Orange Finance is an Automatic Liquidity-Management protocol built on Uniswap v3 with a delta hedging strategy. Our first product, the Alpha Orange Vault, has recently been launched and is open to a limited number of community members on Arbitrum.

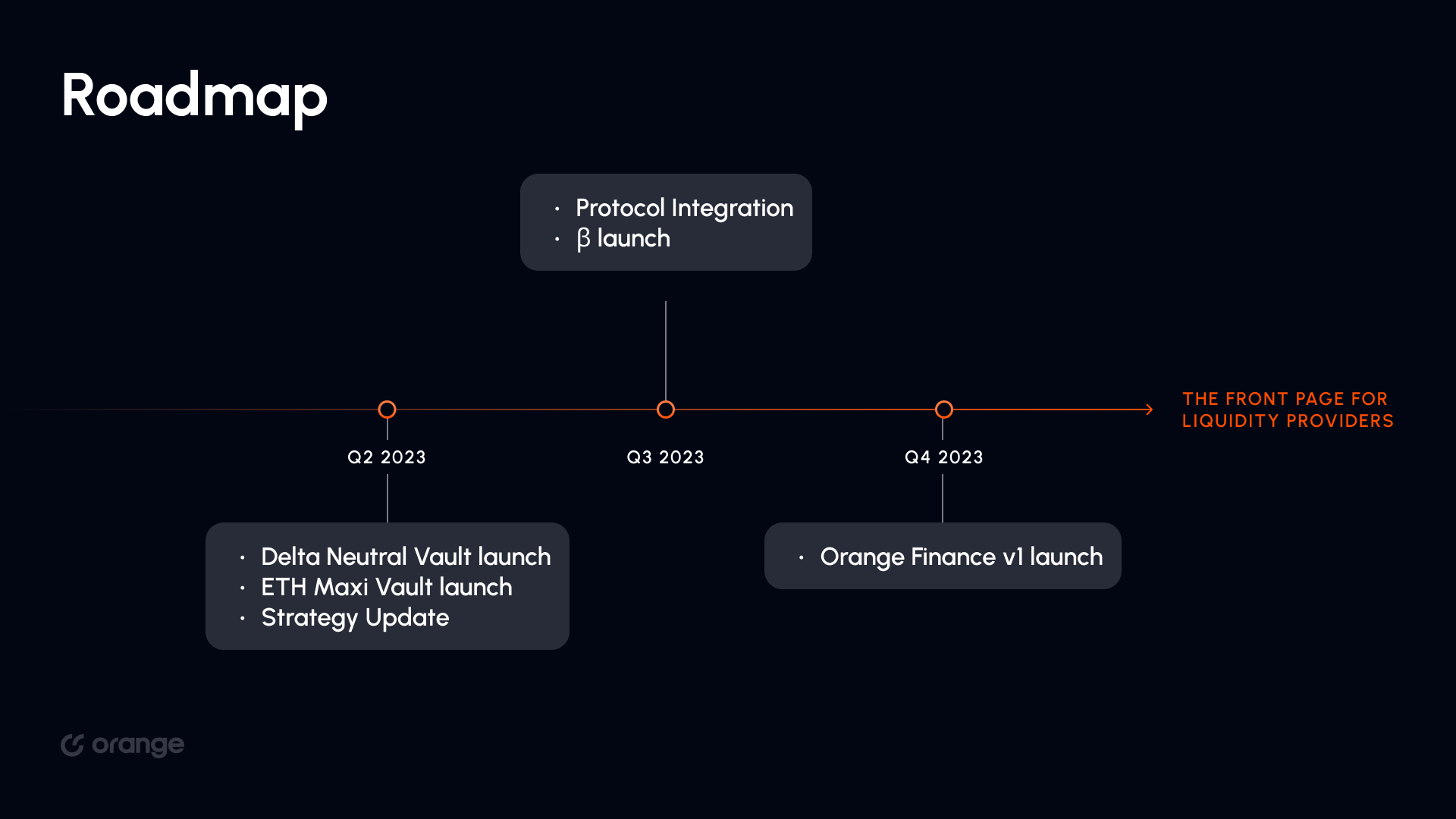

In this article, we will outline our roadmap for the rest of the year.

What’s Next?

Q2

- Delta Neutral Vault

We will launch the Delta Neutral Vault, building upon our initial concept, in Q2. In contrast to the alpha vault, this vault will simply implement a delta-neutral hedge for LPs for the ETH-USDC pool on Uniswap v3, as we initially designed.

