Foreword

It is almost impossible that Web3 entrepreneurs only accept Bitcoin and not USD-- Gary Gensler

Compare with its rivals, the U.S. dollar has top network effects and the widest accepters. Even on the other side of the Atlantic, the old world, people still love this green bill.

The decentralized stablecoins are playing a crucial role in the decentralized world. It can provide core endorsement for the new chain world.

This article will mainly focus on Collateralized Debt Position, looking for anchors in this volatile world.

The following is the content of this article, and it is recommended to read it in combination with the main points.

Background (1) Why stablecoins deserve attention

Huge market space

No need to reconstruct the flywheel effect

Become a new entry to the chain (2) Can decentralization create stable on-chain currency?

Collateralized Debt Position (CDP) Stablecoin (1) Maker Dao (Stablecoin: DAI)

Model

Anti-fragile mechanism

Summary (2) Patch 1 of MakerDao: Abracadabra (Stablecoin: MIM)

Model

Project development context

Vulnerability is inevitable

Summary (3) Patch 2 of MakerDao: Alchemix (Stablecoin: alUSD)

Improvement of DAI - capital efficiency

Summary

Model

Model

Return to common sense, there is no alchemy in the currency circle

1. Background

(1) Why stablecoins are important

1)Huge market cap

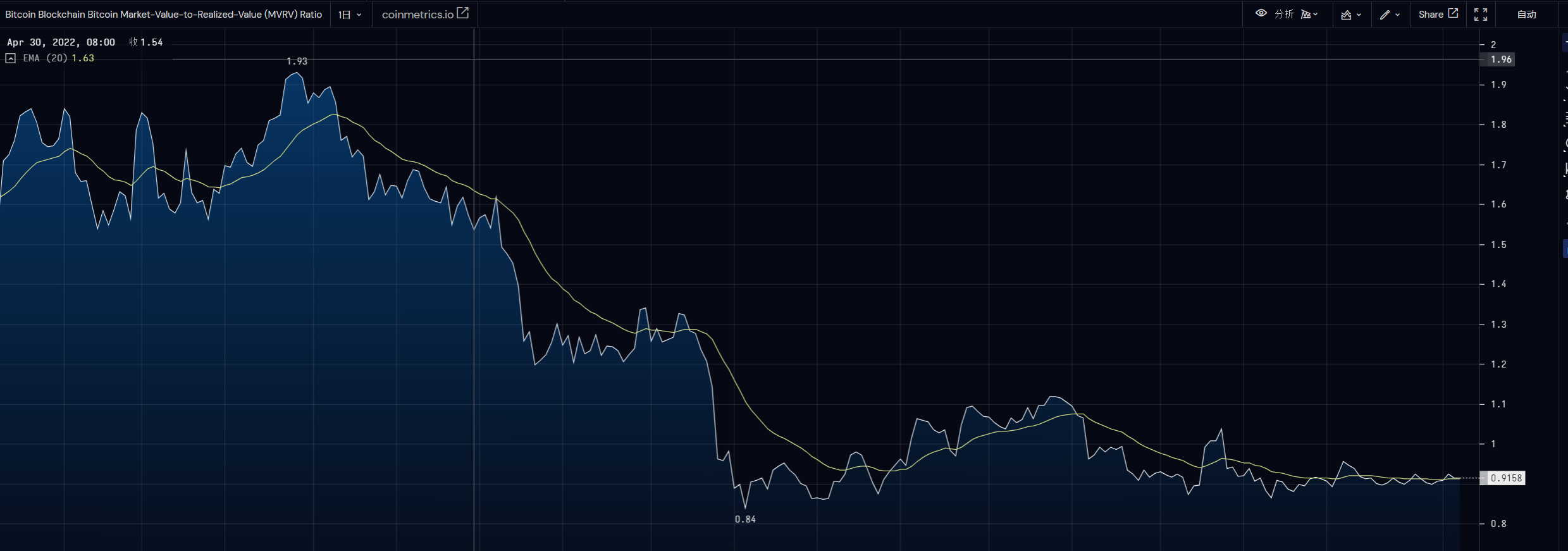

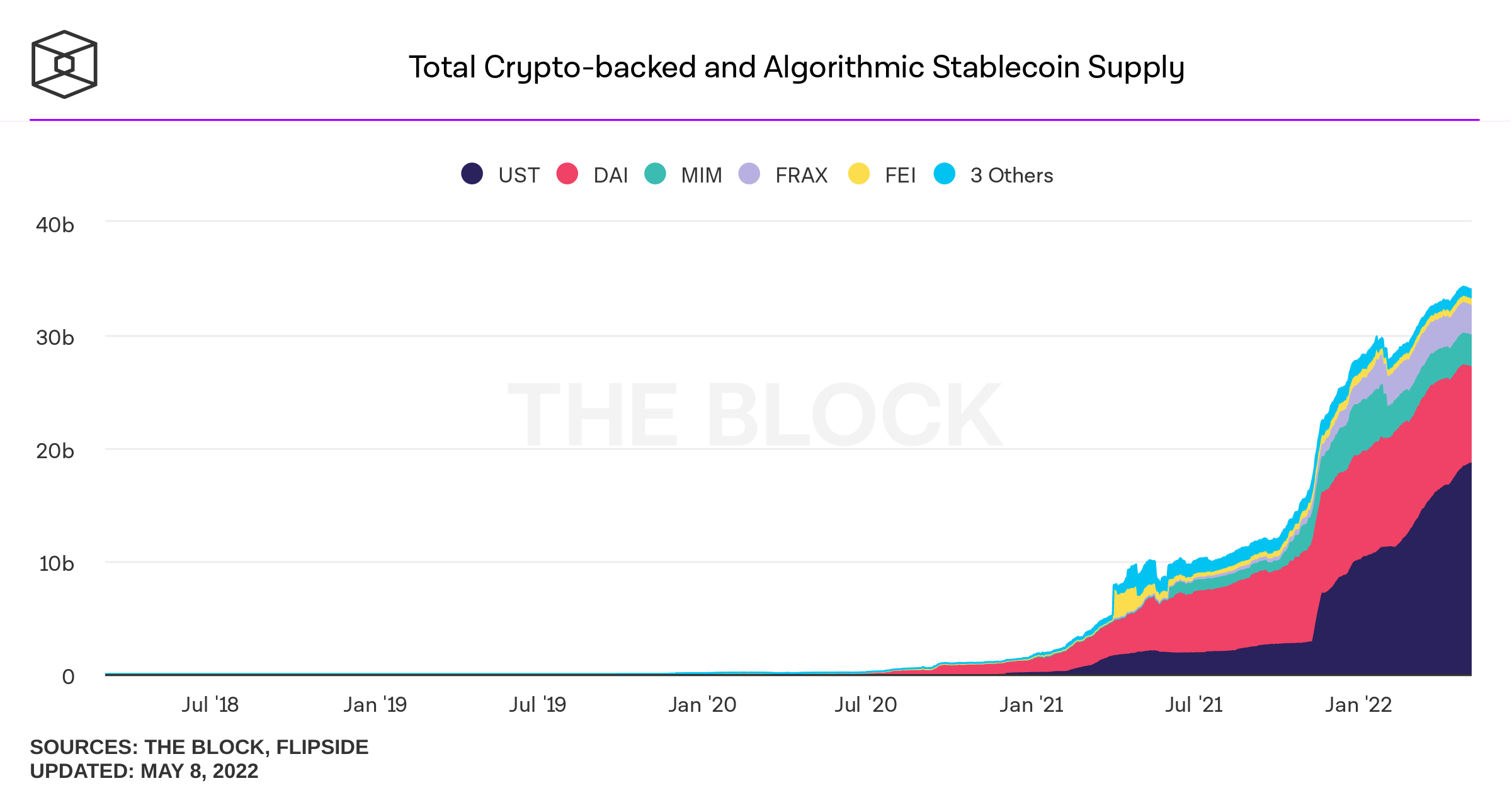

By May 2022, the total market cap of decentralized stablecoins had exceeded $30 billion, accounting for 2% of the total market share. If we add the value governance tokens, the market cap is expected to account for 4% of the total share. Considering that Bitcoin and Ethereum account for more than 60% of the market, stablecoins account for 10% of the market capacity without the Kings(BTC+ETH).

