Moving this article over to Mirror from Medium from November 2021

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in this report constitutes a solicitation, recommendation, endorsement, or offer by MetaStreet or any third-party service provider to buy or sell any securities or tokens or financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

🡺 Discord: https://discord.gg/3FWfreHrY4

🡺 Website: www.metastreet.xyz

🡺 Twitter: https://twitter.com/metastreetxyz

NFT Valuation & Collateral Sizing Methodology

If NFT valuations had a “football field” range of valuations, MetaStreet is specifically interested in the lower-estimate given our risk parameters and ultimate goal: to not be underwater on our collateral.

**Bottom of the football field: **MetaStreet’s view of NFT values focuses primarily on downside protection. As such, we focus on trailing 30-day collateral value (“CV_t30”), which represents the volume weighted average daily transacted floor price for a trailing 30-day window. From there, we apply two discounts:

- Duration discount (“DD”): represents the largest peak to trough drop in CV_t30, over the same period of time as the duration of the agreement in question (ie, a 60-day collateral agreement will look at the largest peak-trough drop in 30-day collateral value over any 60-day period)

- Liquidation Discount (“LD”): represents the estimated additional spread needed to cover liquidation costs in the event of default, (ie, transaction fees, holding costs, etc.)

Using the formula: “CV_t30 x DD x LD”, we can figure out the max proceeds we’d provide against NFT collateral under various collateral agreement durations. This results in max proceeds of $147k USD for CryptoPunks and $63k USD for BAYC, with interest rates varying based on duration.

Another downside-oriented metric we focus on is max weekly exposure, set to 50% of the average weekly transaction volume over a trailing 30-day period. This metric focuses on liquidity in a default scenario, ensuring that ample liquidity will be available to quickly move assets off book if needed.

On taxonomy, respecting “nonfungibility”: our analysis excludes high rarity assets (ie, alien punks, golden apes, etc) which fall outside of the scope, as well as likely wash trades (ie, transaction value less than 15% of the 25th percentile of daily transacted value) in order to focus on truly relevant data points for the NFT asset in question.

