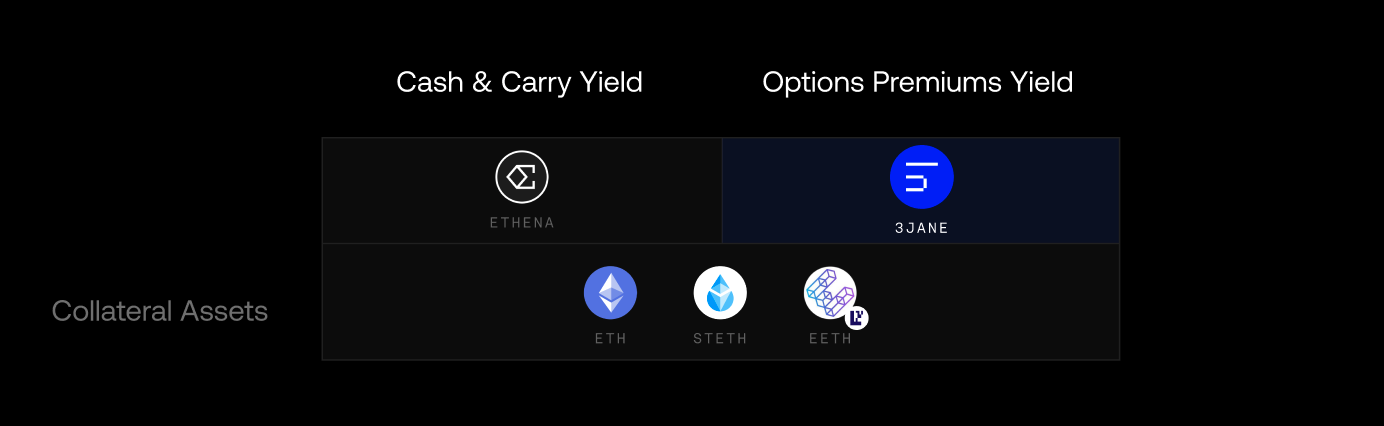

In our whitepaper “3Jane Protocol: Unlocking Crypto-Native Derivatives Yield”, we coin a term called “Derivatives Yield”. What exactly does this term mean?

Loosely, it means any income-like yield earned from trading derivatives such as perpetuals and options. In crypto, this yield will mainly come from two places:

-

cash & carry yield (perpetuals). This is Ethena.

-

options premiums yield (options). This is 3Jane.

Ethena: Cash & Carry Derivatives Yield

Ethena sUSDe is just a construction of two positions:

-

long stETH spot

-

short ETH perpetuals on an exchange (collateralized by stETH)

By doing this, Ethena is effectively an onchain delta-neutral vehicle for farming derivatives yield — particularly the funding rate from exchanges.

3Jane: Options Premiums Derivatives Yield

3Jane eETH-C is just a construction of two positions:

-

long eETH spot

-

short ETH deep out-of-the-money options* on 3Jane (collateralized by eETH)

By doing this, 3Jane is effectively an onchain vehicle for farming derivatives yield — particularly the options premiums yield over-the-counter.

Mainnet coming soon.

Follow the 3Jane protocol twitter and join the telegram!

3Jane will not be offered to persons or entities who are U.S. Persons, Restricted Persons, or Sanctioned Persons. Access and use by such persons is expressly prohibited.

*Options are a type of derivative that grants options buyers access to leverage in crypto without getting liquidated, unlike perpetuals. However, just like perps traders must pay a funding rate to be able to trade on leverage, options buyers must pay something equivalent to options sellers called a premium to get access to leverage. As a result, selling options is commonly used as a way to earn yield by collecting premiums in exchange for taking on a short volatility position. Options are a multi-trillion dollar market in traditional finance. Selling options is not a risk-free strategy. Read more here.