Human will is the most capital-efficient, egalitarian form of collateral ever created.

3Jane is a credit-based money market on Ethereum enabling unsecured lines of credit underwritten against verifiable proofs of DeFi/CEX assets, future cash flows, and credit scores. This unlocks a three-dimensional collateral space within crypto financial markets by introducing future-backed credit alongside existing asset-backed loans. 3Jane integrates onchain address credit scoring models via Cred Protocol and Blockchain Bureau with offchain VantageScore 3.0 credit scores via zkTLS, enabling risk-adjusted underwriting at scale. To maintain protocol solvency, 3Jane operates onchain auctions where U.S. collections agencies can bid on collecting non-performing debt. 3Jane introduces significantly higher capital efficiency by underwriting a larger set of productive DeFi assets at a faster velocity whilst mitigating bad debt by tapping into offchain credit data and offchain recourse.

Credit scores allow 3Jane not only to price risk responsibly - they also unlock an entirely new class of financial primitives. Credit scores are the gateway to the other side of the moon.

TradFi & Credit Scores

In September 2024 Andre Cronje released Credit scores, defi, and Sonic in which he aptly draws a parallel between the evolution of the Internet to DeFi markets - you needed USENET and ARPANET before you got e-commerce and global payments. Similarly, early stablecoins like DAI were prerequisites for DeFi primitives like Uniswap (DEX) and Aave (money market). Andre argues that for DeFi credit to evolve, it must first have a credit score lego to standardize underwriting and enable the securitization of mass-market financial products.

