Crypto needs credit expansion. The modern capitalist financial system relies on two core pillars to drive economic growth: a medium of exchange & the creation of credit. While stablecoins have convincingly delivered on the former over the past 10 years, DeFi growth remains constricted by the absence of a scalable and capital-efficient mechanism for credit creation. To truly become the internet-native financial system — free from bank liquidity — a cryptonative credit primitive must emerge.

Introduction

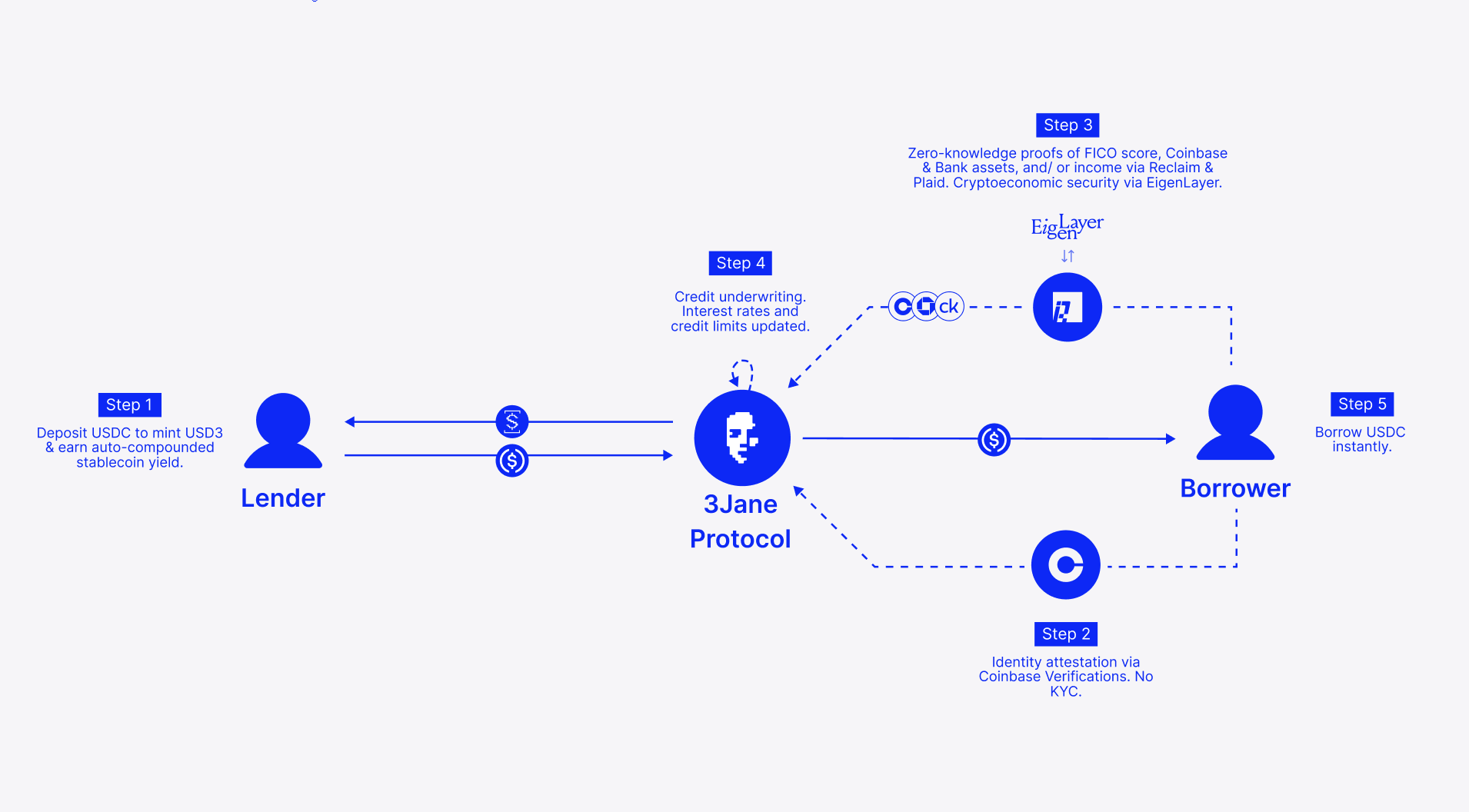

3Jane is the first credit-based money market — built on Base — enabling trustless, permissionless, and censorship-resistant uncollateralized stablecoin loans backed by creditworthiness & future cash flows. 3Jane aims to prove new worlds, underwriting loans beyond the ledger based on verifiable coinbase assets, bank cash / income, and FICO scores.

