This is the weekly Megascope brought to you by Dr.DODO:

- Crypto Headline

- Governance Updates

- Sector Delivery

- Data check

- CT Insights

👀 |Crypto Headline|

- Polygon launched zkEVM on July 21. It is EVM-equivalent which enables any smart contract or dev tool that you can use on Ethereum to be used on Polygon #zkEVM.

- Crypto Exchange Zipmex halts withdrawals, followed by a 40% drop in $ZMT.

- Matter Labs, the company behind zkSync announced the launch of zkSync 2.0 on Ethereum mainnet in 100 days (roadmap attached).

🗣️ |Governance Updates|

- Proof of Humanity proposed to nullify election formalities in HIP 16, which created roles for the Proof of Humanity social channels admins. Due to implementation issues surrounding quadratic voting, HIP 16 can not effectively follow due process as specified for electing or disengaging admins, thus acting as a barrier for admin changes.

- This proposal is a follow-up to previous propositions to activate the Uniswap Fee Switch. The proposal aims to clarify the fee switch's need, design, and utility and suggests testing a 10% protocol fee design on two of Uniswap's largest pools.

- Gearbox DAO aims to compensate contributors for their work over the past three months. The proposal has outlined that the ongoing contributor budget per month will be $58,200 plus extra vested GEAR per month with the current group of contributors.

🍀 |Sector Delivery|

DeFi

- Sushiswap announced a cross-chain DEX: SushiXSwap

- Ethereum stakers on Lido Finance are trading the merge for arbitrage

- Rocket Pool to Offer Staking Services in Race to Catch Lido

GameFi&NFT

- Final Fantasy NFTs coming to Polkadot in Square Enix, Enjin alliance

- Sound.xyz announcing Sound Season Three: Advancing Creative Freedom.

- Sandbox video game Minecraft to ban NFTs on game servers and derivative NFT projects

Infra

- L1 project Sui announced Sui Wallet, which serves as a reference implementation for other potential wallets & applications in the Sui ecosystem.

- Canto, a new commons powered by Free Public Infrastructure, launched devnet on July 16. The launch of LM program is delayed.

- For an overview ariticle on the 10 L1 projects building in the bear market, click https://mp.weixin.qq.com/s/lSpkeWVYUifY64Vam6mu0w

VC

- Dragonfly Capital and Infinity Ventures Crypto led $13 million in a pre-Series A funding round for XLD Finance, a cross-border DeFi tool for emerging markets.

- Crypto-Reward Ecosystem Travel Coin (TCOIN) Secures $35 Million Commitment from GEM Digital Limited.

- Meow Closes $22 Million Series A Funding. The round was led by Tiger Global, FTX etc.

✨ |Data check|

Overview of DAO Ecosystem

DAO was initially mentioned in 2016, and its activity reached the peak in 2021. As various DAO communities have sprung up, recent research discussions related to DAO governance have emerged one after another. So what is the current status of the DAO ecosystem, and what aspects to consider evaluating a DAO? Let's find out with data!

In the article Dissecting the DAO: Web3 Ownership is Surprisingly Concentrated by Chainalysis in June this year, it was pointed out that in several major DAOs, less than 1% of the holders have 90% of the voting rights. Highly centralized voting power, which can lead to decisions that contradict the principle of "decentralization".