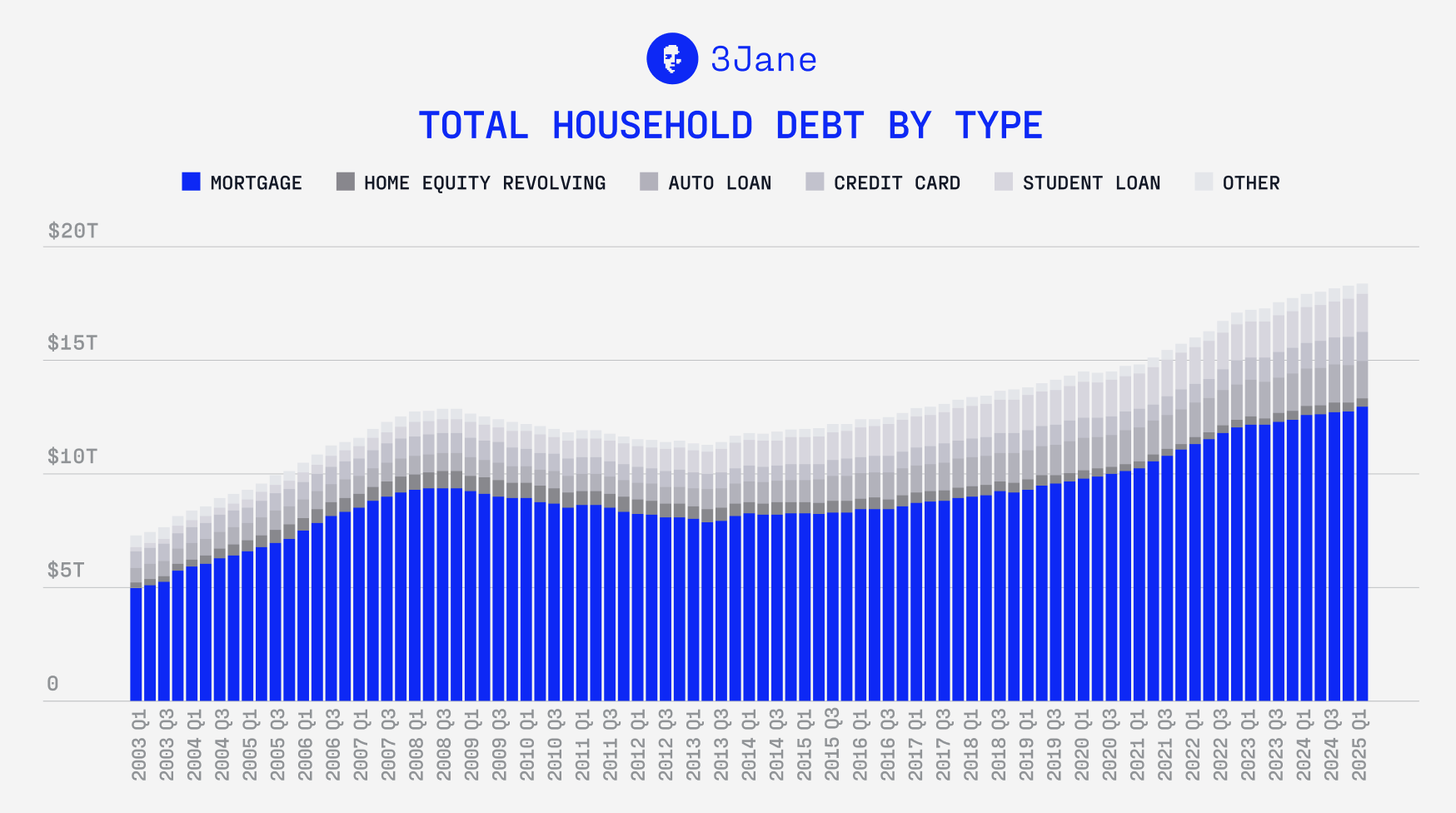

Credit scores are a fundamental financial primitive within the traditional financial system. It enables scalable underwriting of virtually every mass-market credit product, including mortgages, personal loans, and credit cards which in aggregate represent over $14T in outstanding U.S. consumer debt. Furthermore, it serves as the reference point for structuring and pricing consumer-linked asset-backed securities such as credit-card ABS, residential MBS, BNPL ABS, and the CDO’s built atop them. Credit scores ultimately drive a more efficient credit market by compressing credit spreads and driving down borrowing costs. This enables a self-reinforcing flywheel: richer data → scores standardize underwriting → standardized pools securitize efficiently → lower funding costs circle back to borrowers.

Crypto & Credit Scores (2012-)

Credit scores in crypto have a long evolutionary history. They were first introduced in 2012 by BTCJam, a global P2P BTC microlender serving 85+ countries. It used Facebook attestations and in-platform repayment history to grade borrowers A+ through E. In 2017 Bloom Protocol packaged KYC data, utility-bill scans, and credit bureau data into a “Bloom Score” with the intention of having other dapps compose on top. In 2021, ArcX built out a DeFi passport score (0 - 999) from on-chain borrowing behaviour and used it inside its own money market to boost loan-to-value ratios. Good actors could borrow at 90 % LTV without extra collateral and bad actors were throttled to 50%. Useful, but still not truly unsecured. In 2022, teams like Spectral and Cred protocol developed rich machine learning models trained against all tx history in order to devise a per-address credit score.

It is clearly a worthwhile pursuit - there have been dozens of attempts at bringing credit scores to crypto.

Despite more than a decade of experimentation, cryptonative credit scores have failed to reach escape velocity and drive any meaningful financial innovation within decentralized finance and the cryptoeconomy more broadly.

We believe there are two reasons why credit scores have failed to take off:

(1) a scalable unsecured credit vehicle that has solved for legal recourse still does not exist. Credit scores without credit are useless.

(2) 99% of credit behavior exists offchain, the absence of which in underwriting gives little margin for error and presents an existential risk before the product can even scale.

