Part 1. DEX Updates

— Key Takeaways —

💡 The QuickSwap community voted to support the adoption of the V3 "centralized liquidity" model, which will be developed by the Algebra team.

💡 Sushiswap has partnered up with Kava Network, and will be deployed on Kava Network, giving away $14 million in token incentives.

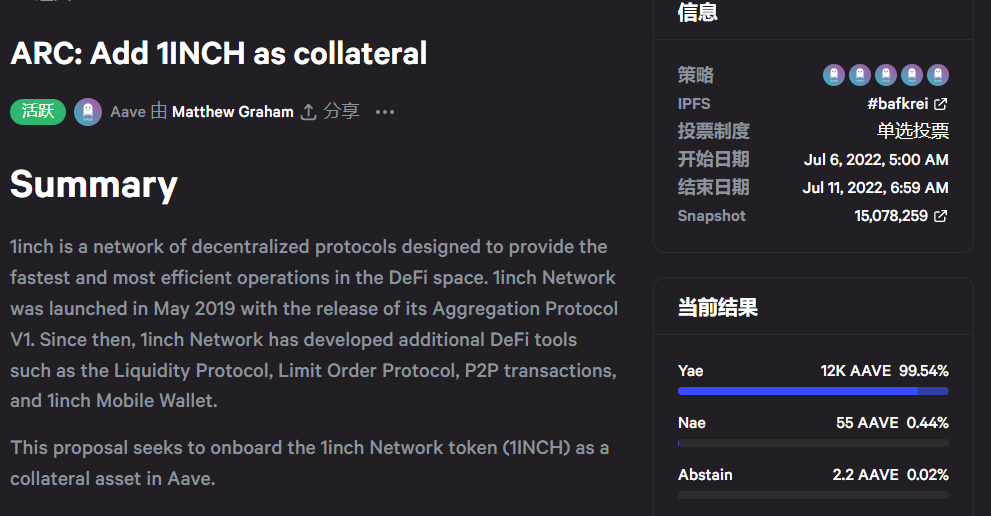

💡 AAVE launches a poll on Snapshot to decide whether to stake $1Inch tokens as collateral.

