So a bombshell was received about NFTs and the crypto space. There is no easy way to reply to such a lengthy video, so this article will try to dissect everything wrong, chapter by chapter. Please take this article as direct thoughts only and another voice of reasoning for those who watched the video and found it unjustified without a proper reply. As this became such a highly shared video, I will try to do my best to justify all statements that are made along the way. So without further or due, here is a crypto ape reply to the now infamous ‘Line Goes Up – The Problem With NFTs’.

Introduction

Dan starts off with laying the groundworks of his video, directly pushing a negative view that the space is overvalued and cringeworthy. So here we observe that the undertone of his video will already be on the negative side. Keep in mind he decided to create his video on a moment when the crypto industry was in a peak hype moment and where narrative is everything. So Dan continues to further explain a bit more about the banking industry and what caused the crash of 2008. And then.. he switches to Bitcoin.. failing already to properly explain the fundamentals of money when he had the proper chance in his 2+ hour long video. As this can be easily overlooked as something that does not need further explanation, many people still believe the current system of their euro, dollar, pound, yen,... is backed by physical gold and most do not know the difference between money and currency. In case you do not explain the basics, people also do not understand why Bitcoin end the later developments exist and continue to come back even stronger year after year.

Bitcoin

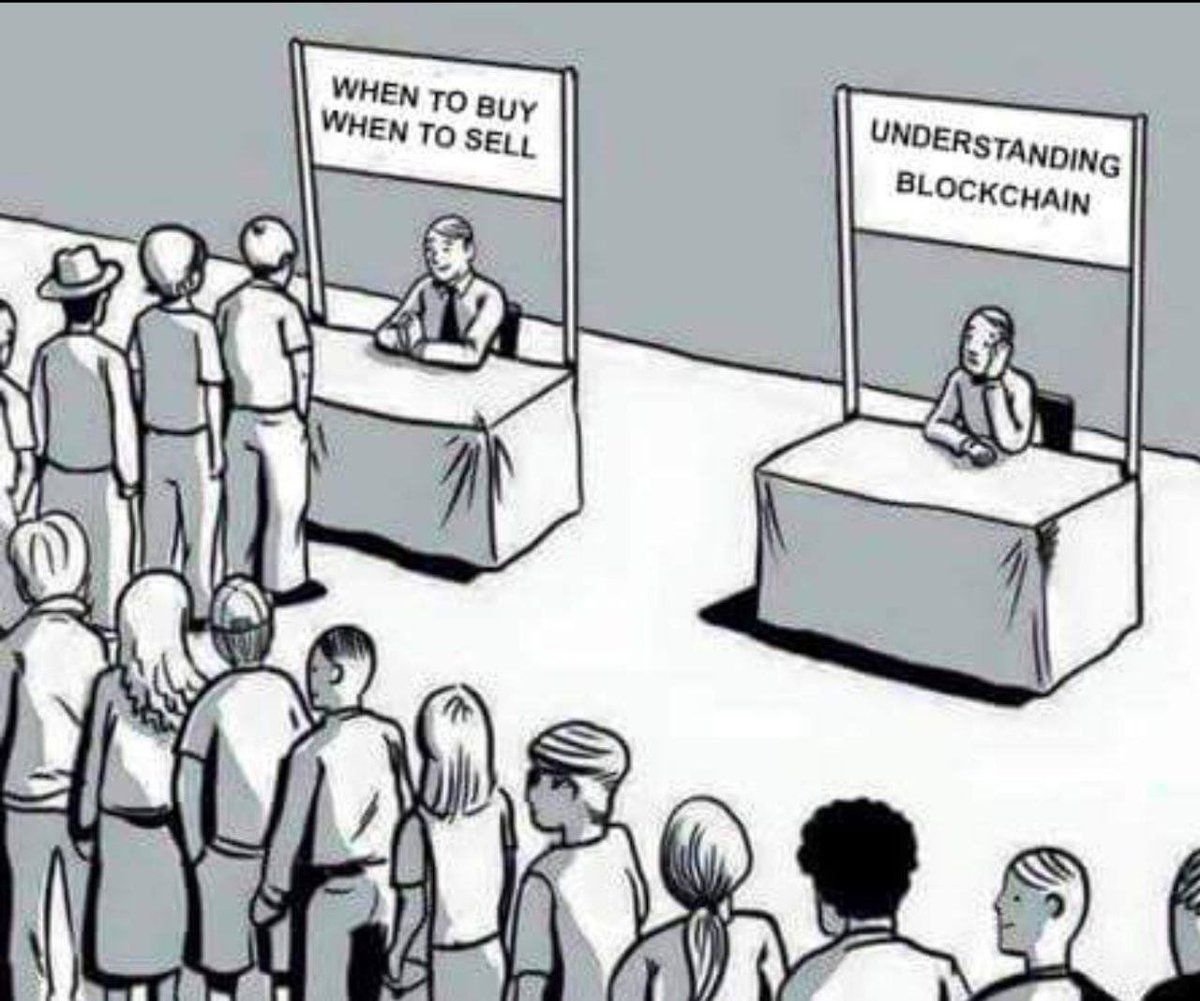

Putting that aside Dan starts to explain the origins of Bitcoin, but first he needs some vocabulary to explain the space and its complexities. The argument is given that some complexities or vocabulary he needs to use are just the result of poorly designed systems and the creations of scam artists. This gives the viewer the skewed perception this only happens in the crypto space. Explaining an entire industry and its inner workings is not that easy. For example, although everyone knows how to use the internet, a lot of people do not know how a car engine works to be able to drive it.. or how an iPhone is manufactured to use instagram.. or what the OSI model is to use the internet. The question is first: Do you want to use it or do you want to understand it? And most people just want to use it, just as everyone knows how to spend a dollar in their pocket, but they do not know how the entire finance system works of bonds and the issuance of dollars.

