Today, we are excited to announce that Merkl reward is now live on Orange delta-neutral ALM vaults.

You can earn $ARB/$GRAIL incentives from Camelot on Orange ALM vaults so your position is automatically managed and delta-hedged.

Rewards are claimable from the Merkl.

Why Orange?

- Delta-Neutral vault

Liquidity provisioning carries significant risk due to asset price fluctuations. Orange Finance counters this with a default delta-neutral strategy, effectively balancing market risks to stabilize profitability.

- Automated liquidity management

Optimizing Merkl rewards demands tight liquidity management, risking reward loss if prices shift.

The Orange ALM vault simplifies this, easing your active involvement and enhancing reward potential.

Eligible vaults on Camelot for Merkl rewards

Anyone can deposit to the following vaults, which are currently eligible for additional Merkl rewards.

Camelot USDC.e - WETH pool and Uniswap WETH -WBTC pool are not listed on the new UI

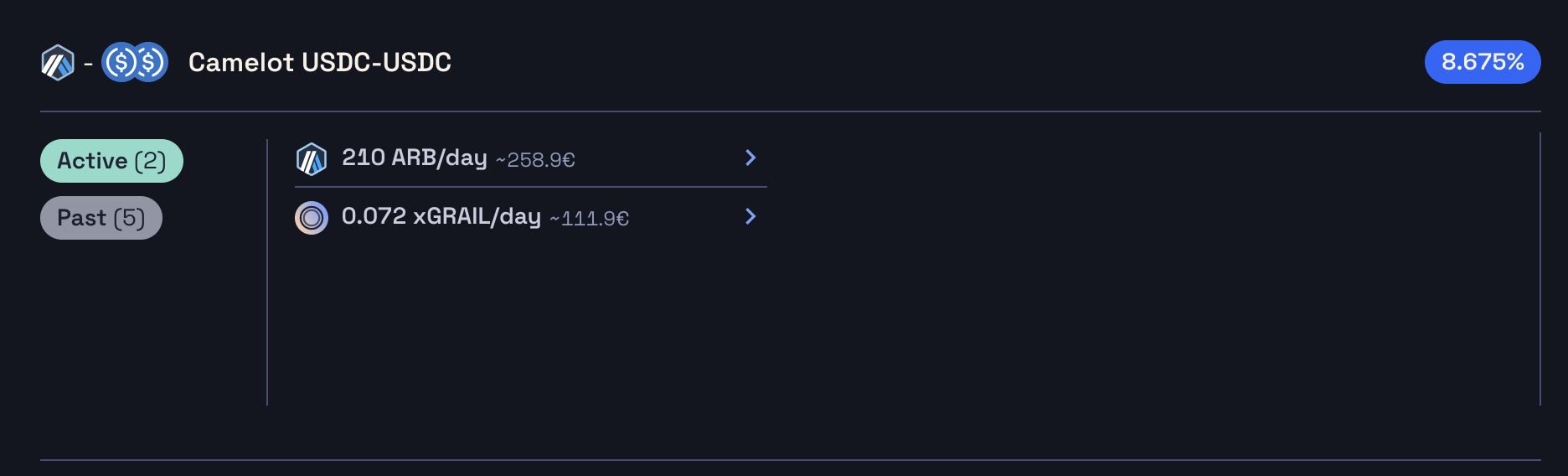

- USDC.e - USDC vault

Vault Capacity: 100k USDC.e

Deposit token: USDC.e

Strategy: Stable, super-narrow range

Price range: The price range is set by simulating volatility with statistical and financial models and parameters.

