Going Back to What's Real: The RWA Renaissance in Crypto

The crypto landscape has been a rollercoaster of speculative trends, with the recent past marked by frenzied cycles of AI token hype and meme-driven speculation. We topped out with TRUMP and MELANIA, which epitomized the market's capacity for absurd tokenization and drained the liquidity from the market. These retardio days are taking a break, giving way to a more substantive approach to crypto again. Bring in the RWA.

The Speculative Wash-Out

The market has cycled through peak excitement around AI tokens, with countless projects promising revolutionary AI capabilities but delivering little more than marketing hype. Simultaneously, memecoins reached a crescendo of ridiculousness, with political figure tokens becoming the ultimate symbol of crypto's speculative excess. These trends exposed the market's hunger for narrative-driven investment, but ultimately left investors searching for real value.

Enter Real World Assets (RWAs): A Return to Substance

Now, the tide is turning. The crypto ecosystem is pivoting back to what matters: tangible, real-world value. Real World Assets (RWAs) represent a mature evolution of blockchain technology, bringing concrete, measurable utility to digital assets.

Ondo Chain: Institutional-Grade RWA Infrastructure

Ondo is leading the charge with its groundbreaking Ondo Chain, a Layer 1 blockchain purpose-built for institutional-grade tokenized assets. Unlike previous blockchain iterations, Ondo Chain addresses critical barriers to RWA adoption:

-

Permissioned validators by select financial institutions, ensuring regulatory compliance

-

Native support for tokenized real-world assets

-

Institutional-grade security and cross-chain messaging

-

Enables sophisticated financial use cases like prime brokerage and wealth management

Learn more:

Other fun stuff happening with Ondo is their latest integration of USDY into the Plume Network:

Midas' mBASIS: High-Yield Stablecoin Strategy

Midas has introduced mBASIS, a market-neutral investment strategy that's turning heads with its impressive performance:

-

33% year-to-date returns

-

42% annualized returns in recent periods

-

Innovative basis trading approach

-

Leverages both centralized and decentralized finance platforms

Learn more:

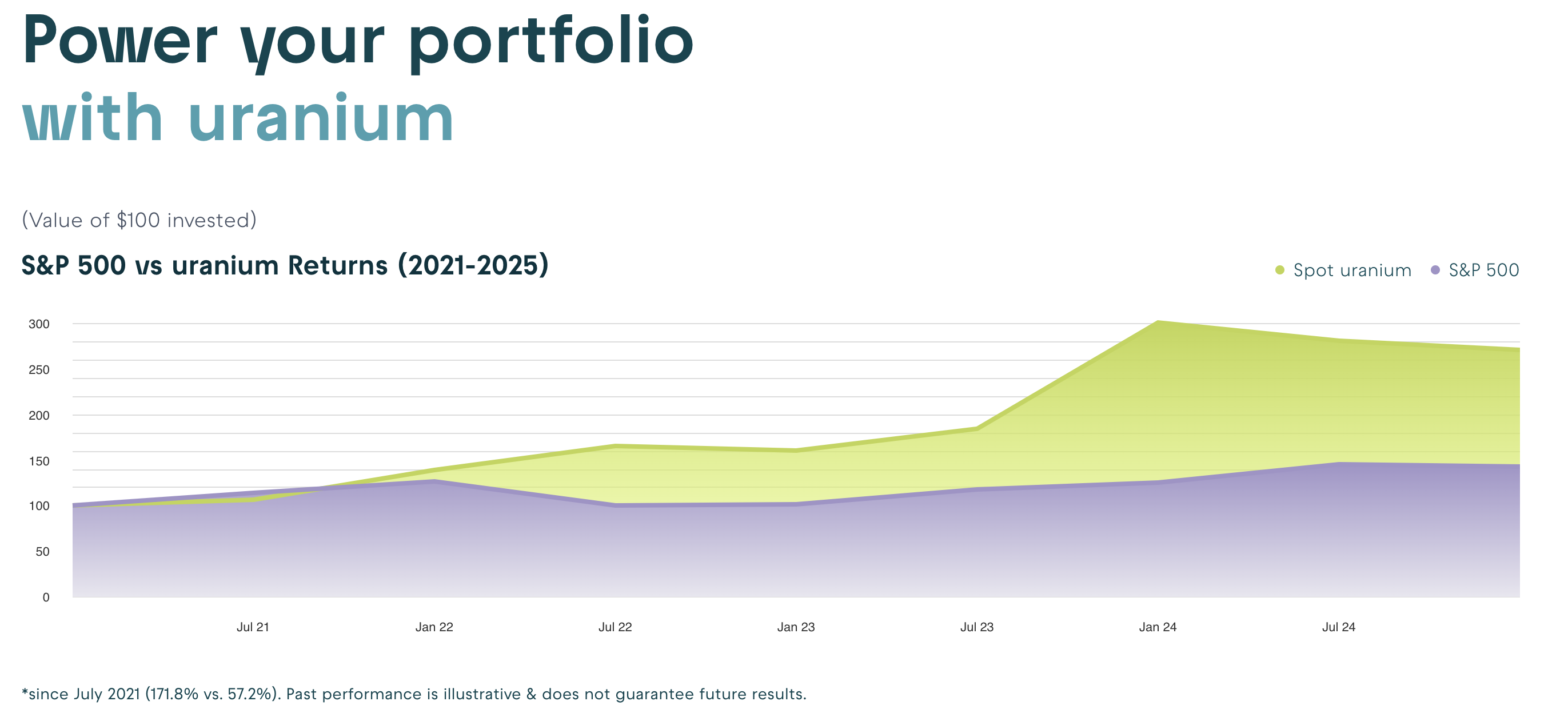

Uranium.io: Commodities Tokenization Reimagined

Uranium.io exemplifies the potential of meaningful tokenization by addressing real market inefficiencies:

-

Brings physical uranium trading onchain

-

Creates a regulated, compliant marketplace

-

Solves access and liquidity challenges in commodity markets

-

Provides a blueprint for tokenizing critical commodities

Get some $u3o8 today:

Learn more:

Alfa: MuDigital, the first RWA project on Monad

Why RWAs Matter

These projects represent more than just new investment vehicles. They're solving fundamental market problems:

-

Reducing friction in traditional trading

-

Increasing global market access

-

Improving price discovery

-

Creating more transparent and efficient markets

The shift to RWAs marks a maturation of blockchain technology. We're moving beyond speculative tokens and meme-driven hysteria to create real, tangible value that bridges traditional finance with the digital world.

The message is clear: It's time to go back to what's real.