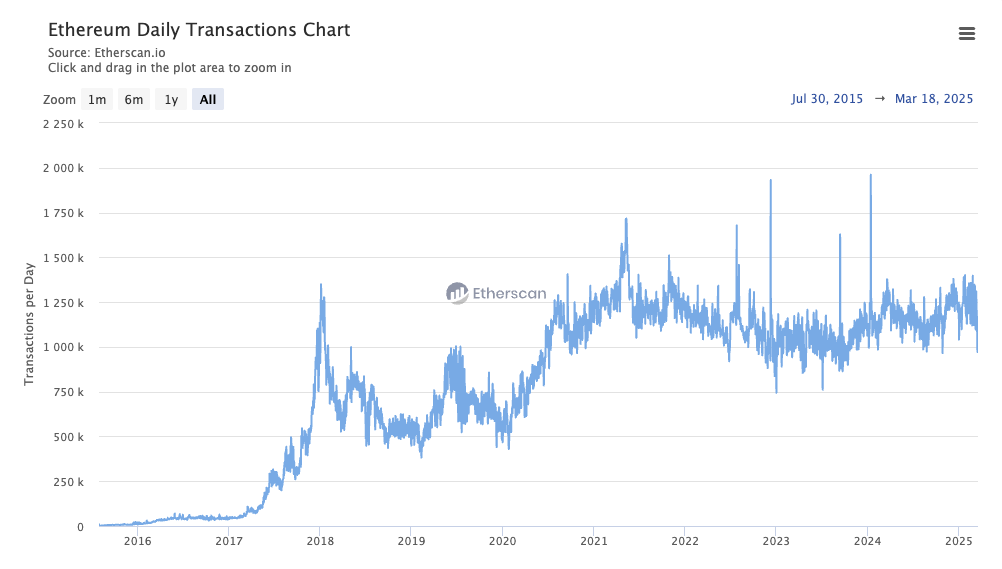

Since Ethereum’s launch in 2014, more than 2.5 billion transactions have taken place across 300 million unique addresses and over 5,000 protocols. This explosion of on-chain data has created what is arguably one of the greatest financial datasets ever assembled, offering unparalleled visibility into user behavior around spot trading, staking, derivatives trading, lending / borrowing, governance participation, NFT purchases, etc.

Early onchain credit-scoring pioneers such as Spectral (“MACRO”) and Cred Protocol (“CRED”) used over-collateralized loan repayment as a proxy for creditworthiness. None of these credit scores were ever meaningfully deployed into production by lending protocols due to the “default problem”: no matter how sophisticated the underwriting, it remains game-theory optimal for a user to strategically default on unsecured DeFi loans.

However, if you can solve the default problem, then this opens up a completely novel design space for credit underwriting that can not only meet but surpass traditional lenders in underwriting quality by incorporating both onchain credit scoring data with offchain tradfi credit data. This is the challenge that 3Jane, in collaboration with Blockchain Bureau and Cred Protocol, is tackling head-on.

3Jane X Blockchain Bureau

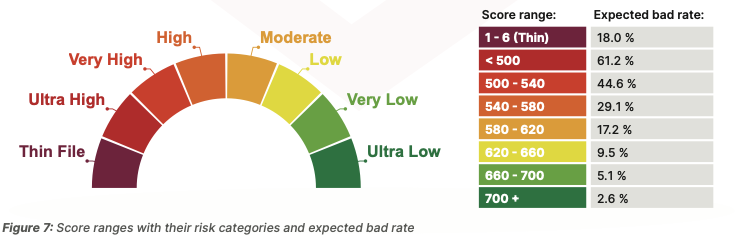

3Jane now leverages Blockchain Bureau’s “Providence” model, which is trained on onchain transaction data from 15 EVM-compatible chains, over 130K DeFi loans, and more than 1PB of transaction history to predict the likelihood that a user will default on a loan.

The Bureau’s model is built on over 1,000 distinct input features that describe wallet behavior at a granular level. These range from simple transactional metrics, such as the number of borrows in the past 90 days or assets held, to more sophisticated behavioral signals such as how frequently a wallet interacts with new protocols or whether it consolidates funds at regular intervals.

Based on these inputs, Blockchain Bureau generates a predictive credit score ranging from 400 to 732, designed to indicate the probability of loan default:

-

700+ → Ultra-low risk borrower, high likelihood of repayment

-

620-700 → Low risk, financially stable DeFi participant

-

540-620 → Moderate risk, possible past defaults or unstable activity

-

<500 → High default probability, history of liquidations, poor financial management

3Jane’s 3CA algorithm now integrates three core data sources: BCB credit scores, Cred credit scores, and Credit Karma TransUnion/Equifax credit scores.

You can learn more about the BCB model details and performance here.