Why yBGT?

When the idea to start Bearn as a new Yearn sub DAO on Berachain arose it seemed pretty obvious what to do. Yearn has been doing liquid lockers, for veCRV and simple autocompounder vaults longer than basically anyone else in DeFi. So these were the first two products we focused on building.

Though in normal Yearn fashion, Bearn is late to the game. So now that Bera has been live for a few months, POL has already rolled out and the BGT wars are in full swing the question is why another BGT derivative?

And why yBGT?

At this point there are plenty of BGT options to choose from on Berachain. Most have chosen Infared (iBGT), which currently owns over 60% of the BGT in circulation even despite rapid gains from other competitors since POL launched like Bera Paw (lBGT). And unlike ve token models, it is actually possible to profitably farm BGT manually without a locker at all.

So what does yBGT do that the others dont?

The answer is we do it all.

When considering how to farm BGT there are a few main things to care about.

-

Yield

-

Governance

-

Liquidity

-

Redeemability

-

Premium

-

Automation

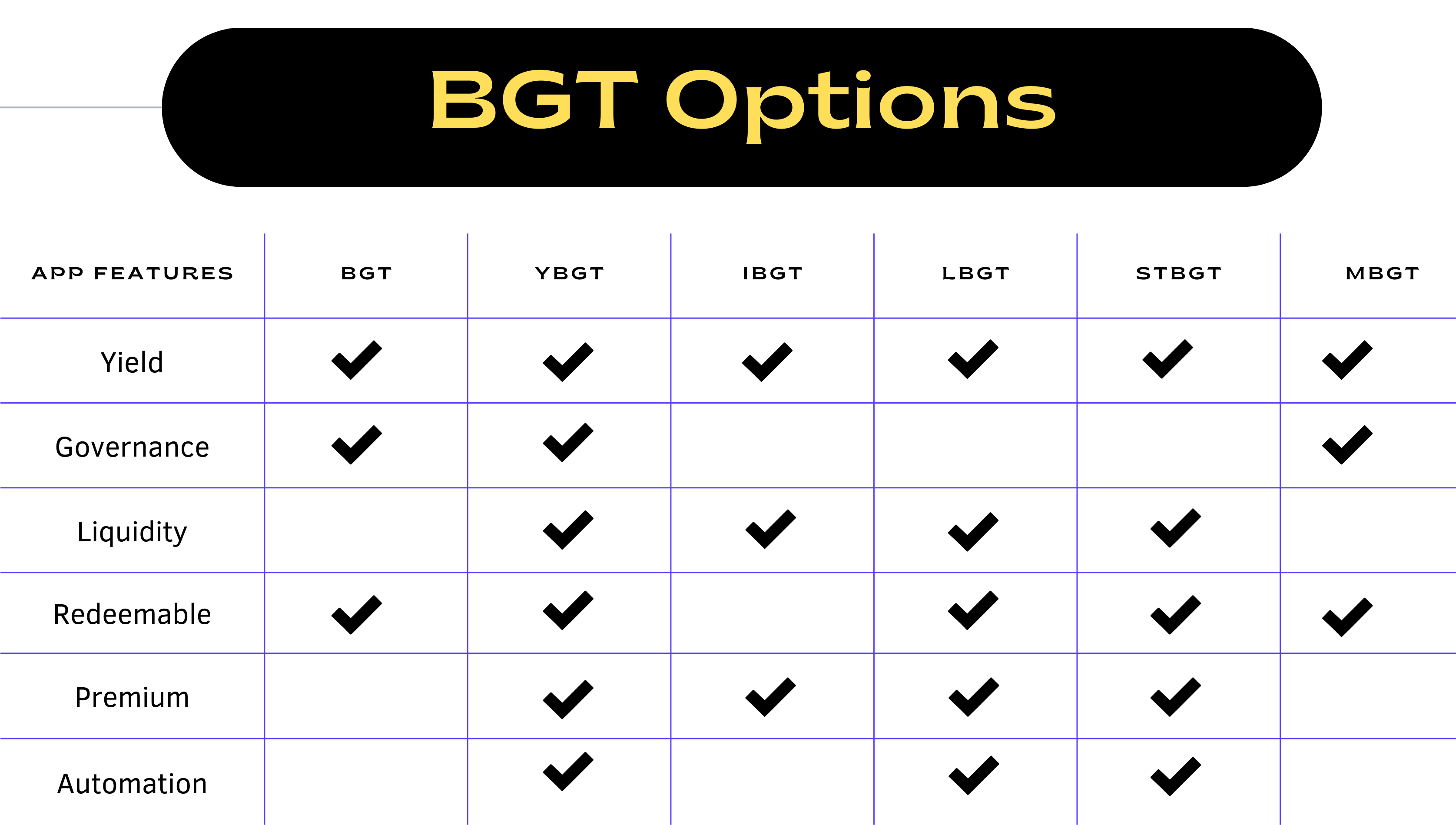

Each of the current BGT options makes certain trade offs, to offer users benefits in the others.

Naked, BGT gives the user the yield, governance, and redeemability, but obviously does not offer any of the other benefits.