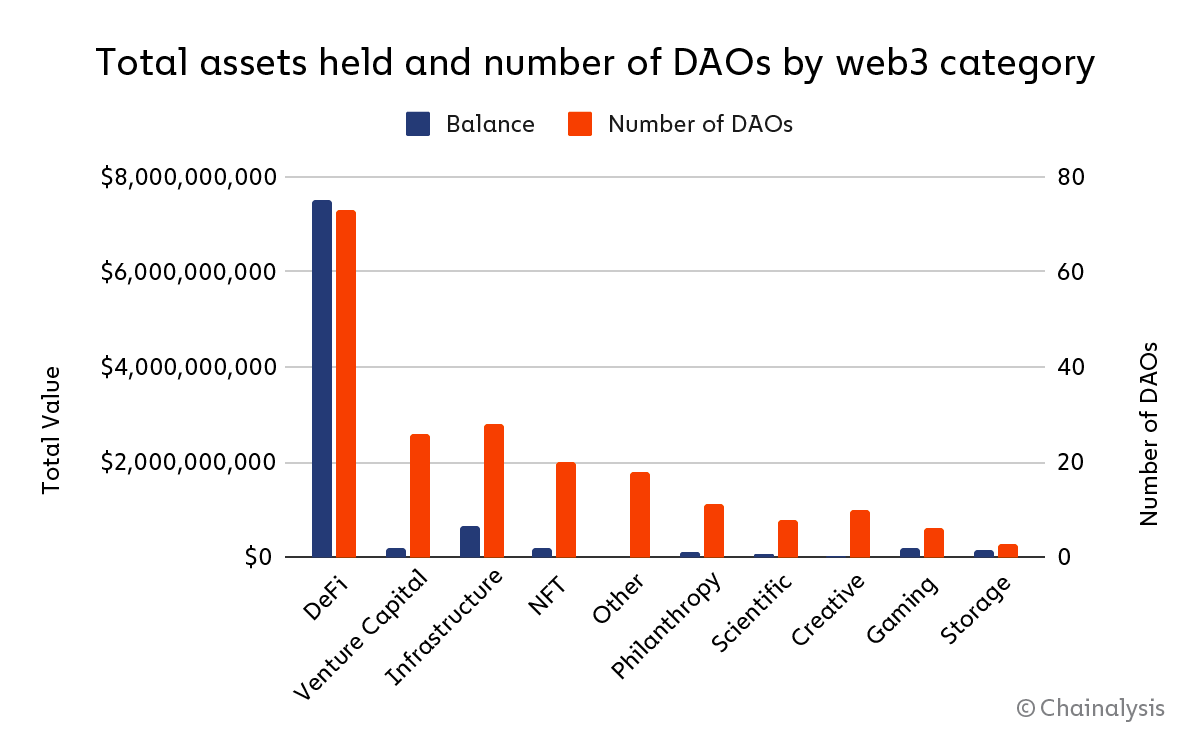

In terms of volume and capital size, DeFi-related DAOs have a huge lead. The DeFi category accounts for 83% of all DAO treasury value held and 33% count of all DAOs.

