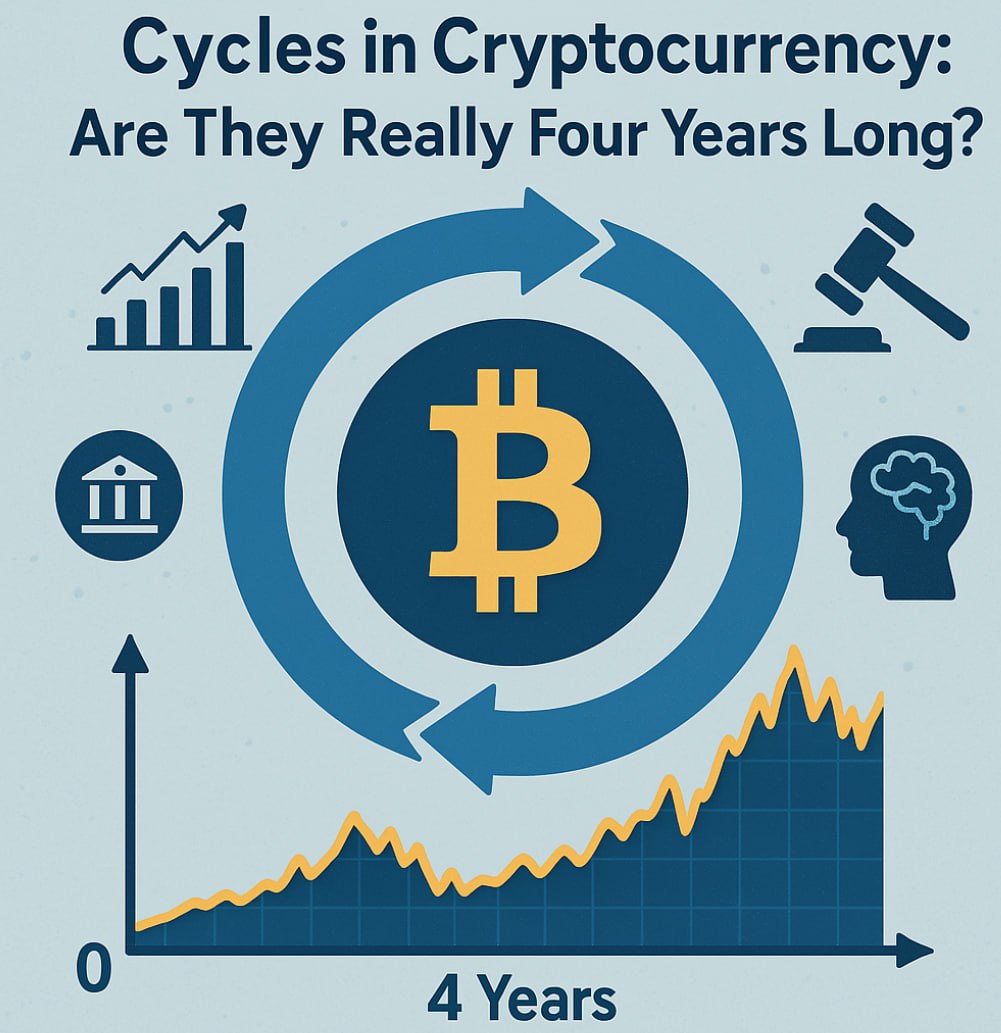

In the world of cryptocurrency, one of the most popular narratives is the idea that market cycles repeat every four years. This belief is often tied to Bitcoin's halving event — a programmed reduction in block rewards that happens roughly every 210,000 blocks, or approximately every four years. While this pattern has shown some consistency in the past, the assumption that every cycle is exactly four years long is a simplification — and potentially a misleading one. Why Do People Believe in the 4-Year Cycle?

Human beings are naturally drawn to patterns. In the chaotic and often volatile world of crypto, the idea of a predictable rhythm is comforting. It provides a framework for expectations: bear market, accumulation, bull run, and correction — neatly packed into a four-year box.

This belief is reinforced by historical data. The 2013, 2017, and 2021 bull markets all occurred roughly four years apart. To many investors, especially newcomers, this feels like evidence of a reliable cycle. In reality, it's more of a coincidence supported by confirmation bias.

What Really Determines the Length of a Crypto Cycle? Several factors influence the length and intensity of cryptocurrency market cycles:

Macroeconomic Conditions

Interest rates, inflation, and global economic events (like the COVID-19 pandemic or banking crises) play a major role in how capital flows into or out of risk assets like crypto.

Technological Development

Breakthroughs in blockchain tech, scalability solutions, and adoption of new platforms (like Ethereum L2s or new consensus models) can spark new waves of interest outside of a fixed calendar.

Regulatory Environment

Government actions, bans, or supportive regulation can drastically shift investor sentiment, extending or shortening a cycle.

Investor Psychology

Fear and greed drive markets. Social media hype, media coverage, and herd behavior can create sharp spikes or prolonged downturns independent of halving dates. Institutional Involvement

As more institutions enter the market, their strategies, risk tolerance, and long-term outlooks will gradually reshape the tempo of cycles.

Cognitive Biases at Play

The belief in rigid 4-year cycles is also a result of recency bias and pattern recognition bias. When investors experience a strong bull run followed by a crash, they look for explanations — and find comfort in past charts. This can lead to narrative fallacy, where the story becomes more important than the data. Moreover, influencers and analysts often perpetuate these cycles because predictable stories are easier to sell than messy truths.

Conclusion: Crypto Cycles Are Real — But Not Clockwork

Cryptocurrency markets do move in cycles, but they are not controlled by a stopwatch. They are driven by a complex blend of psychological, technological, and macroeconomic factors. While the four-year model may serve as a useful heuristic, it shouldn't be treated as gospel.

As the space matures and more external forces come into play, future cycles may look very different from the ones we've seen before. The next true edge in crypto investing may not be in predicting when the cycle turns, but in understanding why it turns.