Today, we’re glad to announce that the LPDfi Vault on Stryke (Formerly Dopex) is Live on Arbitrum.

With the Stryke Vault, we implement automated strategies that are specifically tailored for LPers to maximize the Arbitrum STIP rewards on Stryke. These strategies simplify and redefine the LP experience and integrate seamlessly with LPDfi protocols.

For the first time ever, we are kickstarting the incentivized launch events!

What is Stryke?

Dopex will be rebranding to Stryke!

Stryke will be the world-class platform for decentralized options leading the LPDfi space where you'll experience:

• Cross-chain options market

• Robust Tokenomics

• An innovative governance model

• Community-focused reward gauges

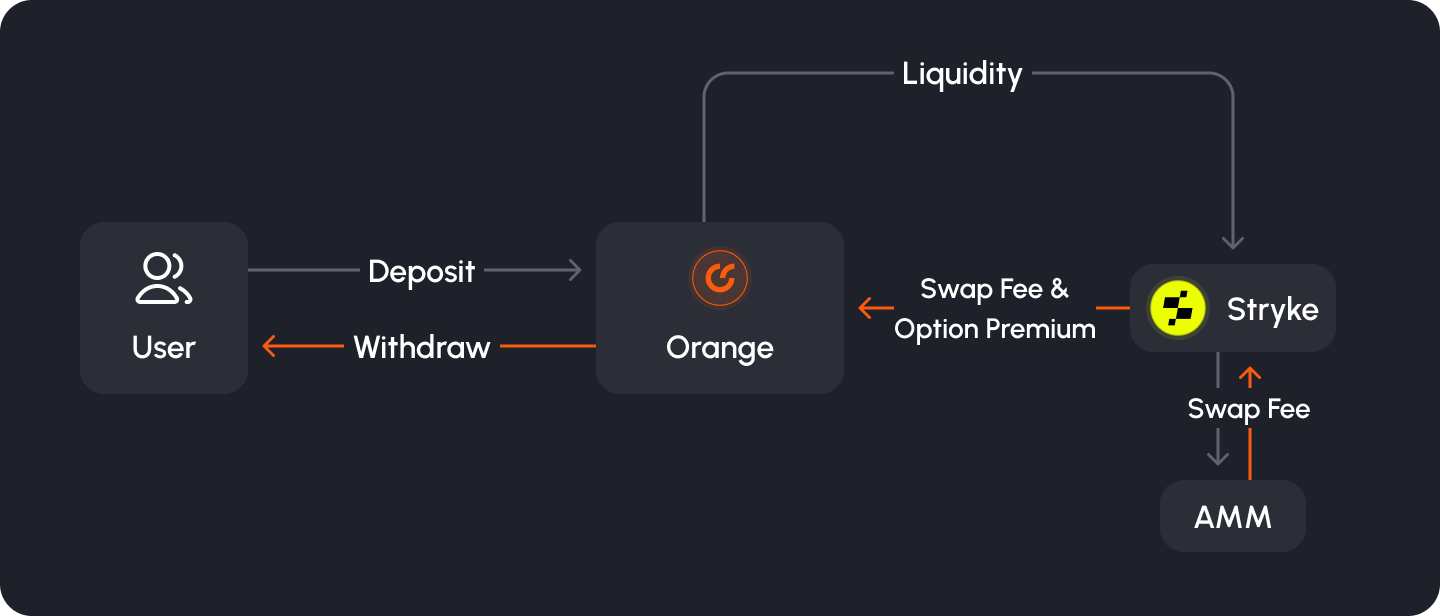

Liquidity providers can earn option premiums and extra rewards while earning standard trading fees from an underlying v3 DEX (e.g. Camelot v3 and Uniswap v3). Traders will be able to tap into this liquidity to trade American-style options on all their favorite tokens.

Our ALM vault elevates the Stryke to an entirely new level.

