DODO #Megascope brings you this week’s Highlights:

-

Arbitrum to launch token $ARB

-

Radiant V2 went live

-

DeFiLlama team fracture

-

Data Check: zkSync and Starknet performance after Arbitrum token launch

👀 Weekly Digest

DeFi

Abitrum Token Launch

The Arbitrum Foundation announced this week that its governance token, $ARB, will be airdropped to community members on March 23, with a snapshot date of February 6, 2023. The token issuance has aroused great response from the community, the number of Arbitrum transactions has skyrocketed, and the TVL of the entire Arbitrum ecosystem has stopped falling and started rising, exceeding $2 billion. The release of $ARB will also mark the transition of Arbitrum to a DAO.

Token Distribution

As the governance token of Arbitrum, $ARB has a total distribution of 10 billion. Arbitrum Foundation will airdrop 11.62% of tokens to individual wallets. The DAO treasury will be allocated 42.78% of the tokens, which will be used according to $ARB holders‘ vote. The Arbitrum ecological DAO will get 1.13%, investors will get 17.53%, and the team and advisors will get 26.94%.

Influence of Token Launch

-

The announcement first led to an increase in the entire Arbitrum TVL and transaction volume. After the issuance of $ARB on March 23, it is expected to enter rapid growth, and the protocols within the ecosystem will also benefit from this airdrop.

-

Arbitrum transitioned to the form of DAO, which is more open and transparent, and the overall operation will enter a new stage.

-

The issuance of $ARB directly drives the growth of the entire Ethereum L2. The number of transactions on L2 that does not have a token has also risen due to airdrop expectations. This part is explained in detail in the Data Check section.

-

The entire market still lacks sufficient liquidity. The issuance of $ARB may absorb liquidity in the market. According to the current valuation, the market value of $ARB may be 500-2000 million U.S. dollars, which will be absorbed in the short-term working capital.

-

On March 22, the Federal Reserve will discuss interest rates, and Arbitrum will issue tokens one day after the interest rate adjustment is finalized. There are two situations. If the Federal Reserve raises interest rates by 25 bp and below, which is in line with market expectations, the entire market will recover, and Arbitrum will issue tokens more smoothly. If the Federal Reserve raises interest rates by 50 bp, which exceeds market expectations, the stock market and the banking industry will be affected, and the tight market liquidity situation will further deteriorate, and Arbitrum’s token issuance may be affected. At present, the market generally predicts that the Fed will raise interest rates by 25 bp.

Valuation of $ARB

-

There are currently many ways to value $ARB in the market, and some traders conduct off-exchange transactions.

-

At present, according to the situation of over-the-counter transactions, the valuation of $ARB is similar to that of MATIC and OP. The ratio of FDV (fully diluted market value) to TVL of the latter two is around 10. According to this ratio, $ARB’s circulating market value is about 2.2 billion US dollars, and the price of tokens is 1.7 US dollars. However, the price of OTC transactions is significantly lower than the price calculated by this method. There will be initial selling pressure. It is also expected that the circulating market value of $ARB will be similar to that of OP.

-

A valuation of $ARB is of little significance at this stage, unless traded off-exchange. For users or individual investors, what needs to be considered is whether they want to sell the airdrop tokens in their hands immediately and if they want to sell them, what is the expected price. In the long run, the narrative and development of L2 will continue. It will only be a matter of time before the number of Arbitrum transactions continues to exceed the Ethereum Mainnet, and the value of $ARB will also be greatly improved in the long run.

Radiant V2 Officially Launched.

Radiant V2 is officially launched, opening the migration channel, allowing users to migrate RDNT tokens in the ERV-20 format of the V1 version to RDNT tokens in the OFT format of the V2 version.

Market Performance

After the launch of Radiant V2, the TVL has risen sharply. As of press time, the TVL has reached 275 million US dollars, making it the second protocol in the Arbitrum ecosystem TVL, second to GMX.

-

The circulation of RDNT has decreased and the currency price has risen. At the beginning of the migration, due to the lack of liquidity in the new currency pool, some arbitrage behaviors occurred.

-

Staking RDNT to obtain dividends and token incentives has a high APR return, which is an important reason for attracting users to stake, and the current APR is still at a high level.

Product Features

-

The interesting feature of Radiant's V2 is the one-click loop. The APR of more than 100% has attracted many users to deposit collateral for loop.

-

Radiant currently supports full-chain lending and is expected to be deployed to BNB Chain this week.

