Price equilibrium, and why the markets fluctuate

After 5 years of preparation, it seems that we can finally expect the Ethereum Merge to take place in a few weeks, specifically on the 15th of September. In spite of the technical complexity involved in what some have referred to as “repairing a plane on the flight”, neither users nor developers would be impacted in a significant manner, but what about investors and traders? Is the Merge priced in? Are the markets forward looking? Does the law of supply and demand only work after the fact?

With the supercycle thesis out of sight since the beginning of the year, many investors find in the Merge a catalyst that will spark a new wave of interest in the most reflexive factor of the markets: attention. Many have referred to this event as a once in a lifetime opportunity, “the biggest structural shift in the history of cryptocurrencies”. Just like the markets, in this article I hope to reach a point of equilibrium that allows us to assess the current situation as objectively as possible.

In its most recent piece, one of the most sophisticated investors in the cryptocurrencies industry, Arthur Hayes, has come up with a narrative that follows the theory of reflexivity introduced by George Soros in The Alchemy of Finance. This narrative anticipates a feedback loop by which market participants will exert an outstanding influence on what the markets will price in anticipation of the merge. As usual, consciously or not, market participants will shape the expectations of other participants, whose biases will reinforce a rising or falling price trend. The future we are trading is, indeed, the Merge becoming a self-fulfilling prophecy.

From a technical point of view, the Merge is the last step in the transition from a Proof of Work to a Proof of Stake consensus algorithm. Currently, an independent Proof of Stake chain known as the Beacon Chain is running in parallel to the original Proof of Work chain. The Beacon Chain, which began accepting deposits in November 2020, is now secured by millions of ETH across over 240K validators. The software upgrade that will deprecate the Proof of Work chain in favor of a transition to Proof of Stake that preserves the entire history of Ethereum transactions is what we will refer to as the Merge. On the technical side, this does not seem like a big deal, other than the rise of an ESG friendly narrative that might bring more economic security to the Ethereum network (for a comparison of the economic security between Ethereum Proof of Stake and Bitcoin Proof of Work, take a look at this spreadsheet). Nevertheless, there is more than meets the eye, so let’s focus on the narrative:

- The network will experience an exponential reduction in its issuance rate.

- Ethereum will continue to experience a reduction in ETH supply due to a portion of every transaction fees being burnt.

- ETH being staked before withdrawals are enabled ahead of the Shanghai fork will contribute to a further reduction in the supply.

This is what many refer to as a triple halvening:

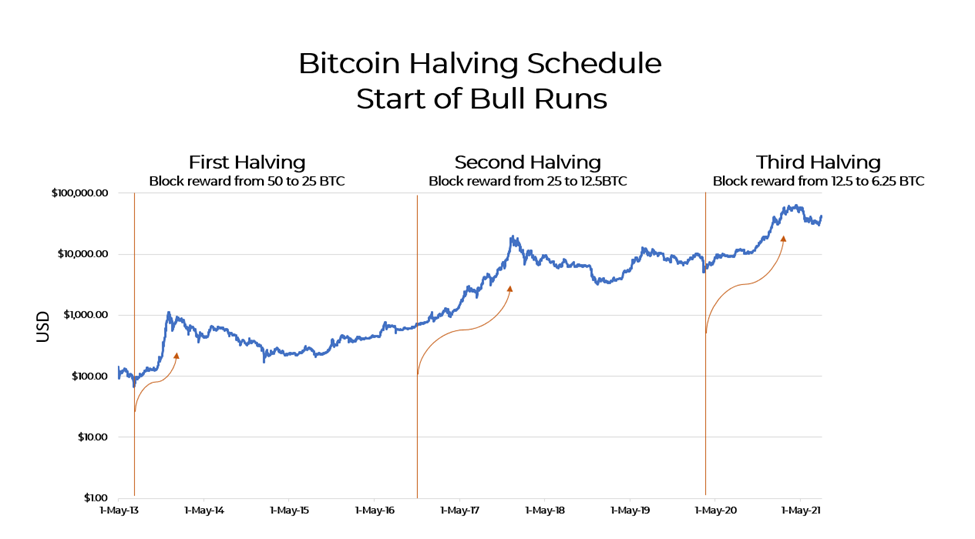

If we were talking about bitcoin, we would expect a price action that would look like this:

Historically, bitcoin has entered a bull market soon after the halving. Then there is a small correction and a period of sideways or downwards trading, and finally there is a strong push to upside.