After that rant he again makes a poor decision instead of choosing to properly educate some basic concepts to ridiculing the technology and the terminology required to understand the basics of the ecosystem. For example, mining is basically the same as minting, validators are the same as miners..and so on.. To bring it to the ridiculous, it is the equivalant of saying that the handbrake and brake pedal both stop the car to a beginner driver... Sometimes it is allowed to simplify complexities, but you can never discard two distinct terms to be the same. You can however place them in a similar group. The first example of an entire industry is now shown in his video, $DOG, delivered with a deliberate overcomplex paragraph in which he just tries to convince his viewers how complex things can get in a funny way to win them over to his biased negative view on the crypto space. After that he does not give any valid use case to the viewer. It is like explaining what a car is to someone that hypothetically does not know it and having it explained as basically a killing machine on wheels by showing an article of a bus accident that drove off a cliff killing all of the passengers...

So we go further and here is where Dan completely misses the ball... He explains that a digital wallet is the same as a bank account. Nothing can be further than the truth. A digital wallet more reflects the power of being a bank than having an account. But if that was not enough, he continues to strike out, with actually wrongly informing his viewers a wallet actually holds coins, while in reality your wallet just holds the keys (or in simplified terms the passwords) that allows you to spend the crypto on the network you own on its eternal ledger.

So the story goes on.. and Dan explains some of the core values of why Bitcoin seems to be important for the world, like anonymity and direct digital transfers. Dan brushes this off as a small feat. Solving the 'Byzantine General Problem', the tech that makes Bitcoin.. well Bitcoin.. was never solved before in the digital realm. The aspect of having value floating like a layer above the internet was a dream for years. So Dan stating that nothing played out as designed is just again simple bollocks and putting his own head in the sand. You just have to look at the numbers, Bitcoin at this time is worth 750 Billion Dollars in total market cap value, if you compare it to its older brother gold, which has been around for thousands of years. Bitcoin in its short lifespan of 12 years has managed to capture already 7% of golds value. 1 Bitcoin went from 0$ to a peak of 63.000$ in value. And even El Salvador declaring Bitcoin as legal Tender. So, I do not know in which world Dan is living in, but in my world Bitcoin has achieved more than most people could have ever imagined already.

The next section dissects Bitcoin's only and best use case, which is apparently buying illegal drugs online. Playing very well into the bias of the crypto sceptic viewer. And failing to again show other legitimate use cases that lead to the innovations we see today such as Smart Contracts and the birth of DeFi.

Now we see more and more, the seeping bias Dan has towards the whole space. Calling out every "bad person" and news article headline that has something to do with crypto. So now we are just 10 minutes in, and we have only been shown negativity, biased opinions, poor examples and logical fallacies to support his own view on the crypto space. We again receive a Dan opinion, that Bitcoin tries to fix the banking industry, which it simply does not try to do, and you can tell if you simply look what Bitcoin does. It is a network that anyone can join or leave without middlemen to transfer value. What the current banking system does, Bitcoin does not care about. It cares about what you own on the network, and that it keeps being yours on the network, that's it. All after effects of that design are after effects. So him stating that Bitcoin is not fixing any problems is correct if you frame it into a biased statement where Bitcoin needs to magically bring everyone out of poverty and fix human behaviour.

Now finally, we have the first 3 minutes of uninterrupted bias and whining. A moment where Dan properly explains Bitcoin for the first time. The focus of the topic is about the energy consumption and the nature of being able to compete for rewards on the network. The points he makes are valid. Bitcoin currently does require vast amounts of energy and the statistics show it not slowing down, with alternative consensus systems that do not require so much energy consumption. It is indeed an argument if Bitcoin is even still up to date with its own consensus method. What Dan fails to focus on, is that using energy is not bad. But what is bad, is if the energy used is damaging our planet. So let us imagine a perfect world where Bitcoin uses 100% solar energy. Would we complain that the Bitcoin signature hypothetically is 5 times larger than the signature of the United States? No, correct? So the energy is not the issue, the road towards green energy is, and the world is waking up to that fact. We want green energy and use products and services that care about green energy, and we want it now. So it IS in the incentive of the miners to look for green alternatives, not only to be more profitable, but also to help grow the ecosystem in their favour. Future potential is also not factored in at all in those arguments. As a side note, Visa is already using Ethereum to settle transactions that Dan probably uses as well.