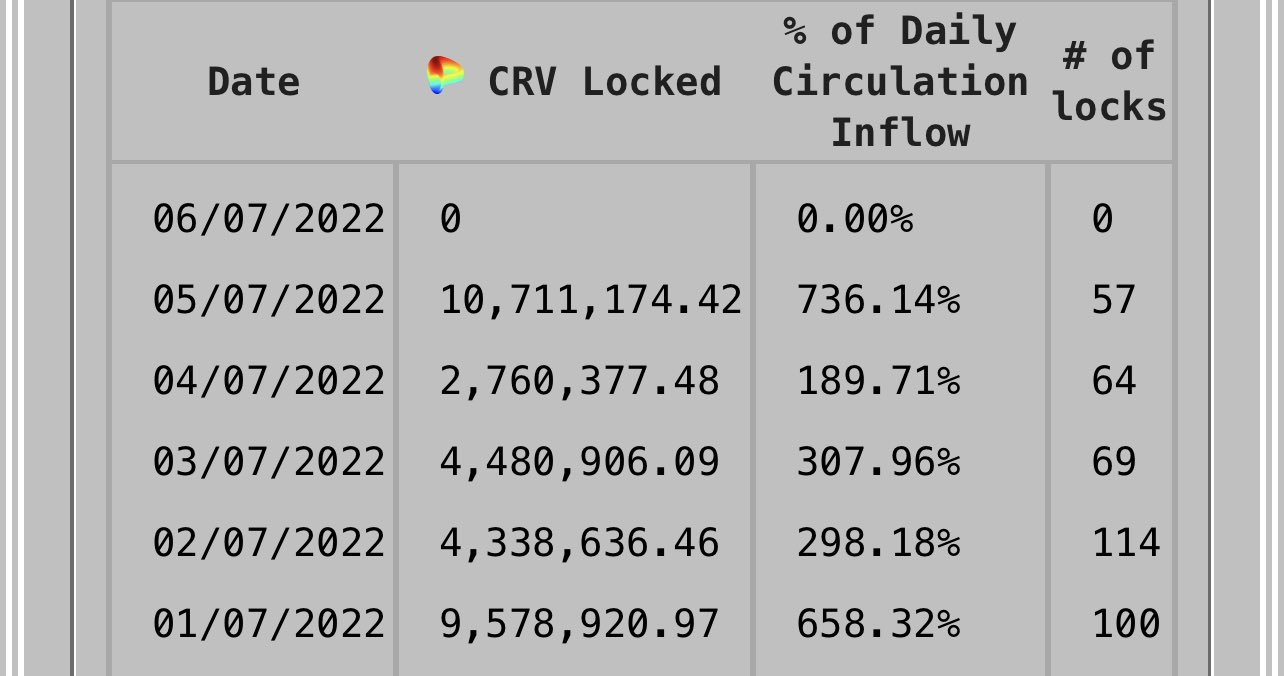

💡 For five consecutive days from July 1 - July 5, the daily lockup volume for CRV was greater than the daily release volume, the largest daily lockup volume since August 14, 2020.

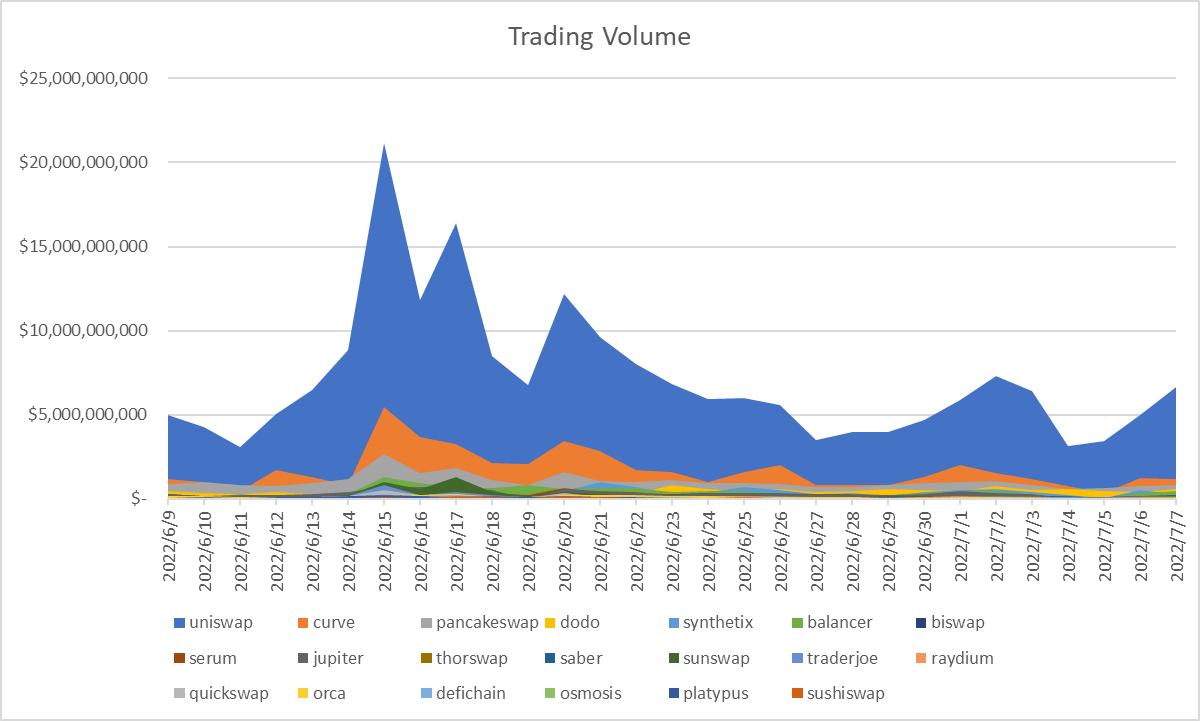

💡 The overall market volume picked up this week compared to last week, with the better performing exchanges being DODO, Thorswap, Defichain, and Sushiswap. Jupiter however, did not perform as well.

— Dex Closeup —

Paraswap

- Partnered up with ZenGo Wallet for a joint campaign. Users can use ZenGo Wallet to trade on Paraswap and the top 500 users in terms of trading volume will each receive $50 in ETH.