- 1st halving 11/28/2012 -> $1,150

- 2nd having 06/09/2019 -> $19,900

- 3rd halving 05/11/2020 -> 69,00

Before addressing how this relates to ETH, it is important to lay some contextual groundwork. Just because markets are forward looking does not mean that certain events are already priced in. As per Dow theory, everything is priced in, but we continue to see how market makers keep suffering from adverse selection one time after another.

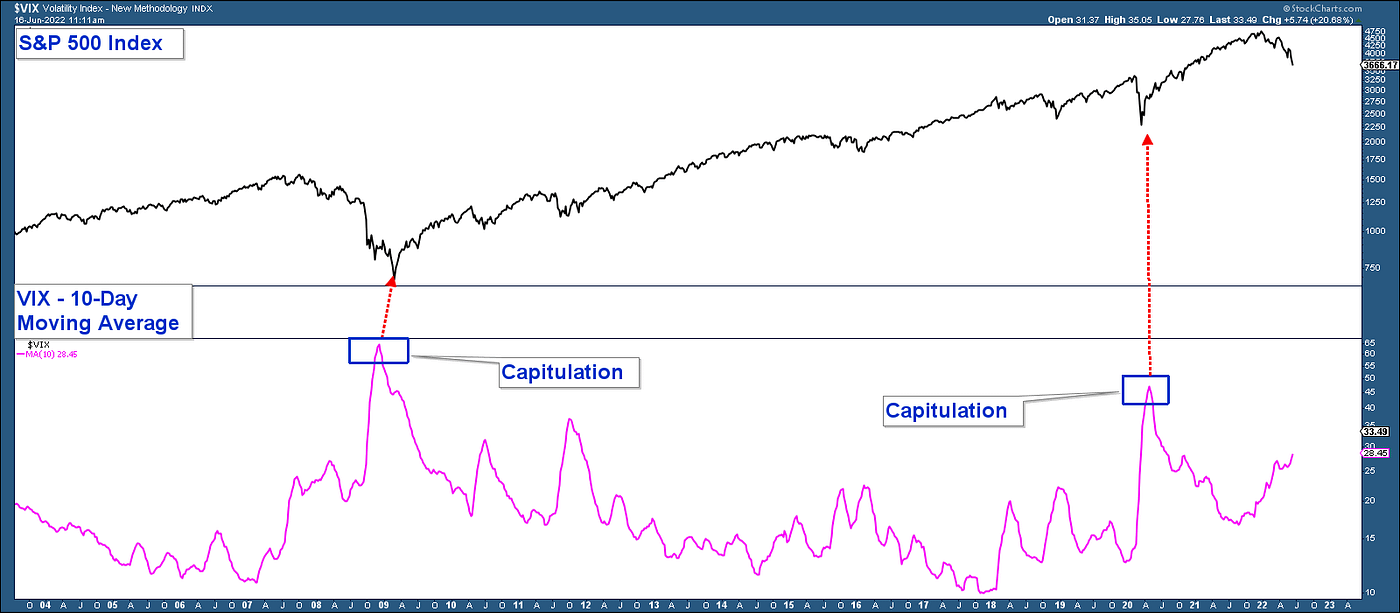

As far as risk assets goes, the absence of a capitulation can be a bit concerning when compared to 2008 or 2020. We have not really seen panic across the global markets.

If we take a slow moving market such as real state, we realize that Generation Z is basically hoping for a housing collapse. So is Jerome Powell, who actively claimed that “homebuyers need a bit of a reset”. Apparently, the FED’s goal is to crash the housing market to get rates back down. In that way, the next generations can benefit from low home prices and low borrowing rates.