Reward APR (at the time of writing, 25th December): 8.675%

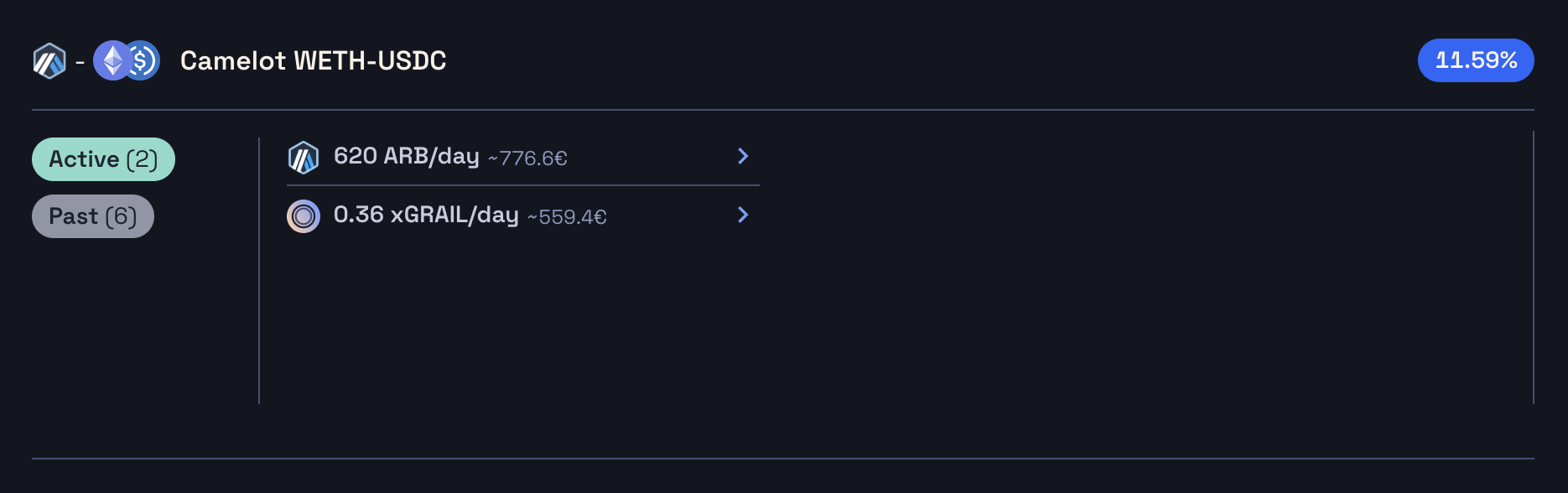

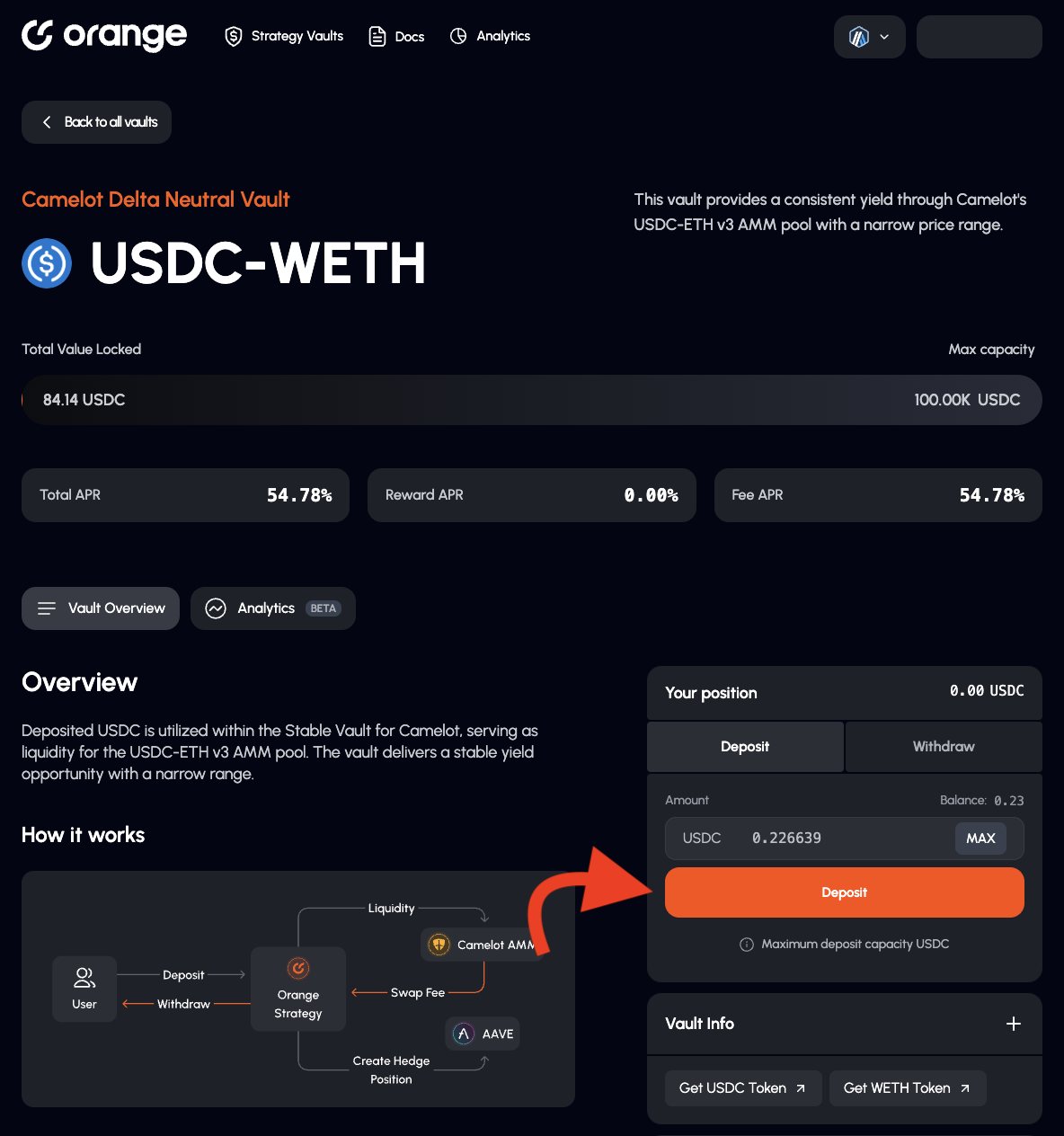

- USDC - WETH vault

Vault Capacity: 100k USDC

Deposit token: USDC

Strategy: Delta Neutral Strategy, using Aave

Price range: The price range is set by simulating volatility with statistical and financial models and parameters.

Reward APR (at the time of writing, 25th December): 11.59%

- WETH - ARB vault

Vault Capacity: 50 WETH

Deposit token: WETH

Strategy: Delta Neutral Strategy, using Aave

Price range: The price range is set by simulating volatility with statistical and financial models and parameters.

Reward APR (at the time of writing, 25th December): 19.94%

- USDC.e - USDT vault

Vault Capacity: 100k USDC.e

Deposit token: USDC.e

Strategy: Stable, super-narrow range

Price range: The price range is set by simulating volatility with statistical and financial models and parameters.