Ethereum

So after an excellent section worthy of discussion about energy, Dan drops the ball of course. We get introduced to Ethereum, by a reference that Bitcoin is a complete failure (...even though it still exists a full 8 years later after Ethereum launched proving him wrong already). He does a fine job giving the sales pitch of a 2014 Ethereum, so kudos there. And... he starts breaking down someones work, by calling it an journalistic abortion.. I did not even read the book, and was already appalled by that comment. If it was that bad of a book for you, why mention it at all in your video? Or perhaps it is just because Dan could not find a book for sale about Ethereum that said it has no use case to feed his internal hate? Or perhaps his approach of journalism is the simple strategy to just call out everything as a scam? And that is the only book worth writing? The whole history of Ethereum is being shackled to chains as an ecosystem of bad actors. It is not even worth explaining the simple basics as to the difference of Ethereum being a Turing complete blockchain compared to Bitcoin, which again was a great feat for human kind to achieve. Unstoppable code on Ethereum, just like Bitcoin created unstoppable value. Now that is amazing! And on the remarks of them dreaming about changing the world, just as Einstein says: "The true sign of intelligence is not knowledge but imagination".

The Machine

So after hearing a very frustrated Dan, who seems to not only have a vendetta against crypto, but against everyone who even touches it. I start to believe perhaps he is so angry because he buys tops and sells bottoms every cycle since its inception? Perhaps that is why he is so frustrated? Jokes aside.. we hear Dan talk about proof of work once more, and his repeated statements of energy waste and the reason for it, namely the 'double spend issue' it solves. As revolutionary solving that problem really was. Dan swipes it under the carpet, and continues towards the alternative Proof of Stake. Now we as the viewer get to know more about the inner workings. But we still have a focus on the negative aspects and not the positive aspects it achieves, such as drastically lowering the barrier of entry and lowering the computing power required to run the network,.. all that without sacrificing the current decentralisation. Can it be improved? Of course, and smarter people than you and me are. An example flaw pointed out is that big stakers get more stake, this is not completely true as PoS can equalize unequal power flaws by code! Can it be cheaper? Always, but that is like complaining about buying Tesla Stock at $1000 now, instead of buying it at $40 in Januari 2019. The more a network grows and proves itself the more valuable it becomes. Risk takers are the earliest, but then also take the highest rewards of what they invested in succeeds. The rewards are also the same for everyone joining the network. It does not matter how big or small your contribution is. Smaller stakers that are not able to stake a full 32 ETH, still have alternative options to earn APY on their stake. But of course that is not a topic that Dan tells his viewers...

Now we go into the blockchain size argument, which has been a discussion for over a decade. I can not state this enough, there are always a new set of problems new technologies face and that they need to improve over time. In the case we talk about the ‘blockchain size‘ multiple solutions were already implemented since its existence and more solutions like Layer 2 and zk-SNARKS are being actively developed. The technology is ready when it is ready. The current blockchain industry will not go away even if for some magical event in one year we bloat the chain with 100s of Terrabytes of data we need to keep. So stating it is an issue, does not mean it can not be improved or not be solved over time. This is again an example of people like Dan who only like to complain and blame everything, without giving any credit or value back.

So we have the classic fork introduction, but not a simple explanation of finality of a transaction, which is again trivial for the viewer to understand. Finality is the assurance or guarantee that cryptocurrency transactions cannot be altered.

The use cases of blockchains. For example logistic tracking, all came to a boom in the ICO craze of 2017. Dan makes fair points of use cases not having any effectiveness on a blockchain and here he is correct. There is no point in morphing an idea with blockchain if your use case does not have any benefits with it. This is not a problem in blockchain it is a problem in human problem solving. Now you hear Dan talking about high transaction fees. These are again the current problems of a hyped market and the current state of the technology. Alternatives like the Layer 2 solutions on expensive chains are affordable and cost 90% less, but you should use them. It is like complaining about a busy and popular highroad during peak times, and not taking a train. That does not make it a bad road, it is the best road else nobody would use it to drive on. Currently a lot of use cases need to share the same road, but this is being noticed and being researched to be expanded and all that by keeping that road operational without closing that is not a small engineering task to achieve. So complaining about problems of today, is like complaining about the early internet loading a single picture in 5 minutes and just closing your eyes and ears what eventually will be solved in the future.

Now we have the famous stablecoins showing up in the conversation. The rise of the stablecoin due to the price fluctuations is an argument, but eventually a stable coin will have happened soon or later regardless of the fact fluctuations occur. Also the statement "goal of crypto in general is to starve public services" is again a show of peak performance in the quality of his video. Stable coins are whatever Dan says not a requirement if you want to convert your crypto to other currencies. As the arguments goes from “Tether is a dodgy private company” to “crypto is a bigger fool scam”. We see that Dan does not know what crypto again is all about.

He tries to show off his big brain, by explaining how the crypto scam works: 'buying a worthless asset believing that you will later be able to sell them to a bigger fool'. If that is the case. Every investment in any asset is a scam right? There are always speculators in any space, some are there for the long sustainable future, some are just there to make a quick buck. Tokens are not different in that regard than shares of a stock in the S&P500, an up only market since its inception rewarding early “adopters”/”investors” with the most rewards, and even additionally with the extra backing of the federal reserve in case things do go down.