What’s the Stryke Vault

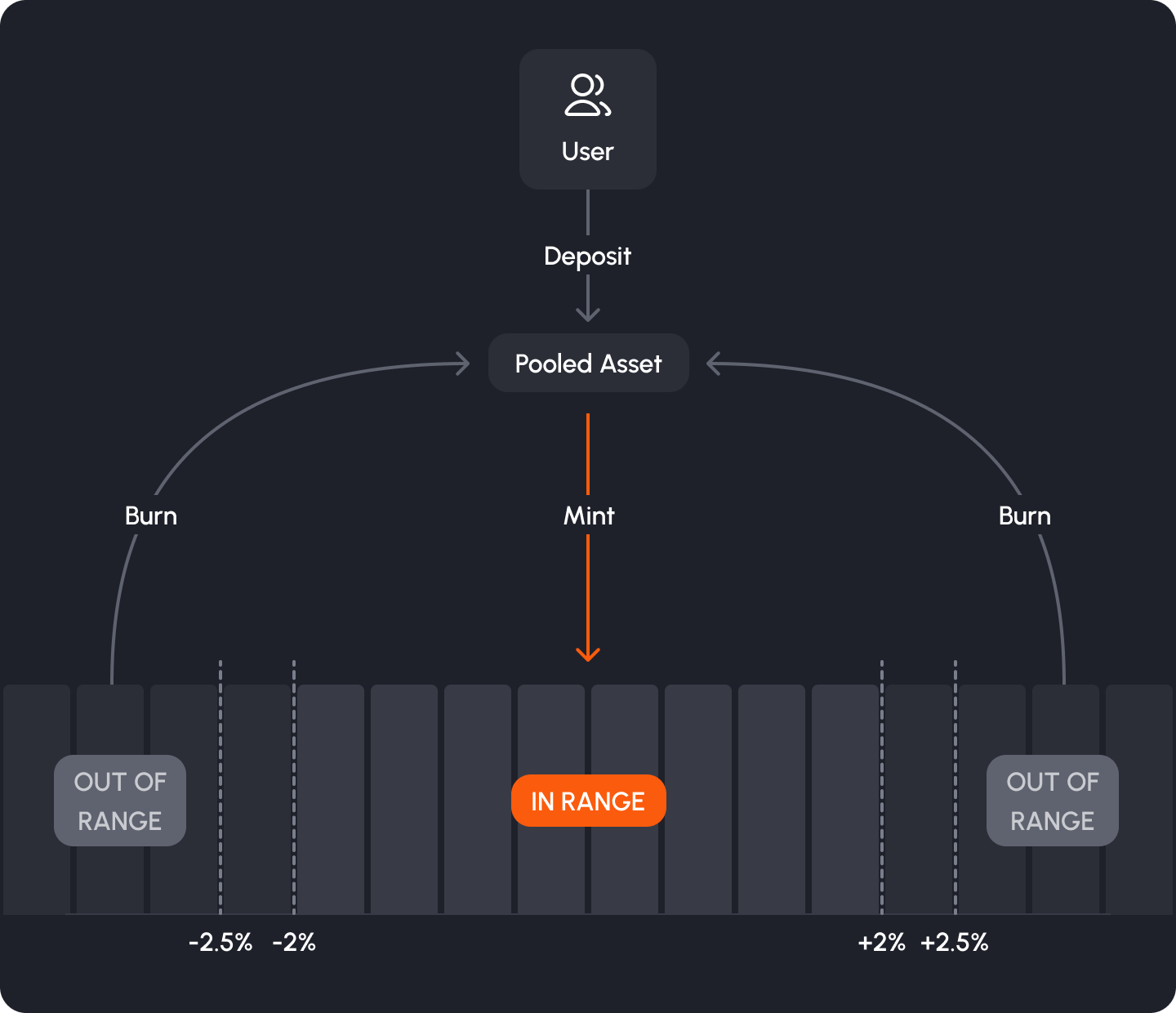

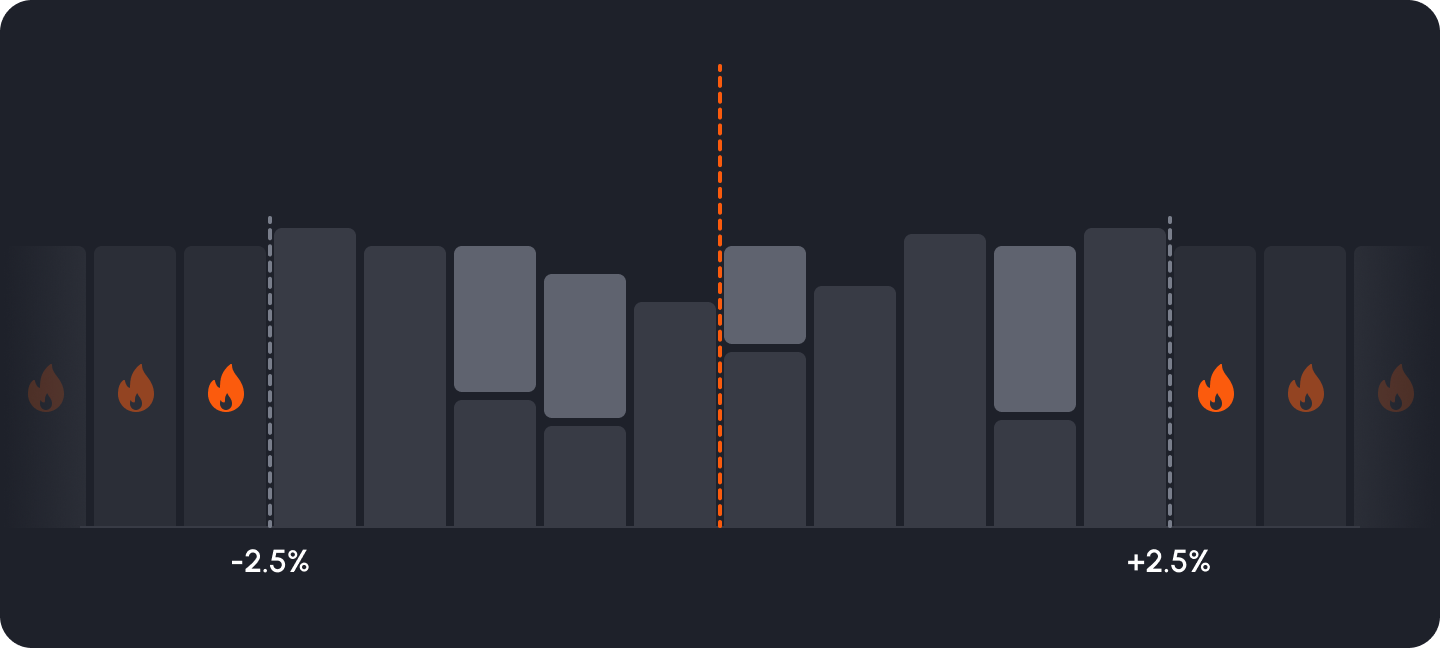

The Stryke Vault will actively rebalance the liquidity position automatically by closely monitoring the utilization status with the following features:

- Auto Rebalancing (maximizing +-2.5% Range rewards)

The vault automatically rebalances the position according to the market condition to keep delivering returns to users. For Auto rebalancing, there is no off-chain component on Orange Finance's end, and we automate liquidity management with smart contracts + Gelato.

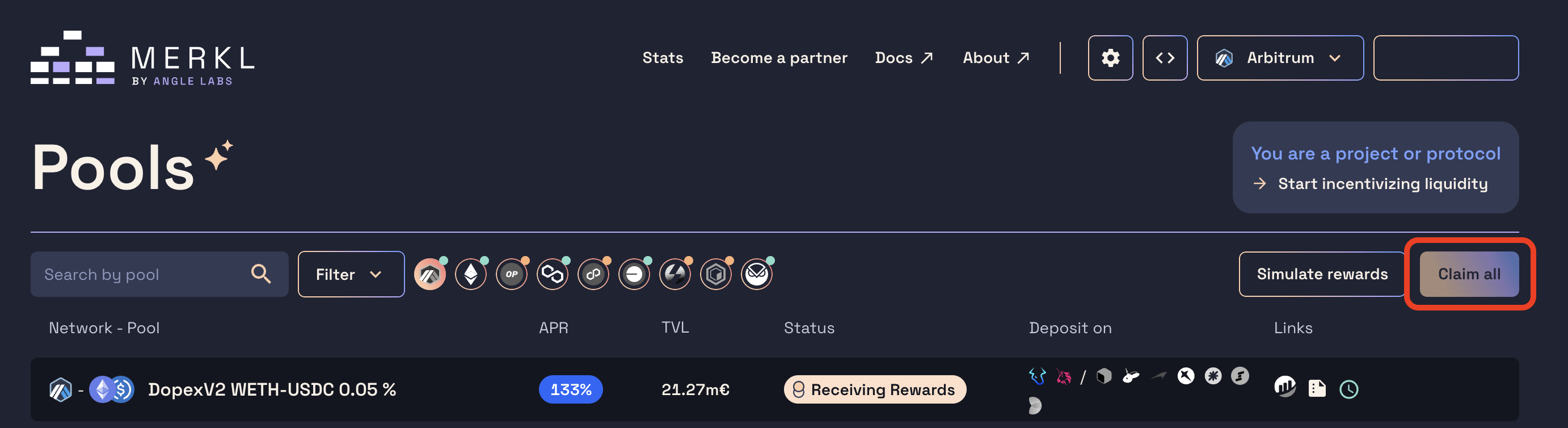

The Arbitrum STIP Reward is distributed to liquidity within a range of ±2.5% from the current price on Stryke through Merkl until 31st March. This vault automatically rebalances to remain within this criteria, thereby maximizing your reward revenue.

To maximize rewards in the presence of asset price fluctuations, our vault offers liquidity within a narrower range of ±2.0%, which is more restrictive than the qualified range.

After the STIP reward ends, users keep getting benefits from the vault with its auto liquidity management to receive higher premiums/fees by keeping the liquidity close to the strike price.

