*中文版请查看/ Chinese Version is below:

In less than a decade, the decentralized exchange (DEX) went from a paper idea to a budding technology and, ultimately, a fountain of money for the crypto empire. Money flew in and out of here. The popularity of DeFi in 2020 made more people realize the importance of on-chain transactions, and the DEX technology also started rapid iterations repeatedly.

If you want to look at the pattern of the DEX today, you can find three branches from the trading pattern. The earliest exploration came from DEX, led by the Orderbook pattern, which solved the problem of slow on-chain transactions in the form of off-chain hosting and transaction matching. Later, the Automated Market Maker (AMM) model accounted for half of the market. More people stepped into the crypto market under the lure of low barriers and high returns provided by algorithms. With the increase in market transaction demand, DEX, an aggregator, has become another emerging force under the GAS fee surge and multi-chain and cross-chain expansion of Ethereum.

Let's take a look at the seven key events from 2014 to now, how DEX has achieved germination and innovation from the aspects of technology, traffic, and gameplay, and how wealth and rights have undergone paradigm shifts behind the dream.

1. Knock Knock: The Counterparty contract opened the door to dreams

In 2014, DEX's dream door opened. The Counterparty contract was the first to appear on the script of decentralized trading. It brought reality to the blockchain, providing the masses with token offerings, on-chain betting, and on-chain transactions based on the Bitcoin network.

However, when Alibaba went public in the United States, Didi and Kuaidi were engaged in a money-burning war in 2014, and the Internet swept the human race at the height of the storm. The public was addicted to the Internet effect and rushed to catch up with a wave of dividends. In this era, when WeChat was not as popular as today and WeChat Payment was not in sight, decentralized transactions only belonged to the entertainment of concept lovers in a small circle. Though it hadn't made waves yet, Counterparty remained a valuable technological mark in Ethereum's history and a cornerstone of technological innovation in on-chain trading.

That year, you could successfully ditch the traditional sports betting platform and use Counterparty Excitement to bet on the FIFA World Cup Brazil outcome. Even more exciting was the innovation of Counterparty DEX. All Counterparty tokens were tradable on DEX, a bitcoin-based network.

The Counterparty protocol opened the door to a new paradigm of on-chain trading with technological innovations.

2. From user to contract: An exploration of the on-chain order book model

With on-chain trading proven to work, the DEX protocol methodically fumbled toward order books used by exchanges. A novel decentralized fundraising model driven by the crazy expansion of the Internet generated another wave of funding in 2017, with new projects successfully funded with just a few pages of white paper. In the first half of this year alone, the financing scale of mainland ICO projects reached 2.616 billion Chinese Yuan. The market heat rose dramatically, and countless gold prospectors poured in. The impetuous summer of bubbles eventually passed after the policy came into play. ICO left a mess.