NFTs exist to get you to buy crypto

And we FINALLY get ourselves into the NFT subject. Props to Dan giving a good effort to explain what an NFT is with some real world examples. And before we know it, as a viewer we again get ourselves into a spiral of negative ranting on why the term "smart contract" is the worst idea humanity ever invented. How it is 'bad, terrible and none of it really works', and that 'the infinite machine wants to financialize the whole world'. So again we hear biased opinions, lies and just false statements. Dan is not only annoyed with how things work, but he is also annoyed why these things he does not understand are receiving real world value expressed in dollars.

He finally realises he is wasting our time with his whining and mans up. Again doing a proper job at firstly explaining the different kinds of smart contracts that can be created. But of course, only in typical Dan fashion with the example of 'a virus that steals all your digital stuff'. Seemingly, bad things only happen in crypto to Dan? Because in his world, cars are never used by criminals, nor the internet, and a knife is only used to spread an avocado toast and never as a weapon.

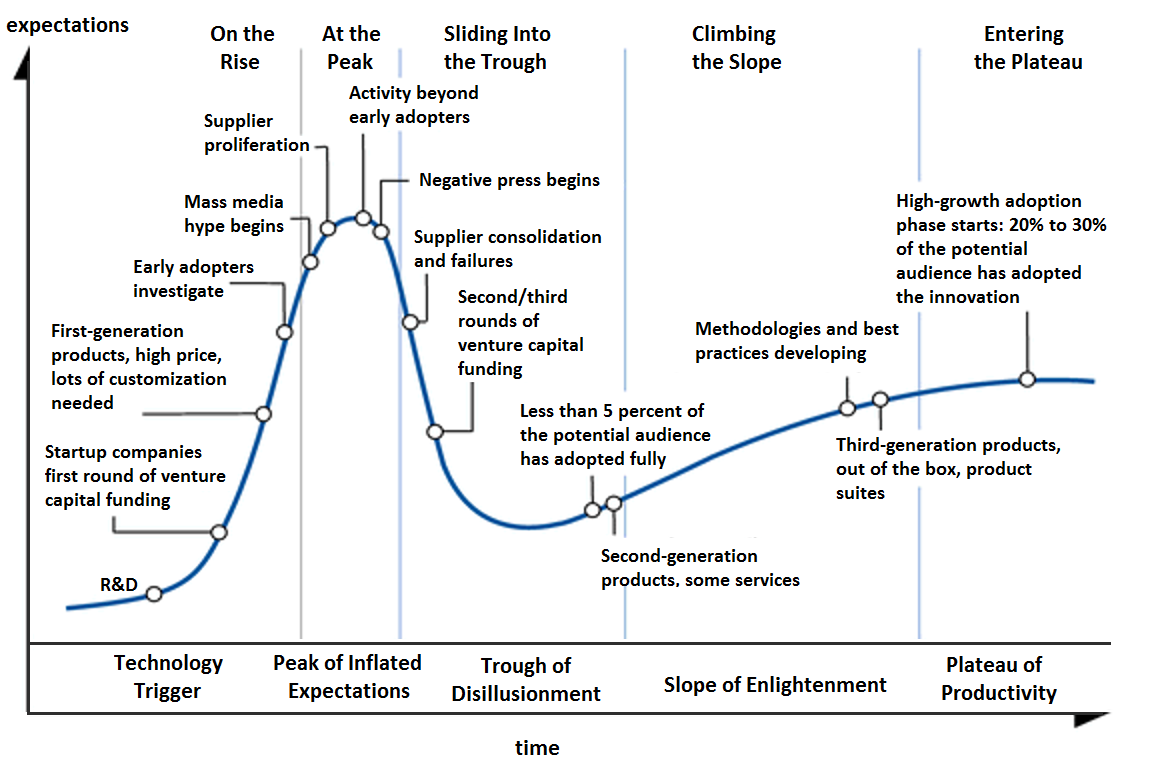

NFTs are indeed only noticed later on, because that is what hype does. Tesla was not noticed by the mainstream only until 10 years later when it suddenly overtook an entire industry and only by then everyone wanted their car and the their stock.

Now we are properly set up with the real problem of NFTs. The hype, the overvaluation, and the fact the even your dog can mint an NFT to sell art. In any market, supply meets demand. A concept apparently Dan is unfamiliar with. So I will explain it to him, in case you sell your used sock (yes sock) online for $100k and there is a buyer for that who am I to judge that sale is not valid? So art is only beautiful in the eye of the beholder. Explaining art to people who do not understand it or just do not appreciate it is a waste of time some would say. Dan is apparently the kind of person who would look at 'statue of David' and state to people it is overvalued because it is just simply the statue of a naked dude.

Now some of the points throughout are of course valid, and a lot of people got caught in the money making machine lottery ticket game. Creators, buyers, dreamers and scammers. That is and will always be an (unwanted?) effect of upcoming technologies. Why perhaps wanted? Because that is for the good or bad of the technology and the people using it in the long term. These events will educate what can happen and will create better, more secure and easier implementations in the future.