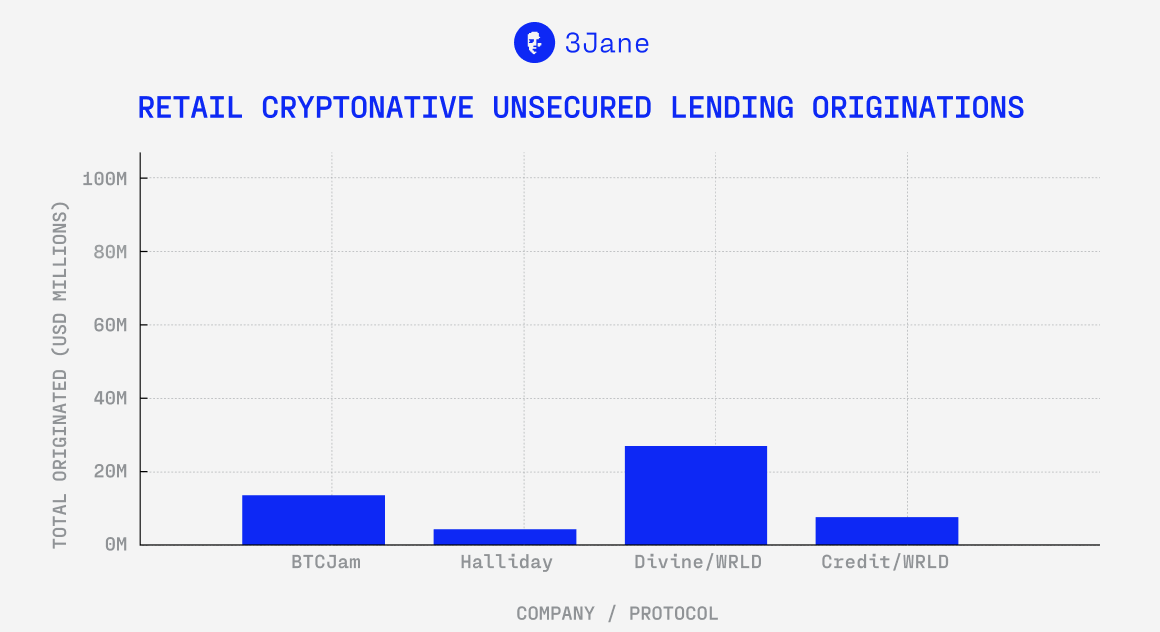

Over the course of 10 years, there have been less than $50M in total retail-facing cryptonative loans originated - less than what a mid-tier BNPL firm originates in a month. The primary drivers of unsecured credit have been focused on extending microloans (typically <$1K) to non-cryptonatives in emerging markets with minimal financial infrastructure who lack credit access, with the intention of bootstrapping and eventually supplanting that system from the ground-up.

This type of credit product certainly serves a market need - BTCJam had originated more than $14M in BTC-denominated loans across 20,000 borrowers. However microlending has historically faced significant challenges in scaling across jurisdictions as well as maintaining low default rates, particularly given that there is limited credit history and the fact that the unit economics of legal enforcement don’t make sense at those ticket sizes. BTCJam eventually went defunct in 2017 due to scalability issues and extremely high default rates upwards of +30%. Divine and Credit, both Worldcoin mini-apps, have taken a very promising approach of tapping into Worldcoin’s scarcity of identity & future $WLD yield as a form of collateral which might very well tip the scales for strategic default deterrence.

Crypto & Credit Scores. And Leverage (2025-)

It is important to delineate the two primary use-cases for debt:

(1) Consumption: borrowing that brings future earnings into the present so the borrower can purchase goods or services that primarily deliver immediate utility. Ex: credit cards, personal loans, mortgages.

(2) Leverage: borrowing to acquire or hold assets expected to yield returns greater than the cost of capital. Ex: business loans, margin trading, real-estate loans, LBO’s, yield farming loans.

Nearly every cryptonative credit score experiment to date has chased (1). We believe the breakout opportunity lies in (2) - a leverage-focused credit vehicle that uses credit scores not only to price risk but to enable a net-new DeFi primitive to exist in the first place.

Early Credit Band Data

3Jane’s thesis is simple: the market will only trust a crypto credit score when it sits inside a credit vehicle that simultaneously (a) enforces repayment and (b) bootstraps initial underwriting with offchain credit data. While we believe we have the most elegant and scalable solution to date for (a), our enforcement mechanisms will take years to validate.

However, we have already made significant progress on (b). Ex-ante underwriting is as important as post-default recovery mechanisms and we would like to share some preliminary data we have collected so far.