After the latest CPI data, everyone seems to be celebrating that inflation is coming down along with the oil prices. Let’s see what the futures markets are expecting for electricity in Germany:

What about gas and electricity bills in Italy?

- July 2021: EUR 120k

- July 2022: EUR 979k

But who knows? You will never have all the information you may need before making an investment or trading decision. You don’t need it either, so maybe the bottom is already in and we are targeting 50bps in September. If data continues to show that inflation has peaked and everyone FOMOs into risk assets, even the most skeptics will be forced to join the market and buy back higher right?

The macroeconomics outlook is not the most favorable, but can the Ethereum Merge mark the beginning of bull market? Looking at similar narratives of the past like the bitcoin ETF in October 2021, or the Coinbase IPO, we would not be expecting much upside.

$BTC price action after ETF announcement in October 2021

$COIN price action after announcing its IPO

All risk assets are trending to the downside, and inflation is becoming more sticky. But what if the triple-halvening in ETH is not priced in? Back to the topic of reflexivity, we can infer that the usage of the Ethereum network is a reflexive variable, where the amount of gas fees that are burnt is dependent on the usage of the network.

- ETH inflation = Block emission — gas fees burnt

- Inflation = Block emission > gas fees burnt

- Deflation = Block emission < gas fees burnt

If we follow Arthur Hayes’ narrative, we would take some extra metrics into account to further reinforce the importance of reflexivity. One of those metrics would be an increase in social media, blog posts, public information… All of that, combined with quality improvements and an increase in the number of dapps, would attract more developers and users. Since the number of users and the price share a reflexive relationship, then the number of developers and the price must also share a reflexive relationship.

But remember, if there is no money to be made, crypto does not have a user base that transacts on chain.

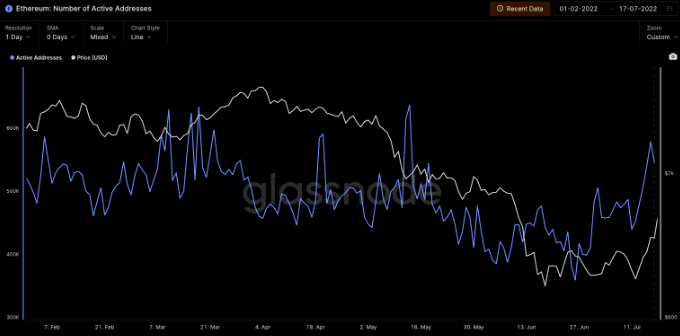

On the flip side, although fees have declined, active users have been in a steady uptrend since late June.

This might seem inconsistent, since more users are expected to lead to higher gas, but we must keep in mind that developers are getting more experienced. For instance, with the Seaport implementation, Opensea has increased its gas efficiency by 35%. This is relevant and, up to a certain point, might explain why a reduction in gas does not strongly correlate to a decline in activity.

On top of that, we could take into account that, in the short term, prices are driven by discretionary supply and demand, whereas structural forces only come into play over the medium to long term. This structural demand in other alternative L1s explains why so many new projects experience a large appreciation at inception. The majority of the supply is locked up, and the discretionary demand is enough to bring the price higher. Afterwards, supply unlocks not followed by structural demand, cause the initial price appreciation to fall significantly.

Better dapps bring in more users, more people use the network, price increases, FOMO kicks in, more engineers are attracted to develop apps on the network, and so on.

So far we know that:

- The magnitude of deflation is dependent on the amount of gas fees burn.

- The amount of gas fees burnt is dependent on network usage.

- Network usage is dependent on the number of users.

- Number of users is dependent on the quality of applications.

- The quality of applications is dependent on the quantity and quality of developers.

- Better applications attract more users.

- More users bring in more attention to the Ethereum network.

- ETH is outperforming BTC, specially since this year’s market bottom.

With such minimalistic framework in mind, we would expect that:

- Traders will buy with expectations of higher prices because they believe the network will be used more, which makes ETH more deflationary, which will push price higher.

- Hedgers will be forced to cover their shorts and be net long ETH as speculators yolo into the triple-halvening narrative.

