1.0 Intro

1.0 简介

Last year, I thought “[[Web3]]” was a good all-encompassing term that captured cryptocurrencies (bitcoin and stablecoins), smart contract computing (Ethereum and other “[[Layer-1]]'s”), decentralized infrastructure networks (video, storage, sensors), non-fungible tokens (digital identity and property rights), decentralized finance (financial services to swap and collateralize crypto assets), the metaverse (the digital commons built in game-like environments), and community governance constructs (decentralized autonomous organizations).

去年,我认为“Web3”是一个很好的包罗万象的术语,它涵盖了加密货币(比特币和稳定币)、智能合约计算(以太坊和其他“第一层”)、去中心化基础设施网络(视频、存储、传感器)、非可替代代币(数字身份和产权)、去中心化金融(交换和抵押加密资产的金融服务)、元宇宙(在类游戏环境中构建的数字公共资源)和社区治理结构(去中心化自治组织)。

We're down 80% since then. Ever since we pivoted to the Web3 moniker, there's been industry-wide carnage. So I recommend we retire the term.

从那以后,加密市场下降了 80%。自从我们转向 Web3 绰号以来,整个行业就发生了大屠杀。所以我建议我们取消这个词。

We need to get “Back to Crypto” in 2023.

我们需要在 2023 年“回到 Crypto”。

• More personal wallets ([from my cold dead hands]) than exchange margin accounts (bad)

•个人钱包(来自我冰冷死去的手)多于交易所保证金账户(坏)

• More privacy (none of your business what I do) than institutional adoption (slowww down)

• (慢慢地)比机构采用更多的隐私(我做什么与你无关)

• Permissionless financial & social applications (live and let live) vs. ponzinomics (fraud)

• 未经许可的金融和社交应用(生与死)与庞氏经济学(欺诈)

If you're new to crypto, I also recommend you check out Bloomberg Reporter Matt Levine's recent Crypto 101 masterpiece (that was recently published as an entire BusinessWeek issue). Building off of Matt and the prior Messari works has freed up my headspace for more new, original content, without leaving newcomers in the dust.

如果您是Crypto的新手,我还建议您查看 Bloomberg 记者 Matt Levine 最近的 Crypto 101 杰作)。在 Matt 和之前的 Messari 作品的基础上,我腾出了更多的空间来获取更多新的原创内容,而不会让新手望而却步。

It makes sense to start with a recap of last year's introductory “Narratives & Investment Themes” chapter and see what held up. How did last year's report do under the stress test of an 80% decline in prices and an absolute bloodbath for crypto startups?

从回顾去年介绍性的“叙述与投资主题”一章开始,看看有什么坚持是有意义的。去年的报告在价格下跌 80% 和对Crypto初创公司进行绝对大屠杀的压力测试下表现如何?

Pretty, pretty good, actually.

漂亮,相当不错,实际上。

Here's what happened in 2022, and what's in store for 2023.

这是 2022 年发生的事情,以及 2023 年将发生的事情。

1.1 Winter is Here: It's Time to Build

1.1 冬天来了:是时候建设了

Last year, I started out with a bang:

去年,我以一记猛击开头:

“My first prediction for 2022: things will get worse before they get better in the “real” world. Inflation will remain above 5% throughout 2022 (70% confidence), while late year interest rate hikes stall the stock market's momentum and hurt growth stocks (60% confidence the S&P dips next year)...Though I waffle on where we are in this particular cycle, the tail winds remain strong and the capital markets flush. So my probabilities are split among three scenarios: 1) most likely, we experience a blow off top before the end of Q1 2022, followed by a shallower, but still painful multi-year bear market…Ironically, the most bearish case here (Q1 [[blow-off top]]) may be the most bullish long-term.”

“我对 2022 年的第一个预测:在“真实”世界中,事情会在好转之前变得更糟。通货膨胀率将在整个 2022 年保持在 5% 以上(70% 确信),而年底加息会阻碍股市的势头并伤害成长型股票(60% 确信明年标准普尔指数会下跌)......尽管我对我们在这个特定周期中所处的位置喋喋不休,但顺风依然强劲,资本市场也畅通无阻。因此,我的概率分为三种情况:1) 最有可能的是,我们在 2022 年第一季度末之前经历了一次高潮,随后是一个较浅但仍然痛苦的多年熊市......具有讽刺意味的是,这里最悲观的情况(第一季度冲顶回落)可能是最看涨的长期情况。”

That's more or less what happened. And the speculative mania is now behind us.

这或多或少是发生了什么。投机狂潮现在已经过去了。

A lot of people lost money in 2022. Some poorly managed companies went under (normal in capitalism, pre-2008). But many of the survivors are well capitalized and shipping product. The core theses generally remain unchanged, and now we're left with true believers and long-term builders – fewer gamblers, scammers, and tourists.

很多人在 2022 年亏了钱。一些管理不善的公司倒闭了(在资本主义中很正常,2008 年之前)。但许多幸存者资本充足,产品出货。核心论点通常保持不变,现在我们只剩下真正的信徒和长期建设者——更少的赌徒、骗子和游客。

I live for the build years.

我为建设年而活。

We can focus on building life rafts for those worried about inflation and currency debasement; “exit” technology that helps people vote against two party systems and authoritarian rule alike; and decentralizing solutions that check the incumbent powers in tech, finance, and government.

我们可以专注于为那些担心通货膨胀和货币贬值的人建造救生筏;帮助人们投票反对两党制度和独裁统治的“退出”技术;以及检查技术、金融和政府中现任权力的去中心化解决方案。

The core substance of crypto hasn't changed: in a world where few, if any, of these institutions are viewed as both competent and ethical (a16z: How to Win the Future, slide 8), crypto offers a third path that seems increasingly credible, despite its volatility.

Crypto的核心实质没有改变:在一个很少(如果有的话)这些机构被视为既有能力又有道德的世界里([a16z:如何赢得未来], 第8页), Crypto 提供了第三条路径,尽管它具有波动性,但似乎越来越可信。

Need a globally accepted asset that you can store in your head “just in case” you need to emigrate from a failing country? There's Bitcoin. How about a platform that routes your app around Big Tech censors? There's Ethereum and a multitude of emerging Layer-1 (“L1”) protocols. Can't access credit? There's DeFi. Hate 30-50% take rates for artists? NFTs. Trying to fund research for your own rare disease cure? DAOs.