Reward APR (at the time of writing, 25th December): 7.203%

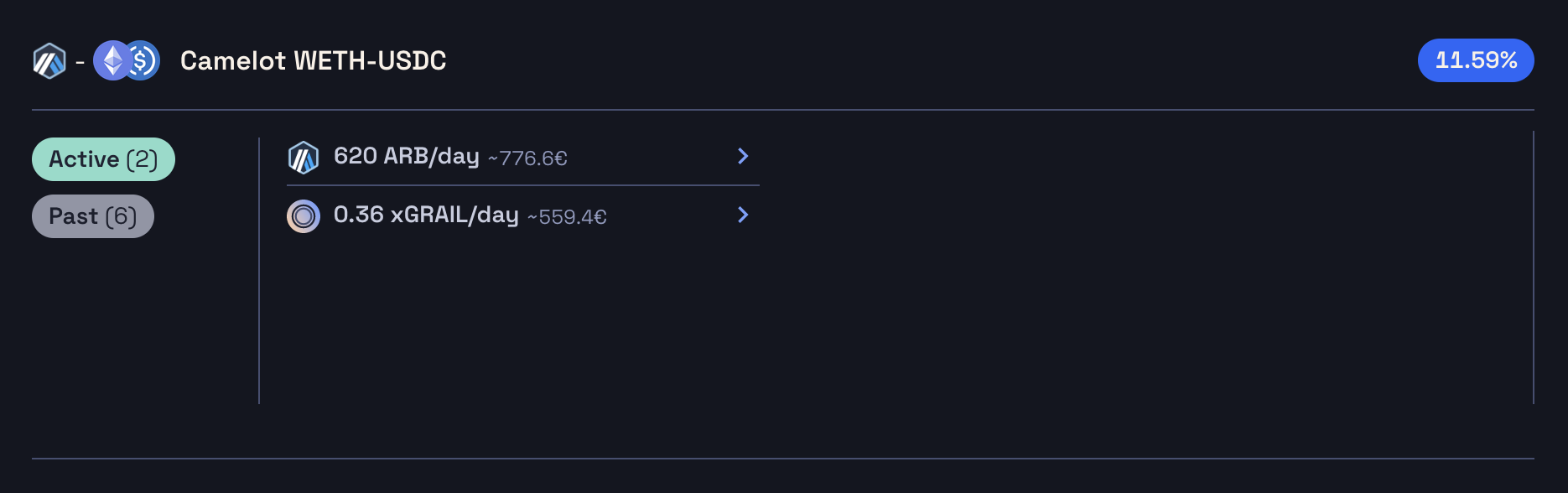

- WETH - USDC vault

Vault Capacity: 50 WETH

Deposit token: WETH

Strategy: Delta Neutral Strategy, using Aave

Price range: The price range is set by simulating volatility with statistical and financial models and parameters.

Reward APR (at the time of writing, 25th December): 11.59%

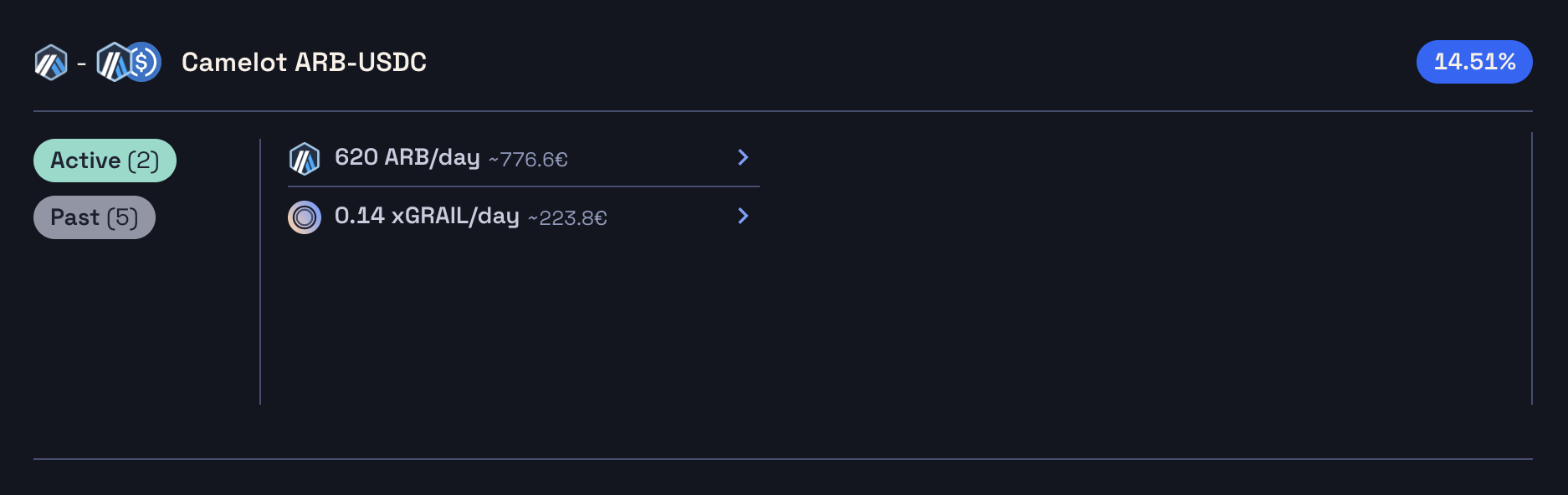

- USDC - ARB vault

Vault Capacity: 100k USDC

Deposit token: USDC

Strategy: Delta Neutral Strategy, using Aave

Price range: The price range is set by simulating volatility with statistical and financial models and parameters.