- All the pressure is on the buy side.

- The only ceiling is every human on Earth owning an ETH wallet address.

- The pre-merge backwardation in the futures markets (futures price < spot price) will lead to post-merge contango (futures price > spot price) as market makers who are hedging their exposure selling future contracts will go into the market to buy spot ETH.

So far so good, the magnitude of deflation and the price of ETH have a reflexive relationship. Better dapps bring in more users -> more people use the network -> more gas fees are being burnt -> supply is reduced -> price increases (low supply and high demand). Ok, now bear with me, let’s look at each scenario one by one.

There will be a diminishing ETH issuance

After the Merge, there is no longer a need to pay miners for validating transaction on the network, which will result in savings of 13,000 ETH per day. These miners will be replaced by staking nodes whose budget will start around 2,000 ETH per day. As more validators join the network, the daily ETH issuance will increase to 5,000 ETH. This implies a significant difference ranging from 8.000 to 11,000 ETH of daily net savings.

It is fair to assume that ~85% of miners issuance is sold into the market, whereas staking nodes are not only exposed to a lower selling pressure, but also require only a fraction of the issuance that miners do in order to provide the same level of security. These nodes do not have fixed electricity costs, so we can assume that there is no need to sell a portion of the issuance to cover expenses

Deflation from EIP-1559? Is it priced in?

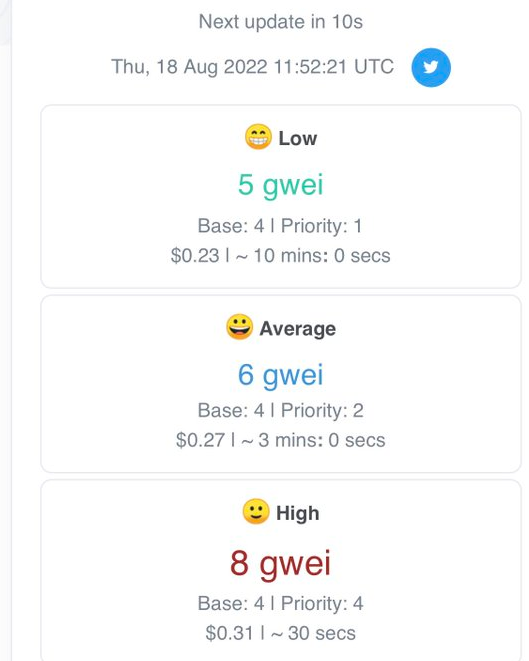

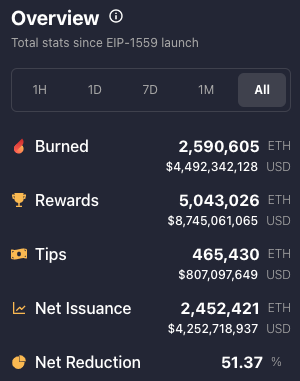

The fact that a portion of transaction fees are burn is nothing new at this point. EIP-1559 has been implemented for over a year now, so chances are high that this is already priced in. A quick look at ultrasound.money reveals a current burn rate of 0.99 ETH/minute.

We can back up this data with additional information from watchtheburn.com.

We can see that the amount of ETH being burned every day is in a clear downtrend. This reveals that EIP-1559 was quite significant in its early days: the burn was so high that ETH supply would turn deflationary. Nowadays, this chart is going down and to the right, barely burning 1,600 ether per day.

At the end of the day, gas fees are the cost of doing in the business, and we know from experience that everyone loves doing business in the bull market. DeFi summer, NFTs, metaverse… everyone was willing to spend more than $200 in transaction fees. All of a sudden, everyone found out where the yield was coming from, and the willingness to pay for block space started to decrease.The Otherside metaverse launched by Yuga labs is probably the best example of that. A metaverse land sale for BAYC holders that generated $285M in sales, out of which $176M were wasted in gas. Looking at the chart below, can you guess when that happened?

By the way, there is also a good observation looking at the burning distribution. What will happen if/when L2s start charging gas fees in their own native token?

