As an India-based unicorn, Polygon has a strong presence in the Indian crypto scene. The company has been actively hosting developer training, partnerships with top universities, hackathons to grow its developer talent base, and incubating startups.

Lack of innovation:

There's criticism about the innovation on Polygon, as the Ethereum Virtual Machine (EVM) compatible chain enables developers to copy models from Ethereum to Polygon easily. For this reason, despite having a vast number of projects in the Polygon ecosystem, many of them are multi-chain projects on Ethereum.

5/ Recent Development

Polygon Studio:

In the summer of 2021, the team launched Polygon Studio - an internal unit aimed at drawing existing gamers towards blockchain games. Since then, the team has onboarded over 100,000 gamers and over 500 apps, including big brands such as The Sandbox, Decentraland, and OpenSea.

Mobile integration:

Polygon announced the partnership with Nothing Phone (1) to provide simple access to dApps, blockchain games, and payments via the Polygon network.

Financing rounds:

Polygon raised $450M through a venture financing round from Sequoia Capital India, Softbank, and Tiger Global in Feb 2022.

6/ Comps: Piecing the Data Together

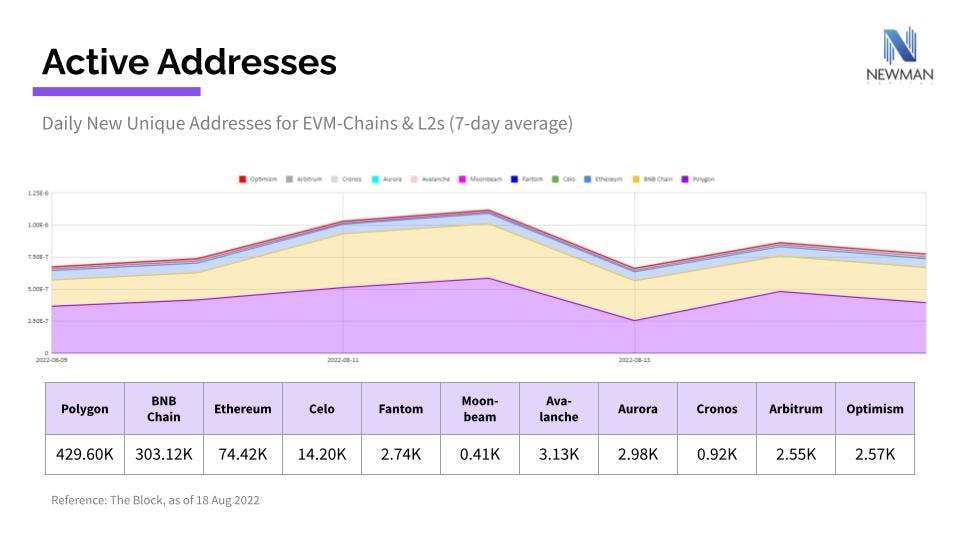

Daily New Unique Addresses:

Polygon has been one of the most active EVM chains in the market. According to The Block, on many days during the first half of Aug 2022, Polygon has maintained approximately 400K new unique addresses on a 7-day average basis, the highest among other major competitors, such as BNB Chain. In the same period, Polygon outperformed other major L2s in that perspective as well; it has 168x and 167x more daily new unique addresses than Arbitrum and Optimism respectively.

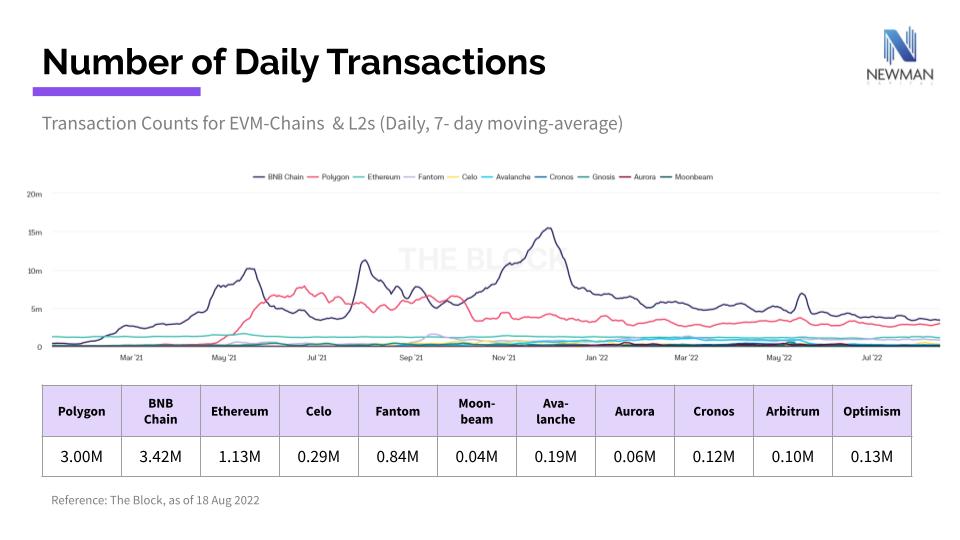

Transaction Counts:

Data also shows that Polygon has significantly higher transaction counts than Ethereum over the past year. Reports from Nansen show that the transaction count on Polygon was as much as 700% higher than on Ethereum in Q3 of 2022. Although the number has gradually decreased, it has been hovering in a stable range of 200-300% higher than on Ethereum even today. On the other hand, in the same period, Polygon has 30x and 23x more transaction counts than Optimism and Arbitrum respectively.