需要一种全球公认的资产,您可以将其存储在脑海中以“以防万一”需要从失败的国家移民?有比特币。一个让你的应用绕过科技巨头审查的平台怎么样?有以太坊和大量新兴的 Layer-1(“L1”)协议。无法获得信用?有 DeFi。讨厌艺术家 30-50% 的抽成率? NFTs。试图资助您自己的罕见病治疗研究? DAO。

This isn't boosterism. Even Bloomberg's Matt Levine, a crypto skeptic, sees the potential:

这不是助推主义。即使是 Bloomberg 的 Matt Levine,一个加密怀疑论者,也看到了潜力:

“Perhaps this is all a self-referential sinkhole for smart finance people, but honestly it would be weird if that's all it ever turned out to be. If so many smart finance people have moved into the crypto financial system, if they find it so much more enjoyable and functional and productive than the traditional financial system, surely they'll eventually figure out how to make it useful.”

“对于精明的金融人士来说,也许这都是一个自我参照的无底洞,但老实说,如果事实就是如此,那就太奇怪了。如果有这么多精明的金融人士进入加密金融系统,如果他们发现它比传统金融系统更有趣、更实用、更高效,他们肯定最终会想出如何让它变得有用。”

The debate doesn't really center around whether crypto could be good these days.

这些天来,争论并没有真正围绕 Crypto 是否会好。

Like most other areas of tech, crypto can be great or it can be abused. It all depends on the specific product, the ethos of the builders, and the rollout strategy.

与大多数其他技术领域一样, Crypto 可能很棒,也可能被滥用。这一切都取决于具体产品、建设者的精神和推出策略。

If tokens help solve the “cold start” problem of network effects-reliant businesses in their battle to disrupt incumbents, that's a good thing. Good token designs will look more like [[growth capital]] than seed funding. (My [[litmus test]] has always been: does this token create an early user base and improve the product, or does it primarily reward the founders and VCs?) Tokens only work in markets where [[network effects]] could exist. Otherwise, you're transparently partaking in a multi-level marketing scheme.

如果代币有助于解决依赖网络效应的企业在颠覆现有企业的斗争中的“冷启动”问题,那是一件好事。好的代币设计看起来更像是成长资本,而不是种子资金。 (我的试金石一直是:这个代币是创造早期用户群并改进产品,还是主要奖励创始人和风险投资人?)代币只在可能存在网络效应的市场中起作用。否则,您显然是在参与多层次营销计划。

Do the knives get better when Cutco sells more of them? No. Most people lose time and money getting sucked into the machine, and it's annoying to friends.

当 Cutco 卖得更多时,刀具会变得更好吗?不会。大多数人会浪费时间和金钱在机器上,这让朋友们很恼火。

Does a crypto product get better when more people are added, in terms of liquidity, user interactions, and/or application interoperability? Yes. If a token can accelerate a product's time to usability, and reward its beta testers, it's a powerful tool.

在流动性、用户交互和/或应用程序互操作性方面,当更多人加入时,加密产品会变得更好吗?是的。如果代币可以加快产品的可用性并奖励其 Beta 测试人员,那么它就是一个强大的工具。

Let's build more powerful and sustainable tools this winter.

让我们在这个冬天打造更强大、更可持续的工具。

1.2 Crypto is (Still) Inevitable

1.2 Crypto 是(仍然)不可避免的

It's easy to be bullish in times of euphoria. But you only see who's got staying power when the tide goes out. It's been a bad year in many respects, especially for the greedy, the levered, and the unethical.

在牛市很容易看涨。但你只有在潮水退去时才能看到谁在裸泳。从许多方面来看,今年都是糟糕的一年,尤其是对贪婪、杠杆化和不道德的人来说。

The long-term builders may have been temporarily hurt by association, but they haven't been the ones who perpetuated frauds or fleeced investors. These innovators (open-source software and infrastructure developers) will be here long after the trash (opaque lenders, trading bucket shops, ponzinomic promoters, “genius VCs,” and paid hype men) from this cycle are long gone.

长期建设者可能暂时受到协会的伤害,但他们并不是使欺诈永久化或剥削投资者的人。这些创新者(开源软件和基础设施开发商)将在这个周期中的垃圾(不透明的贷款人、交易对赌行、庞兹经济学的发起人、“天才风险投资人”和付费炒作人)早已消失之后很久出现。

And good riddance! (We'll talk all about the crypto credit bust in Chapter 3 on CeFi.)

祝你早日摆脱! (我们将在第 3 章中讨论有关 CeFi 的加密信用泡沫。)

Beneath the wreckage is a stronger foundation than we've ever had before: $10s of billions in capital, an influx of world-class talent, four years worth of demographic change towards digital natives, and dozens of “zero-to-one” innovations in crypto scalability and application primitives.

残骸之下是我们前所未有的坚实基础:100 亿美元的资本、世界级人才的涌入、数字原住民四年来的人口变化,以及数十个“零对一”加密可扩展性和原始应用工具方面的创新。

Crypto remains inevitable because we've made significant progress in the build-out of bitcoin, stablecoins, distributed computing, blockchain scalability, decentralized financial primitives (DEX, lending, asset issuance), and governance structures. Crypto 仍然是不可避免的,因为我们在构建比特币、稳定币、分布式计算、区块链可扩展性、去中心化金融原始工具(DEX、借贷、资产发行)和治理结构方面取得了重大进展。

These innovations will not be uninvented.

这些创新不会不被发明出来。

Bitcoin has entered its “historic buy” range by several measures. Stablecoins now represent four of the top ten crypto assets. Their volumes rival global card networks and banks, and they can actually generate sustainable yield now that the true risk-free rate of return (U.S. Treasuries) is above zero. The Merge, the software equivalent of the Moon Landing, went through without incident, and other Layer-1's like Cosmos, Solana, and various rollup chains made significant breakthroughs as well. Fees are way down as a result!

比特币已通过多项措施进入其“历史买入”区间。稳定币现在代表了十大加密资产中的四种。他们的交易量可与全球信用卡网络和银行相媲美,现在真正的无风险回报率(美国国债)高于零,他们实际上可以产生可持续的收益率,[以太坊合并]相当于登月的软件,顺利通过,Cosmos、Solana 和各种 rollup 链等其他 Layer-1 也取得了重大突破。结果费用大大降低了!

We're two years into a secular bear market for DeFi, which still faces technical headwinds (hacks) and regulatory challenges, but the core primitives (Automated Market Makers, Flash Loans, Protocol Controlled Value, etc.) are all here to stay. NFTs are data wrappers that open the door for secure sharing or transactions of any intellectual property, synthetic asset, consumer digital good, or identity token on-chain. They may look like toys to start, but they are almost unfathomably important as a technical primitive. We now have true DAOs, with on-chain voting, delegation, and community treasury management. These entities cross borders and allow for the rapid formation and wind down of online communities and collectively-managed property. We may be in crypto's 3rd inning, but DeFi, NFTs, and DAOs have barely stepped into the batter's box.