Staked ETH can’t be withdrawn

Staked supply is locked and withdrawals will not be implemented until the Shanghai fork.

- Before rewards can be claimed, you are being paid for illiquidity and possible failure of the Merge.

- After the Merge, the real yield might decrease significantly as more ether are staked.

The Ethereum foundation said they were not gonna stake pre-merge and, weeks before the Merge, nobody is debating whether to stake with Rocket Pool or Lido. The narrative has shifted towards a Proof of Work fork that has rushed all opportunistic participants to the exit. Instead of selling ETH, these participants have started borrowing ETH to get free ETHw. This has brought the stable APY to 6.75%. No need to tell you that it will keep going up.

By the way, the fixed borrowing rate on Notional with a September 25 maturity date is currently 4.22%. Sounds like a better deal.

Anyways, so the current plan is to deploy the withdrawal functionality for staked ETH in a software update that will take place 6 months to 1 year after the Merge. As a matter of fact, we can clearly observe that there is a locked ETH supply in the Beacon chain that has been earning yield. Effectively, ETH rewards have been issued on both the PoW and PoS chains, but only the PoW emissions have been exposed to selling pressure. What will happen to the emissions on the PoS chains? Some will probably re-stake, others might want to realize profits… that’s the next catalyst on the horizon: an unlock with unclear consequences, and possibly some dips that will not be bought as aggressively.

Now to the fun part, what should we expect for the staking APY post-merge?

- 25% staking APY?

- ETH Supply peak at 120M?

- Long-term ETH supply target 100M?

First of all, is this yield really risk free? Or does it account for the risks involved in a possible unsuccessful Merge? After a few weeks, when there is no longer a narrative about a Proof of Work fork and the amount of staked tokens increases… what will happen to the staking rewards?

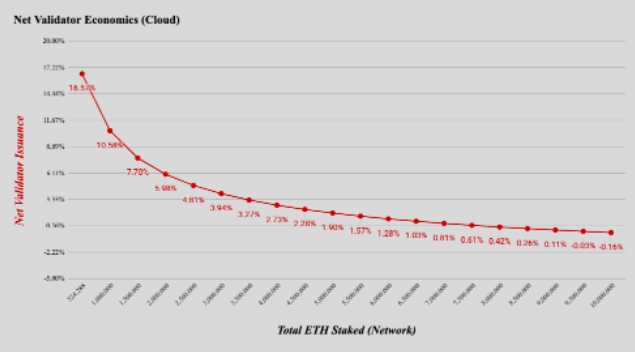

Staking rewards cannot be high when a big % of the supply is staked. Basically, the yield from staking is a penalty for those who are risk-averse and have not taken advantage of the opportunity to stake before the Merge happens. Those participants are now paying the cost of their risk aversion and fear of a possible failure in the Merge, so they are not benefitting from the net inflation of staking rewards. According to stakingrewards.com, 10.88% of eligible tokens are being staked.

More people will stake after the Merge, and the network will be more secure because it will take more resources for someone to attack the network. However, as more participants stake ETH, the yields for those staking rewards will be lower, but the annual inflation for the entire network will be higher.

