This is a continuation of my original post on the state of Ethereum staking in Latam: Enhancing Ethereum’s security with Latin America: Introducing KipuStakers and the current state of staking in the region.

With Ethereum’s move to Proof of Stake, hardware requirements lowered (you can run Ethereum in fairly basic machines!), while a stake requirement of 32 $ETH was introduced, which is almost 60k dollars at current prices - that amount is definitely no joke.

And yeah, the reasoning has been explained a few times already, it’s pretty much an amount with a decent balance between decentralisation, finality and overhead for the full nodes. But it’s definitely a high barrier of entry for most of the world.

Thanks to protocol legos and the recent efforts from the community to increase accessibility, like the possibility to use DVT protocols with staking pools, or even the option to re-stake, we can see a path for ‘low’ stake cheap validators that can perform just as good as vanilla machines. This opens the door for underrepresented regions (the global south for the most part) to be able to help secure Ethereum and have a vote within its consensus.

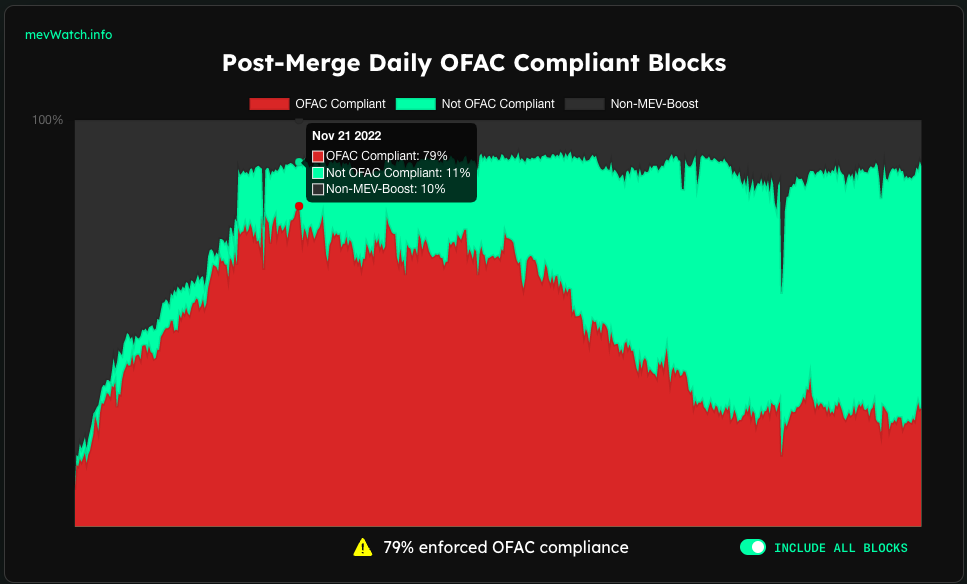

This is an important fight because geographical decentralization matters. For Ethereum to retain its title as the most credible neutral blockchain, things like ~80% of the validator set censoring Tornado Cash transactions because of OFAC (U.S. Government agency) sanctions can’t happen again.

Here I want to make the case for Latam as the best opportunity for a complete and sustainable staking business for a few reasons:

-

Out of all underrepresented regions, we’re the only one sharing language and culture. ETH KIPU is proof of the incredible coordination that’s possible here.

-

We also live on less money. At current prices, the staking reward sits at $3639.98/year or $303.33/month - that’s close to the minimum wage in almost every Latin American country (see Statista).

I can envision a virtuous cycle with a local staking industry, where money from rewards can be used for community initiatives, like local Ethereum events, or just for-good IRL social causes. We can generally get more done with the same amount of capital than groups in developed countries.

The staking business just makes more sense here.

Now, to be fair, the stake itself is a challenge we haven’t solved yet. Even with protocols needing a bond lower than 32 $ETH, we still need to find the rest of the Ether to run a validator.

On big and permissionless protocols like Lido or RocketPool that’s not much of an issue, spin up a validator and complete the stake with users’ Ether deposits, the problem is that geographic incentives for these protocols are very tricky, and generally you can’t specify where do you want your stake to be deposited.

For protocols with more flexibility, like StakeWise v3, where you can create independent vaults where Ether is deposited and managed by the operators of that vault, the challenge is then finding a good enough reason for a big number of tokens to be deposited. This we can solve if we can make a push to build strong consensus on the social layer of the Ethereum community to the point where it becomes a positive marketing/PR play for big actors.

Once big projects like funds, DAOs, etc. see there’s upside on staking in underrepresented regions, they will have the possibility to earn the same yield as with any other service, but with extra benefits. “Set up a few validators in Latam, get local communities and the broader Ethereum ecosystem to support and applaud you”.

^ That’s something we can very likely offer (remember ETH KIPU?).

And that’s not enough, if we want thousands of dollars to flow into our node operators, we need to demonstrate cheap and excellent execution - the staking experience must improve in order to do that, providing easier and more accessible resources (e.g. there’s very little content in Spanish) and promoting the use of redundancy protocols/DVT to make up for the electrical or Internet connection, which isn’t always the most reliable.

Some of the challenges to develop this industry are being worked on already, but if you’re interested in helping, even if it’s with something as small as a piece of content or even a meme, I’d love to chat! Feel free to reach out.

In future posts I want to dive deeper into the numbers and business models needed to make this dream a reality. Like the estimated amount of ETH needed at a 10-20% market standard protocol fee to sustain at least one Node Operator in each country of the region and more.