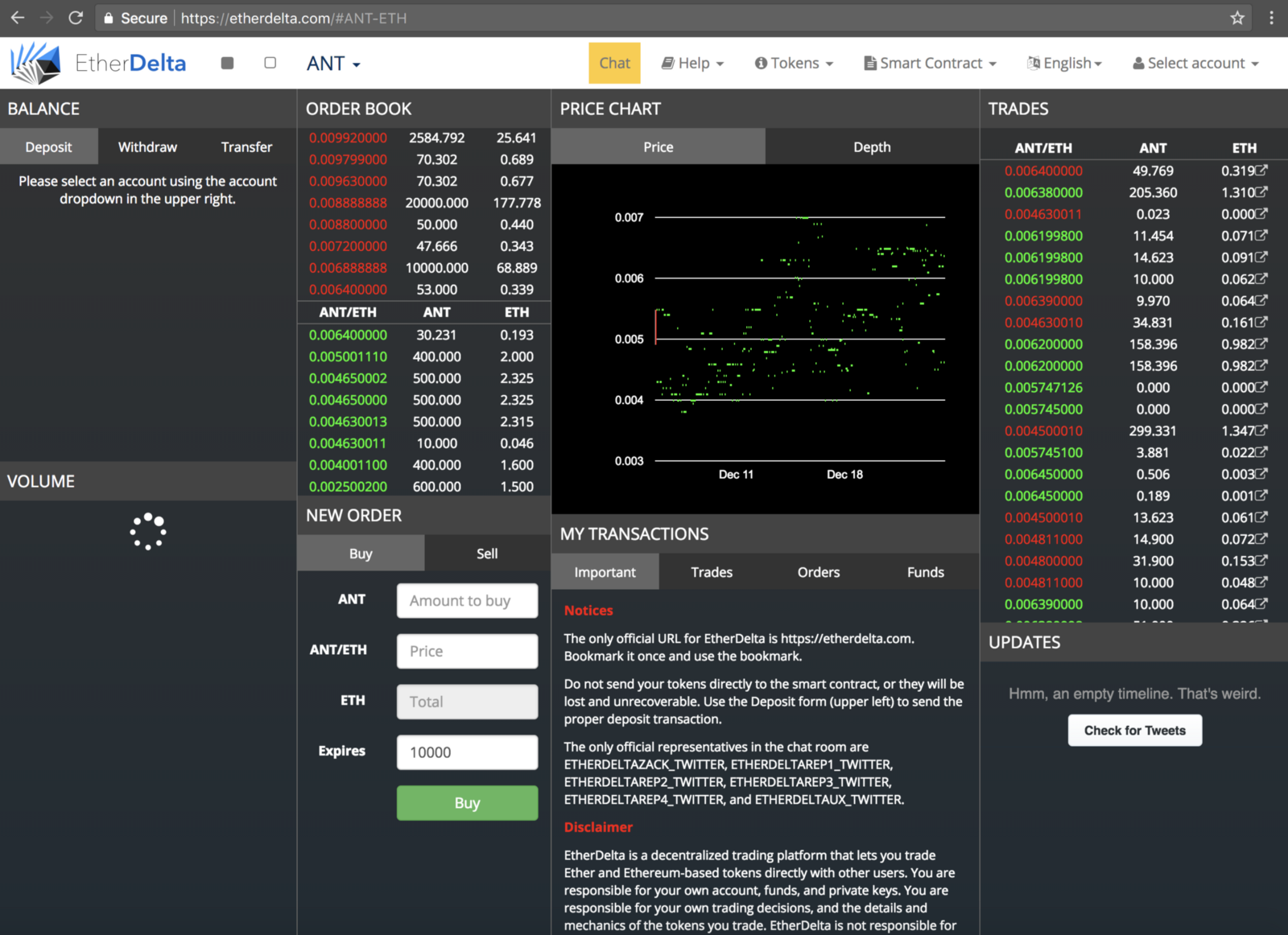

The market cooled rapidly, but decentralized trading did not stop. At this stage, DEX began its next journey from user to contract model. From IDEX, EtherDelta to 0x Protocol, many DEXs explored and implemented the encryption mapping of traditional financial transaction mode repeatedly around the form of an on-chain order book.

Let's start with IDEX. It is essentially an optimized simulation of the Counterparty protocol on Ethereum. IDEX orders are centrally packaged by off-chain servers and then submitted to the Ethereum network. This model of unmanaged exchange with a central entity reduces decentralization.

The original DEX represented EtherDelta adopting an on-chain order book and settlement model. Subsequently, EtherDelta's 0x Protocol implemented better encoding and additional functionality, making it possible to implement on-chain settlement and off-chain order book logic. Under the 0x Protocol, anyone can maintain an order book and become an off-chain matchmaker, while market makers can set their transaction management fees.

When EtherDelta accounted for nearly 40% of all DEX transactions on Ethereum and was sitting on its head seat, the darkest moment for all DEX's quietly arrived. On a single day in December, two hackers stole nearly $1.4 million from EtherDelta users by changing the domain name settings. Until 2021, the U.S. government was still soliciting information from victims of hacking attacks.

This series of hacks changed the course of history, as the loss of users and transactions made EtherDelta unattractive and eventually became the guinea pig of SEC (U.S. Securities and Exchange Commission) for a less-decentralized DEX trading law.

In a low liquidity market, the order book model of price discovery failed to take the spotlight, and in the years that followed, it almost came to a halt without much innovation.

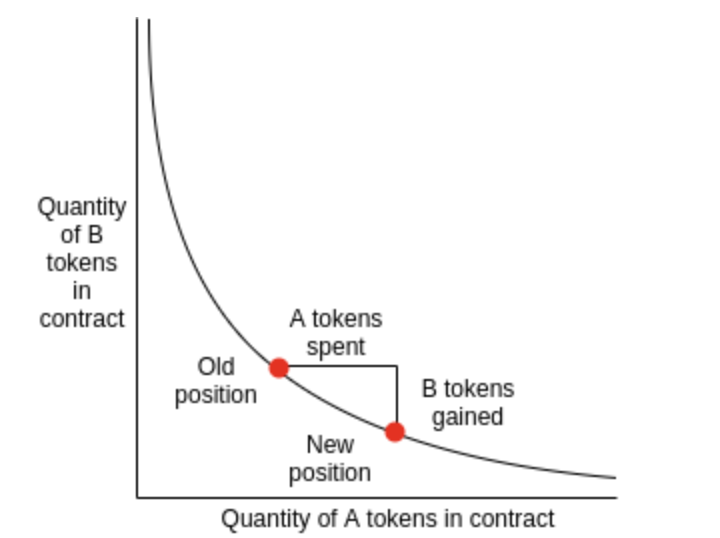

When the market turned into a bear market, DeFi was experiencing a period of relative calm. DEX protocols laid the foundation around Vitalik's idea of the x∗y = k curve, and a high-rise building is about to appear on the page.

3. AMM's first milestone, the runaway Uniswap

In August 2018, AMM (Automated Market Maker), which rewrote DEX's trading model, was born in Bancor's podcast article.