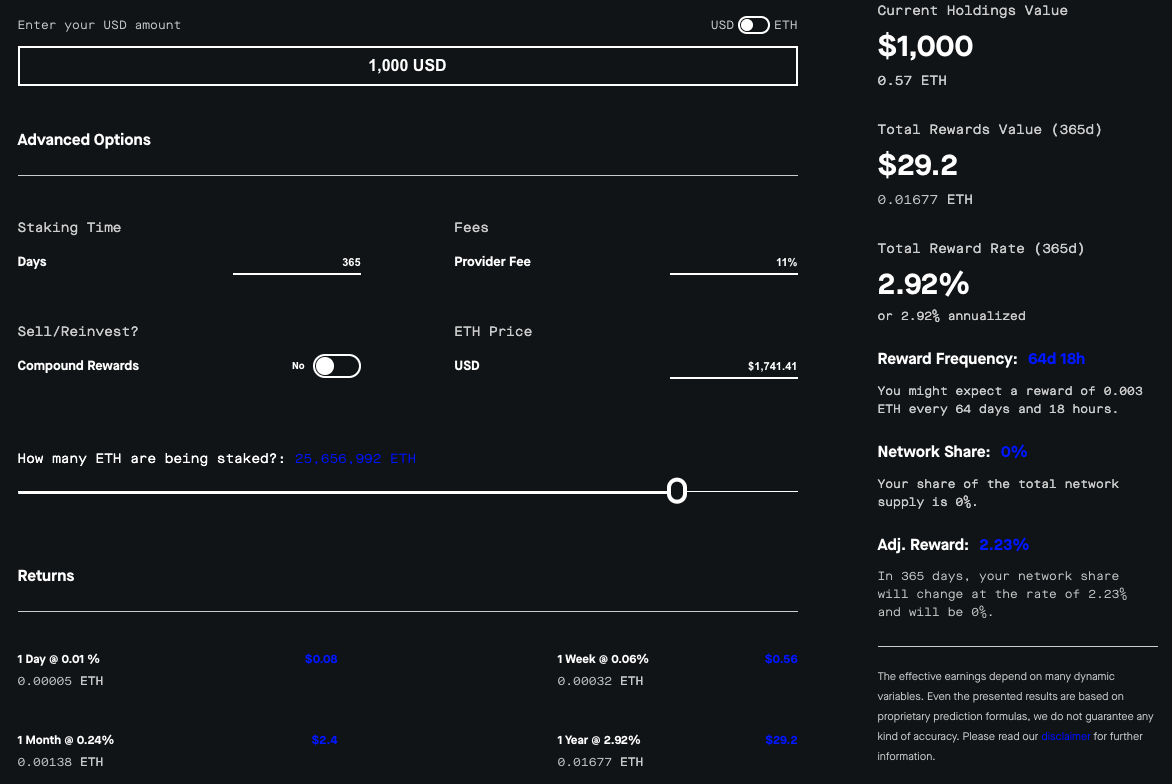

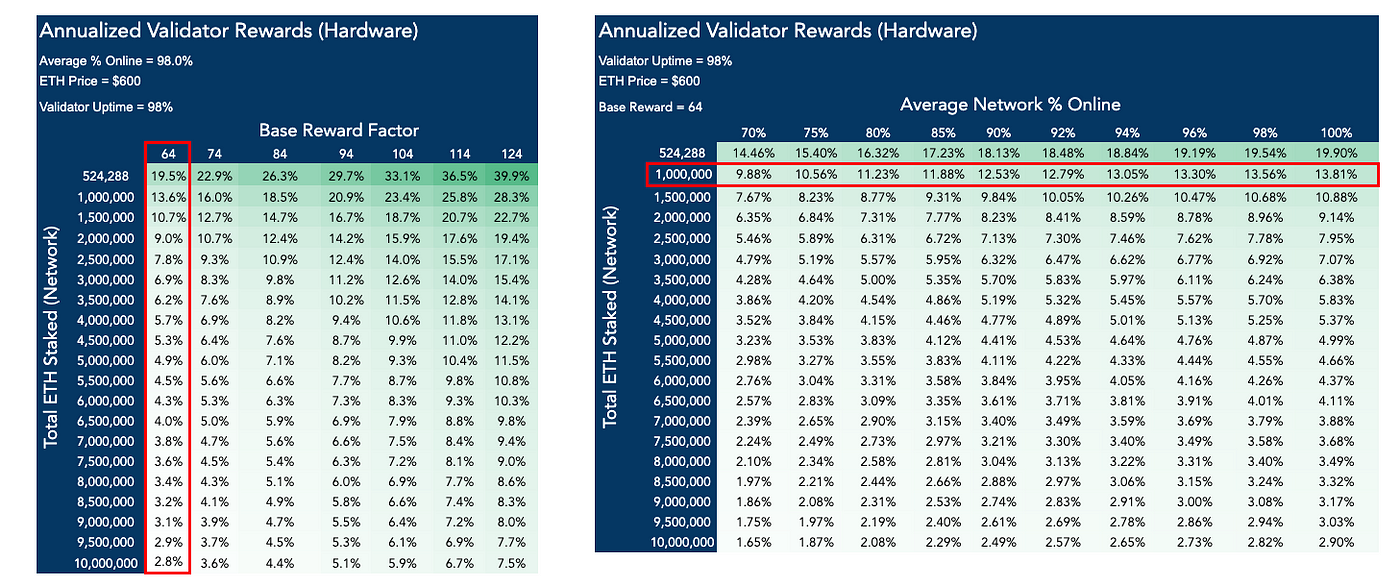

Rewards are given for actions that help the network reach consensus, so that the network gets stronger against attack vectors. You can try this yourself in this calculator and you will observe that, as you move the slider to the right (increasing the number of ETH being staked), the total reward rate decreases

The current nominal yield is ~4%, but the real yield is actually negative, since we must account for 4.4% of new ETH being issued every year. Based on historical data, here is what the net issuance of ETH would look like, from -0.5 to -4.5% depending on network fees.

The key point here is that such deflation is taking into account historical data. If the majority of people are extrapolating past data to anticipate ETH issuance, they might be getting the numbers wrong to calculate the yield too, so maybe there is more “hopium” than data backing up some claims.

Right now miners receive 90% of issuance, while staking nodes receive the remaining 10%. After the merge, staking nodes will receive 100% of both issuance and transaction fees. The issue, however, is that it is not realistic to assume an ETH staking reward of ~20%, since that would be taking into account a low staking participation rate and a large fee pool. Currently, 10.88% of ETH is staked, and the staking reward is relatively low (4.05% annualized according to stakingrewards.com.

Many expect the staking rewards to raise to ~20%, but we have already explained how that’s not possible, since the number of ETH being staked is very likely to increase after the Merge. Even if fresh capital enters the demand side of the equation, more tokens will need to be purchased and staked. Everyone will want to profit from a high yield, and the rewards will be distributed to a larger user base, thus diminishing individual returns.

It seems likely that the staking APR will start converging to a 2% over time, a chunk of which will go centralized exchanges (many take up to 25% of the rewards), and liquid staking providers (Lido takes 10% of the ETH rewards earned). This approach would envision a yield of ~3.5–4%, minus inflation. This would take us approximately to a~3% minus inflation in the first half of 