The negative part of the NFT space nowadays where the usage of a decentralised server is not aligned with the ethos of crypto is correct. But crypto is not there to enforce anyone to do anything with the functionalities it provides. Ideas, turn into implementations and afterwards turns into reality and then it turns into use cases we did not even expect to happen. This is not a flaw of the system. This space is still hard for people to understand and it is only seeing exponential growth since it’s exception. It is similar to complaining about buying crypto on an exchange and the exchange being hacked and funds stolen. The point of owning crypto is self-custody, that is aligned with the Ethos of crypto what the users do with crypto is their own freedom of choice. What Dan fails again to understand is the bigger picture. Crypto just pivoted from a small bubble of crypto enthusiasts who know how to program to a new creator economy where anyone can sell any digital good to any buyer who wants it.

Talking about flaws in the system does not make it better, but at least that is the goal crypto enthusiasts are thriving for, not just in the hype years of 2017 and 2021. But they continue to work on improving the ecosystem even when nobody talks about it and that all while still being insulted as being scam artists, while in reality they have the bests of intentions. Taking out some random comments on the internet is also not a great way to make a point, because as we all know, the internet is always right about everything right Dan?

Perfect synchronised pessimistic sentences take us further with just a confirmation Dan is only talking about a hyped market, where people are just buying anything they can because they fear they have missed the boat on this new NFT thing they keep hearing about. Blaming an entire industry it is deliberately creating a network and software with its only goal to scam every thing and every one. Now we keep hearing Dan complain that it benefits the price of Ethereum. Like what do you expect? Everything that gets usage, gets a higher evaluation. More people buying Tesla cars year over year, makes the stock price of Tesla go up. Usage equals valuation. Again Dan trying to make an argument based on logical fallacies. It is just too perfect how Dan invisions an entire industry of people, from sales, to marketing, to developers, to creators of creating a 10 year old running scam. Buying in early is not a scam, it is called investing. The same as buying Amazon stock at $10 in 2001, and cashing out your investment at $3000 in 2022.

So are you bored yet, because I am.. I think not a single person likes it when someone just sees the negative side of every single thing that exists in this world. The price is of course great when it goes up, are we not human? The question is are YOU still around when the prices go down? Because the developers who worked during 2018, 2019, 2020 definitely will be. Even though they could never have known in advance the NFT hype in 2021. Do not forget NFTs are a single use case of crypto! A lot of people in the crypto space that are there for more 10 years, the early earliest adopters have never touched or bought an NFT. Why? Perhaps because they do not feel the need to? Because they do not like the art? Because they simply do not want to buy a 500k ape because they find it overvalued even though they have a portfolio worth of a small country.

Now you can discuss all day long if paying an NFT of 170k is worth it or not, and they can try the same to try otherwise. But you know what. That is okay people have different opinions. You do not have to agree on every decision a person financially makes or finds about a technology. I find a ridiculous for example people pay $10k for a Gucci shirt, but if they want to do that, that is fine. That is where the supply meets demand.

Now we see Dan gave in to the pressure of the crypto Twitter and he buys a Coolcat NFT, but not because he likes the community or the art. But simply because he wants to understand, something he clearly does not. Even again validating it with his own actions, that he just joined a random NFT community without having any attraction to that community to begin with.. In case you do not understand "the attraction", it is not required too. It is that simple. There are many people who do not understand the appeal of buying and playing video games. In fact, it is larger than the movie and music industries combined, and it is only growing. So now I am curious how Dan would describe these people in the ‘90s and ‘00s? "Anti-social nerds who live in the basement with their moms until they are 40 years old"? Yeah..

The unbearable cringe of crypto

Without even knowing what future NFTs could potentially serve in the future we hear a tiring row of blant statements of how all NFT art is ugly and copied. Although of course not every project is legit, you can easily find great projects that are not even hyped at all. I choose not to give any examples here because it would most likely be used against me as "a shiller of those projects just to pump my own bags", which is sad, because sometimes you just want to give a shout out to projects of people that deserve it and that are being overlooked and this statement counts for any space.

Scams are being outlined once again and no other legitimate use cases of NFTs such as real estate, identification, patents, voting,.. are being brought forward. Leaving the sceptic viewer validated once more, with the thought, "Yes! NFT was a scam all along! I knew it!".

Now I guess many of us know the basketball or football sticker books right? You would need to buy a pack of stickers and you would perhaps be lucky and find a shiny rare card in the lucky small pack of stickers you bought at the grocery store. Apart from the unlimited supply of the stickers, minting is exactly the same thing. You pay some money and you get a chance to receive a sticker in return that could be rare. Now you can copy this concept to sell stickers of any kind of sport right? But that would be a mistake as well, because there would be little demand.

We have a Dan criticizing about projects trying to raise funds for ideas they would like to implement. Why he thinks this is bad is beyond me. Did you ever hear about Kickstarter? It is a place outside of crypto that tries to raise funds to implement an idea. What about VC funding? Angel Investing,... ? The history of crypto has already shown how this already played out. In 2017 the ICO boom happened, where a lot of people tried to raise funds with a token that would revolutionize a certain business idea. So where are they now 4 years later? A lot of them turned out to be scams and bad ideas. However again, this is not unique to crypto alone. Did you ever hear about Theranos? Nikola Corporation? These were huge billion dollar companies that turned out to be scams in the traditional investing space. So now, what did survive from 2017? Many great projects that now form a big part off for example the DeFi ecosystem. Which Dan probably thinks is a scam as well, but I guess that is not a shocker to anyone.