Reward APR (at the time of writing, 25th December): 14.51%

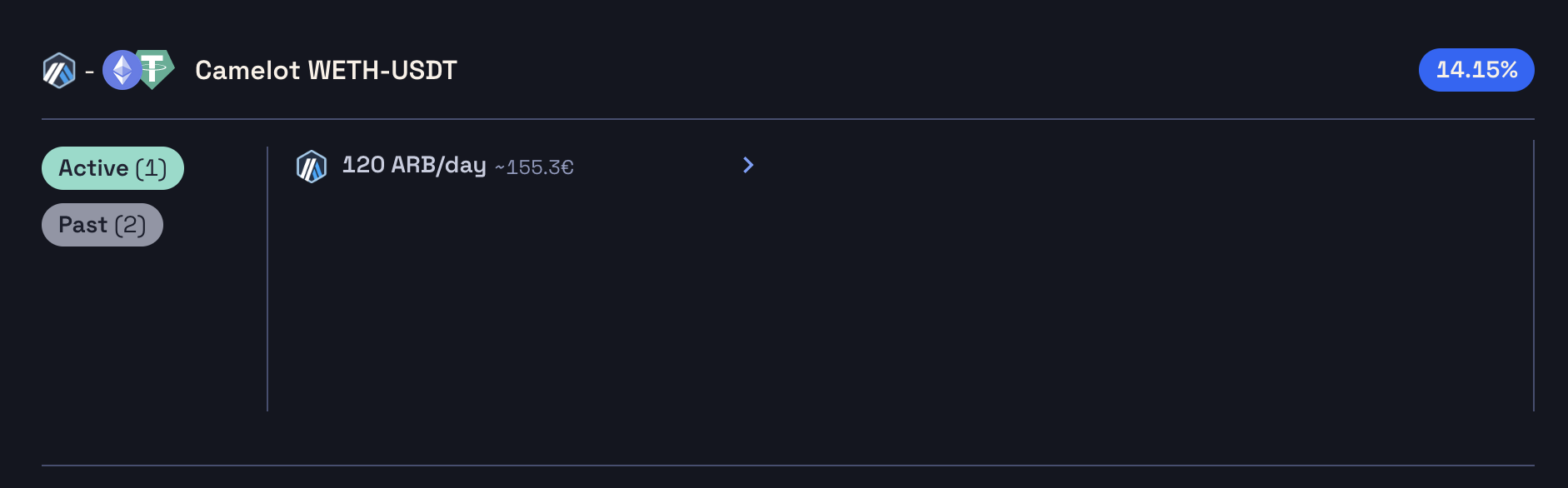

- WETH - USDT vault

Vault Capacity: 50 WETH

Deposit token: WETH

Strategy: Delta Neutral Strategy, using Aave

Price range: The price range is set by simulating volatility with statistical and financial models and parameters.