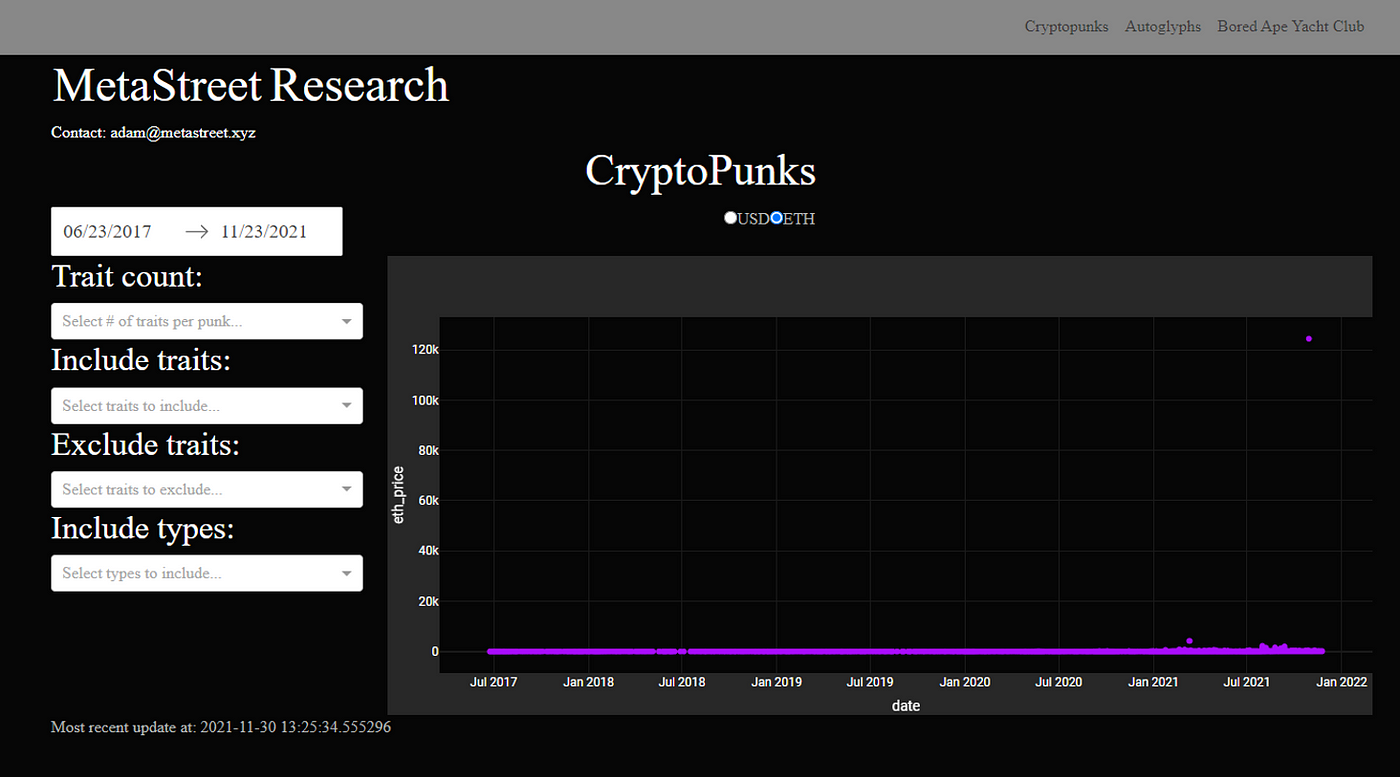

Office buildings (large, chunky assets with tailored valuations) are treated differently in valuation from residential real estate (semi-fungible/abstracted assets with broad valuations based on parameter ranges) — in the same thinking, we also separate high-rarity assets with close-to-floor assets, as demonstrated by the sample CryptoPunks charts below.

Figure 1 — limitation of outliers, pre-heuristic analysis

Figure 2 — contextualizable data analytics

Taking all of these inputs into account, our ultimate output shows collateral value / max proceeds of ~82 ETH / ~33 ETH for CryptoPunks and ~35 ETH / ~14 ETH for BAYC. Interestingly, duration discount doesn’t change across 30–90-day durations, primarily because the CV_t30 absorbs much of the short-term value swings (ie, if we look at CV_t7, the duration discounts are more pronounced). However, note that interest rate ranges will further compensate for principal risk over longer durations, to be updated weekly to market clearing levels. Additionally, you’ll see that the max CryptoPunk volume that MetaStreet would originate this week would be $17mm, or $20mm for BAYC, based on trailing transaction volume.

Figure 3a — CryptoPunk “collateral value” valuation heuristics

Figure 3b — BAYC “collateral value” valuation heuristics

Note: this methodology is entirely experimental at this time, and could be subject to broad updates given the nascency of the NFT space.

CryptoPunks vs Bored Ape Yacht Club: Hands Off “Proof of Provenance” vs Active Community Management

We generally bifurcate the current NFT landscape into three buckets: profile pictures (“PFPs”), gaming assets, and digital artworks. Like many others, we view the current NFT population as being at the cusp of relevance — many NFT projects are likely worthless, taking advantage of a tremendous hype wave (see: Gartner hype cycle) that is likely to cool off in the near term. In future installments, we will profile gaming assets and digital artwork as an asset class, but today we want to focus on PFPs with a specific interest in CryptoPunks and BAYC as the most well-known, blue-chip assets in the subsector.

CryptoPunks were one of the earliest examples of NFTs, with the original mint occurring in 2017, even pre-dating the standard ERC-721 format that nearly all NFTs take now. With the reputation of the “first” NFT to be used as a profile picture, CryptoPunks carry tremendous cultural value in the digital ecosystem. Ownership of a CryptoPunk signifies the owner was either early in the space and therefore relevant and educated on digital assets or wealthy and able to spend ~$350k USD or more on their digital identity. The magnitude of this conspicuous consumption is amplified exponentially with the reach of social media networks (like buying a Lamborghini and getting to drive it around the country every day).

Bored Ape Yacht Club is, in our opinion, the next evolution of what the PFP asset class can achieve. Despite an original mint in only May of 2021, the project has quickly garnered one of the strongest (and loudest) communities in the PFP space. While CryptoPunks will always hold the position of the “first”, BAYC is taking a more active approach to value creation, with the ownership of a BAYC NFT getting access to exclusive events (both IRL and in the Metaverse), additional NFTs (MAYC), and full IP ownership (in contrast, CryptoPunks IP is owned by the creating company, LarvaLabs). This actively managed approach has resulted in the addition of major mainstream celebrities to the community (Jimmy Fallon, Post Malone, Future, etc.) and even a recently announced merchandising partnership with Adidas.

Diving into the actual price performance of these NFTs, both CryptoPunks and BAYC have experienced meteoric growth in 2021:

CryptoPunks

- Transaction values have grown from mid-single digit ETH values in January of 2021 to the ~80–100 ETH range since September of 2021.

- Through 2021, there has been 558,000 ETH of transaction volume, or $1.6bn USD (excluding extremely rare assets — aliens, apes, zombies).