-

Users deposit mortgage assets to obtain income, and loop can increase income, but if you want to obtain token rewards, you need to stake RDNT's LP token, dLP. Each position needs to lock at least 5% of dLP to obtain the reward, and the longer the staking time, the higher the dividend multiple and the higher the APR.

Opportunities & Risks

-

Radiant V2's complex staking lock-up and revenue distribution mechanism has aroused some doubts from the community. This mechanism is actually a flywheel to reduce the circulation in the short term. The more people stake to lock, the higher the token price, and the higher the APR directly related to the currency price, the more people enter the protocol to stake. At present, the flywheel has started, and the superposition of BNB Chain will bring new mortgage assets and new liquidity expectations. There may be certain speculative opportunities, but be careful of risks.

-

The risk point of Radiant V2 is that, first, most of the APR comes from the release of tokens, which is strongly related to the token price. If the token price drops, the APR will be greatly affected, and the reverse flywheel may drive more Selling; second, the withdrawal of user reward needs to be vested after 90 days, not immediately unlocked, and the lock-up time of dLP is longer, the income of these tokens can not be immediately cashed, so there is greater uncertainty; third, when users loop, collateral-based returns are negative and risky.

DeFiLlama Team Fracture

This weekend, the DeFiLlama team had a disagreement over the issuance of tokens.

-

Previously, the founder of DeFiLlama, the core developer 0xngmi, and another founder did not reach consensus on the issuance of tokens, and decided to fork the DeFiLlama product. Another founder, who controls the Twitter account and the Defillamma domain name, decided to issue governance tokens.

-

The next day, the DeFiLlama team stated that due to poor communication and misunderstandings within the team, the DeFiLlama team apologized for the incident that happened yesterday. There are currently no plans to issue LLAMA tokens, any airdrops will be discussed with the community and the team will strive to operate in a more transparent manner to ensure this does not happen again.

The underlying reason behind this event lies in the profitability of DeFiLlama products. DeFiLlama has been unable to find a source of profit for a long time, and the founders are eager to find a way to realize it.

So does DeFiLlama have the conditions to issue coins? Obviously not. DeFiLlama is a data website. There is no protocol revenue, and there is no perfect business model. Governance tokens do not help or improve this product. DeFiLlama should find its own profit-making method or a sound token launch plan.

It is a pity for the community that the product itself is affected due to disagreements among team members, and from this perspective, a team or DAO that focuses on governance from the beginning may have been a better path.

Datacheck

Last week, Arbitrum announced that it will issue $ARB on March 23, which once again stirred discussion on token airdrops and the rush to find the next potential project to earn token rewards. So Today’s #DataCheck takes a look at the data performance of zkSync and Starknet, the other two Layer 2 projects with high potential of token airdrop, after $ARB.

1/ About on-chain activity

-

In the past week, among all Layer2 projects, zkSync Lite and StarkNet have achieved more than 4 times and 3 times growth respectively, surpassed Arbitrum;

-

TPS of zkSync Lite reached a highest record in the history, which was 2.17 on March 19;

-

StarkNet’s TPS also reached an ATH of 1.07 on March 19.

2/ TVL

ZkSync’s TVL has increased by 10% since March 16th and currently stands at $72 million;

Starknet’s TVL has increased by 32% since March 16th and is $11.28 million now;

Considering the overall rise in the market during this period, the increase in TVL is not prominent.

3/ Token Deposits Txs from Ethereum

-

Token Deposits Txs from Ethereum to zkSync Lite & Starknet have increased significantly since March 16, and reached a peak on March 19;

-

Most of the cross-chain token transactions are ETH, and a small amount of transactions are ERC20;

-

ZkSync reached 18,724 txs and Starknet reached 8,393 transactions on March 19.

4/ Unique Address from Ethereum

-

Since March 16, the number of unique addresses has increased significantly, reaching a peak on March 19, with ZkSync Lite at 17,012 and Starknet at 8,572;

-

Cumulative Unique Addresses of ZkSync Lite reached 600k in the latest week and Starknet reached 155k, nearly one quarter of ZkSync.

