Introduction

3Jane is a crypto-native derivatives protocol built on EigenLayer. 3Jane enables the collateralization of any EigenLayer restaked asset in derivatives contracts (inspiration). 3Jane unlocks a novel derivatives yield layer for the EigenLayer ecosystem, allowing native restakers, liquid restakers, and LRT holders to earn derivatives yield in addition to staking and restaking yield. 3Jane represents a broader necessary evolutionary step for EigenLayer toward financialization.

Financialization of EigenLayer

EigenLayer v1 is about building out the trust network boilerplate infra to support generalizable validation of any software module. As such, the past six months were defined by a golden age of building out other AVS infra (i.e. chains, DA’s, bridges, oracles) that then borrows EigenLayer security to enforce validation. However, as of now restaked assets are entirely unproductive assets that earn 0% APY from said PoS systems. Enter Derivatives Yield.

Derivatives Yield: The New ETH “Farm”

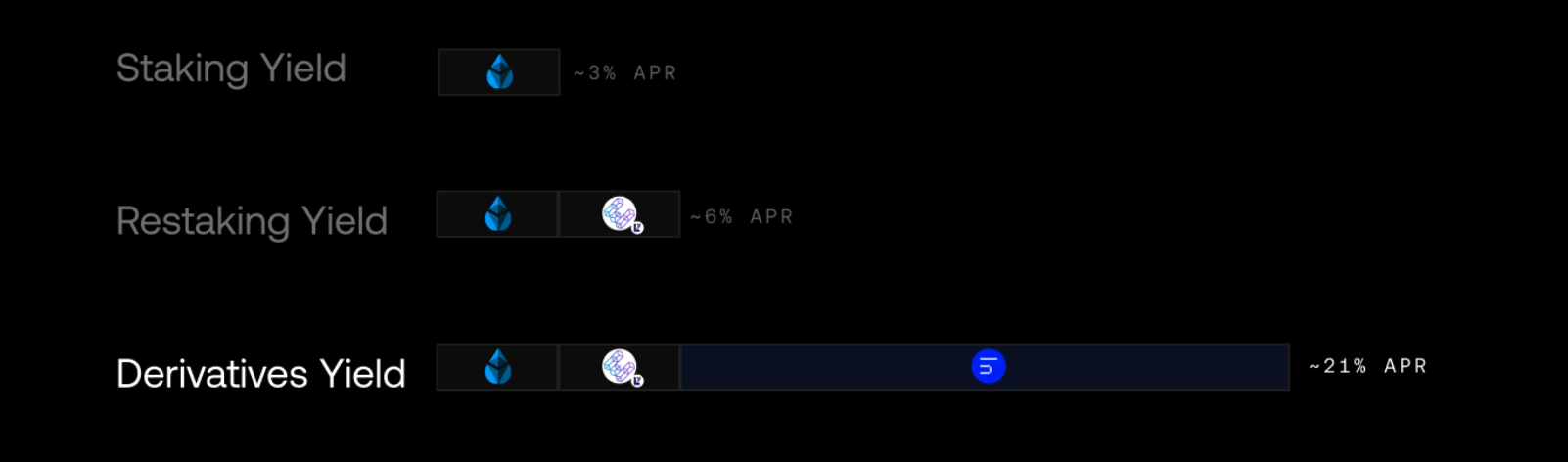

3Jane allows users to generate enhanced yield, without any opportunity cost, through the financialization of EigenLayer assets in derivatives contracts. By doing so, 3Jane unlocks a novel yield layer for ETH-denominated assets through options. Users simultaneously earn:

-

collateral yield (ETH Mainnet PoS staking, AVS PoS restaking)

-

options yield (ex: call option premiums)

Depositors can wrap LRT’s in 3Jane and begin accruing options premiums yield, earning up to 15% APR in ETH terms in addition to staking and re-staking yield.

If the past six months were a golden age for infrastructure then next six months will be a golden age for anything EigenLayer financialization. 3Jane will simply swallow the entire restaking industry.

Mainnet coming soon.

Follow the 3Jane protocol twitter and join the telegram!

3Jane will not be offered to persons or entities who are U.S. Persons, Restricted Persons, or Sanctioned Persons. Access and use by such persons is expressly prohibited.