- Monitoring the utilization status for auto-withdrawal/redeposit

Currently, LPers on Stryke are rarely able to withdraw their liquidity as their liquidity is often utilized. Orange addresses this issue by monitoring the utilization status frequently, enabling the vault to shift liquidity into the valid range as soon as possible.

Besides auto-withdrawal, this feature redeposits your liquidity back automatically into optimal range to earn rewards again.

- Anytime Redemption

Users can redeem their liquidity anytime even if the position is utilized. Positions that cannot be burned will be returned to users in the form of the Stryke LP token, which should be managed by users on Stryke UI after redemption.

- Single Asset Deposit

Users don’t need to prepare both assets to provide liquidity. Orange supports single-asset deposits. Deposited assets are once pooled within the vault, and will be collectively supplied with liquidity from other users to Stryke pools through batch transactions in the next cycle.

- 0.1 % deposit fee

Deposit fees of 0.1% are charged as a one-time fee at the time of deposit. These fees cover the gas costs associated with frequent rebalancing across multiple ticks.

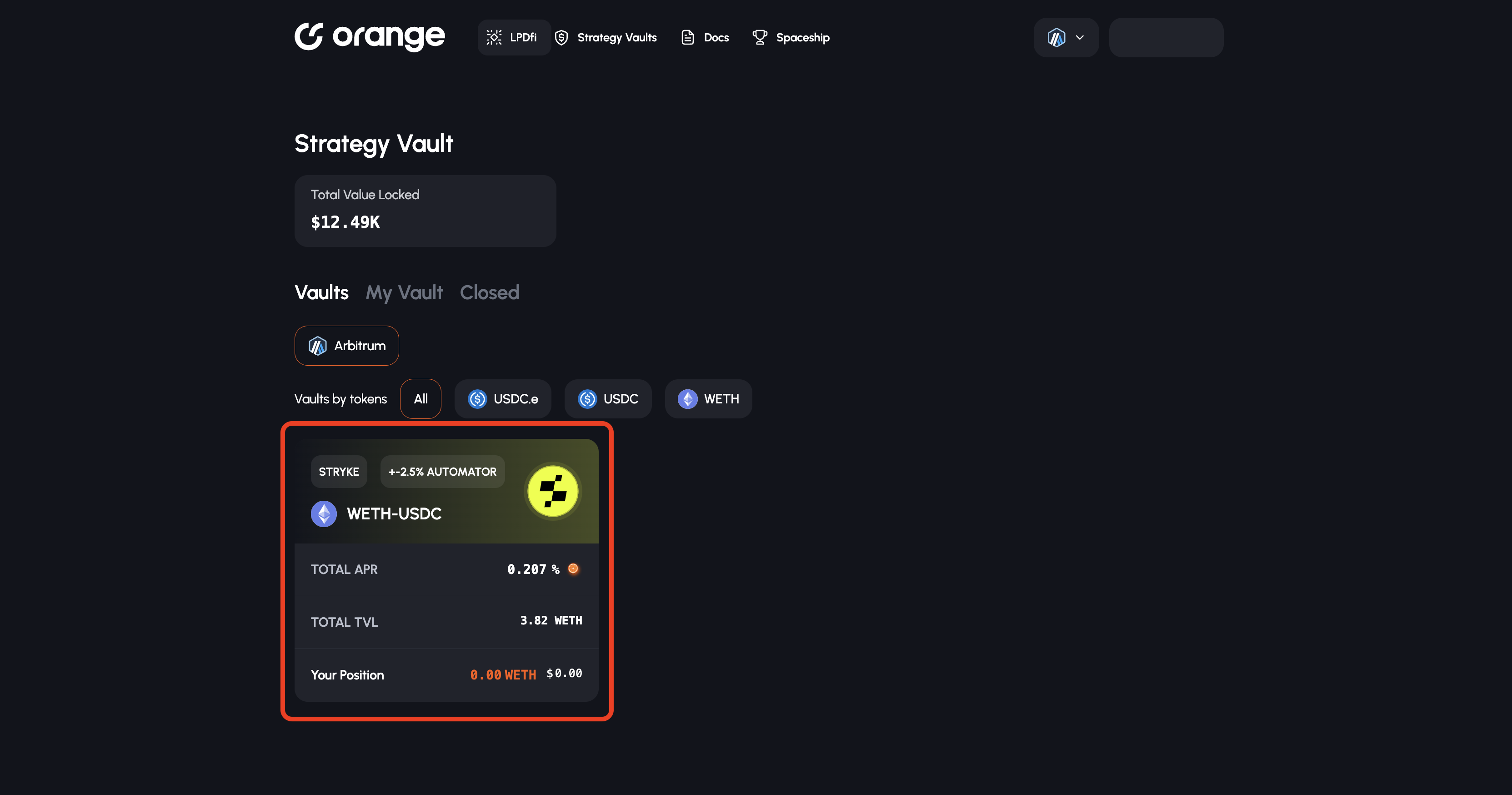

The Stryke WETH-USDC STIP Vault

Orange is introducing a new vault upon WETH-USDC Stryke CLAMM. The vault delivers effortless liquidity management, maximizing the Arbitrum STIP rewards, to Stryke LPers.