Bancor pioneered AMM, but unilateral liquidity improved the user experience but failed to attract users. Bancor suffered from low yields, low liquidity, and high slippage.

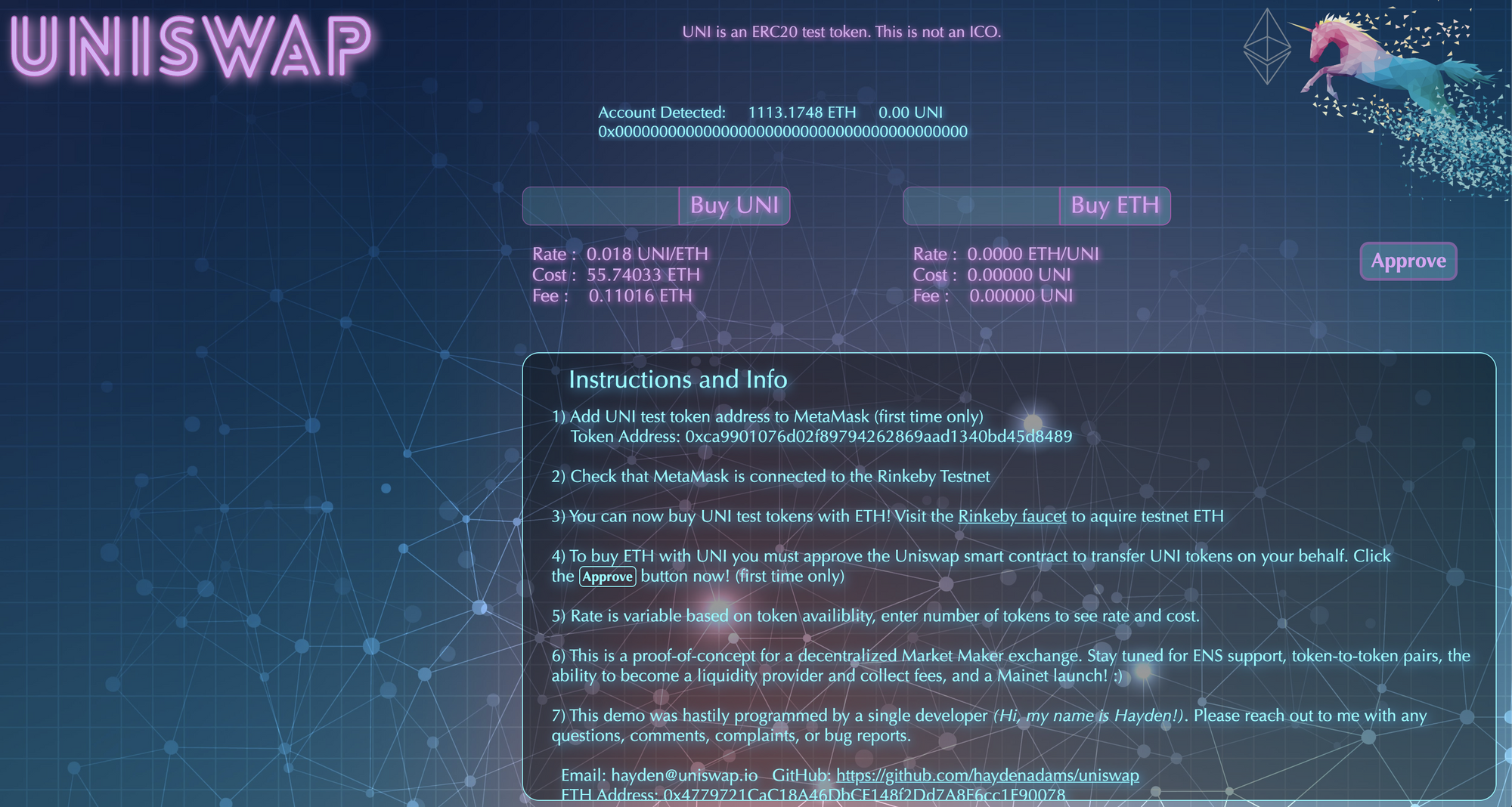

Uniswap brought the simplicity and composability of the AMM to public awareness.

In 2017, Hayden Adams completed a proof of concept, and this was where Uniswap started.

On November 2, 2018, Uniswap released the initial version on the Ethereum main network. In contrast to EtherDelta, Uniswap built the concept of liquidity pools and automated market makers on a user-to-contract model. Uniswap had a lower transaction cost than Bancor, although the mechanism was similar.