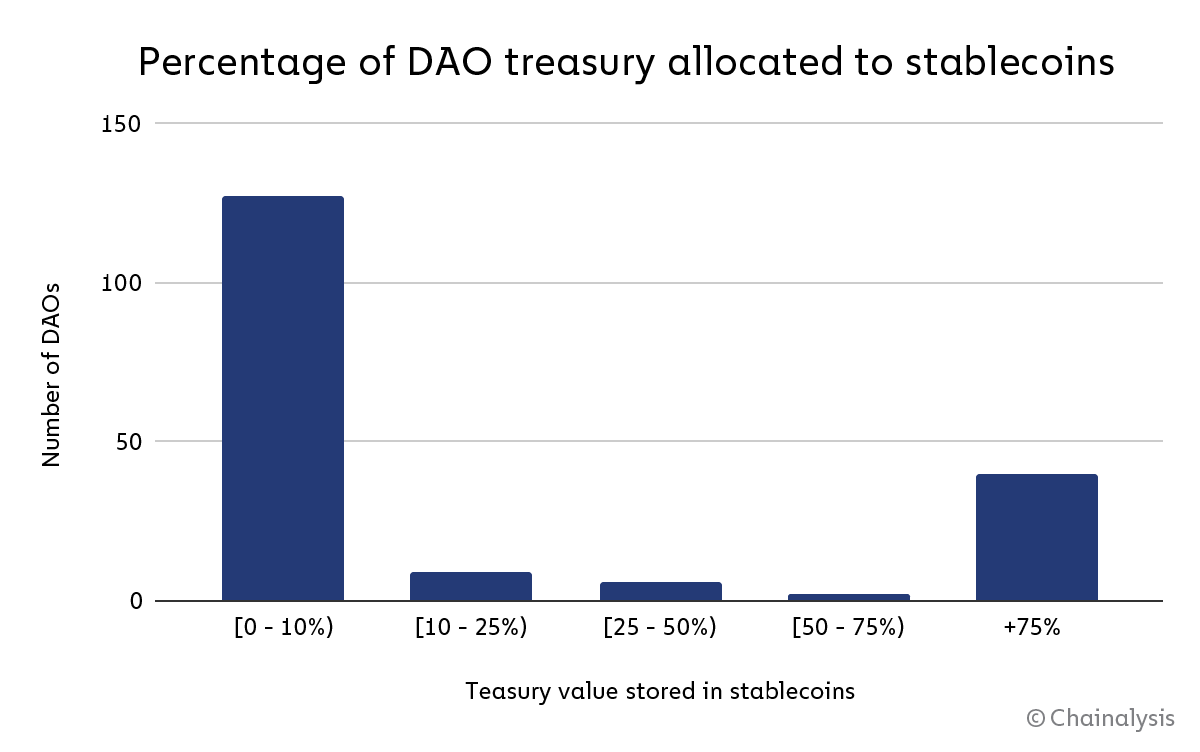

The state of DAO's treasury assets is one of the important indicators of the operation of the DAO organization. The Chainalysis survey found that in terms of token types, USDC is the most commonly held token in various DAO treasuries. However, from the perspective of asset value, the asset value of DAO is mainly concentrated in a single asset, and the value of stablecoins usually accounts for a small amount.

Undiversified DAO treasury will have huge down-side risk. The current common method of DAO to DAO asset exchange, although in some aspects, realizes asset diversification, but due to the strong correlation of crypto assets in a specific category, the performance of these DAO treasuries are not more prominent when it faces major market adjustments.