- At current prices, the total market cap of CryptoPunks would be 830,000 ETH ($3.6bn USD)

Figure 4a — CryptoPunk historical price performance

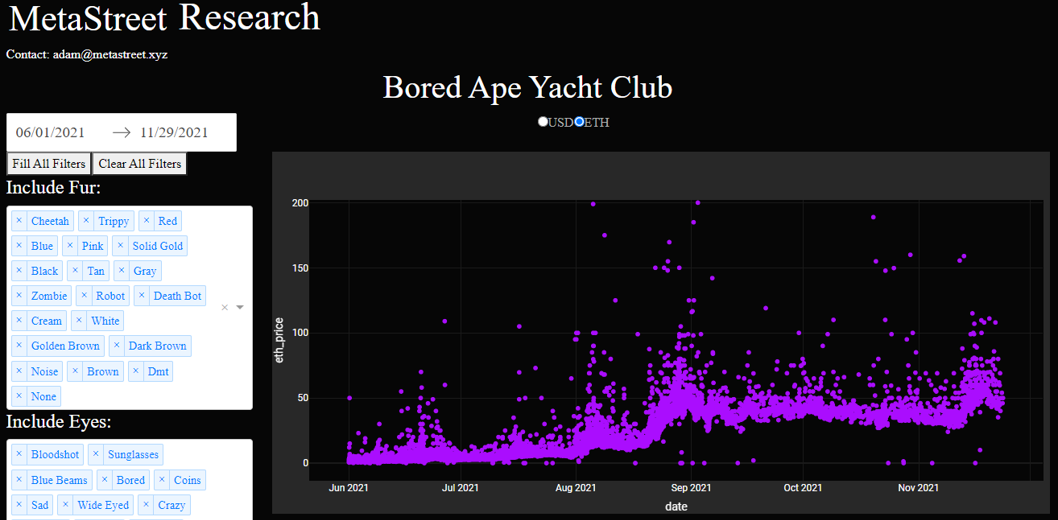

BAYC

- The original mint was in May of 2021, and transaction values have grown from sub 1 ETH to the ~25–35 ETH range since September of 2021.

- Since mint, there has been 226,000 ETH of transaction volume, or $755mm USD (excluding extremely rare assets — golden, trippy, zombie).

- At current prices, the total market cap of BAYC would be 430,000 ETH ($1.8bn USD)

Figure 4b — BAYC historical price performance

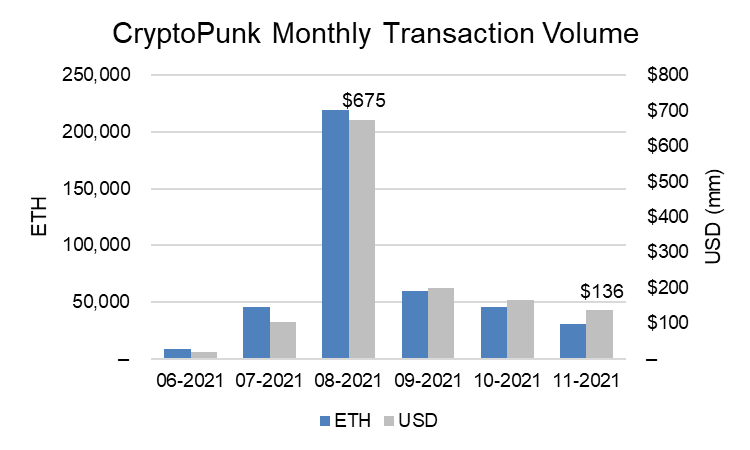

In comparing transaction volume, we see that for the past three months CryptoPunk transaction volume has been declining (though still comfortably above $100mm/month) by about 20% per month. Meanwhile, BAYC transaction volume bottomed out in October at $85mm, with November up 120% to $188mm (and also above CryptoPunk transaction volume for the first time ever). While this is certainly a positive trend for BAYC, we wouldn’t spend too much time focusing on the CryptoPunk decline as the monster month in August of over half a billion USD in transaction volume likely satiated much of the demand without unique near-term catalysts.

Figure 5a — CryptoPunk monthly transaction volume

Figure 5b — BAYC monthly transaction volume

How does this look from a near-term price standpoint? Both asset types have held up well in Q4, with healthy transaction volume providing validity to the price data points. We expect BAYC to continue to climb in the near term, while CryptoPunks hold and possibly pull back slightly as ETH tests ATHs.

Figure 6 — recent week-by-week price analysis

While many casual spectators of the NFT space view asset values as highly volatile and speculative, we think setting a variety of parameters around volume, duration and price can help to quantify and box off much of the perceived risk. CryptoPunks and BAYC are two of the most well known and well respected NFTs, and we expect they will continue to lead the market in the near term.

Thanks for reading! We would welcome discussion on this or any other related topics on our Discord. Thank you for being a member of the MetaStreet community!

🡺 Discord: https://discord.gg/3FWfreHrY4

🡺 Website: www.metastreet.xyz

🡺 Twitter: https://twitter.com/metastreetxyz