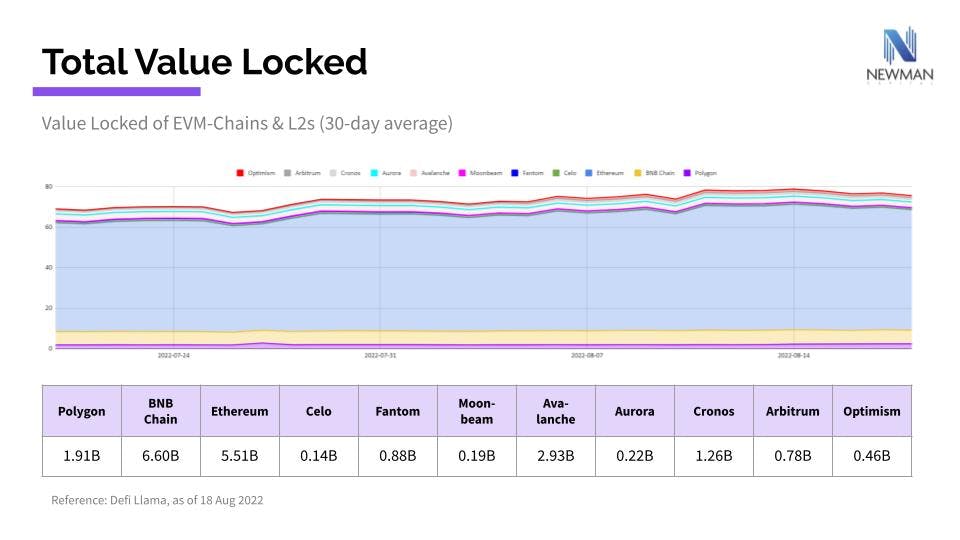

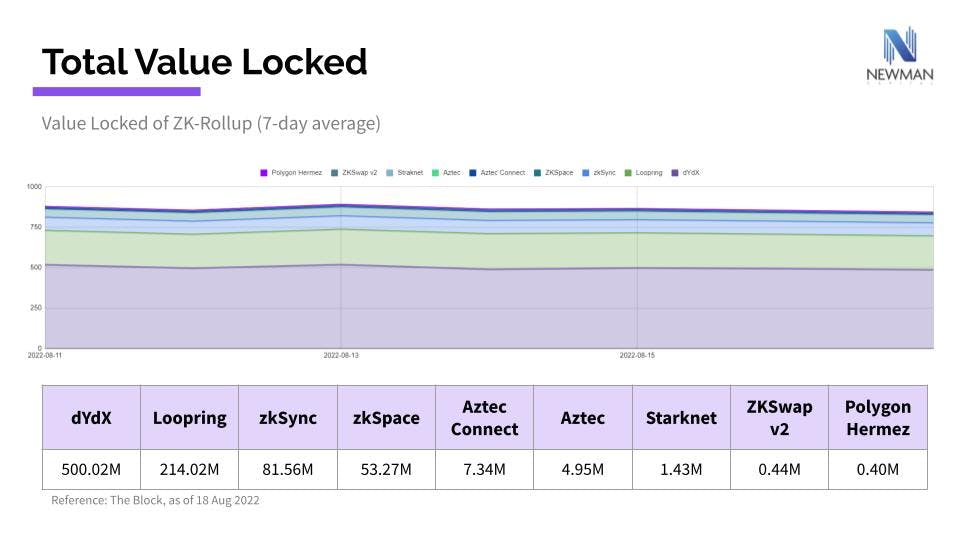

Total Value Locked (TVL):

Polygon is well positioned to capture the value unlocked by L2s, with TVL at $1.91B, after Ethereum and BNB chain. Polygon’s proof-of-stake (PoS) chain certainly has dominance within the scaling landscape, but when we look at the ZK-rollup scene, Polygon Hermez has a rather weak presence, with only 0.05% of market share.