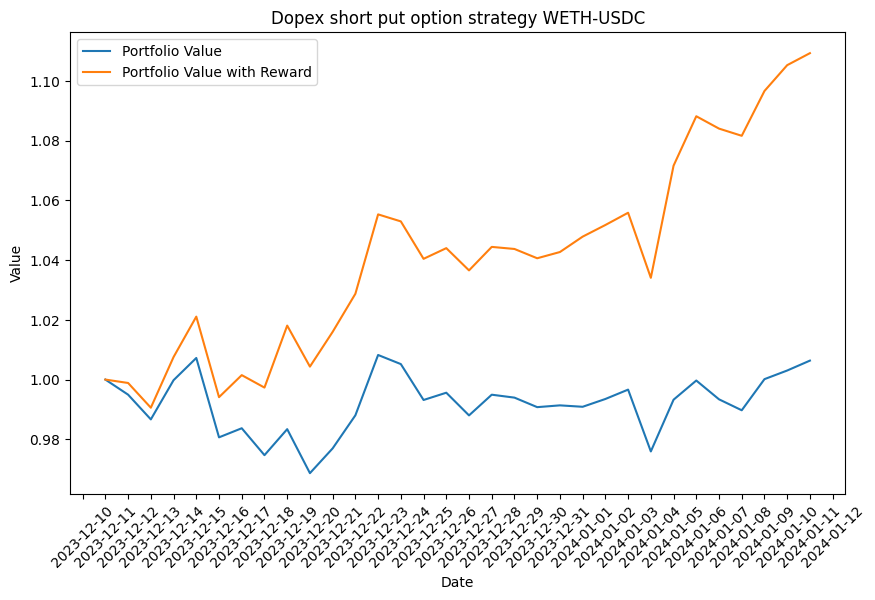

The APR is based on our backtesting, covering the period from 10 Dec 2023 to 12 Jan 2024.

-

Stryke WETH-USDC STIP Vault

- Strategy: STIP maximizing strategy

- Deposit Asset: WETH

- Capacity: No Cap

- Total APR (backtest): 133.8% (LP APR 7.56% + Reward APR 126.24%)

Note: LP APR includes fee + the value appreciation/depreciation of the assets.

Deposit liquidity before Merkl rewards start for the new system

Merkl rewards to the new system will start on March 2nd.

Deposit liquidity to the Stryke Vault by March 1st to kickstart your yield farming!

How to use the Stryke vault

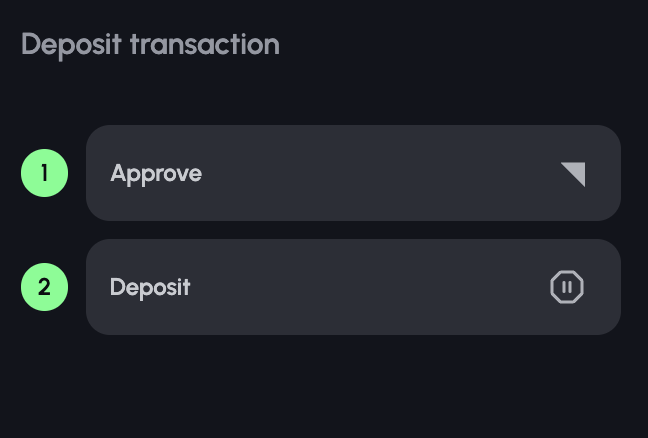

Deposit

Step 1. Connect your wallet

(Step. 2 Set up the Arbitrum network)

You can set up and add the Arbitrum network to your wallet from the link below.

Step 3. Select the vault

Step 4. Type your deposit amount

Step 5. Approve & Deposit

Clicking the “Deposit” button, please send Approve and Deposit transactions.

Step 6. Get rewards on Merkl

You can claim rewards from the link below.