USD3 is 3Jane’s yield-bearing asset backed by a pool of cash advances, allowing depositors to lend and can compose across DeFi whilst simultaneously giving borrowers access to a global pool of instant liquidity.

This marks the next major step in DeFi’s evolution — a transition from a purely asset-based economy to a credit-based economy.

Problem :: Hard Collateral :: Minimal Credit Expansion (2017-)

Since the launch of Aave in 2017, DeFi has followed an overcollateralized lending model, requiring users to post collateral greater than the value of the loan. Over-collateralized lending protocols have found product-market fit, growing to $50B in TVL and facilitating >$10B in outstanding loans. While over-collateralization ensures a lower cost of capital, higher loan sizes, and importantly a lower risk to lenders, there are two major problems:

-

Capital Inefficient — this is an inherently liquidity dilutive model, locking up more capital than liquidity it provides. This perpetuates liquidity fragmentation across protocols and chains and introduces significant opportunity cost by precluding users from permissionlessly deploying collateral more productively in exotic yield bearing assets, farms, or exchanges in real-time. This model was borne out of a necessity to ensure lender solvency in the absence of a robust identity primitive in an anonymous and adversarial context.

-

Minimal Collateral Base - users can only borrow against what lives on the ledger - namely ERC-20’s, NFT’s, and ENS names. This confines the collateral base to $140B — DeFi’s total TVL. Lending protocols are en masse neglecting FICO scores, +$273B in Coinbase assets, +$18T in U.S. commercial bank deposits, and +$23T in U.S. annual personal income, which combined is >100x the size of DeFi today.

These two issues jointly have silently caused the “great credit rationing” within DeFi for the last seven years, limiting credit creation to those with assets already in the system and preventing economic expansion into new domains backed by Coinbase assets and bank cash flows. As an industry we’ve traded in long-term economic growth for short-term market solvency. But what if it didn’t have to be a choice?

It’s time to bring +$1T of provable soft collateral into the system — built on robust identity and verifiable proofs — and enable an era of infinite credit expansion in crypto. It’s time to bring the world onchain.

Solution :: Soft Collateral :: Infinite Credit Expansion (2025-)

Trust (lessness) accelerates human coordination.

How do you bring +$1T of offchain assets and income onchain? You can either literally bring it all onchain, or you can prove the existence/ownership of it all today with API responses backed by cryptoeconomic security, and extend credit against it.

3Jane is a peer to pool credit-based money market which extends unsecured loans based on verifiable proofs of soft collateral:

-

crypto & cash assets - ERC-20’s & NFT’s, DEX deposits, Coinbase crypto, bank cash via Plaid.

-

cash flows - money market & staking yield, bank income via Plaid.

-

credit scores - address creditworthiness via Cred protocol, FICO scores via Credit Karma.

Overnight, DeFi is evolving from a $140B collateral base and <1M users to a +$1T in value across +70M crypto users that can immediately borrow USDC onchain for trading, yield farming, or other liquidity needs. This is called infinite credit expansion and is what will accelerate DeFi’s economic expansion in conjunction with stablecoins.

Bootstrapping Trust

Provable off-chain data :: zkTLS. 3Jane leverages Reclaim to a) obtain and b) prove the provenance of API responses in a privacy-preserving manner without revealing PII, allowing 3jane to post proofs of FICO scores, Coinbase asset data, Bank cash, and income data onchain without introducing additional trust assumptions. In addition, 3Jane utilizes EigenLayer’s cryptoeconomic security to ensure a collusion resistant set of designated proof verifiers. Lenders will have trustless transparency into off-chain borrower financial data.

Identity :: Coinbase Verifications. 3Jane leverages Coinbase Verifications for sybil-resistance and a low-friction KYC mechanism for legal recourse in the case of default. By connecting their onchain address to their Coinbase account, users will be able to borrow without having to provide additional KYC to 3Jane.

Recourse :: Onchain Debt Collection Auction. In the case of default, 3Jane will initiate a global & permissionless debt collection auction, allowing individuals and entities such as debt collection agencies to bid on and purchase a pool of non-performing loans at a discount and pursue collections.

The 3Jane Endgame

AI agents will fully embrace crypto rails before humanity does. AI agents will incorporate crypto rails for better lending just as they already have for better payments.

3Jane aims to be the global unsecured credit facility for verifiable AI agents, offering stablecoin lines of credit for liquidity needs in any and all financial flows for themselves or on behalf of their overlords.

Timeline