If you want to understand the price law of BTC, watching this metric may help you!

The metric we’re introducing today is Short Term Holder MVRV. The metric source: looknode.com.

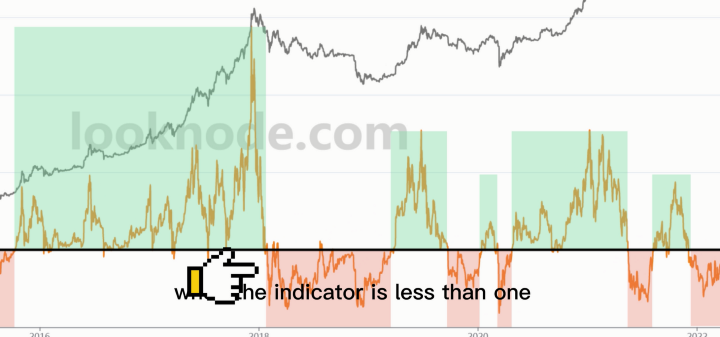

Short Term Holder MVRV is used to track the ratio of Market Value to Realized Value of BTC held for less than 155 days.

When the indicator is less than 1, it means that short-term holders hold BTC in an average state of loss, and the smaller the indicator value, the greater the loss.

When the indicator is greater than 1, it means that short-term holders hold BTC in an average profitable state, and the larger the indicator value, the greater the profit.

The indicator value equal to 1 is the cost line for short-term entry, so it is usually also the support or resistance line for the price.

Observation reveals:

When the indicator changes from less than 1 for a long time to greater than 1 for a long time, BTC begins to enter a bull market.

when the indicator changes from a long term greater than 1 to a long term less than 1, BTC begins to enter a bear market.

At the same time, when the indicator turns from a low point to an uptrend, historically, it often corresponds to the short-term bottom of the market.

The above is the tutorial guide for this metric. Of course, you can also visit looknode.com and discover more interesting phenomena through your own analysis.

Website: https://looknode.com

Twitter: https://twitter.com/looknode_com

Telegram: https://t.me/looknode_com

Disclaimer: This report does not provide any investment advice. All data is provided for information purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.