- A partnership with fiat currency trading platform Ramp, and the trading API is provided by Paraswap.

QuickSwap

- The community polled to support the addition of a separate loan marketplace.

- 99.98% of QUICK and dQUICK holders voted in favor of the V3 "Centralized Liquidity" model. The " Centralized Liquidity" model will use Algebra's V3 model, developed by the Algebra development team.

SpookySwap

- Initiated a proposal to apply for new market making capital for $BOO to launch on a second primary market centralized exchange, the capital will be used to cover listing fees as well as market making.

Sushiswap

- In partnership with Kava Network, Sushiswap will be deployed to Kava Network with a planned $14 million token incentive.

— Market Overview —

TraderJoe

- Teased new JOE V2 feature, the Liquidity Book function.

1inch

- AAVE launches a poll on snapshot to decide whether to add $1inch tokens as collateral.

Curve

- Polled to approve a sETH pool gauge to the Optimism network.

- For five consecutive days from July 1 - July 5, the daily lockups for CRV was greater than the daily emission, the largest daily lock period since August 14, 2020.

Part 2. Data Tracking

Trading Volume and Market Share Analysis

In terms of trading volume, the overall market was up this week compared to last week. The best performers were DODO, Thorswap and Defichain, all of which saw significant increases. The rest of the better performing exchanges were Balancer, Raydium, and the worse performing exchanges were Sushiswap, Uniswap, etc.