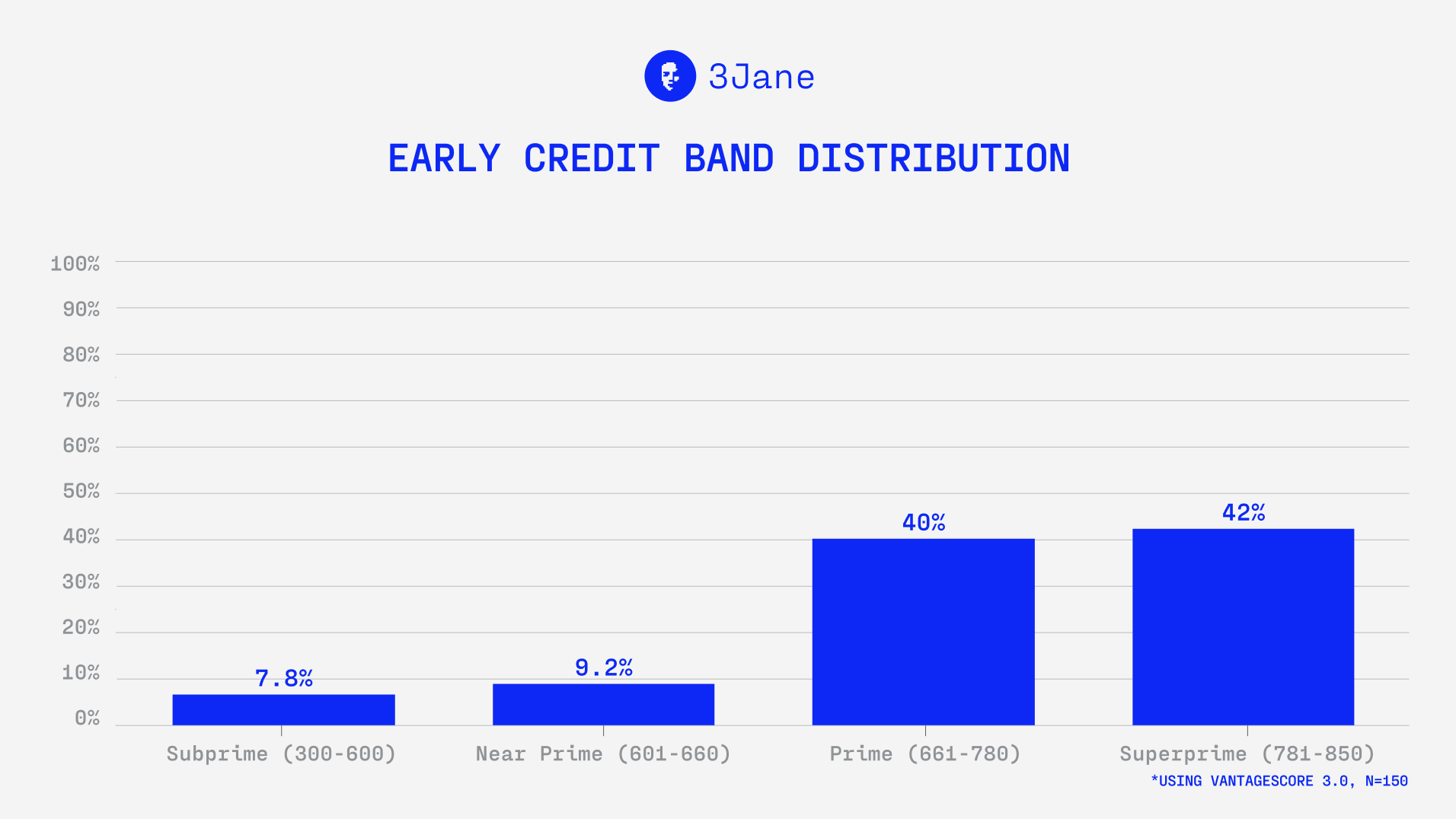

Over the past 1.5 months, we’ve accumulated credit scores (alongside other credit report metadata) across ~150 DeFi users who have signed up for early access. As far as we know these are the very first insights shared on offchain credit behavior across the cryptonative population. Credit score distribution (VantageScore 3.0):

While this is most certainly not a representative sample, early data shows that mass-affluent/high net worth yield farmers and traders in the United States have an average VantageScore 3.0 of 740 and a 763 median, which is considered prime/prime-plus.

This pool is ~60 points above the U.S. consumer median- we believe this is largely due to selection bias. Anyone holding a sizable DeFi portfolio is, by definition, sitting on meaningful assets. That elevated net worth tends to come with stronger credit scores, since people who amass and manage wealth generally demonstrate financial literacy.