我们进入 DeFi 的长期熊市已经两年了,它仍然面临技术逆风(黑客攻击)和监管挑战,但核心原始工具(自动做市商、闪电贷、协议控制价值等)都将保留下来。 NFT 是数据包装器,可为任何知识产权、合成资产、消费数字商品或链上身份令牌的安全共享或交易打开大门。它们开始时可能看起来像玩具,但作为一种技术原始工具,它们的重要性几乎深不可测。我们现在拥有真正的 DAO,具有链上投票、授权和社区资金管理。这些实体跨越国界,并允许在线社区和集体管理财产的快速形成和结束。我们可能处于 Crypto 的第三局,但 DeFi、NFT 和 DAO 几乎没有进入击球点。

Don't get discouraged. The dream lives on.

不要气馁。梦想继续存在。

1.3 Surviving Winter, Redux

1.3 熬过冬天,归来

You heeded my advice last year, right anon?

去年你听从了我的建议,对吗?

At the absolute height of the bull market, I wrote about what exactly would happen in a crypto winter, and warned that the medium-term concern for me was “From what height do we crash?” even if I was neutral in the short-term and mega-bullish in the long-term. I've lived through multiple crypto winters and warned that many would lose faith amidst a multi-year grind lower in asset prices, stark political and regulatory headwinds, and stagnating user enthusiasm and product demand.

在牛市的绝对高度,我写了一篇关于加密冬天究竟会发生什么的文章,并警告说我的中期担忧是“我们会从什么高度崩溃?”即使我在短期内保持中立,在长期内超级看涨。我经历了多个加密冬天,并警告说,在资产价格多年下跌、严峻的政治和监管逆风以及用户热情和产品需求停滞不前的情况下,许多人会失去信心。

I take no pleasure in saying I told you so, but...

我不喜欢说我告诉过你,但是...

“In addition to eating big paper (or real) losses, you'll see people have breakdowns, go bankrupt due to over-leverage (or poor tax planning), quit otherwise promising projects, turn nasty, depressed, or apathetic, and generally lose sight of the longer-term potential of crypto. To make matters worse, the next bear market will be a regulatory nightmare, and we won't have the bull market vibes to help defend ourselves against all of the consumer protection, fraud and abuse, systemic risk, ESG, and illicit activity FUD that our enemies will throw at us. At the same time, the “grassroots” crypto herd will thin because it's tougher to wage war when you've lost 90% of your savings and need to go find a real job again.”

“除了承受巨大的账面(或实际)损失外,你还会看到人们精神崩溃,因过度杠杆化(或糟糕的税收筹划)而破产,退出原本有前途的项目,变得令人讨厌、沮丧或冷漠,并且通常忽视了Crypto的长期潜力。更糟糕的是,下一个熊市将是一场监管噩梦,我们不会有牛市的氛围来帮助我们抵御所有的消费者保护、欺诈和滥用、系统性风险、ESG 和非法活动FUD,我们的敌人会扔给我们。与此同时,“草根”Crypto群体将会减少,因为当你失去了 90% 的积蓄并需要重新找到一份真正的工作时,发动战争会变得更加困难。”

Do you still believe?

你还相信吗?

If you're reading this report there's a good chance that you do, but are now wondering how best to navigate a prolonged winter. The answer is as simple as it is challenging and unglamorous:

如果您正在阅读这份报告,那么您很有可能会这样做,但现在想知道如何最好地度过漫长的冬天. 答案既简单又具有挑战性且平淡无奇:

Build!

建设!

In many respects, it's easier to build in bear markets than bull markets. There are fewer distractions, real product-market fit becomes easier to identify without the noise of a token, and the weak and flaky contributors wash out of the market.

在许多方面,在熊市中建仓比在牛市中建仓更容易。干扰更少,真正的产品市场契合度在没有代币噪音的情况下变得更容易识别,弱者和不稳定的贡献者被淘汰出市场。

There's also a big difference between this crypto winter and previous cycles: dry powder. In 2015, cash was hard to come by, and even some of today's industry leaders struggled to raise capital at the time(Kraken and Chainalysis are two unicorns that come to mind). In 2018, there were a few crypto curious investors, but many of the projects who raised money via ICOs had squandered their balance sheets by holding ETH through a 90%+ decline.

这个加密冬天和之前的周期也有很大的不同:基金备用金。 2015年,现金来之不易,就连今天的一些行业龙头在当时都举步维艰(Kraken 和 Chainalysis 是我想到的两个独角兽)。 2018 年,有一些对Crypto充满好奇的投资者,但许多通过 ICO 筹集资金的项目在持有 ETH 超过 90% 的情况下挥霍了资产负债表。

There are bridges to build, standards to set, primitives to develop, users to onboard, infrastructure to stress test, and product stories to tell.

有桥梁要搭建,有标准要设定,有要开发的原始工具,有要加入的用户,有要压力测试的基础设施,还有要讲述的产品故事。

There's no rest for the weary, and if you played your cards right, you unwound levered bets, paid your taxes, didn't get greedy day trading, and parked some assets in cash for a rainy day. You're probably feeling ok right now, despite the market backdrop. We'll survive and advance and look back on this year with pride, because we survived.

疲惫的人没有休息的时间,如果你打得好,你就解除了杠杆赌注,缴纳了税款,没有贪婪的日间交易,并以现金存放一些资产以备不时之需。尽管市场背景如此,您现在可能感觉还不错。我们会活下来,继续前进,并自豪地回顾这一年,因为我们活了下来。

What else would you do, anyway? Go work in a bank?

无论如何,你还会做什么? 去银行工作?

1.4 How Low Can We Go

1.4 我们能走多低

Last year I asked, “doesn't it just feel a little toppy?” and tried to show people just how far ahead of our skis we were getting when it came to crypto asset prices, and how close market caps were getting to what looked more like 10 year TAMs. The drivers of asset prices were blinking “sell” but many of us just couldn't help ourselves.

去年我问,“不就是感觉有点头皮发麻吗?”并试图向人们展示我们在加密资产价格方面领先了多远,以及市值与看起来更像是 10 年 TAM 的差距有多大。资产价格的驱动因素正在眨眼“卖出”,但我们中的许多人就是情不自禁。

Let's flip the script this year, and ask, “how much lower can we go?”

让我们今年翻转剧本,问问“我们还能走多低?”