2)Inherent flywheel effect

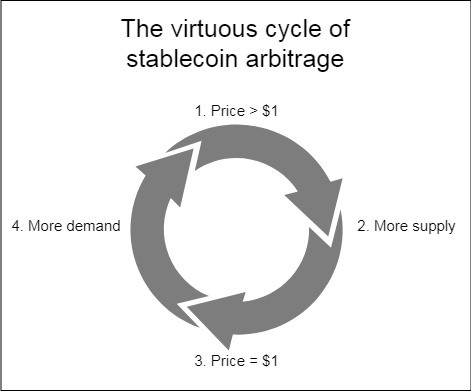

Since stablecoins are pegged to the U.S. dollar, their natural value like a social consensus, value store, and unit value of stablecoins does not require intense market education, and could seamlessly borrow from the U.S. dollar.

3)A bridge to the Web3 world

As the anchor of the world monetary system, the U.S. pegged stablecoin can communicate the new and old world. It is the onboard ticket for the old world to get exposure to the new world.

(2) Can we create stablecoin?

After 2021, decentralized stablecoins have seen a growth spurt. The dominant stablecoins are Collateralized Debt Position and algorithmic stablecoins. The former one sacrifices some capital efficiency to ensure higher stability. The latter needs to face the "death spiral".

The following content will cover the Collateralized Debt Position to give you a glimpse of stablecoin’s mechanism.

2. Collateralized Debt Position (CDP) Stablecoin

(1) Maker Dao (DAI)

Being the pioneer of stablecoins, DAI gains the decentralization of issuance on the premise of relinquishing some of the risks of capital efficiency and upward decoupling; compared with pure algorithmic stablecoins, DAI gives up capital efficiency to seek higher stability which is proven by each fluctuation days. On the premise of avoiding a downward death spiral.

1)Model

Minting process: Each DAI is formed by over-collateralization of other assets.

Capital efficiency: In order to achieve higher stability, the system adapts an over-collateralization mechanism to ensure its own stability.

(2)Anti-fragile mechanism

1) Emotion guarantee

Over-collateralization is the first firewall. This firewall will urge borrowers to deposit more collateral assets (ETH, UNI, LINK, YFI, etc.)when the crisis came to make sure all their portfolio is not liquidated.