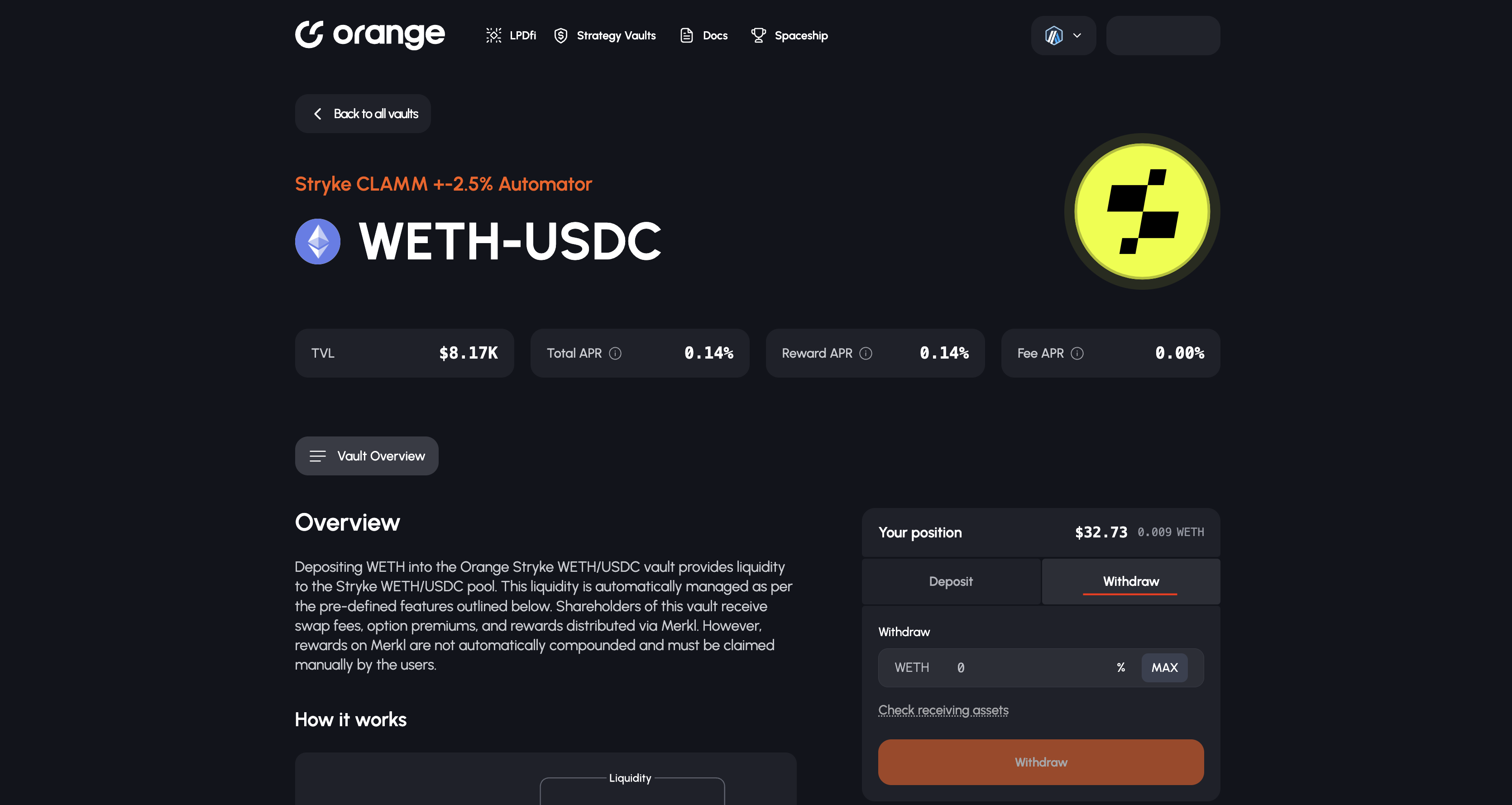

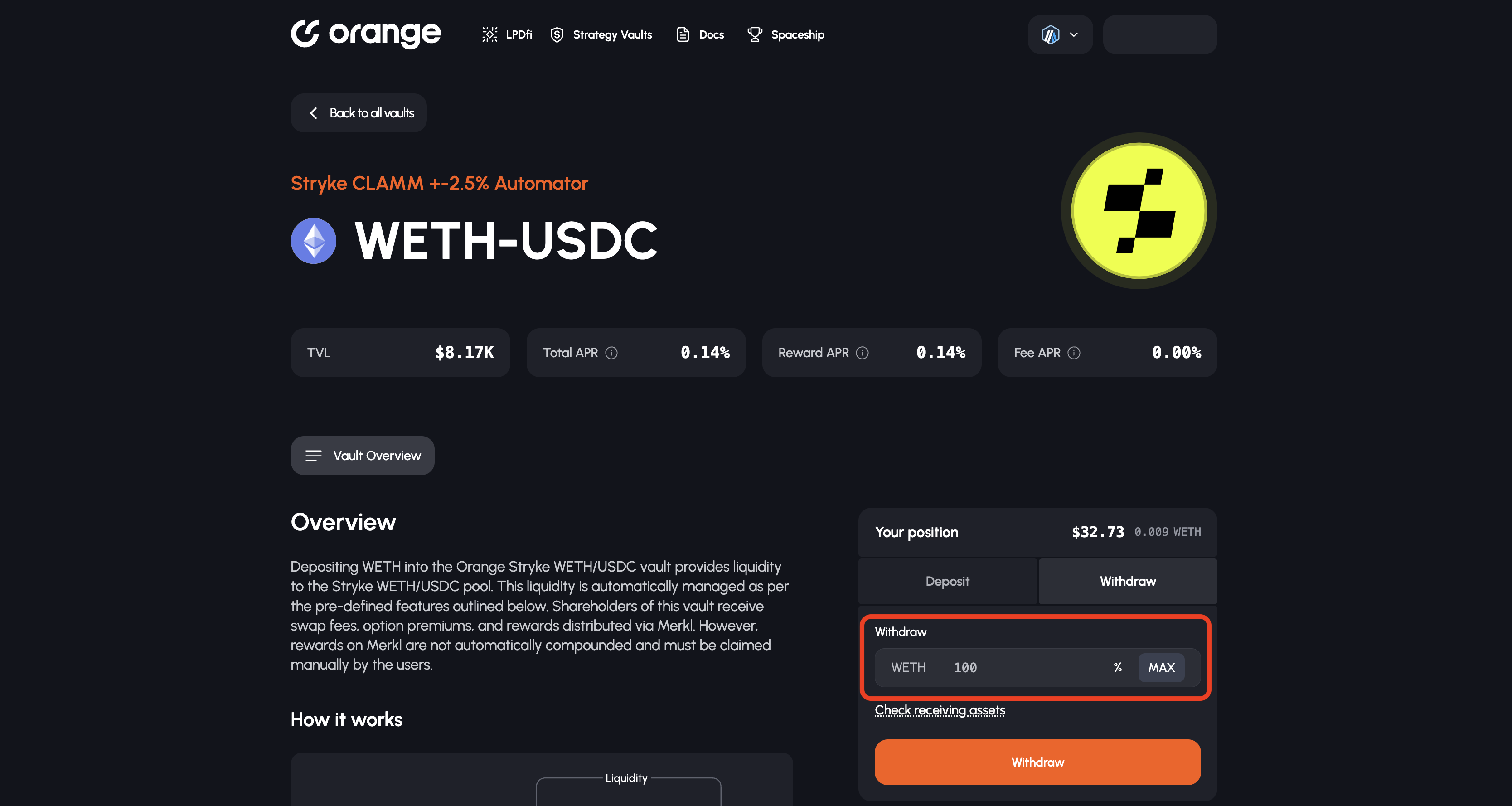

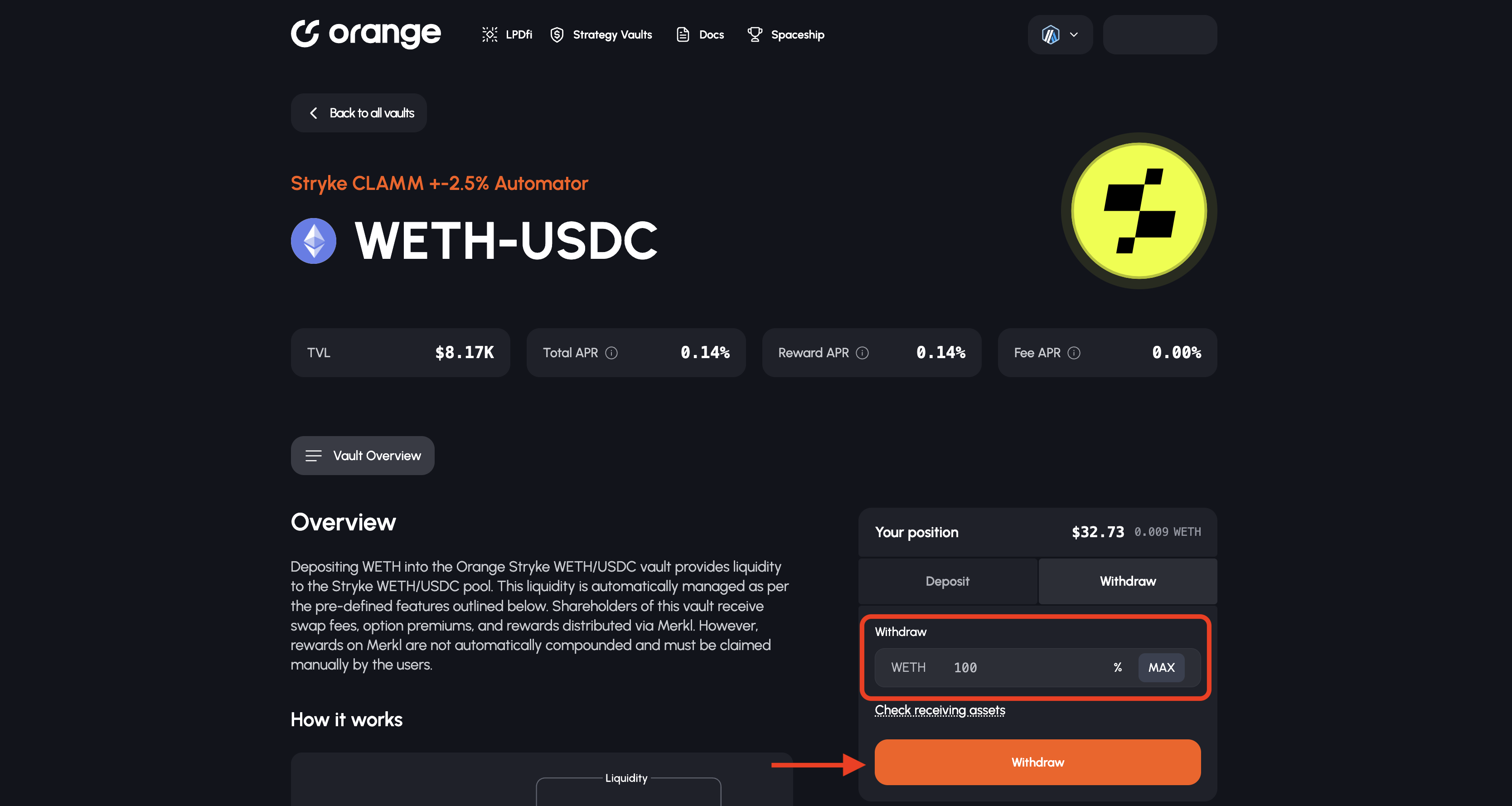

Withdraw

Step 1. Click the “Withdraw” tab

Step 2. Type your withdrawal amount

Step 3. Withdraw

Click the “Withdraw” button.å

Note: Users can redeem their liquidity anytime even if the position is utilized. Positions that cannot be burned will be returned to users in the form of the Stryke LP token, which should be managed by users on Stryke UI after redemption

Audit by yAudit

Security is our top priority at Orange. The smart contracts and codebase for Orange's new vault have undergone a comprehensive audit by the top firm and Stryke's main auditor, yAudit. Orange also receives security consulting from Watchpug, Code4rena’s top auditor, during live development to ensure the safety of the codebase. Zero critical vulnerabilities were identified, and all issues were patched and addressed immediately. Find the Dual Currency audit report here.

The Stryke Vault launch campaign

Celebrating the release of the Stryke Vault, we are hosting two campaigns: The Spaceship, and Thread Competition.

The Spaceship