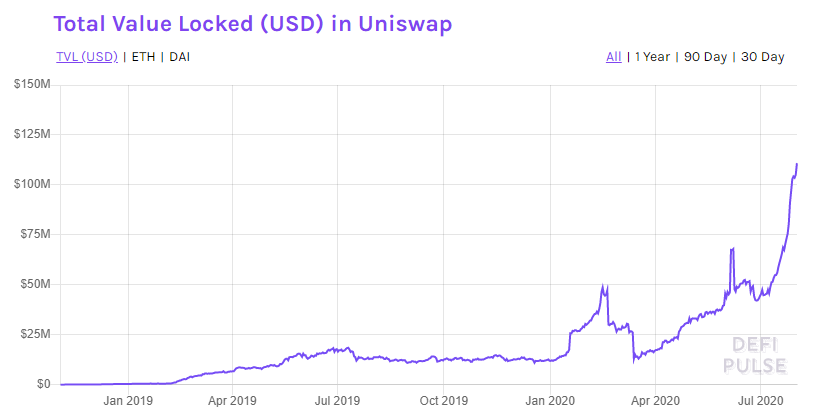

Uniswap defeated Bancor for the first time in February 2019. Uniswap quickly gained ground as trading volume surged. Its constant product algorithm x*y = k represented a new turn of DEX Market: CFMM (Constant Function Market Maker), a popular AMM algorithm. Uniswap became the leader of DEX, and TVL is still doing well today.

In May 2019, upstart dYdX started building a trading system based on the order book model. Then, dYdX targeted the perpetual contract market, and it adopted the order book model to match leveraged trading as its strategy, equipped with the low gas and high-speed trading brought by the StarkEx engine. Eventually, it quickly took over the derivatives market.

This excellent knight broke new ground in the DEX market for the weak order book model.

4. The liquidity debate that started with a tweet

The global COVID-19 pandemic in March 2020 exacerbated the market panic, with ETH prices plummeting by more than 30% in less than 24 hours. UMA and Compound started the myth of building wealth in the Summer that followed and kicked off DeFi Summer. In July, When Yearn Finance went live, Andre Cronje distributed the governance token YFI to the Yearn community, which was fully distributed through liquidity mining. This model won strong support from the DeFi community, and funds flowing into the incentive liquidity pool were locked up with over $600 million. DeFi market rose rapidly and stood out. DeFi tokens kept setting new highs, and high rewards attracted batches of users to enter the market crazily.