-

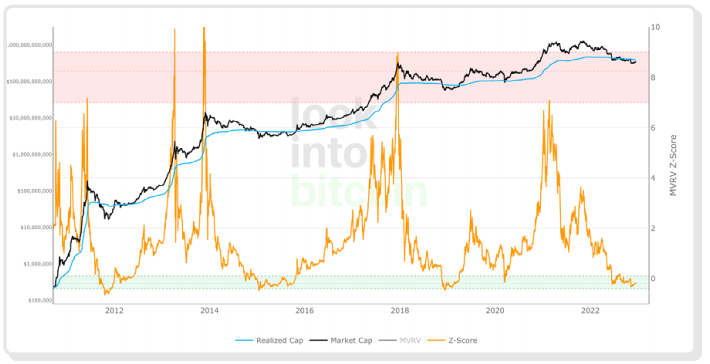

Bitcoin: My favorite metric for BTC from cycle-to-cycle has been Market Value to Realized Value (MVRV). It has been nearly infallible as an indicator for how hot or cold the market has gotten. This simple ratio looks at current price times supply (market cap) versus the cumulative “realized” value of “free float” coins (those that have moved in <5 years) at the price at which they last moved on-chain. Market cap can stay the same when realized value spikes and vice versa. It's a dynamic measure that accounts for flow. An MVRV that hits 3 has meant “sell right now” and a MVRV below 1 has meant “start accumulating” for crypto's entire history for BTC.

-

比特币:我最喜欢的 BTC 从周期到周期的指标是市场价值到实现价值(MVRV)。作为市场热度或冷度的指标,它几乎是万无一失的。这个简单的比率着眼于当前价格乘以供应量(市值)与“自由浮动”硬币(那些在 <5 年内移动的)以它们最后一次在链上移动的价格计算的累计“实现”价值。当实现价值飙升时,市值可以保持不变,反之亦然。这是一个考虑流量的动态指标。达到 3 的 MVRV 意味着“立即卖出”,低于 1 的 MVRV 意味着“开始增持”BTC 的整个 Crypto 历史。

Where are we now? January 2015. December 2018. i.e., Sell-a-kidney-to-buy-more territory.

我们现在在哪? 2015 年 1 月。2018 年 12 月。即,卖肾买肾。

BTC is beginning to act more like a credible neutral reserve asset (we'll talk about this “outside money” concept more in the Bitcoin section). From both a MVRV and risk return standpoint, BTC seems a bit more attractive today. Bitcoin's parity with gold would yield a 25x return, so there's a lot to like in adding a 4% position in digital gold for every ounce of gold you buy. At today's prices, bitcoin-gold parity would bring us a $500,000 bitcoin.

BTC 开始表现得更像是一种可靠的中性储备资产(我们将在比特币部分更多地讨论这个“外部货币”概念)。从 MVRV 和风险回报的角度来看,BTC 今天似乎更具吸引力。比特币与黄金的平价将产生 25 倍的回报,因此为您购买的每盎司黄金增加 4% 的数字黄金头寸有很多好处。按照今天的价格,比特币与黄金平价将为我们带来价值 500,000 美元的比特币。

2. Ethereum: Is ETH a tech platform or distributed bank? A little bit of both, perhaps, but I'd argue the network is more comparable to the latter. The best comparisons to Ethereum on the tech side might be to AWS, Google, and Microsoft. After all, the protocol is a virtual machine and “world computer.” But its economic drivers (MEV and transaction fees), and unit economics (financial services' basis points vs. cloud margins) make it look more like Visa or JPMorgan. There's nothing wrong with that! Ethereum is already a top five financial platform if you look at financial services, and ETH has become a disinflationary asset with its Merge to Proof-of-Stake, minimizing the dilutive impact holders will experience going forward.

2. 以太坊: ETH 是技术平台还是分布式银行?也许两者都有一点,但我认为网络与后者更具可比性。在技术方面与以太坊的最佳比较可能是 AWS、谷歌和微软。毕竟,该协议是一个虚拟机和“世界计算机”。但它的经济驱动因素(MEV 和交易费用)和单位经济学(金融服务的基点与云利润率)让它看起来更像 Visa 或摩根大通。这没有错!如果你看一下金融服务,以太坊已经是排名前五的金融平台,而 ETH 已经成为一种反通货膨胀资产,它合并到股权证明,最大限度地减少持有人的稀释影响前进的经验。

The question is whether you think there is enough real value flowing through the Ethereum platform today and in the medium-term to justify a 5x in valuation that would catapult the asset beyond financial services and onto the “Big Tech” leaderboard. I grok the favorable post-Merge Ethereum economics, but I don't see a scenario where ETH leapfrogs Web1 giants any time soon. Too much of Ethereum's current transaction processing is finance and trading related, and DeFi's unit economics will face pressure in a high-inflation, high-interest rate environment.

问题是您是否认为今天和中期有足够的实际价值流经以太坊平台以证明 5 倍的估值是合理的,这将使资产超越金融服务并登上“大型科技”排行榜。我理解有利的合并后以太坊经济学,但我看不到 ETH 会很快超越 Web1 巨头的情况。以太坊目前太多的交易处理与金融和交易相关,而 DeFi 的单位经济将在高通胀、高利率环境下面临压力。

Apple's P/E is 23 and growing. Microsoft's P/E is 24 and growing. Google's P/E is 16 and growing. Ethereum's “P/E” is 195, and its revenues are shrinking, with protocol revenues near multi-year lows. The crypto market is still giving ETH simultaneous credit as a monetary asset (relative value to bitcoin), a computing platform (cloud startup multiples), and a yield generator (financial stock thanks to staking). If any of those three narratives cool, it will face headwinds. (Long Bitcoin dominance?)

Apple 的市盈率为 23,并且还在增长。微软的市盈率为 24 倍,并且还在增长。谷歌的市盈率为 16 倍,并且还在增长。以太坊的“市盈率”为 195,其收入正在萎缩,协议收入接近多年低点。加密市场仍在同时给予 ETH 作为货币资产(相对于比特币的相对价值)、计算平台(云启动倍数)和收益生成器(由于质押而产生的金融股票)的信用。如果这三种叙事中的任何一种表现出色,它将面临不利因素。 (长期比特币主导地位?)

-

Other Layer-1's: The other thing to consider in the ETH bull case is the network's potential substitutes, of which there are now many, though none have yet emerged as true peers. ETH currently enjoys a 70%+ market share in what we'll call the “neutral” L1 space (netting out Binance's BNB token). In other words, there's about $155 billion of ETH and $57 billion of “other L1” assets. Whether you think that's right or not will largely depend on how excited you are by the various other L1 network's locked market caps and value capture mechanisms.

-

其他Layer-1: 在 ETH 牛市案例中要考虑的另一件事是网络的潜在替代品,现在有很多,尽管还没有成为真正的同行。 ETH 目前在我们称之为“中性”L1 空间(扣除 Binance 的 BNB 代币)中占有 70% 以上的市场份额。换句话说,大约有 1550 亿美元的 ETH 和 570 亿美元的“其他 L1”资产。你认为这是否正确在很大程度上取决于你对其他各种 L1 网络的锁定市值和价值捕获机制的兴奋程度。

The “venture and insider” ownership of Solana, Avalanche, and Aptos ⭐ tokens, for example, are still quite high. Will selling pressure hit those networks once supply unlocks? Likewise, value capture for other alt-L1 chains, such as Cosmos, remain unclear (though recent efforts have been made to fix that). Will any other L1 developer ecosystem catch up? Will any rival Ethereum's unit economics as a high value settlement chain? The relative value trades all come down to business development wins (app distribution) and recruiting wins (can you attract developers to build on non-Ethereum blockchains).