A self-organizing high-control group

So as mentioned before, products that are ideas mostly first need a raise of capital before being able to execute on that idea. Many crypto projects that were announced in 2017 did not see their projects bloom until 2 years later. Money lending protocols, decentralised oracle networks and decentralised naming services are a part of that basket of projects that were really well received by the crypto space and those appreciated a lot in their respective token value even though we clearly were positioned in a bear market in the years that ensued 2017. So why does Dan keep on insinuating that NFTs are a scam? Because he assumes they are also in the future and that none of the current ones will survive. The same insinuation critics had in 2017 about every single ICO token that came to the market.

Now we go deeper into the internet, and the value of memes in communities. These are not artificially created words, but are mostly born out of a particular event in time. The misspelled infamous word 'hodl' is one example of that. So Dan not understanding that, would indeed arguably deserve him the callout of an 'okay boomer' on the internet. But let Dan think what he wants to think, these words are indeed again created in this giant complex scam to make him buy a NFT of a 2d picture.

Crypto reality

Putting aside the fact that Dan expects the world to be completely free, there are indeed things that can go wrong in projects. As in any space, hacks and bugs happen in software and crypto is not resistant to them. It will however currently be the most scrutinised if it does happen. Databreaches? Facebook, Linkedin, Twitter, Ebay, Yahoo,.. do you remember them? So again putting the whole blame on crypto is just plain wrong.

Metamask is a clear concern and this can not be denied, too many people are using it and it is a point of failure. And alternatives exists, but as long no 10x better alternative shows up, people will keep using it. Normal users are hard to educate that just want to use the network. And that is again up to the ecosystem to improve over time. It is indeed a very valid point, but instead of seeing this as negative I see this as an opportunity for innovation. Encryption is also a thing that just works. And multiple innovations in crypto are making it possible for sensitive information to be stored without sharing any personal information. A feat that is currently being intensively researched and implemented in crypto projects.

So keeping the video in the same pace and negatively formatted. We hear Dan talk about the infestation of malware and scams again. So I guess Danny is still sending out letters by Post, because mails still include scams, viruses and so on. Perhaps Dan got pinned by that Wealthy Nigerian Prince? 'Pin that somewhere in your brain Dan'. Okay, okay, no more lame jokes.

So if there is one topic that repeats itself again and again, is that Dan assumes scams like these are only happening in the crypto space. But it is fairly obvious it mostly is due to the fact that people are not yet educated enough on that subject. Even now companies still need to enforce their employees to take "Data Security and Privacy" seminars. How do you think the knowledge is of those same people that just entered the crypto space in 2021? So yes, it takes time, and many people will get scammed, but it is on us to improve the ecosystem so this happens less and that people get educated on that subject.

Another case of NFT that people mostly do not know of, but is very popular in the crypto space is something called POAPs (Proof of Attendance NFTs). These are limited, so sometimes rare NFTs that are only given out by the organisation of a particular event to those who joined that event. But of course the mainstream does not care about that innovation yet, because they can not earn $100k on it. But it is fun for those who collect them, and it provides them that sense of bragging rights being able to prove they claimed that POAP in the first place. Of course this is something Dan will never say in his video, because it is legitimate use case of an NFT and his goal is to crush the technology.

There is no privacy on the chain

Trust is something Bitcoin solved by making sure no middlemen are required for something that does not need it. And thinking Bitcoin is completely private is just a plain wrong assumption and not doing the research required if that is what you believe. Nowhere in the original 8-page Bitcoin whitepaper does it state Bitcoin is there to solve privacy issues. Facebook is the best example of that where employees can basically access your entire profile, run analytics on your profile to see what you like so they can put you in a target group for advertisement. Do not even forget Facebook is hacked multiple times, so everyone their data is just out there in the open. So, what we can though enjoy is the invention of the technology to have more privacy improvements over time than ever before in comparison to traditional systems. Where after a while you as the owner of your data are able to choose who can see what, why, when and even for how long. That data will not anymore rely on the mercy of a single company or government, but it will be safeguarded by math.

This is now the perfect time to educate Dan on something called Layer 0. If layer 1 in the crypto space is the unstoppable blockchain. Layer 0 are the people that decide to use it. That is actually the ultimate final consensus layer. In case the majority of people are willing to use a network as it is today then that is their current choice of preference. Now what if the system is flawed as Dan says? Well that opens up competition for developers to create a 10x better network than ever before and ultimately the good will chase out the bad.

Now complaining about a scams in crypto, is like complaining about bad actors and being scammed in real life. Are you mad when someone steals you out of your credit card details? Yes. Are you mad people when people steal your front porch packages? Yes. Are you mad when you clicked on a phishing link because you got a text message from a friend that turned out to be a scam? Yes. Does that mean credit cards, amazon and your friends are bad? No. So a new platform and technology comes with of course their new set of problems. Like how a car now revolutionized commute and commerce, it also allowed crime and scams to grow in different directions. Does this again mean cars are scams? No.