Reward APR (at the time of writing, 25th December): 14.15%

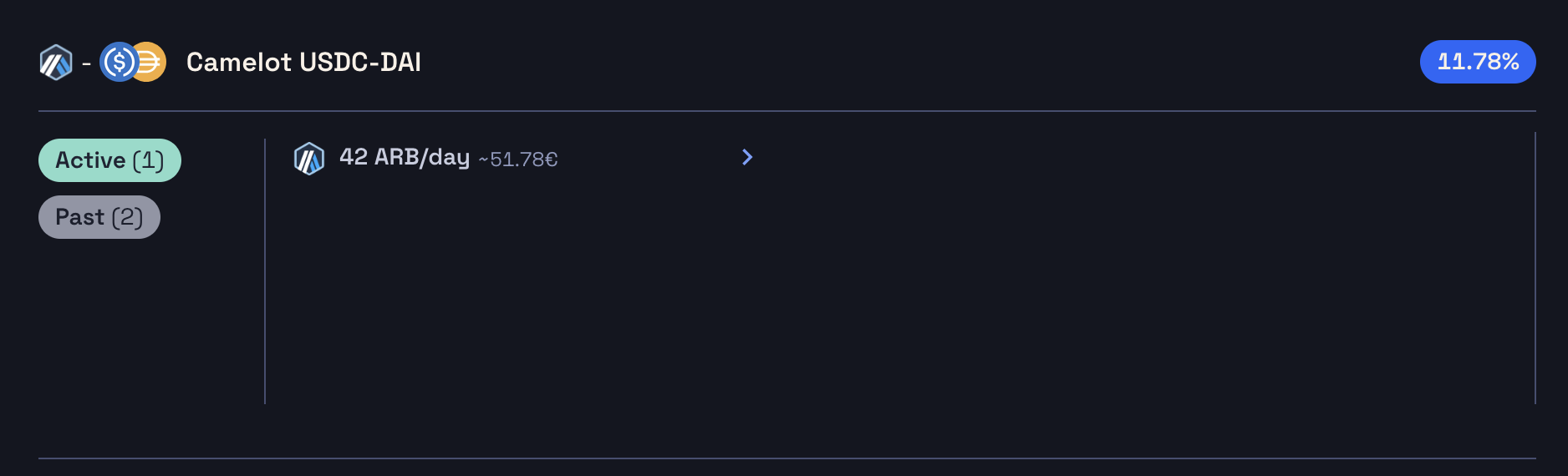

- USDC - DAI vault

Vault Capacity: 100k USDC

Deposit token: USDC

Strategy: Stable, super-narrow range

Price range: The price range is set by simulating volatility with statistical and financial models and parameters.

Reward APR (at the time of writing, 25th December): 11.78%

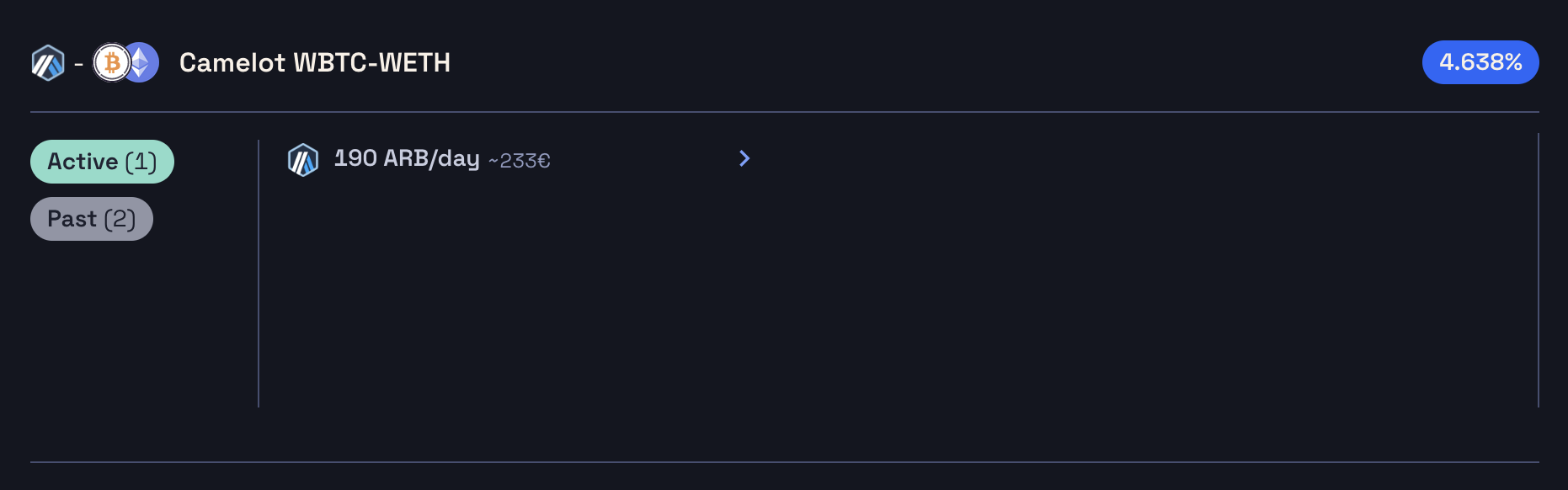

- WETH - WBTC vault

Vault Capacity: 50 WETH

Deposit token: WETH

Strategy: Delta Neutral Strategy, using Aave

Price range: The price range is set by simulating volatility with statistical and financial models and parameters.