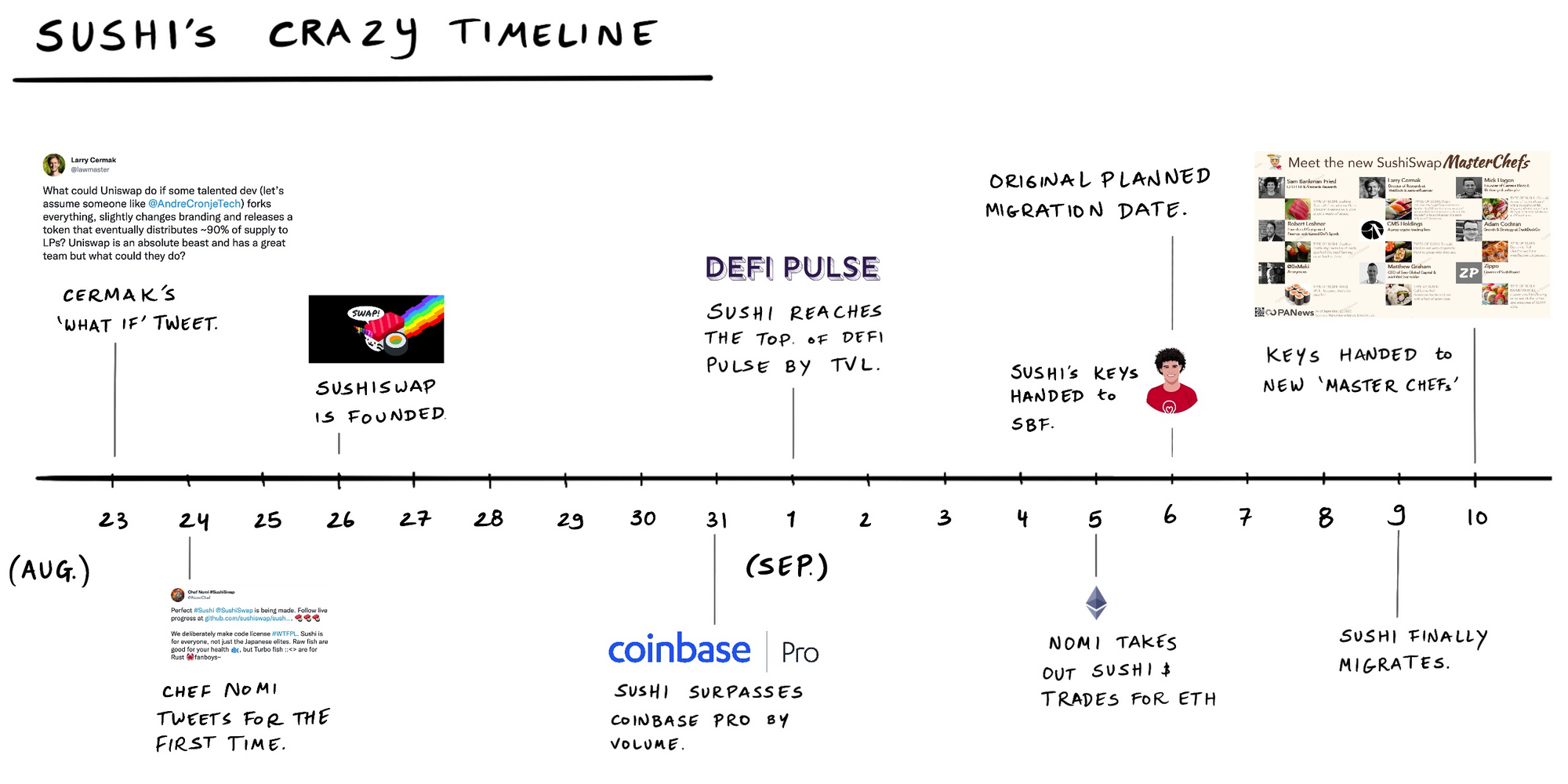

At the moment, Larry Cermak might not have thought that he would become the director of Chen Kaige of crypto goods. A tweet instead of a steamed bun caused DEX liquidity "murder."

The movie's first shot began with a tweet from Larry Cermak on August 23, 2020, imagining the chemistry of forking Uniswap with a token that allocates 90% of the supply to LPs.

Two days later, the man of the hour arrived. Chef Nomi's Tweet told the public: Perfect SushiSwap was being made! Like Nomi, a Hearthstone moniker, SushiSwap was playful, unique, and toxic, with an easy-to-pick-up, easy-to-copy gene from the beginning and brand culture that emerged.

It's hard to imagine, but SushiSwap robbed Uniswap of nearly 53% of its liquidity in three days with vampire attacks.

Why Sushiwap is a clone of Uniswap and why vampire attacks are always mentioned, look at its business model:

- Select Uniswap Capital Pool to provide liquidity and will receive "UnisWAP-LP-pool-tokens" to represent the share of the liquidity provided in the capital pool;

- Pledge those "Uniswap-LP-pool-tokens" to SushiSwap contracts, and SushiSwap will distribute SUSHI Tokens on a proportional basis, and then these SUSHI Tokens will go to market for circulation;

- At a particular moment, SushiSwap's smart contract will convert all pledged Uniswap-LP-pool-Tokens into SushiSwap-LP-pool-Tokens and redeem all pledged assets in Uniswap Pool. And put them in the same pool as SushiSwap.

Uniswap LPs got rewarded only the 0.3% transaction fee for the liquidity. Before Uniswap launched the token, SushiSwap made an early strike wisely and chose to distribute it through governance token SUSHI distribution. SushiSwap knew the little ledger in the mind of every on-chain speculator─a trade where the money was good.

According to Nomi, Sushiwap passed on a 0.25 percent fee to the LPs and another 0.05 percent to its token SUSHI holders. Continuous reward distribution plus token governance binds LPs to the protocol itself, becoming a community of long-term interests. High yields encouraged profit-seekers to drain liquidity from Uniswap to SushiSwap. In the end, SushiSwap's smart contract got rewarded with nearly $2 billion in "Uniswap-LP-Pool-Tokens."

When we were marveling at the greatness of SushiSwap and exclaiming that Uniswap, the DEX winner, was about to be eaten away by encroachers, the plot took a turn for the better. SushiSwap tower teetered and suddenly collapsed.

Just like the beginnings of SushiSwap and the mystique of his stage name, Chef Nomi made another unexpected move on September 5.

He sold his entire SUSHI token, worth about $14 million.

The market felt betrayed. Chef Nomi went to the community to explain that instead of selling money and "absconding," he focused on moving to new platforms. In disbelief and anger, Chef Nomi "voluntarily" labeled as a traitor could not be removed, despite posting confessions on Twitter, handing over the project's private key to SBF, and returning the sale funds to the Treasury the next day.

He then disappeared from SushiSwap's project.

