I discovered crypto (mainly BTC and ETH) during my masters around 2017 after reading about it on Twitter. The crypto space has evolved rapidly and found its way to product-market fit, revolutionizing traditional finance (TradFi) for good and setting up the first stones for a more fair, balanced and decentralized finance (DeFi). Investors can now borrow against their crypto collateral, invest in crypto communities with social tokens or buy digital art.

The proliferation of new types of alternative assets within the crypto space, particularly DeFi, social tokens and NFTs shows no sign of slowing down, and these new asset types don’t play well with traditional brokers. Crypto holders have to create investment flows manually and interact with protocols one at a time.

While retail investors have access to ETFs and other bundled financial products, in crypto, we the users are still primarily interacting directly with exchanges (e.g. Coinbase, Binance, Uniswap), wallets (e.g. Metamask, Phantom) and specific protocols (e.g. Aave, Anchor, Compound). Both data and execution are well-taken care but today it should be possible to incorporate logic into our actions.

As the interest surrounding the potential of decentralized finance continues to grow, Since Jan 21 the participation has ballooned with a Total Value Locked (TVL) in DeFi protocols 5x to over $100B as of Dec 21, the question is then, how will both professional and everyday investors continue to explore the use cases of DeFi protocols.

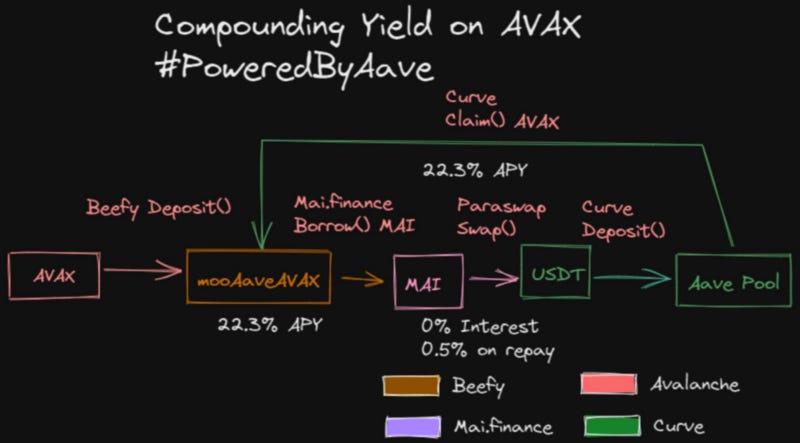

The truth is DeFi will grow in the following years and we’re still missing an operational layer to determine how we allocate our funds intelligently. Experienced code-savvy investors create custom scripts to automate portfolio management with Python, Solidity or even Excel -with the work and complexity it carries. While the vast majority of crypto investors who can’t code interact with protocols through different user experiences or surrender due to its complexity.

If we get rid of the technical layers present in the smart contracts and scripts, what we’re left with is an easy-to-use tool that helps both advanced and novice crypto investors. Imagine creating your own strategies from building blocks using a no-code visual editor. Each block is composable and can include assets, triggers, conditions, filters and protocol-specific actions. For crypto investors a platform that democratises composability, automation and execution it’s inspiring and opens the door to new strategies. For crypto protocols this means a gateway to create their own strategies and share them with an open community of crypto investors.

This is a vision worth exploring in DeFi. A mission to create an open platform for the composability and automation of crypto. Bridging opportunities that only a few have access to regular users is a powerful idea that will benefit the whole industry.

We’ve spent time this past year doing research and understanding the ever-growing ecosystem of web3, from first principles to whitepapers. We believe DeFi is the first lego component to an economy becoming more tokenized and tradeable. If you’re also excited about these types of opportunities, we would love to hear from you!

Disclaimer: We publish these memos to basically articulate a big idea we believe the world ought to see. When you read it you’ll notice there is no technical diligence nor particular alpha whether when or how will happen if ever. That’s all, and aha moment of what could happen.