Solana、 Avalanche 和 Aptos ⭐代币的“风险和内部人”所有权仍然相当高。一旦供应解锁,销售压力会打击这些网络吗?同样,其他 alt-L1 链(例如 Cosmos)的价值捕获仍不清楚(尽管 最近已经做出努力 来解决这个问题)。其他 L1 开发者生态系统会迎头赶上吗?将任何竞争对手以太坊的单位经济作为高价值结算链?相对价值交易都归结为业务开发胜利(应用程序分发)和招聘胜利(你能吸引开发人员在非以太坊区块链上构建)。

The “Ethereum killers” may have the money to compete aggressively, but as an investor your choices are to either pick winners, or buy the basket. (Short Ethereum L1 dominance?)

“以太坊杀手”可能有足够的资金来积极竞争,但作为投资者,您的选择是要么挑选赢家,要么买入篮子。 (做空以太坊 L1 优势?)

-

DeFi: The entire universe of free-floating DeFi tokens currently trades at less than $15 billion. That doesn't even crack the top 100 banks by market cap. DeFi's market share of global financial services is a measly 0.2%. Meanwhile, Total Value Locked (“TVL,” a measure of user assets deposited into a protocol's smart contracts) in DeFi is just $40 billion, barely good enough to crack the top 50 US banks by assets, and a shade bigger than infamous Nashville juggernaut, Pinnacle Bank.

-

DeFi:整个自由浮动的 DeFi 代币领域目前的交易价格不到 150 亿美元。这甚至没有进入市值前 100 名的银行。 DeFi 在全球金融服务市场的份额仅为区区 0.2%。与此同时,DeFi 中锁定的总价值(“TVL”,一种衡量用户资产存入协议智能合约的方法)仅为 400亿美元,勉强足以跻身美国前 50 大银行按资产分类,并且比臭名昭著的纳什维尔巨头 Pinnacle Bank 大得多。

Perhaps we are finally nearing the bottom of DeFi's trough of disillusionment. It will be a long road back to 2020, but positive regulatory developments, improvements in contract security and development best practices, and lower transaction fees thanks to scaling breakthroughs could make DeFi one of the best risk reward sectors of crypto for years to come. Remember, the core DeFi protocols were built during the last bear market.

或许我们终于接近 DeFi 幻灭低谷的底部。回到 2020 年的 DeFi Summer 还有很长的路要走,但积极的监管发展、合同安全和开发最佳实践的改进,以及由于规模突破而降低的交易费用,可能会使 DeFi 成为未来几年Crypto中风险回报最好的行业之一.请记住,核心 DeFi 协议是 [在上一次熊市期间] 构建的 。

-

NFTs: Any given NFT project can go to zero, but NFTs as a data construct will eventually wrap around tens of trillions of dollars worth of assets. We're at about $8 billion today, so there's…uh… room to grow. But I'd rather be long picks and shovels infrastructure businesses vs. specific projects in the NFT space, as almost nothing I've seen has established a “fundamental” driver of value beyond art, and the jury is still out on which art will have staying power. You better like the jpeg enough to hold it forever vs. flip it.

-

NFT:任何给定的 NFT 项目都可以归零,但作为数据结构的 NFT 最终将环绕价值数十万亿美元的资产。我们今天 大约 80 亿美元,所以还有……呃……增长空间。但我宁愿长期选择和铲子基础设施业务,而不是 NFT 领域的特定项目,因为我所看到的几乎没有任何东西能够建立超越艺术的“基本”价值驱动力,而且对于艺术将成为什么样的价值尚无定论。有持久力。你最好喜欢 jpeg 足以永远保存它而不是翻转它。

-

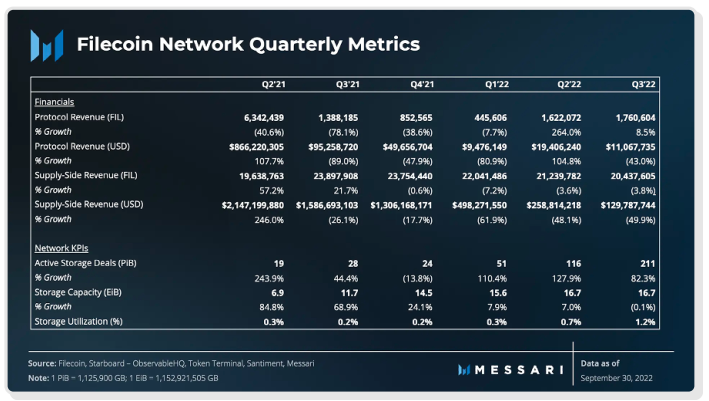

DePIN: Decentralized physical infrastructure networks (DePIN, or “token-incentivized,” TIPIN, which I don't like and refuse to use, since it sounds like a NSFW government agency) will be one of the most important areas of crypto investment for the next decade. Storage solutions like Filecoin ⭐ and Arweave, decentralized wireless networks like Helium, and other hardware networks are critical to the industry's long-term viability. They could also disrupt an absolutely ginormous set of monopolies. Legacy cloud infrastructure is a $5 trillion global market cap sector, while DePIN is just a $3 billion market cap sector for crypto players. Not a bad sector to spend time in. We're tracking it quarterly.

-

DePIN: 去中心化物理基础设施网络(DePIN,或“代币激励”,TIPIN,我不喜欢并拒绝使用,因为它听起来像 NSFW 政府机构)将是中的一个未来十年加密投资最重要的领域。存储解决方案,如 Filecoin ⭐和Arweave、像 Helium 这样的分散式无线网络和其他硬件网络对于该行业的长期生存能力至关重要。它们还可以破坏绝对巨大的垄断。传统云基础设施是 5 万亿美元的全球市值部门,而 DePIN 对于加密玩家来说只是一个 30 亿美元的市值部门。花时间在一个不错的部门。我们正在跟踪它季度。

1.5 Bear Market Building

1.5 熊市建设

If bear markets are for building, it begs the question: what should we build?

如果熊市是为了建设,那就引出了一个问题:我们应该建设什么?