Reward APR (at the time of writing, 25th December): 4.638%

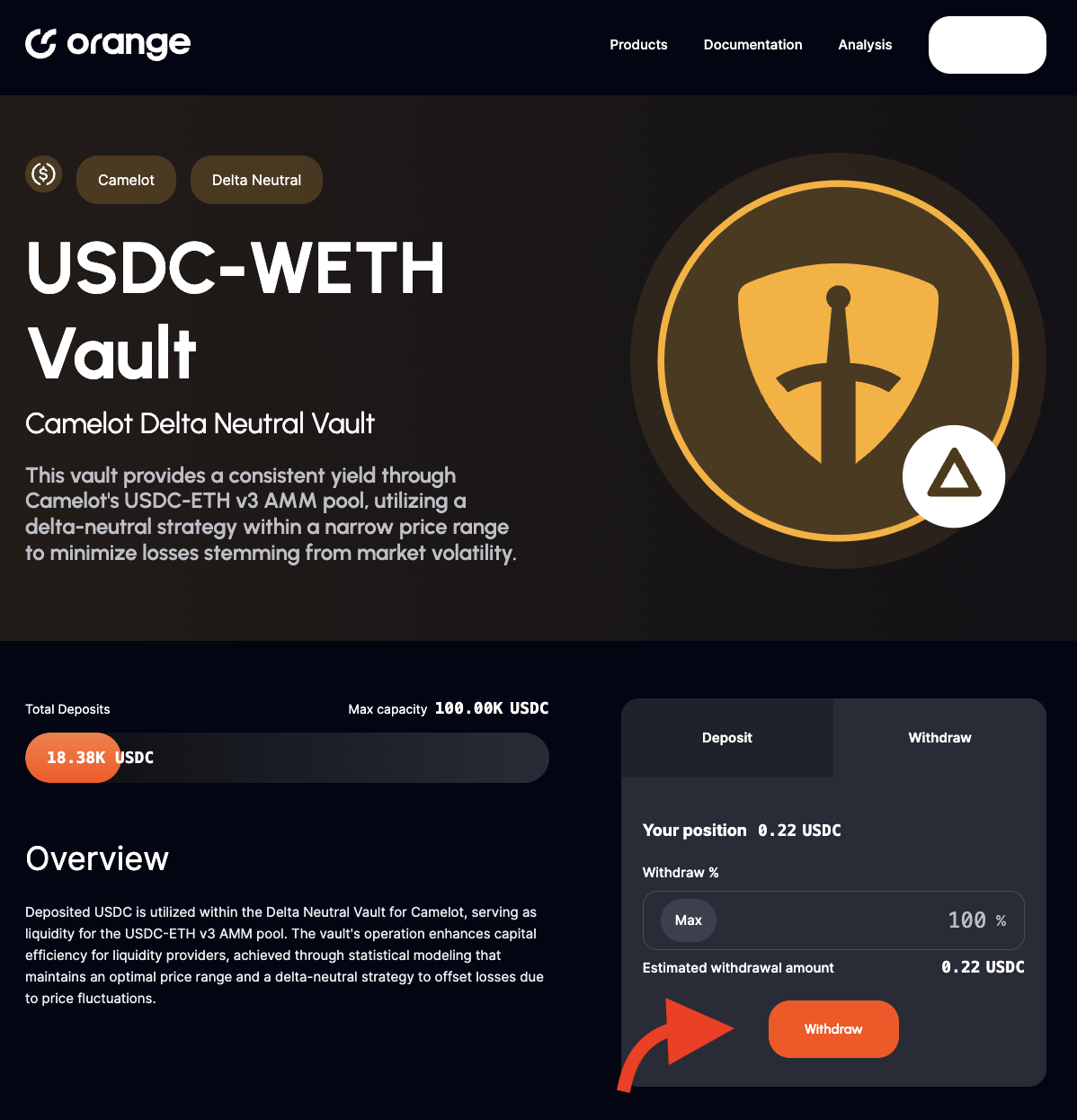

Migrate liquidity to new vaults for Merkl rewards

We have deployed vaults on a new UI.

If you are an existing Orange LP, you must migrate your liquidity to a new vault from our new UI as soon as possible.

You cannot get Merkl rewards without migration, if you are providing liquidity to the following vaults, USDC-USDC.e vault, USDC-WETH vault, and WETH-ARB vault on the old UI.

Old link:

New link:

Step 1: Withdraw liquidity from an old UI

Step 2: Go to the new UI and select a new vault

Step 3: Migrate liquidity to a new vault

About Orange Finance

Orange Finance is an automated liquidity management protocol at the forefront of LPDfi innovation in the DeFi space. Our mission is to simplify liquidity provision and enhance profitability within LPDfi protocols. We're actively developing liquidity management vaults on top of LPDfi protocols, making LPDfi more accessible and user-friendly. Orange Finance stands as a pivotal gateway connecting users and LPDfi protocols, contributing to the growth and stability of DeFi liquidity.