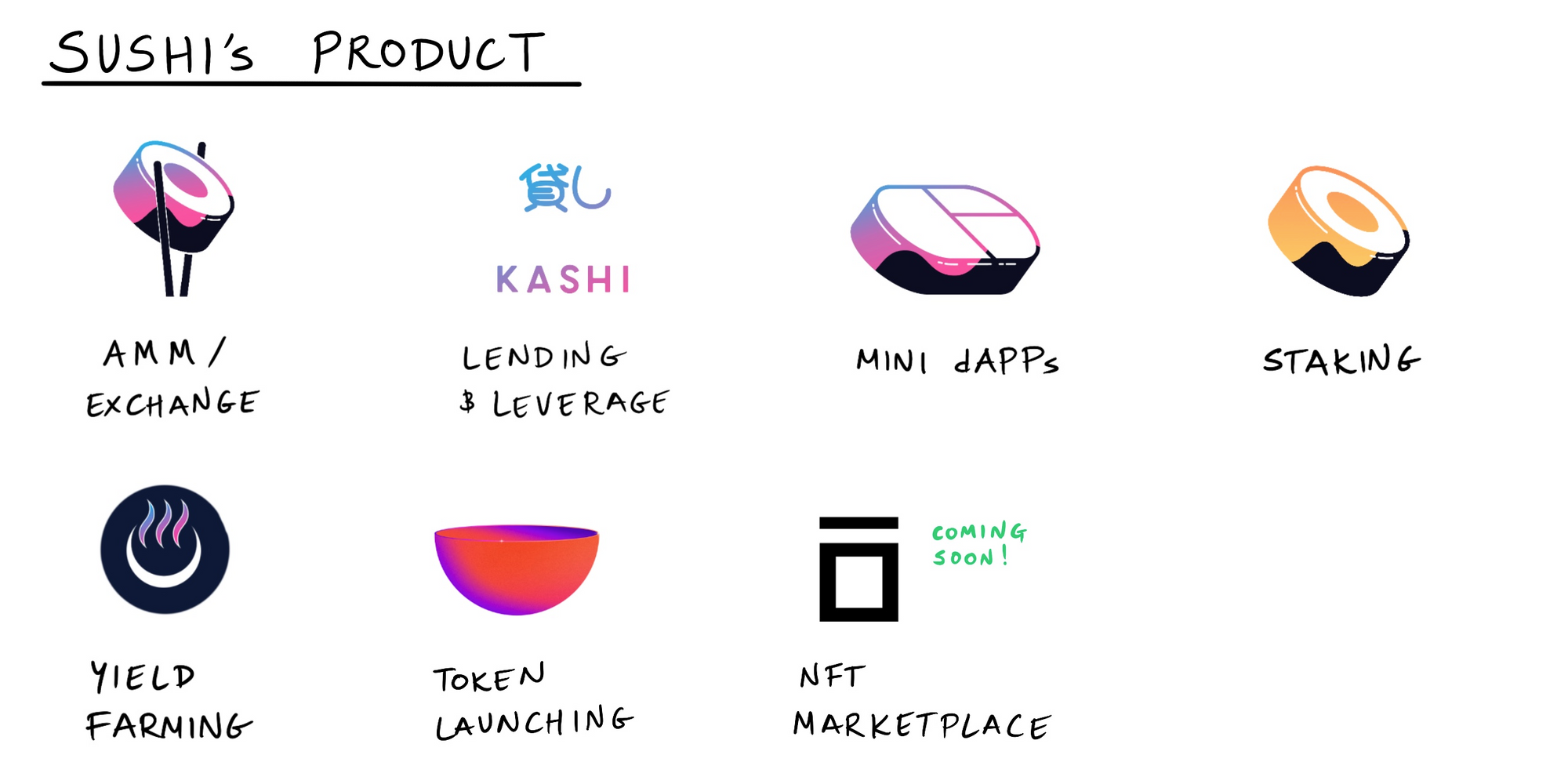

On September 9, Sushi finally migrated from Uniswap to form a separate decentralized exchange. SBF then handed over the AMM keys to some of the new "cooks" shown below.

Uniswap launched and airdropped over 1.5 billion governance tokens UNI to early users on September 17. Uniswap regained control of the track, and the battle was over.

It was a battle over protocols as a naked struggle for wealth and power among emerging crypto market players*.* Where wealth was gathered, the undercurrent of power flew. Uniswap rewarded LPs' contributions with transaction fees but hid voting rights, giving the community wealth but losing "rights." Redistribution of power and wealth was an opportunity to turn the market around. SushiSwap's strong community, brand-building, and token incentives had decentralized power. SushiSwap's copy was "bold and shameless," but it became a symbol with powerful imitative power and destructive power. Open-source code can be easily copied, but communities and brands cannot.

5. Algorithmic logic or flow gameplay?

Uniswap and SushiSwap parted ways and diverged on the road to a more significant capital utilization rate.

From Bancor, the originator of AMM, to Uniswap V2, Balancer, Curve, or upstart DODO, the representatives of CFMM, both had done well in the market in exploring the logic of customizable AMM algorithms.

Trading volumes of pioneer Bancor were still unremarkable at DeFi Summer. When Bancor's existence was about to be "forgotten," December's V2.1 release brought it back into the spotlight. Bancor V2.1 proposed an elastic BNT supply model and introduced impermanence loss insurance to AMM pools. Accumulating steadily, Bancor's liquidity and trading volumes grew astonishingly over the next few months.

Balancer introduced the liquidity guide pool mechanism based on the constant function algorithm. To differentiate from Uniswap, Balancer was offering users "price stability" reassurance. The mysterious herb in the recipe was designed to adjust the proportion of stored assets and allowed the project side to customize the proportion of tokens in the capital pool. The maximum deviation of the capital ratio was to be 2:98, which lowered the token price and stabilized the price.

Among the new projects launched in 2020, Curve made its name in the large-scale, low-slick-point stable coin AMM exchange market. It debuted as the TVL king of the DeFi world. Its token, veCRV, was not transferable. This "defect" led to another protracted Curve war in the fragmented ecosystem, opening a new outlook for the veTokens model.