As the network grows in value and users, it is in the interest of those closely involved in the development to be strongly aligned with those that want to use the network and to treat them all as equals. It is a search for a long term sustainable growth for a better future they work on in the benefit of everyone. Do not forget that some people are even anonymous doing their work without any praise (like satoshi), trying to create something that benefits everyone in the world to a better future. If Dan does not see that, that is okay. But do not disrespect people that currently have an impact of how a better future world could look like.

A unified system is also not bad how Dan explains it to be. The internet is a unified system and a central system of data transfer. You are also not able to use another 'internet'. Does that mean it is bad? Dan loves to take subjects so out of context they indeed they do not make any sense for a person that does not know a lot about crypto and the technology it entails. Did you know the internet is still a privacy disaster? Because 'https' a way of secure communication over the internet is only enforced by the browsers you use. So the internet is still an unsafe place, if you do not use the correct tools to protect you from bad behaviours that can happen when using it.

If this 'looks like scam' then every NFT Room I'm in looks like scam LOL

'The primary use case of tokens beyond speculation, ultimately, is to function as access passes'. False. Dan his opinion again and not a fact! Also the rant of how everything needs to turn into money is a very pessimistic outlook how society currently works. Without giving any reason to why Dan thinks this way, we as a viewer of course need to again get this statement at face value. You can practically sell and buy everything in real life as well. Being anonymous is also something in you can not even do in real life, as there are cameras everywhere nowadays. It is however still possible on the internet of you know which tools again to use if you value your privacy. Even if we assume Dan his comments that this technology is a privacy disaster. Then Dan, who is Satoshi Nakamoto? Exactly.. this proves the point and case around privacy and the usage of blockchain.

And again Dan his main focus in this section is about the hype of NFTs and the metaverse of 2021 and not the 10 years that precedes it. Arguing that again some elite group hold all the power in everything crypto. Yes Dan, that is of course what crypto is all about. Taking from the poor and giving it to the rich. That is indeed why crypto is being considered as legal tender in the poorest countries of the world. Now it all makes sense (sarcasm)!

Now we have a point of the usage of NFTs in particular to the gaming industry. Yes, as everything in this world. Any kind of good or service that is created can be used in a bad way just for the simple outcome to make more money. This can be easily related to the upcome of 'free to play' games. Where although it is an improvement, and gives every person in the world finally a chance to play a game. It will also in the wrong hands be a method to extort players of a game by selling in-game items. Now Dan gives his example of the use case of NFTs in gaming by an explanation of an NFT scam created again in 2021, the year of the hype and a time where all scams prosper. As in the famous words of uncle Ben, with great power lies great responsibility. Try not to exclude people either because you can, because that just simply makes you an asshole.

Play-to-earn exists to get you to buy crypto

In a world that is constantly evolving we sometimes find ourselves trying out new things. Krypto kitties was actually the first real NFT game that was pretty popular all the way back in 2017. A simple game structure where you could play and breed cat NFTs. Even back then, there was a time it was so popular, it was making Ethereum fees very expensive to use. That was one of the eye-openers for developers that showed networks like Ethereum with high demand will need better scaling solutions. Those were actively developed on for years so they are able to work today. Projects like Arbitrum, Optimism and Polygon are fast, cheap and easy to interact with and that is the result of not complaining, but from years of hard work by developers so it can work today. They are not only introducing a faster system, but are expanding the uses cases that were ever possible and achievable back in 2017.

Now is NFT gaming unfair? Definitely some games, yes. And definitely the ones with a lot of hype around it like Axie Infinity. It is true that as a normal user you are pretty much left out not being able to play the game if you do not have the funds to do so or were not early. Does it mean the people who play the game are unhappy for it? No. Or the developers? No. Again in typical Dan fashion of negativity he just does not understand why there would be people that are different than him have a different outlook of what makes such a game attractive to play and invest in. The argument that people make money out of other people playing is just the way an economy tends to work. Some people trade their time (8 hours per day, 5 days per week) for money. Then there are other people that take more risk and have more capital and invest in assets that bring them a return instead. Having these kinds of scarce assets in a game is very new, and that is why there is also so much hype and speculation around it.

Is this sustainable for games and good for the players? That is a good question and we will only know the outcomes later on. We will definitely hear some crazy stories in the coming years how in-game assets skyrocket or plunge in price because of a change in the game or simply because a celebrity started playing it. We also keep continuing to work for a job we sometimes do not like, to just get a paycheck at the end of the month. The beauty in my opinion is at least you are not required to rely on the game if you do not want to. At the moment it feels like most games that came out are an experiment and glimpse of what the future of gaming will look like, and it is a good model to challenge the current 'free to play' model.

We're all going to make it and by 'we' I mean 'us'

First of all buzzwords are created by mainstream media and companies, not by developers or people who create the space. It is mostly trying to categorise and market something into the general public so people take notice that something new they do not know is emerging. Of course Dan has the assumption 'crypto' is all about financial gains. Although there are many use cases for years like decentralised oracles that bring unbiased price feeds and stable coins like USDC that even VISA uses, so practically everyone in the world is already using the blockchain without even realising it they do.