2) Liquidity Guarantee

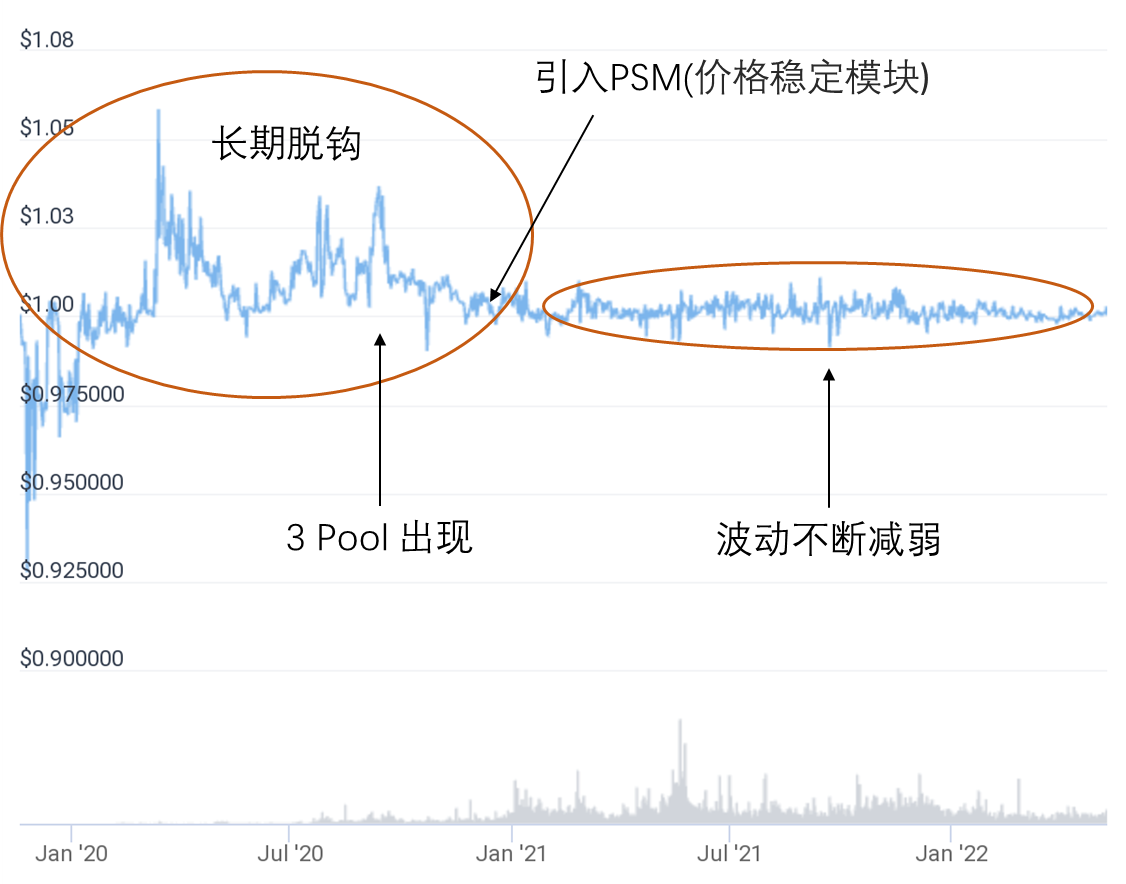

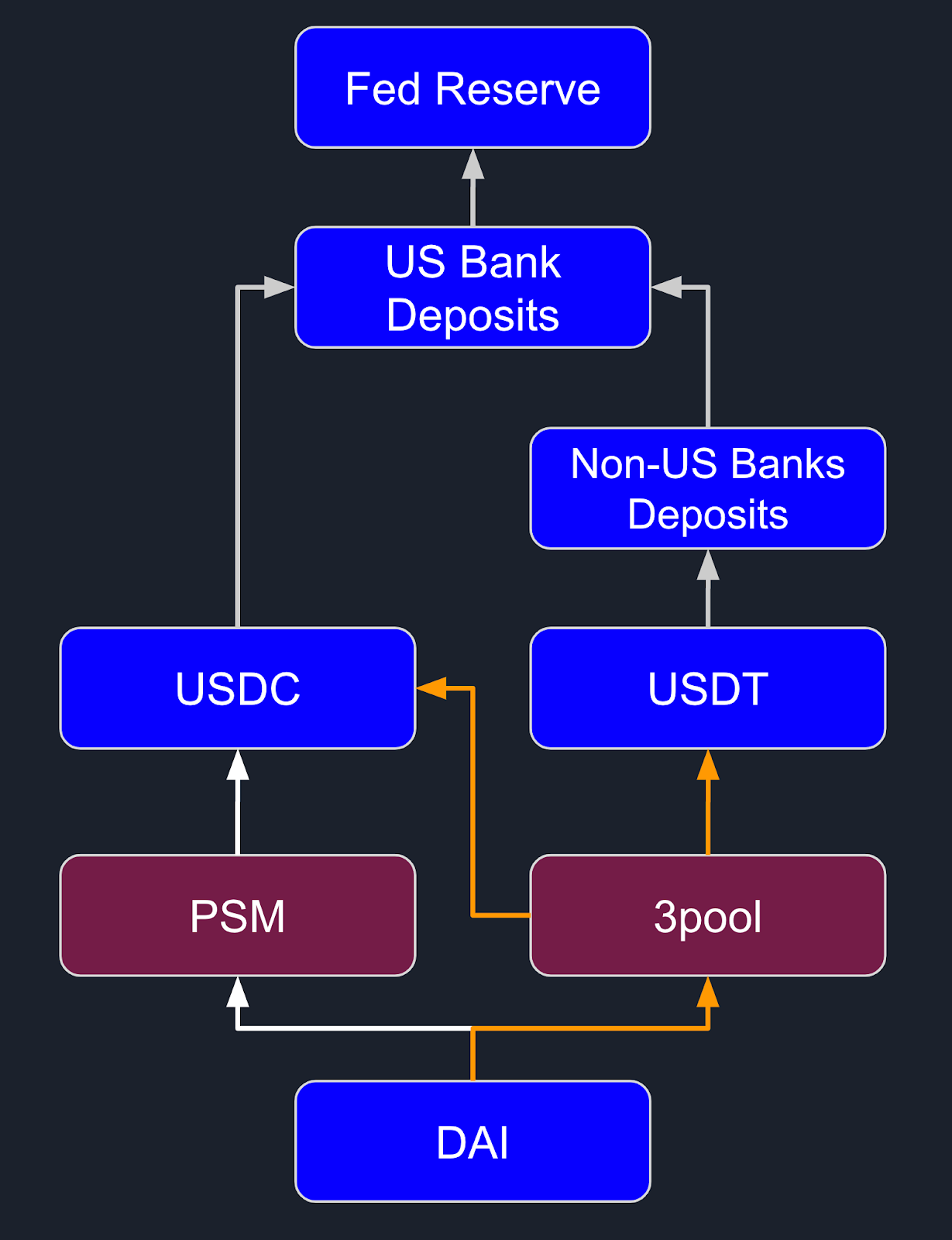

3 pool + PEG module will help to repeg when the market is facing failure.

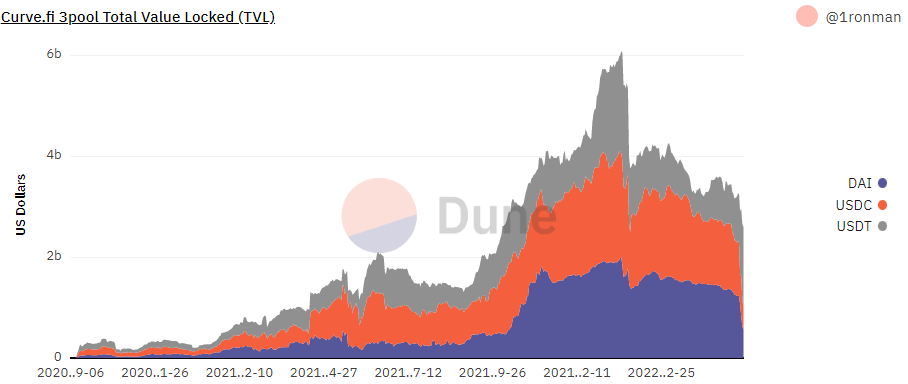

3pool

3pool of Curve Protocol is the core trading pair of this DeFi protocol. By definition, It is a stablecoin liquidity trading pool made up of DAI, USDC, and UDST, and has over 3 billion TVL. Other stablecoins will also create a liquidity pool by connecting to 3pool to peg its price to USD.

As the largest stablecoin Curve pool, 3pool enjoys the benefits of a large number of CRV releases, making it a good place to earn CRV income with low risk and further increasing the depth of liquidity.

The liquidity accumulated by 3Pool will deter those malicious short sellers。

**PSM**

The pegged stable module allows users to directly exchange a given collateral crypto asset for DAI at a fixed rate, rather than buy the DAI on the market. The PSM allows users to exchange other stablecoins for DAI at a fixed exchange rate to help peg DAI to $1.

After the middle of 2020, the volatility of DAI gradually lowered with the creation of 3Pool and PSM.

Derek Lim stresses that the 3 Pool, which brings high liquidity, is an important foundation for DAI's stability. In the end, he also use a picture to support his view:

Logic: The support between USDC and USDT in 3pool and Dai is similar to PSM. The PSM module allows traders to be driven by the arbitrage space and inject liquidity directly into the protocol when the price is decoupling up.

Token price fluctuations: From statistics, after the 3 Pool came up, the fluctuation of DAI seems to have converged, but from the chart above, it seems that PSM plays a much more important role than 3pool.

Currently, the 3pool is still dominating the market.