To provide liquidity on Uniswap, you can only take a "positive delta" position, which means you cannot benefit from bearish token pools. By hedging the delta of a liquidity pair, however, you can take a neutral position in the market moving in any direction.

Orange Finance will provide a negative delta by using Aave, a decentralized lending protocol. It is easy to provide a negative delta by using the lending protocol.

(Introducing Orange Finance)

With the introduction of the Delta Neutral Vault, users will have the option to choose from different vault strategies for their investments. While the alpha vault thrives in strong market trends, the delta neutral vault aims to provide a lower but more stable return for liquidity providers. As a liquidity management protocol, Orange Finance will continue to expand its range of vault strategies to cater to different risk-return preferences.

- ETH Maxi Vault

In addition to our current Alpha Vault, which only accepts USDC deposits, we plan to release a new vault in Q2 called the ETH Maxi Vault. Similar to our first vault, this new offering is a delta-hedging liquidity manager for the ETH-USDC pool on Uniswap v3. However, it differs in that it only accepts ETH deposits.

In this vault, users can hedge USDC against ETH instead of hedging ETH against USDC, allowing them to earn ETH-based fee revenue without being impacted by the USDC price movement relative to ETH.

With the ETH Maxi Vault, our users will have more flexibility and choice in terms of which token they want to deposit and which token they want to earn fees in.

- strategy update for vaults

In Q2, we will be updating the strategies used in our vaults to improve the efficiency of our price range setting and delta hedging strategy, ultimately maximizing capital efficiency for our users.

While our alpha product currently uses Bollinger Bands and 3DMA to set a price range and adjust the hedging position based on market trends, we see this as only the beginning. We are always looking for ways to improve our strategies and maximize returns for our users.

To that end, we continuously explore various statistical approaches, such as the GARCH model and Monte Carlo simulation, to develop more sophisticated and efficient methods for optimizing returns for liquidity providers. In the near future, we plan to implement these improved strategies to provide even better results for our users.

Q3

- β (public launch with larger max. cap)

In Q3, we are planning to launch the beta version of Orange Finance to the public with a larger maximum cap. This will allow everyone to take advantage of our liquidity management strategy on Uniswap v3.

Currently, the vault is only available to selected community members and deployed for the ETH-USDC pool on Uniswap v3, with a maximum cap of $250k. However, as the capacity of the vault is already filled, we will gradually increase its size until the β launch. Additionally, we may deploy other vaults for different pairs and DEXes to provide more opportunities for users to participate in our strategy.

- Integration to other DeFi protocols

We are planning to explore integrations with other prominent DeFi protocols. Through these collaborations, we aim to unlock a broader range of liquidity pools for our users, enhance their capital efficiency, and expand their opportunities in the DeFi ecosystem.

As of now, our vault is primarily focused on managing liquidity within Uniswap v3. However, with the expiration of the Uni v3 license, we are witnessing the emergence of various concentrated liquidity-type DEXes.

We will deploy more vaults to cover various DEXes, providing users access to more liquidity pools. We're also exploring leverage opportunities for users to amplify their returns. Additionally, we're focused on enhancing the utility and value of LP tokens, maximizing the benefits for users within the Orange Finance ecosystem.

Our ultimate goal is to establish the Orange ecosystem across multiple DeFi protocols. By doing so, we will empower our users with enhanced access to diverse opportunities within the dynamic DeFi landscape.

Q4

- Orange Finance v1

Orange Finance began as a liquidity manager for Uniswap v3, but our vision extends far beyond that. We aspire to transform Orange Finance into a comprehensive protocol that unlocks real yield opportunities within the DeFi landscape.

With the upcoming v1 release, we will delve deeper into the protocol's potential and introduce new features and functionalities, such as the implementation of multiple hedging strategies. Additionally, we are considering the issuance of our native token as a means of decentralization upon the v1 launch.

As we progress towards v1, we remain committed to building a robust and versatile platform that empowers users to maximize their returns and participate in the evolving DeFi ecosystem. Stay tuned for more updates on our journey to revolutionize yield generation with Orange Finance.

About Orange Finance

Orange Finance is an Automatic Liquidity-Management protocol for concentrated liquidity-type DEXes such as Uniswap v3, maximizing the capital efficiency of Uniswap v3 by maintaining an efficient price range through the use of statistical modeling and delta hedging strategies.