DODO, launched in August 2020, pioneered the Proactive Market Making (PMM) algorithm by stepping in from AMM's "inert liquidity." PMM algorithm uses price prediction to adjust the pricing curve, and the parameters are simple but flexible. The flatter curve can effectively improve the utilization rate of funds and reduce the trading slippage and volatile loss. DODO officially launched version V2 in early March 2021, bringing professional market makers onto the chain with DODO Private Pools (DPP) launch.

In addition to bringing professional market makers onto the chain, DODO will also provide active market-making tools/liquidity management tools for other protocols in the future. So other protocol parties, or any developer, can use DODO DPP tools independently to make markets for their Protocol tokens, significantly increasing the efficiency of assets.

On the other hand, the "Food Factory" DEX Association, led by Chairman SushiSwap, was well versed in traffic and gameplay and was making a lateral push to expand its product line.

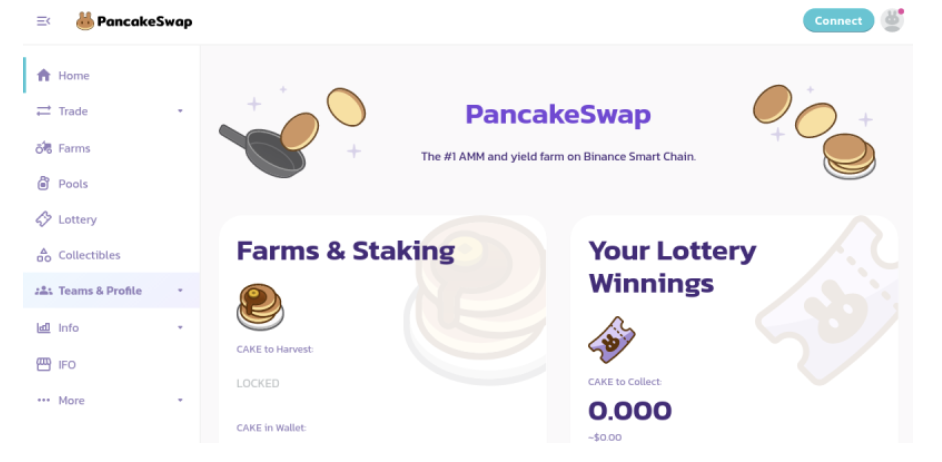

In September 2020, there was a new PancakeSwap. PancakeSwap, whose name suggests sushi, was once considered the DEX version of Binance. PancakeSwap landed in the BSC (BNB Smart chain), relying on the resources of the sponsor Binance. PancakeSwap factory had a complete product line: crypto asset trading, IFO, NFT asset trading, guessing activities such as lotteries, and predicting price rises and falls, which generated sufficient wealth effects.

PancakeSwap did not copy the birth story of SushiSwap, but just like SushiSwap, spread its charm with attractive icons and names. The spreading of the toxic effect formed a large and vibrant Pancake community.

From SushiSwap to Pancakeswap, the successful food DEX series proved that the switching costs of the DeFi world went beyond simple code copy. Intangible costs such as community traffic, brand image, trust, product gameplay, etc., cannot be discarded. Starting from distinct brand characteristics and differentiated product suites, it quickly swept up traffic and increased user engagement and activity. With one set of moves, it successfully resisted competitors, absorbed amazing wealth, and finally took DeFi market share.

6. Ultimate goal of DEX aggregator: user value capture

The AMM model battlefield was full of smoke, algorithm, traffic, and gameplay continued to upgrade. The armies of the order book were constantly running forward to unleash their potential. During the year, dYdX token airdrops were all over the place. With more than $550 million in transactions in less than a year, Serum DEX, a Solana-based HFT (High-Frequency Trading) platform, was one of the fastest-growing DEX markets.