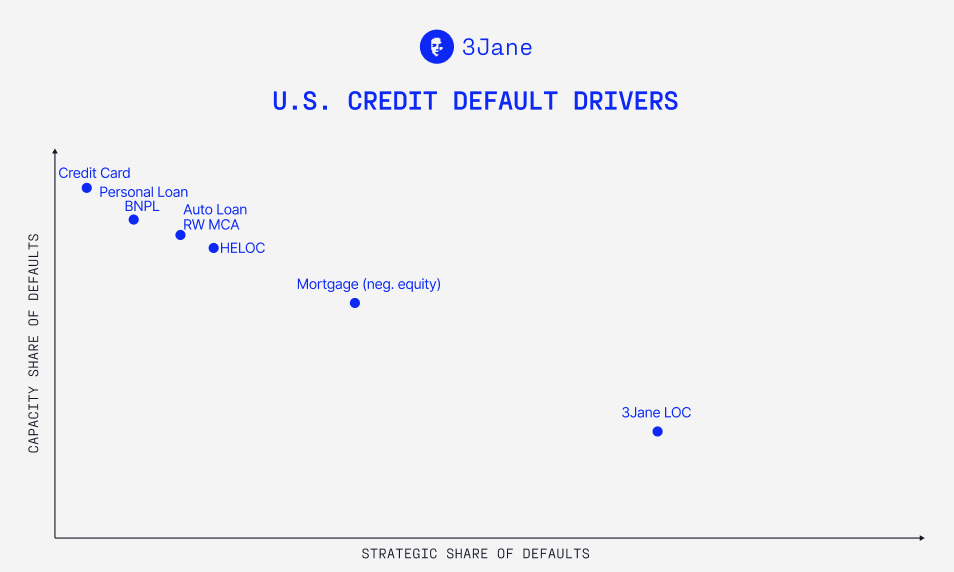

It is important to note that this is not a distressed credit pool. These are capital-efficient, asset-rich users - many with significant portfolios, deep credit files, and high asset visibility. As a result, we expect that an overwhelming share of the defaults that do occur are of a strategic nature.

Defaults generally fall into two buckets:

(1) Inability to repay: due to income shock, loss of liquidity, or job loss.

(2) Willingness to repay: strategic defaults where borrower has the means, but walks away (e.g. because LTV > 1).

In traditional credit cards and personal loans, (1) drives nearly all defaults. In 3Jane, where user behavior is tied to portfolio value, willingness to repay under stress becomes the dominant variable.

Residential Mortgage Backed Securities (RMBS)

This is exactly the phenomenon observed in RMBS during the 2008 crisis. When the U.S. housing market collapsed in 2007–08, researchers and regulators spent years dissecting who defaulted and why. The key insight is that credit scores influence both probability of default and the type of default (ability vs willingness). Ex-ante underwriting is as important as post-default recovery mechanisms.

3Jane is introducing a fundamentally novel credit product into the cryptoeconomy, and as such has little prior arts to go off of. Instead we look to tradfi credit products, particularly residential mortgage-backed securities (RMBS), to build up our intuition around probability of default (PD’s), loss-given-default (LGD’s), and broader strategic default behavior to model our credit risk premiums for our initial vintage of credit lines.

In a future piece, we will delve deeper into how we derive 3Jane’s credit risk premiums.

Next Steps

In order to bootstrap and scale 3Jane’s unsecured credit marketplace without sacrificing risk discipline, we’re running the protocol through a deliberately sequenced flywheel. Each loop tightens our underwriting, boosts supplier confidence, unlocks progressively larger credit capacity, and compresses credit spreads. You can read more about our scaling strategy.

-

Credit Line Launch - first vintage of credit lines (up to $1M) go live in September

→ Open to 75 U.S.-based users with >$200K in DeFi assets.→ 20 spots remain. Claim one of the 20 remaining spots.

-

USD3 and sUSD3 deposits will become permissionless shortly after

-

We will continue publishing research pieces on DeFi yields, credit scores, credit spreads, and performance of analogous tradfi credit products.

-

Read our whitepaper and docs to learn more.