3) The first safety mat in the crisis - dealing with small storms

If the crisis came out, the price of collateral tends to plunge, when the collateral ratio hit 140%, Maker DAO will start to collateral to make sure the collateral is above the ratio.

Incentives for arbitrageurs: A small percentage of collateral will be received as a reward during the liquidation process.

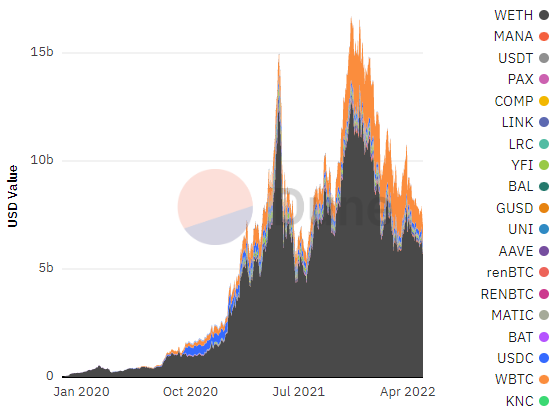

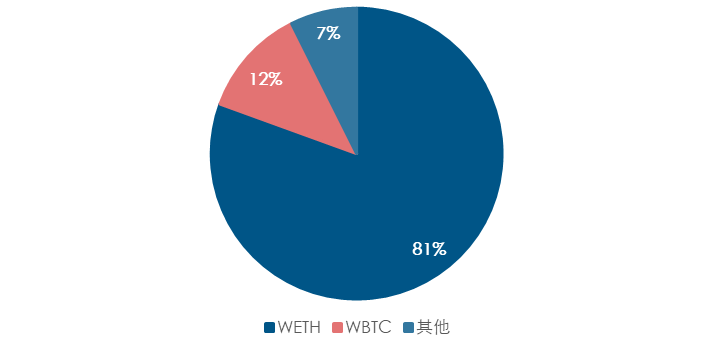

DAI’s collateral is mainly from ETH and BTC. After the 2020’s market crash, the trading depth of these two assets has continued to increase, and it is difficult to believe that they will completely lose liquidity even when the black swan came. A long-term decoupling of DAI's Black Thursday 2020 is largely unlikely.

DAI’s collateral is mainly from ETH and BTC. The trading depth of these Kings will continue to maintain at a certain level, and it will still act like a liquidity pool for the DAI.

4)The second safety mat in the crisis - Response to Large Storms

If the price of the collateral falls rapidly, then there will be an inequality: treasury debt > treasury collateral. At this point, the system will mint MKR out of thin air and sell it to the market to fill the gap between debt and collateral.

5)The third safety mat in the crisis - The holders of DAI pays

If MKR liquidity disappears and the liabilities in the vault remain, then DAI holders will eventually bear the cost and the market will reprice their DAI.

(3)Conclusion

From the above analysis, we could believe the DAI can get through a crisis of a century, which means we do not need to buy slightly higher security by participating in UXD. Because UXD gives up the potential uptrend of collateral.

The mainstream in the bull market is to create a stablecoin without a death spiral.

2. Patch 1 of MakerDAO: Abracadabra (Stablecoin: MIM)

(1) Model of MIM

Collateral: Each MIM is backed by a specific interest-bearing token (ibTKN). On most protocols, there is a liquidation risk if users face the liquidation of all their collateral.

General borrowing process:

General Value Exchange for Borrowers:

paid interest to obtaining liquidity

Borrower benefits:

Stable token price with relatively low-interest rates

Keeping collateral/lending capacity while maintaining primary ibToken exposure

** LP supply liquidity process: **

General value exchange for MIM-3CRV LP:

Provides liquidity in exchange for $SPELL earnings

Advantages of MIM-3CRV LP:

Transaction fee Withdrawal

High APY of $SPELL

(2)Project development context

Step 1: Nesting dolls. With the empowerment of Yearn, it can provide a higher yield to the market and attracts seed users; the project side of Abracadabra realized Curve's importance for its stability of price, and purchase liquidity.