Celebrating the release of the Stryke vault, we are hosting an exclusive launch event named "The Spaceship". For detailed information, you can check the article below.

To put it short, we’re rewarding Orange users with up to 37,500 ARB based on TVL— both individual and collective! We’re also introducing a leaderboard so that you can stay up to date on how you’re measuring up in the competition in real-time.

Sharpen Your Pens — The Thread Competition Returns

Besides ‘The Spaceship’, we are hosting our 2nd thread competition.

This time, the Stryke team offers prizes to winners — the top three threads discussing Stryke Vault will receive rewards of 1,500 USDC, 1000 USDC, and 500 USDC respectively.

There are three criteria to be qualified:

-

The topic is the Stryke vault

-

Mention “The Spaceship” and how it works

-

Tag the following accounts: @0xOrangeFinance, @dopex_io

-

Posted in our #twitter-content-creator channel on Discord.

-

put this link ( https://bit.ly/3IwILSD ) for the Stryke vault in your post

Winners will be chosen by the Orange team after the contest concludes on the 24th March at 23:59 (UTC).

We’re looking forward to all your submissions!

Orange Finance: The LPDfi Gate

Our automated strategies simplify your journey, eliminating complex management tasks. No more need to scour Twitter for updates. We provide all the essential insights, features, and rewards of each LPDfi protocol in one streamlined platform, maximizing your earning opportunities with ease.

More and more protocols will be built on top of AMM. Orange will integrate upcoming LPDfi, and continue to deliver stable yield to our users. If you are building an LPDfi protocol, please feel free to shoot a DM via Twitter or drop a comment in our Discord server!

About Orange Finance

Orange Finance is an automated liquidity management protocol at the forefront of LPDfi innovation in the DeFi space. Our mission is to simplify liquidity provision and enhance profitability within LPDfi protocols. We're actively developing liquidity management vaults on top of LPDfi protocols, making LPDfi more accessible and user-friendly. Orange Finance stands as a pivotal gate connecting users and LPDfi protocols, contributing to the growth and stability of DeFi liquidity.