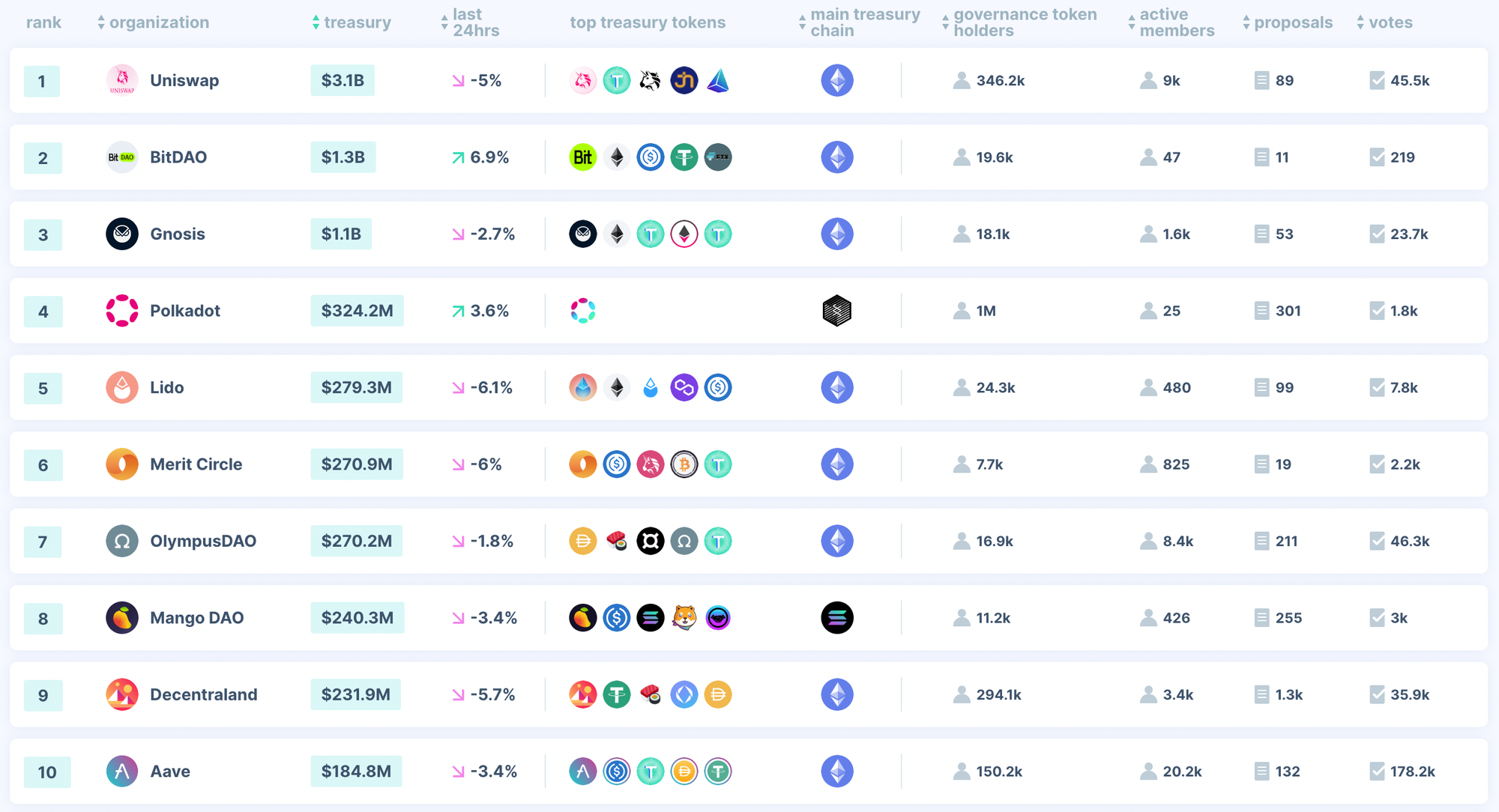

The data statistics website DeepDAO has collected statistics on 2,241 DAO organizations. According to its 07/21/2022 data records, the total treasury assets of these DAOs are about $10B, of which 18 are DAOs with AUM greater than $100M, 59 are greater than $10M, and 103 are greater than $1M. In addition, there are 3.8M governance token holders in 2241 DAOs, of which 686.5K are active proposers and voters, accounting for about 18.1%.

Through analysis, it is found that current DAOs are mainly built on the Ethereum chain. Among the top 10 DAOs in treasury assets, Olympus DAO has the highest governance activity (active users / total governance token holders) at nearly 50%, followed by Aave at 13.5%. The total number of governance users of Aave is nearly 10 times that of Olympus DAO, while the treasury is only a little more than ½ that of Olympus, reflecting Aave’s higher degree of decentralization.

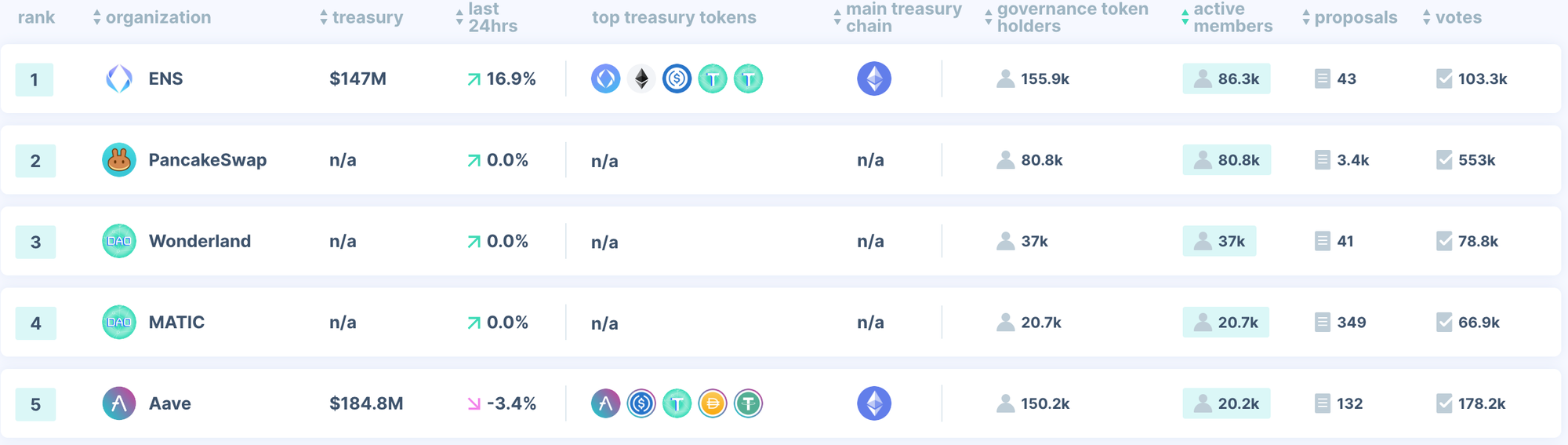

The ENS community has the largest number of active users, saying 86.3K, accounting for 55.4% of the total. The ENS community outperforms by using Orca Protocol's technology to create Pods that can be called "workgroups". The technology brings the conceptual framework of ENS DAO's workflow on chain and allows them to operate in a DAO-native way.

🎵 |CT Insights|

-

Polygon is strengthing its business development in a bear market. Here’s a recap of Polygon ecosystem brought to you by @milesdeutscher.

-

The Lightning Network offers Bitcoin holders a risk-free way to returns. Amboss’s Magma and Lightning Labs’ Lightning Pool allow users to buy and sell liquidity, offering higher yields than Lightning Pool:

-