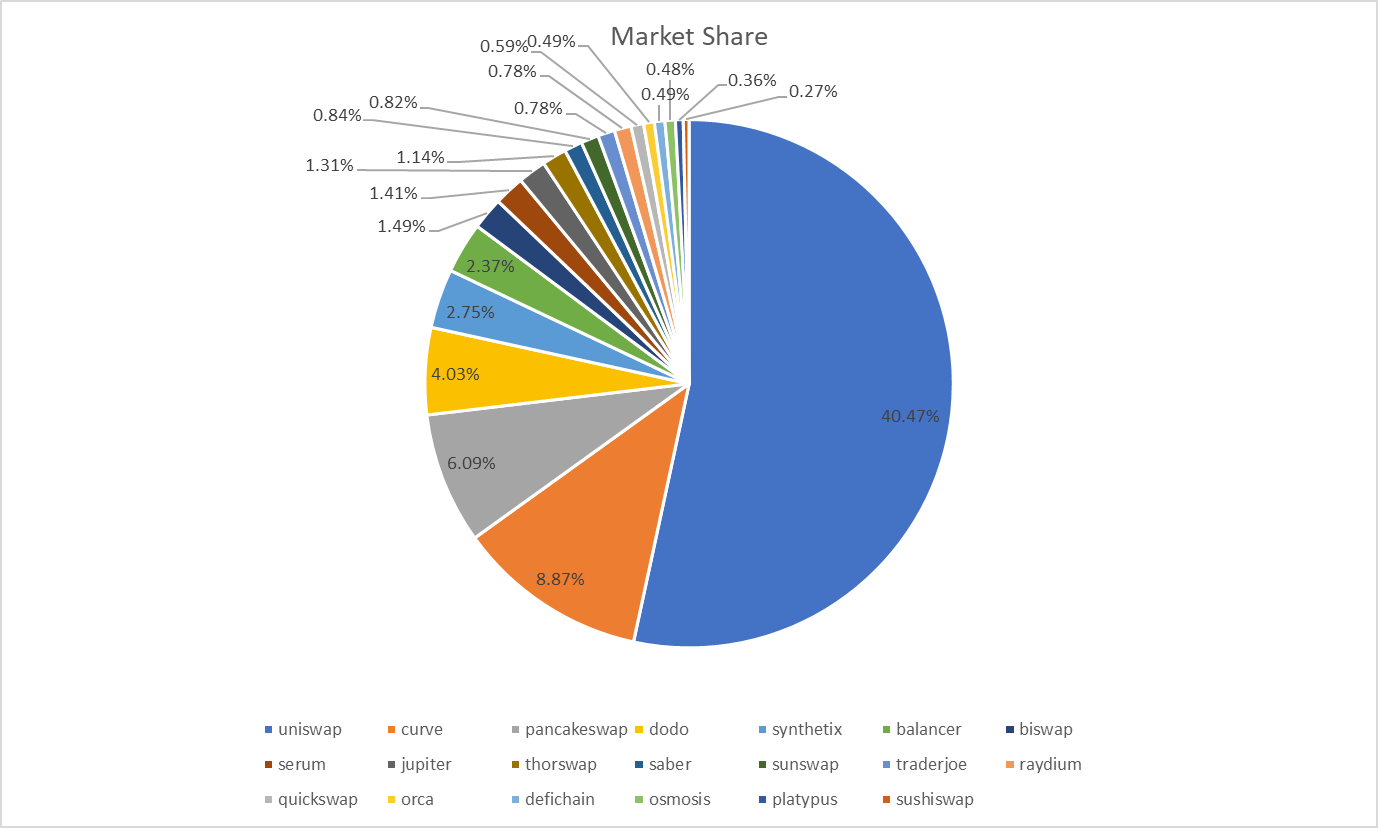

In terms of market share, the top three DEXs were Uniswap, Curve, and Pancakeswap, which saw their relative shares decline. The poor performers were: Sushiswap, Jupiter.

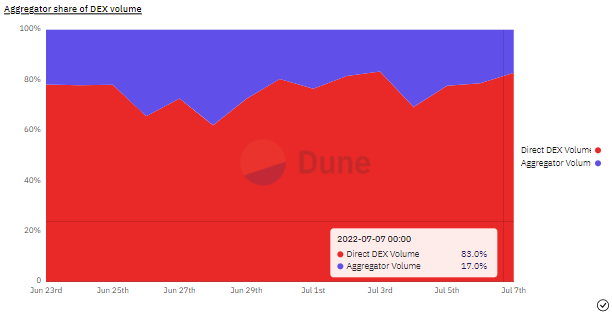

The market share of aggregators on ethereum increased compared to last week, from 18.3% to 21.35%.

Whale Watch

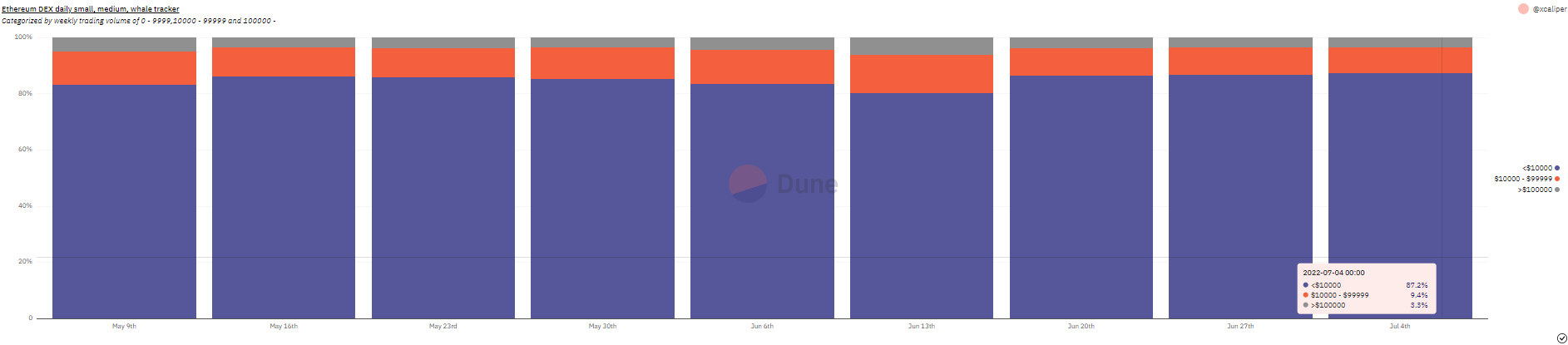

This week's Whale trades on ETH had minor changes compared to last week, with small to large sized trades remaining more or less the same.

Part 3. Project Analysis

Maverick

- Maverick is a new DEX in beta that is currently deployed on the Ethernet test network.

- Maverick features the Maverick AMM mechanism. This mechanism has been tested and it has proven to provide lower slippage, less transaction fees and protection against infrequent losses, resulting in a better trading experience for users.

- The new mechanism proposed by the project can improve the efficiency of users' funds, in addition, users do not need permission to build liquidity pools.