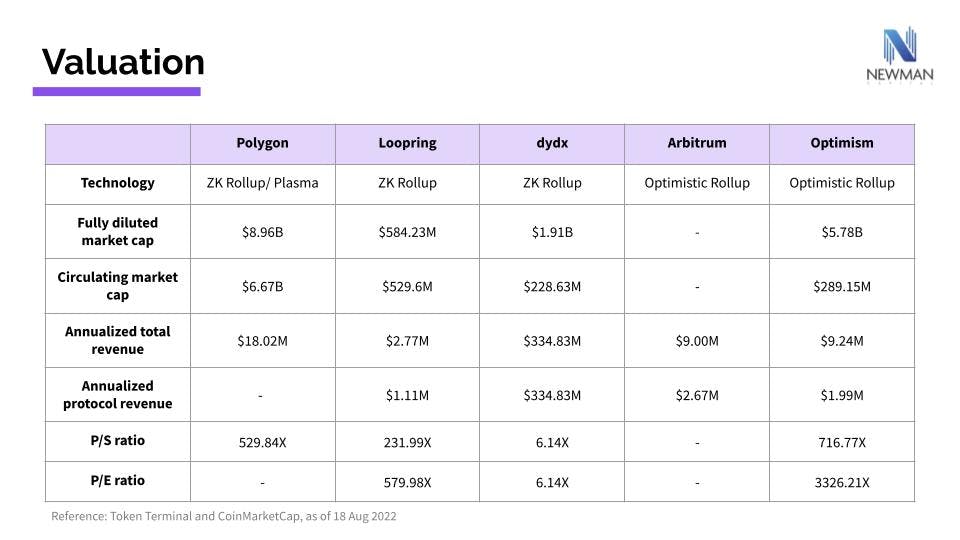

Valuation:

In our research, we compared key valuation metrics of the leading L2s and found that Polygon has outperformed its peers in multiple segments, including market capitalization, revenue, and price-to-sales (P/S) ratio. Polygon's fully diluted valuation (FDV) was 1.55 times higher than Optimism - Polygon's top competitor as of 18 Aug. In addition, Polygon's annualized revenue is equivalent to Aribtrum and Optimism combined, and the P/S ratios of Polygon and Loopring are 529.84 and 231.99 respectively, which means that investors see the value of Polygon as roughly three times higher than Loopring for the same amount of revenue collected.

Pricing Analysis:

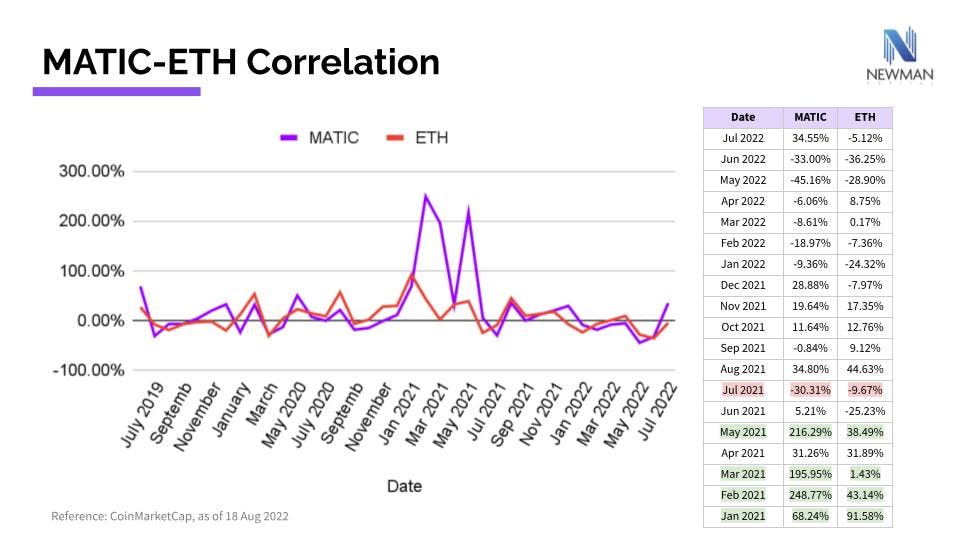

Our study shows that the price correlation between MATIC and ETH has been strikingly high since Jul 2019. The only exception is Q1 in 2022, where MATIC's price jumped by 200% due to its launch. Major positive catalysts of the Polygon ecosystem include product launches, updates, acquisitions, and partnerships, while the negative ones include overall market downturn and technical issues. (Note: in Mar 2022, Polygon suffered a technical issue and had not produced a new block in 11 hours)

7/ Conclusion

Positioned as the "swiss army knife" of Ethereum's scaling solution, we see promising valuation, on-chain data, and corporate development strategy from Polygon. Through its comprehensive suite of rollup solutions, Whether it’s users wanting faster transaction speed, enterprises seeking privacy, or developers looking for scaling solutions, Polygon's portfolio offers something for everyone. Within the L2 landscape, it's still too early to tell who will emerge as the leader, but what is more certain is that with Polygon's aggressive expansion and growth strategy, the company is here to stay as long as it can draw projects to its platform.

Disclaimer: This material has been shared solely for information purposes, and must not be relied upon for the purpose of entering into any transaction nor investment. Newman Capital is not an investment adviser, and is not purporting to provide you with investment, legal or tax advice. You are always advised to DO YOUR OWN RESEARCH before making any investment decision. Newman Capital has a position in MATIC token.