For context, let's start with some history. In 2015, the answer was bitcoin trading and custody infrastructure, and dozens of billion dollar companies were formed to provide the on-and-off ramps between the crypto economy and legacy financial system. In 2018, the answer was decentralized applications, and dozens of large DeFi (USDC, Uniswap, Aave), NFT (OpenSea ⭐, Punks, ENS ⭐), and decentralized infrastructure projects (Filecoin ⭐, Helium, The Graph ⭐) were incubated during the depths of winter, while Ethereum and an entire ecosystem of L1 and L2 blockchains emerged to satisfy demand for on-chain blockspace. Look at the biggest problem areas in 2022, and you'll likely spot the sectors that will spawn the next unicorn solutions.

对于上下文,让我们从一些历史开始。 2015 年,答案是比特币交易和托管基础设施,数十亿美元的公司成立,以提供加密经济和传统金融系统之间的进出坡道。 2018 年,答案是去中心化应用,期间孵化了数十个大型 DeFi(USDC、Uniswap、Aave)、NFT(OpenSea ⭐ 、Punks、ENS ⭐ )和去中心化基础设施项目(Filecoin ⭐ 、Helium、The Graph ⭐ )深冬,而以太坊和 L1 和 L2 区块链的整个生态系统应运而生,以满足对链上区块空间的需求。看看 2022 年最大的问题领域,您可能会发现将产生下一个独角兽解决方案的领域。

• Want to solve systematic risks? We'll need investments in disclosures standards (hi, Messari!), proof-of-reserves and on-chain monitoring infrastructure, and crypto's GAAP accounting moment to discern fundamentals vs. greater fool investing.

•想解决系统性风险?我们需要投资披露标准(嗨,Messari!)、储备证明和链上监控基础设施,以及Crypto的 GAAP 会计时刻,以辨别基本面与更愚蠢的投资。

• Want to solve the hacking problems? This year was a disaster for on-chain hacks, whether it was poor smart contract design, economic model exploits, governance deficiencies, key security issues, social engineering attacks, and more. Solving security issues at scale (with AI monitoring, algorithmic circuit breakers, etc.) will be huge.

•想解决黑客问题?今年对链上黑客来说是一场灾难,无论是糟糕的智能合约设计、经济模型利用、治理缺陷、关键安全问题、社会工程攻击等等。大规模解决安全问题(使用 AI 监控、算法断路器等)将是巨大的。

• Want crypto financial markets to be competitive? Over-collateralized lending isn't too appealing vs. legacy finance. But you can't have undercollateralized lending without major default risk…unless you can leverage new identity and reputation primitives.

•想要加密金融市场具有竞争力吗?与传统金融相比,超额抵押贷款不太吸引人。但是你不可能在没有重大违约风险的情况下进行抵押不足的贷款……除非你可以利用新的身份和声誉原始工具。

• Want to ensure Amazon or Google or Apple can't shut down crypto? We still need scalable decentralized hardware networks, jailbroken device app stores, and decentralized data marketplaces that begin to siphon data from our soon-to-be unstoppable AI overlords.

•想确保亚马逊或谷歌或苹果不会关闭加密?我们仍然需要可扩展的去中心化硬件网络、越狱设备应用程序商店和去中心化数据市场,它们开始从我们即将成为不可阻挡的 AI 霸主那里吸取数据。

• If you aren't too creative, but you are entrepreneurial, you can always follow some of the biggest VCs in the space, and ask what they wish existed. A lot of them publish requests for startups, which provide a great starting point to get your creative juices flowing and find areas of interest and potential founder-market fit.

•如果你不太有创意,但你很有创业精神,你可以随时关注该领域一些最大的风险投资公司,并询问他们希望存在什么。其中很多发布创业请求,这提供了一个很好的起点,让您的创意源源不断,找到感兴趣的领域和潜在的创始人市场契合度。

How can you not be excited to build? The spoils are there for the taking. We just need the right teams to get going and create the markets.

你怎么能不兴奋地建设呢?战利品在那里等着拿。我们只需要合适的团队开始行动并创造市场。

1.6 Decoupling of Cryptos: Back to the Basics

1.6 解耦 Crypto:回到基础

This has been a good year for the fundamentals enjoyooors. For years, Bitcoin and Ethereum investors have grappled with how best to fairly value their ecosystems without much financial precedent. But we actually have real data – and tools – to support today's asset valuations today.

今年是基本面享受的好年头。多年来,比特币和以太坊投资者一直在努力解决如何最好地公平评估他们的生态系统,但没有多少金融先例。但我们实际上有真实的数据和工具来支持今天的资产估值。

Did you know that you can track quarterly financial statements directly from the blockchain for 40 top protocols?

你知道吗,你可以直接从区块链中追踪前 40 名的季度财务报表协议?

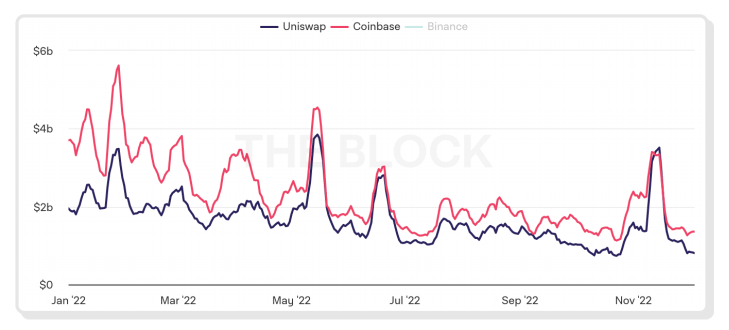

Or did you know that you can essentially front-run the SEC's obsolete financial reporting process, and predict a confidence interval for Coinbase trading volumes simply by looking at Uniswap and adding 40-60%?

或者你是否知道你基本上可以抢先运行 SEC 过时的财务报告流程,并通过查看 Uniswap 并增加 40-60% 来预测 Coinbase 交易量的置信区间?

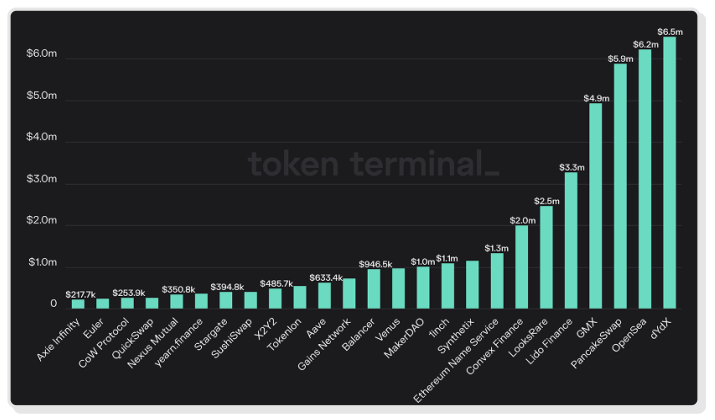

Or that you can confidently say that we're now back down to just 13 decentralized applications with $10 million in run rate revenue? (Ugh.)