2023, and ~2.5% minus a more significant inflation in the second half of 2023. Higher fees mean more ETH being burnt, but we have already seen that is not very relevant right now (remember that down-and-to-the-right chart). That has impact on the staking rate, but it also helps on the adoption side, since lower gas fees will attract more users (and less staking nodes, since the rewards will be lower). Is the optimal scenario a point where gas fees are high enough to burn all new issuance? It could be, since that would enable ETH supply to be stable while keeping the gas fees low enough as to not inhibit adoption.

Up until now, some investors have been skeptical of using traditional equity frameworks for valuing crypto tokens. They reason that these tokens have a tendency to trade more around narratives, and less around fundamental values. However, now that more people are starting to agree that Dapps should generate revenue and be treated as a business that generates income, we can translate such thought process to how a PoS network operates similar to a stock. By that analogy, real yield is no different that the potential dividend an investor can get by owning a stock, which comes from the revenue side, not the costs side. However, all narratives around the Merge seem to be concerned about the costs side, which will be captured by MEV searchers, staking pools, centralized exchanges… In fact, these protocols do have expenses that are paid as issuance, similar to stock-based compensations. This issuance does not reduce your dividend payments immediately, but reduces the share of future dividends you get, which reduces the present value of future cash flows.

It is alleviating to see light at the end of the tunnel. Ethereum is now shipping a long awaited upgrade that might lead to more user adoption and might attract more users because of its ESG friendliness and increasing security. This is the first step towards a set of tech improvements that will eventually lead to reduced MEV, lower gas fees, higher performance, and more value accrual while maximizing decentralization, censorship resistance, and democratic access to block rewards. But who knows how long we will have to wait for that.

New to trading? Try crypto trading bots or copy trading