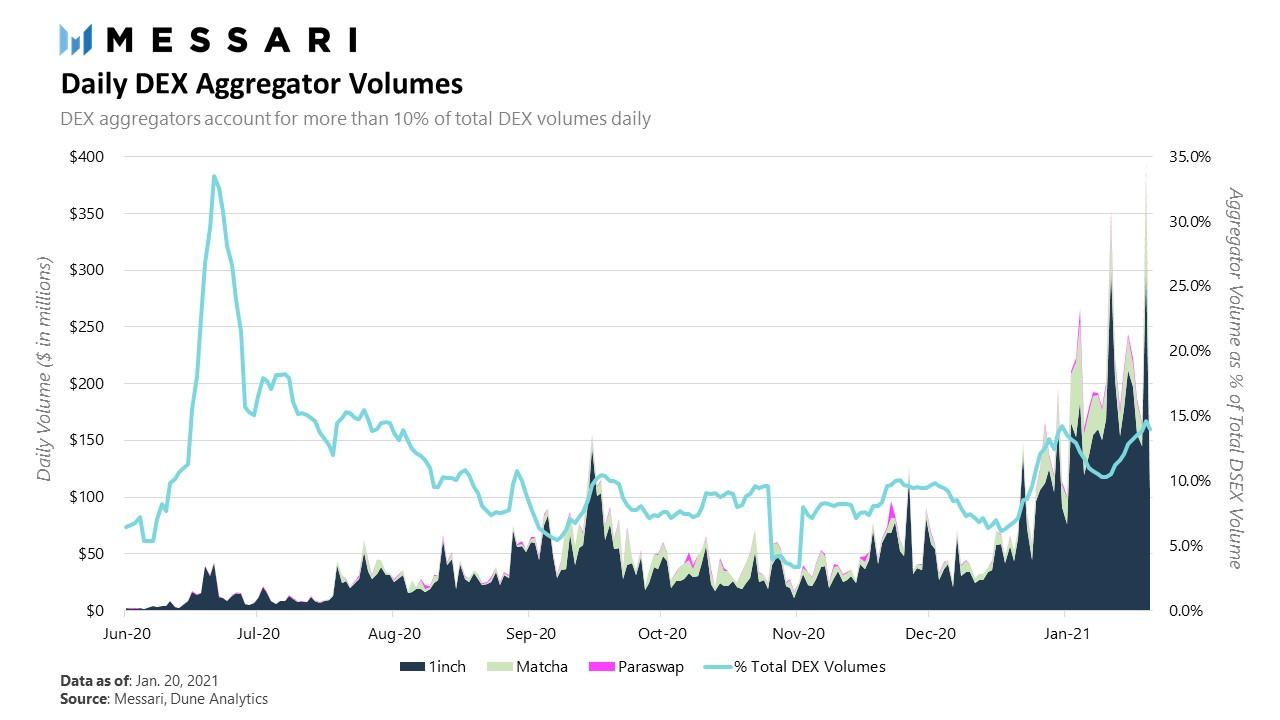

The internal competition in the DEX market was increasingly fierce, and the complex market environment made price capture and order arbitrage more difficult for traders. Aggregators at the core of the DEX waited around to efficiently match a given deal with multiple sources of liquidity, anchoring the best price to come out on top.

1inch launched V2 in December 2020. Through users brought by the past issue of 1INCH tokens and focusing on the front-end user experience of the new version, 1inch opened up its new model of instant governance.

Another thing worth talking about was Matcha, built by 0x Protocol. In capturing user funds, it adopts a strategy of lowering user barriers, such as using 0x APIs and smart order routes to aggregate liquidity and provide optimal transaction execution. Its V2 version also announced support for fiat money.

The ultimate goal of the DEX aggregator is user value capture. Unlike the AMM model, traders interact indirectly with DEX through aggregators. In our understanding, if AMM is competing for LPs' benefits, DEX aggregators are competing for traders' funds, attracting the most liquidity sources and competitors giving the lowest cost becoming the ultimate control user.

7. Who will lead the next DeFi wave

Key DeFi indicators improved significantly during DeFi Summer. Uniswap's monthly transaction volume increased from $169 million in April to over $15 billion in September 2020, an increase of nearly a hundredfold. DeFi TVL increased more than ten times from $ 800 million in April to $ 10 billion in September.

The AMM model, order book model, and aggregator are the three pillars supporting the existing DEX market. Active market-making AMM on the chain became the new trend, and novel liquidity design became the focus of DEX version update. Uniswap V3 and Curve V2 continue to iterate, bringing higher returns for LPs in terms of liquidity concentration, rate, and composability. It was covered in detail in our last article. The order book market opened a mixed-mode, with IDEX combining traditional order books with AMM Liquidity pool in late 2021 to announce the upcoming release of its V3 Hybrid Liquidity DEX on Polygon. Aggregators captured user value with low-cost, high-value services.

In the fragmented multi-chain universe, a series of innovations are racing towards the two goals of financial efficiency and user experience competition.

The independent application chain Osmosis based on the Balancer model and Cosmos SDK is also a DEX. Because it adopts the underlying architecture of the application chain, it has more space for the application. Introducing a mechanism called "Superfluid Staking," which allows OSMO holders to pledge their tokens and provide liquidity (and therefore both returns), improves network security while maximizing capital efficiency. This feature is not available on the Ethereum blockchain, as Ethereum cannot issue ETH rewards to Uniswap or SushiSwap LPs. 1inch also recently launched P2P transactions. Traders can set the trading price, the floating range of tokens relative to the market, and the expiration time and then trade to the designated wallet address to improve DeFi user experience.

"The demand for such services has been there, but few platforms currently offer it to users. 1inch fills this gap by implementing P2P exchange functionality today."

DEX's technology is still young, and some flaws remain. But the massive liquidation caused by a Black Swan event more extreme than dYdX's contract outage is what users and DEX fear most: the collapse and end of the trust. Many new players entered the game after Uniswap and SushiSwap's liquidity protocol battle. Algorithm iteration, gameplay change, APY addiction, everything is inevitable. The market has ups and downs. After the waves wash the sand, we believe that there will eventually be an option that can lead to the next wave of DeFi.