或者你可以自信地说,我们现在已经退回到只有 13 个去中心化应用程序1000 万美元的运行率收入? (啊。)

The next cycle will be driven by real usage and sustainable protocol economic models. And the data above is freely available to anyone who knows where to look. In fact, we're investing aggressively in the build-out of better protocol metrics. We think it's time for a GAAP or IFRS standard for crypto assets. (Learn more about the on-chain apps we're building, and join us!)

下一个周期将由实际使用和可持续协议经济模型驱动。任何知道去哪里找的人都可以免费获得上面的数据。事实上,我们正在积极投资构建[更好的协议指标]。我们认为是时候为加密资产制定 GAAP 或 IFRS 标准了。 (详细了解我们正在构建的链上应用程序,并加入我们!)

By the time the regulators figure out what disclosures should look like for the crypto economy, this will be a fully solved problem. Value investors and consumer protectors rejoice: next cycle's rally just might reflect fundamental user adoption, and it will be free for all to investigate live.

当监管机构弄清楚加密经济的披露应该是什么样子时,这将是一个完全解决的问题。价值投资者和消费者保护者欢欣鼓舞:下一个周期的反弹可能恰好反映了基本的用户采用,而且所有人都可以免费进行现场调查。

1.7 VC: There's (Still) Money in the Banana Stand

1.7 VC:垃圾桶里(仍然)有钱

“It's a seed round in a fruit protocol, Michael. How much could it possibly cost? $10 million?”

“迈克尔,这是水果协议中的种子轮。它可能要花多少钱? 1000 万美元?”

(RIP Lucille)

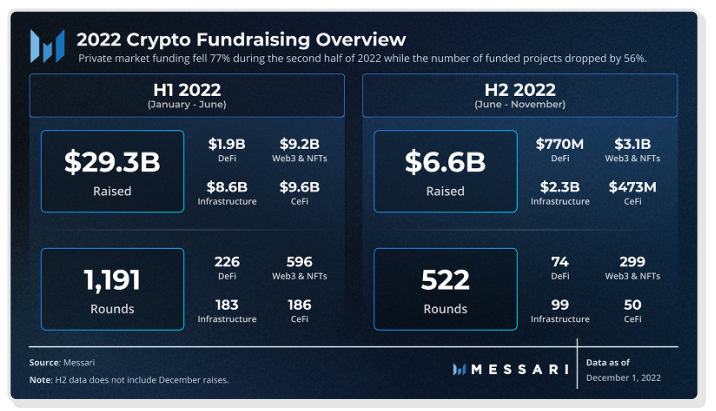

In all of 2021, there were 247 investment rounds into Centralized Infrastructure startups, 500 investment rounds into Decentralized Infrastructure and NFT startups, and 218 rounds into “CeFi” startups, representing $28.5 billion in total funding. In the first half of 2022 alone, there were 183 centralized Infrastructure investments, 596 in Decentralized Infrastructure and NFTs, and 186 in CeFi, representing another $27.4 billion in total funding.

2021 年全年,有 247 轮投资于中心化基础设施初创公司,500 轮投资于去中心化基础设施和 NFT 初创公司,218 轮投资于“CeFi”初创公司,代表[总资金 285 亿美元]。仅在 2022 年上半年,中心化基础设施投资就有 183 项,去中心化基础设施和 NFT 有 596 项,CeFi 有 186 项,总融资额达到 274 亿美元。

Only the DeFi sector total deal flow was slow (from 348 in 2021 to 226 in the first half of 2022), but there too, its total dollar funding eclipsed the 2021 full-year numbers ($1.9 billion in 1H vs. $1.7 billion in 2021).

只有 DeFi 行业的总交易流量缓慢(从 2021 年的 348 笔减少到 2022 年上半年的 226 笔),但其美元融资总额也超过了 2021 年全年的数字(1H 为 19 亿美元,而 2021 年为 17 亿美元) ).

But the slowdown became real in the second half of the year:

但经济放缓在下半年成为现实:

Crypto [[venture markets]] have come crashing back down to earth in 2H, and we're on pace for a 70%+ reduction in investment dollars vs. the first half. The total investment pace has slowed as well, and there's less dry powder for later stage crypto deals. The companies that raised in 2021 and 2022 should have lengthy runways – if they're smart. That capital is fresh, which means it should last an average of another 1-2 years at minimum, but I'm not confident that many up only founders will make the adjustments necessary to survive beyond then.

Crypto风险市场在 2 小时内崩溃回落,与上半年相比,我们预计投资金额将减少 70% 以上.总投资步伐也有所放缓,后期加密交易的干粉也越来越少。在 2021 年和 2022 年融资的公司应该有很长的跑道——如果他们聪明的话。这笔资金是新鲜的,这意味着它应该至少平均再持续 1-2 年,但我不相信许多 up-only 创始人会做出必要的调整以在之后生存。

The venture markets for more mature companies will likely get more ruthless in 2023. It's put up or shut up time for Series A+ companies to demonstrate their businesses are fundamentally sound in spite of the bear market and its pressures, and we expect to see a significant reduction in deal sizes and pace. We'll see if 2021's Chad investors stay Chads.

到 2023 年,更成熟的公司的风险市场可能会变得更加残酷。尽管熊市及其压力,A+ 系列公司证明其业务基本面良好的时间到了,我们预计会看到显着的增长减少交易规模和步伐。我们将看看 2021 年的乍得投资者是否会留在乍得。

2021's fund vintage – capital deployed at all-time highs at the tail-end of the zero interest rate environment – is unlikely to look very pretty. But now that reality has set back in, it might not be a bad time to deploy capital professionally.

2021 年的基金年份——在零利率环境的末期以历史最高水平配置的资本——不太可能看起来非常漂亮。但现在现实已经倒退,现在可能是专业配置资本的好时机。

1.8 The Macro Rebound vs. The Dumpening

1.8 宏观反弹与暴跌

Everything so far in this report has assumed that the bear market will continue for the foreseeable future, and there is no “V-shaped recovery” for the crypto markets. I think that's a fairly safe bet, but…

到目前为止,本报告中的所有内容都假设熊市将在可预见的时间内持续未来,加密市场不会出现“V 型复苏”。我认为这是一个相当安全的赌注,但是……

-

It's still all about macro (and regulation). The resting market sentiment is that we will have a recession in 2023, with some debate over its potential magnitude. The market also seems to trust that central banks will continue to tighten until inflation is under control. Though contrarian, there are some investors who think it's more likely that the Fed will pivot once the recession really gets going and accept multi-year high inflation in lieu of a depression or global reserve currency crisis (Watch: Luke Gromen). If that's the case, then physical commodities like gold and oil would perform strongly. And digital gold and digital oil might follow suit. Macro forces led the 2020-2021 crypto bull market. It led to the 2022 collapse. Why not the 2023 recovery?