The sheer negativity of being able to sell any digital good you can is just an option and choice people should be able to have. Again Dan, the option to do so, is not the requirement you have to.

In case you are mad of blockchain being very limited right now, you are not alone. Since years restrictions of blockchains are being lifted and every year more and more progress by more and more smart people are getting made to make crypto more usable. Now being made of people going a different direction and creating their own blockchain with own tokens is just how free market competition works. You can be made about it again, but this is what will make the blockchain stronger, and competition will do the rest.

Is it a concern your assets are now on one chain or on the other? No! Theses assets can easily be transferred from one chain to the other if required too, as Dan even mentioned. Dan reflects that as being this huge problem. Why is that again, I do not see it? He of course does not explain why, he just simply states the obvious how it works, with a repetition of his previous statements that blockchain is slow and expensive.

Now there is some truth to the fact that some blockchains that are now cheap are just cheap right now because they do not have any usage. But he again fails to educate the viewer that newer alternatives already arised where more users mean less fees while keeping security and speed.

And almost two hours later into the 'video' we see that scams are still a key focus. Somehow Dan really believes that blockchains have marketed themselves as a scam free world. But he appears to be the only one that got that memo. Marketplaces that sell NFTs are indeed very centralised, but nothing stops anyone from creating a more free marketplace that is completely decentralised in the future.

DAOs exist to get you to buy crypto

The existence of a DAO governance is explained at a good pace, no mistakes were made as he was very objective. Organising a group of people with an incentivized token seems indeed like a good strategy at first, but like everything that idea in some structures can bite that project back if it is not integrated properly. Many great DAOs were created like the decentralised exchange Uniswap. A token everyone received as long as they have used the platform. Using those tokens as voting rights are a pretty good idea, as it makes people who actually use the platform signal on proposals what they want to see prioritised and happen in future implementations of that platform. Keep in mind again, this structure is nothing new. Shares of a stock of a company also gives you some kinds of voting rights. So the benefits and the flaws exist in both worlds. The beauty in crypto is that anyone in the world can have those tokens, regardless if your government wants you to or not. So are DAOs a scam? No. Can DAOs be ineffective and scams? Yes.

So how do we deal with the comments of 'The DAO' event and DAO structures? Yes, many mistakes were made in the early days, and if those people who were around back then could turn back the clock they probably would do some things differently. But as always, hindsight is 20/20. Can DAOs restructure how things work today? Yes, and we will see which kinds of shapes and forms it will take in the coming years. All concerns Dan raises mostly already have played out in a lot of current DAOs and as just as expected they can become messy situations. DAOs are not a perfect world, and probably nobody expects that either, but they do offer a new way of freedom and options people can organise themselves with towards a specific goal. A DAO, will later become nothing more than a company structure, such as a LLC or a S Corporation. That is however a personal opinion, even I do not know how DAOs will potentially position themselves in the future. Any kind of discussion online of the future of DAOs and their benefits is also weird to take at face value, which Dan really likes to do, with his example of Twitter and Discord posts.

I know it's rigged, but it's the only game in town

And here we have our conclusion, after a very exhausting 2 hour and a half long youtube video. We hear crypto is created from a 2008 crisis and flawed system, and recreated as that same system but in a different form of more scams and wealthy and ultra wealthy people. Before we have an exciting statement he really hates the ugly ass ape cartoons.

Conclusion

So.. A very long video of a very frustrated person. So in the end is Dan right about the crypto ecosystem? He is right and also completely wrong. Let me explain. Crypto is a revolution on its own. First of all we had a moment, an invention that took place and it took a while for people to catch on what that meant. That invention inspired different kinds of people, enthusiasts, developers, investors,.. Afterwards a whole ecosystem emerged of use cases and before you know it we are here 13 years later with a history that many people still have a hard time grasping their mind around because they mostly hear about crypto when there is a time of overspeculation. This is human nature. People are not interested in normal day events, they want the stories of people making life changing money, because those are the dream stories people like to hear. Wanting to bet on the next picture that could be worth $1,000,000 is also nothing bad. As long as people take care and they educate themselves so they simply do not get scammed in the process. This is nothing different than buying a lottery ticket in real life. Having crypto being tied to value is a doubled edged sword for the ecosystem as well, because now we have this new thing that can do practically unlimited things only with the limitation of our imagination. So bad and good ideas will be created and that is the normal course of action. So as response to Dan, this has been very tiring to sit through, but a respond had to be made towards this overpessimistic view of the ecosystem.

Dan his video gets released just after the heat of a 'line goes up' year. An overhyped year, which only could come to fruition because of the work that was put in the years before it. He successfully gathers over the skeptics to his personal vendetta against crypto by just telling them what they actually want to hear, namely that everything does not make sense and that everything is a scam. The video is not only completely disrespectful, but it is also full of logical holes and misinterpretations of the crypto space.

That is why I would like to end this on a positive note, by thanking everyone that made any contribution to this ecosystem with their bests of intentions to better human kind. From the people that inspired Satoshi, to the early adopters that helped him out coding the first version of Bitcoin, to any user and creator of todays ecosystem. Keep building for a better tomorrow. Thanks!