Step 2: Expand the track. To attract more users by joining various popular decentralized lending platforms;

Step 3: Listing on the exchanges. Launch curve, build MIM-3pool to obtain liquidity, build MIM-UST and ensure its own income.

(3)Inevitable Vulnerability

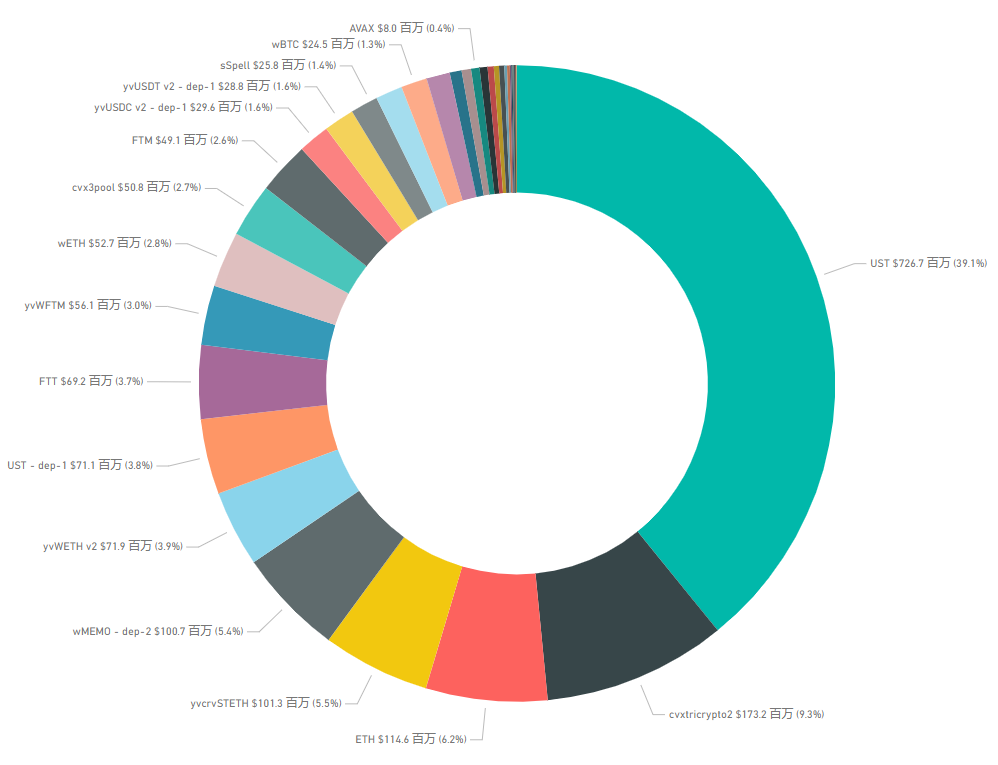

In terms of collateral quality, the proportion of UST has increased since the beginning of the year, which increases the instability risk of the system.

From the perspective of the mortgage ratio, the mortgage ratio was below 50% at the beginning of 2022, but it further increased to 57% in early March 2022, and the vulnerability of the project is strengthening.

(4)Summary

MIM trades its stability for a higher return. However, analysis its data in March, the staking risk of the project is relatively high, and the stability may not face too many challenges.

In the future, Abracadabra founders could can implement and update its own collateral situation and win a larger community formula with transparency.

3. Model of MIM(Alchemix)

(1)Improvement of DAI - capital efficiency

Users need to deposit (such as Dai or ETH) into the contract, and the contract will pool the collateral and deploy it to yearn's yDAI Vault for liquidity mining.

(2)Summary

Solving the problem: DAI has been facing low capitalization for a long time. The emergence of Alchemix will undoubtedly give investors who hold Dai coins a new opportunity.

Disadvantages: Compared with Abracadabra, this project requires high segmentation of project income and low capital efficiency.

3.Invest in common sense

The Collateralized Debt Position steer by Maker Dao, increasing the yield with the help of Abracadabra, and forging ahead with Alchemix. After the bull market brought by of DeFi Summer and the revival of DeFi 2.0, the currency circle has indeed entered a bear market. When the music comes to an end, common sense is about to return.