-

这仍然是关于宏观(和监管)的。目前的市场情绪是,我们将在 2023 年出现经济衰退,对其潜在规模存在一些争论。市场似乎也信任央行将继续收紧货币政策,直到通胀得到控制。尽管持相反观点,但仍有一些投资者认为,一旦经济衰退真正开始,美联储更有可能转向并接受多年高通胀来代替萧条或全球储备货币危机。如果真是这样,那么黄金和石油等实物商品将表现强劲。数字黄金和数字石油可能也会效仿。宏观力量引领了 2020-2021 年的Crypto牛市。它导致了 2022 年的崩溃。为什么不是 2023 年的复苏?

-

We don't usually predict the next major market catalyst in advance. But I'd keep a close eye on the 2022 developer report from Electric Capital for a peek at where there might be kindling for the market recovery.

-

我们通常不会提前预测下一个主要的市场催化剂。但我会密切关注 [Electric Capital 的 2022 年开发者报告],以了解可能存在的问题为市场复苏火上浇油。

On the other hand, we still have a number of negative potential market shocks.

另一方面,我们还有一些潜在的负面市场震荡。

-

For Bitcoin, miners are puking just about everything they mine to cover operating costs and debt service. That's predictable weekly selling pressure that shows no signs of abating. It is likely that the Mt Gox bankruptcy proceeds (137,000 BTC) are distributed in early 2023. And although it wouldn't hit the bitcoin spot market directly, it's plausible that DCG and Genesis might be forced to sell up to ~$60 million shares of GBTC per quarter for the foreseeable future.

-

对于比特币,矿工们正在吐出他们开采的几乎所有东西来支付运营成本和偿债费用。这是可预测的每周抛售压力,没有减弱的迹象。 Mt Gox 破产收益(137,000 BTC)很可能在 2023 年初分配。虽然它不会直接冲击比特币现货市场,但 DCG 和 Genesis 可能被迫出售 在可预见的未来每季度高达 6000 万美元的 GBTC 股票。

-

Ethereum's post-Merge supply dynamics are disinflationary, though it's unclear whether the tax consequences of post-Merge staking rewards will lead to significant spot selling pressure in the market in order to cover liabilities incurred from staking income. Even though miner's selling pressure is a thing of the past for Ethereum, this new tax selling impact is new and difficult to predict.

-

以太坊合并后的供应动态是抑制通货膨胀的,尽管尚不清楚合并后质押奖励的税收后果是否会导致市场出现巨大的现货抛售压力,以弥补质押收入产生的负债。尽管矿工的抛售压力对以太坊来说已成为过去,但这种新的税收抛售影响是新的且难以预测。

-

Beyond BTC and ETH lies a mess of project-specific selling. L1 and DeFi tokens with large token treasuries that unlock for founders or early investors; forced selling of positions held by bankrupt funds or collateral held by distressed lenders; poorly designed tokens that suffer from economic death spirals. We'll get into some specifics later in the report, but for now, know this: there is currently more than $50 billion worth of supply that could theoretically hit the $250 billion “long-tail” of assets.

-

除了 BTC 和 ETH 之外,还有特定项目的混乱销售。 L1 和 DeFi 代币,拥有大量代币宝库,可供创始人或早期投资者解锁;强制出售破产基金持有的头寸或陷入困境的贷方持有的抵押品;设计不佳的代币会遭受经济死亡螺旋。我们将在报告的稍后部分详细介绍一些细节,但现在,请了解这一点:目前价值超过 500 亿美元的供应量理论上可以达到 2500 亿美元的“长尾”资产。

1.9 Buyouts vs. Bankruptcies

1.9 收购与破产

It's hard to believe how bullish we were last year about the slate of upcoming crypto IPOs. BlockFi was a rocketship! Circle was going to SPAC! Blockchain, DCG, and Kraken looked like they might be next. GBTC seemed to have a fighting shot at approval given the SEC's approval of several inferior futures-based ETFs.

很难相信我们去年对即将到来的加密 IPO 的名单有多乐观。 BlockFi 是一艘火箭飞船! Circle 要去 SPAC!区块链、DCG 和 Kraken 看起来可能是下一个。鉴于美国证券交易委员会批准了几只劣质的基于期货的 ETF,GBTC 似乎在获得批准时打了一枪。

Instead, in the past few months, BlockFi filed for bankruptcy, Circle pulled its SPAC, Blockchain took an emergency down round, Kraken has laid off 30% of its staff, and even DCG might be on the brink due to levered share buybacks and a disastrous six months for its lending subsidiary Genesis. I mean, Coinbase debt is now yielding 15%.

相反,在过去几个月里,BlockFi 申请破产,Circle 撤回了 SPAC,区块链紧急下轮,Kraken 裁员30%,甚至由于杠杆股票回购及其贷款子公司 Genesis 灾难性的六个月,DCG 可能处于濒临崩溃的边缘。我的意思是,Coinbase 债务现在的收益率为 15%。

None of this is great. BUT, it does present a compelling potential entry point for larger institutions who believe crypto will have a long-term role in the global economy. If you believe in crypto, doubt that you will be able to innovate your way into a market leadership role organically, and believe that your compliance and regulatory cloak position you well to clean up a technically sound, but operationally inferior “crypto institution,” you might want to shoot your shot in 2023.

这些都不好。但是,它确实为相信 Crypto 将在全球经济中发挥长期作用的大型机构提供了一个令人信服的潜在切入点。如果你相信 Crypto,怀疑你是否能够通过创新有机地成为市场领导者,并相信你的合规和监管外衣使你能够很好地清理一个技术上合理但操作上较差的“加密机构”,你可能想在 2023 年开枪。

Fidelity or Blackrock might like DCG in a distressed buyout situation. JPMorgan might jump at the chance to lob in a hostile takeover bid for Coinbase at just 5% dilution. If the institutions were, indeed, coming last year, then you have to wonder whether the barbarians are at the gates and Wall Street is ready to execute a slow takeover of crypto.

Fidelity 或 Blackrock 可能会喜欢处于困境中的 DCG 收购情况。摩根大通可能会抓住机会以仅 5% 的稀释度对 Coinbase 进行恶意收购。如果机构确实去年来,那么你不得不怀疑野蛮人是否已经到了门口,华尔街是否准备好对Crypto进行缓慢的接管。

I'm not saying that I particularly like that future.

我并不是说我特别喜欢那个未来。

I'm just saying it could happen, and it's looking more plausible by the day that this downturn could end up proving to be the bridge that institutions – on Wall Street and in Big Tech – needed to integrate crypto products at scale. Through M&A.

我只是说它可能会发生,而且到今天这种低迷可能最终被证明是桥梁看起来更合理华尔街和大型科技公司的机构需要大规模整合加密产品。通过并购。