Infared's iBGT gives users yield and liquidity that can trade far above par. But that means you give up governance rights, as well as the potential for any redemptions directly to BERA if it were to trade below peg.

yBGT on the other hand is set to be the first BGT option to give users each of these benefits.

Let’s break them down one at a time.

Yield:

First, the mack daddy of the needs, that sweet sweet yield. Come for the Bears, stay for the yield.

BGT is the revenue generating token of the Bera system and as such the yield it produces is the main driving factor behind its demand.

Bearn runs no validators and has no back door deals with anyone. That means we delegate our BGT based off one thing, dem APR digitz. So unlike other wrapper’s we are not beholden to any specific validator and therefore in the short term will always be able to outperform the overall percent return on our BGT compared to them.

While being vertically integrated comes with its benefits, the freedom to move BGT boosts to any validator on the network based on the changing dynamics gives us, a large competitive advantage when it comes to generating the highest amount of yield with our BGT.

The staked yBGT yield is payed 100% in stables as well, to assure the easiest and most user friendly options available.

Governance:

As it's literally in the name, this one should be obvious, but so far is the one most easily cast aside by users. It is also more than just normal governance votes, since the holder of the BGT also chooses which validators are boosted with the BGT. Which then controls the reward vaults distributed to as well as the end yield the BGT pays.

Other than mBGT using any non-native BGT option currently means you lose any governance control over your BGT. While this may not be a big deal for many normal users it will matter to larger users as well as protocols who have some bigger incentives to make sure the validators boosting their pools are getting the most BGT possible to give out. This is also becoming of even greater importance as we have seen the control over BGT continue to centralize since its launch.

In the future yBGT will come with its own pass through governance rights. Meaning you will be able to vote on both chain level votes, such as new reward vaults, as well as controlling where your relative share of BGT is delegated to.

While the implementation is still in the works, this setup also opens up the first instance on Berachain where users can actually get governance leverage on their BGT. In the same way that staking yBGT or iBGT gives you the yield of > 1 BGT since the full supply is not staked. Voting with 1 yBGT can potentially give users > 1 BGT vote. Meaning for those that due care about governance and boosts, there is no more efficient vehicle to use than yBGT, even more so than native BGT.

Liquidity:

Native BGT is soulbound, so this is the main driving factor behind having a liquid derivative at all.

Bearn like all the other wrappers will be incentivizing our LP pools to give users easy access to liquidity to move both in and out of yBGT as needed. This will also give it the ability to be used in DeFi as collateral etc.

Though to create more positive flywheels we will be pairing yBGT primarily with yBERA instead of WBERA like others. More will be announced soon on yBERA but it is simply a 4626 wrapper for BERA that always maintains a 1:1 price with BERA and can be minted or redeemed at anytime to WBERA.

This means on the surface it will function the same as pairing with WBERA, however yBERA is a Yearn multi strategy vault that can earn yield on the underlying deposits while sitting in the LP pool. The yield from this will then be used as the main source of bribe incentives to that very same LP pool for BGT emissions. This means we have a large, real and continuous source of bribe incentives that can also provide liquidity to support the overall Bearn product suite and Bera ecosystem at the same time.

Redeemability:

This is what gives BGT intrinsic value, and while liquidity to sell the token is nice, liquidity is fickle, especially when needed most.

I know BGT is currently all the rage and the question is more about what the premiums are not discount. And while many of the Bera young bucks may not understand the importance of this, Yearn has seen more booms, busts, crashes and depegs of every kind than you can imagine. And we can assure you when crypto starts doing crypto things, a rage quit option that puts a floor price on the peg is a one of a kind feature that every other liquid locker in DeFi would be jealous of.

Not only is being redeemable important for the busts, but it allows for some very unique use cases in the booms, such as un-liquidatable loans...

Premium:

While redeeming puts a floor price on your BGT, a wrapped version lifts the upper bound on the price to whatever the current market rate is.

Redemptions are built for the worst of times, but yBGT still allows for the premium to pump in the best of times. We have capped the floor but tore the ceiling off, now that’s what you really call up-only technology.

Given its yield maximization, governance optionality, and floor price, we foresee the premium on yBGT being as high or higher than any of the other options on the market.

Automation:

To get the full benefit of BGT someone needs to be boosting, claiming, selling rewards etc.

Bearn was built from the beginning to gives users the option to come as they are. Be as little or as much involved with the POL game as you like. We support all use cases.

-

Earn yBGT and play the full POL games, or simply deposit and auto compound.

-

Manually stake, claim rewards, vote on each proposal and epoch or just deposit into the styBGT compounder and set and forget.

This means that we can support every user from the newest newb to the most aggressive POL power user, the smallest fish to the biggest whales, the Bera curious to the Bera Maxis and everybody in between.

yBGT was built to be the strongest BGT derivative on the market, and while we may not yet have the TVL of the other options, what we do have (other than a can do attitude and some elbow grease) is the best BGT.

We believe building a version of BGT that gives users the most out of it will ultimately win in the end.

And that hasn't even begun the discussion of of how it works with our stable coin.....

It's time to demand more out of your BGT. That's yBGT.