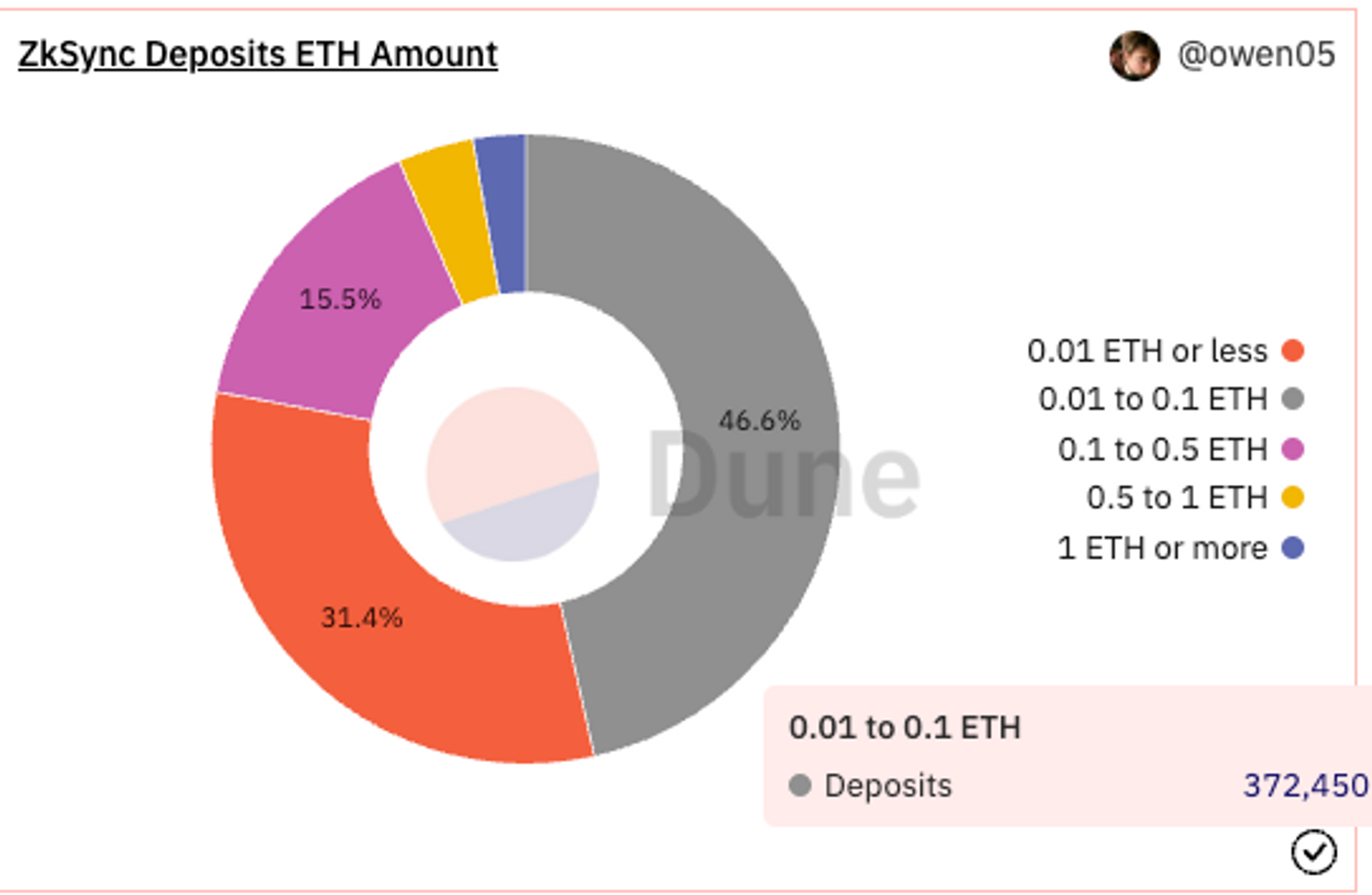

5/ Deposits of ETH Amount

-

0.01 to 0.1 ETH accounts for the most deposits in both networks;

-

The proportions of below 0.1 ETH transactions in both networks are close, which are nearly 80%;

-

The proportion of more than 1 ETH is less than 3%, which is very small.

6/ About ZkSync era

Note: zkSync 2.0 is now zkSync Era, and zkSync 1.0 is now zkSync Lite

zkSync Era only allow registered projects to deploy and test their dapps on zkSync Era. So there's no significant change in growth right now.

🚄 Bullet News

Infrastructure

- Lido V2 is launched on the testnet and tested to use SSV Network's DVT (Distributed Verification Technology) to improve the centralization of node verification.

Market

-

ParaSpace was attacked, and the project team suspended the protocol. After that, BlockSec assisted in preventing an attack from happening and recovered more than 2,900 ETH. Paraspace has proposed compensation measures, and affected users can obtain NFT, which can be exchanged for tokens in the future. The team stated that the security patch has been launched, and the protocol will be restarted in batches before March 25.

-

Space ID is launched on Binance Launchpad and airdropped tokens. The release cycle of the community airdropped tokens is 30% of the tokens will be unlocked online, and the rest will be released linearly every month in a two-year cycle.